One discussion that recently gathered pace is whether shares of Tesla Inc., the carmaker whose stock has risen more than 300% in 2020, should be part of a US benchmark.

The Palo Alto, California-based company this year became the seventh-largest US public company, even though it only posted its first annual profit in 2019. A jump in revenue and expectations for increased unit deliveries have made the carmaker’s stock a hot asset this year. Yet, the stock isn’t part of all large-cap US benchmarks.

Qontigo’s flagship large-cap benchmark for the US, the STOXX® USA 500 Index, does include Tesla’s shares. The STOXX USA 500 is based on an objective and clear rule of free-float market capitalization. In tracking companies’ size, the benchmark attempts to accurately reflect investment trends and market flows. There are no quality, profitability or discretionary criteria involved in the selection process, with the only constraint being that components’ weights are capped at 10% to avoid overconcentration.

A quarterly review and rebalance keeps the index contemporary and up to date with market developments.

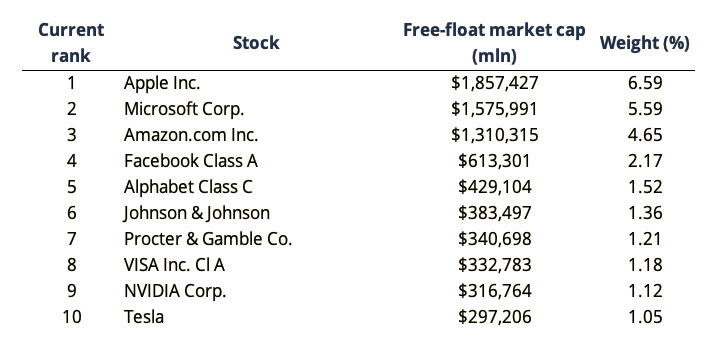

Figure 1 shows the ten largest constituents in the STOXX USA 500 Index as of Sep. 25 this year, with Tesla ranked No.10. The stock’s position was as high as No.7 on Aug. 31 this year, before a market rout in September weighed on its share price. Tesla has been a constituent of the index long enough to allow investors to have benefited from this year’s stock surge — even after the recent pullback.

Figure 1 – STOXX USA 500 Index components

Tesla represents about three quarters of the Automobile & Parts Supersector’s 1.43% weight in the STOXX USA 500 Index and is one of only three carmaker stocks. Its weight is on average 10 times that of competitors General Motors Co. and Ford Motors Co.

By contrast, Tesla failed to find a place in the widely followed S&P 500 in an index review on Sep. 4. The S&P 500 tracks stocks weighted by their float-adjusted market value. Inclusion is based on quantitative factors such as size, liquidity, investability and financial viability (members must be profitable over the past 12 months, including the most recent quarter). However, constituent selection is at the discretion of an Index Committee based on the eligibility criteria.1

Driving outperformance

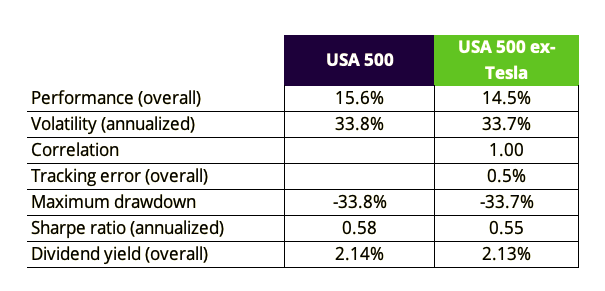

Amid increased profitability and investors’ favor, Tesla’s outperformance has left its mark on US markets in the past year. Figure 2 displays metrics for the STOXX USA 500 Index against a simulated version that excludes Tesla’s stock.

Figure 2 – STOXX USA 500 simulated without Tesla

In the 12 months shown on Figure 2, estimates based on the simulation show that Tesla accounted for more than 1 percentage point of the benchmark’s gross performance. The extra returns would not have come at the cost of any significant increase in volatility, decrease in the overall dividend yield or material tracking error, based on this simulation.

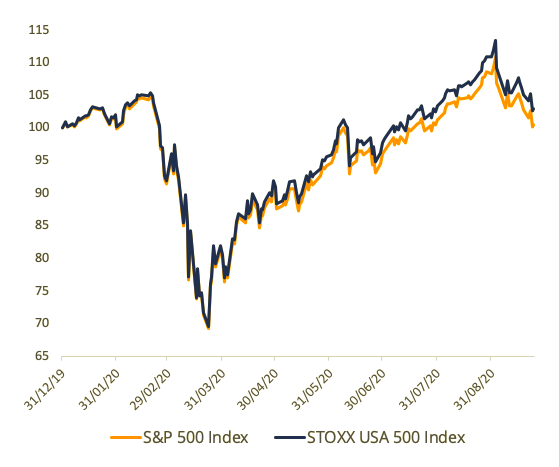

The extra return may also help explain some of this year’s outperformance of the STOXX USA 500 versus the S&P 500 (Figure 3).

Figure 3 – STOXX USA 500 vs. S&P 500

In having Tesla in the benchmark, STOXX USA 500 index investors have gained exposure to a ‘growth’ story while keeping volatility at bay. STOXX indices stand out for having an entirely objective and neutral security selection process based on transparent rules that investors have visibility into. This methodology adds certainty for managers who can anticipate and therefore prepare for upcoming changes.

The role of a benchmark is to provide an accurate representation of underlying market and economic trends. In the case of Tesla, investors in the STOXX USA 500 were able to benefit from one of the market stories of 2020.

Photo: Tesla.

1 For more information, visit S&P Dow Jones Indices’ S&P US Indices Methodology.