This article is a contribution from Optiver.1

Climate change is one of the most urgent issues of our time. Discussions on how to support and accelerate the green transition are critical and at Optiver we believe it’s important to play an active role in this. Our approach is two-fold. Firstly, to help build trust in the ESG category and ultimately accelerate the ESG transition, we are actively sharing our knowledge and expertise of capital markets in the ESG discussion. Secondly, we are contributing to the ESG transition through our core business of liquidity provision.

When it comes to liquidity provision in ESG derivatives, we expect the ESG versions of derivatives to eventually replace their original benchmarks. In the future, ESG products will not be viewed as a separate product/class, but simply another dimension of investment criteria. With this vision in mind, this paper conducts an ESG ‘pulse check’ by examining the performance of the most traded ESG future in Europe vs. the relevant ‘traditional’ benchmark product on multiple liquidity and commercial metrics. In addition, we’re comparing the relative performance of ESG futures in European capital markets versus that of the US. We believe these metrics provide insight into how we, as an industry, are performing and if we are on the right track to support the ESG transition in capital markets. They also indicate additional tweaks that could be made to further aid in the transition.

The role of the financial industry in the ESG transition

Collaboration among financial industry participants is key for the industry to achieve its common goal of accelerating the transition towards sustainable investing. Only through a coordinated effort, and by acting and not just talking, can we support the ESG transition. At this stage, it is more important for the industry to continuously take steps in the right direction than for each step to be perfect. A pragmatic yet proactive approach needs to be taken by the respective market participants. For example, exchanges can facilitate the ESG transition and show their commitment by offering competitive exchange fees and a compelling LP program that attracts both liquidity providers and investors, while liquidity providers can provide competitive prices that reduce the cost of execution and attracts liquidity to the market. This is also why we are a liquidity provider in the ESG Large 80 future on Euronext, we support various ESG futures on Eurex and we are a lead market maker in the recently launched SPX ESG options on CBOE.

An ESG ‘pulse check‘

Various efforts have been undertaken by different market participants. Exchanges put a lot of emphasis on developing their ESG derivatives suite and as liquidity providers, we continue to increase the number of ESG products that we support. To assess how we are progressing as an industry and to determine where we can improve our efforts, we have reviewed the most traded ESG future in Europe vs. the traditional benchmark using various metrics.

Comparing on/off-screen percentages of ESG contract vs. benchmark

Robust and diverse buy-side and end-investor demand coupled with good product design and competitive exchange commercials help build healthy order books which attract liquidity to trade on-screen. To assess order book health – comparing on- vs. off-screen volumes can provide insight.

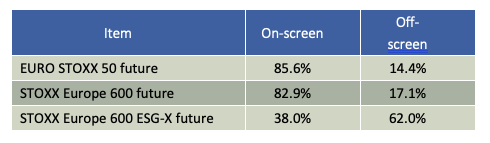

Exhibit 1

Exhibit 1 shows the on- vs. off-screen volumes of the EURO STOXX 50 Index future and STOXX Europe 600 Index future, compared to the STOXX Europe 600 ESG-X Index future, which is the most actively traded ESG future in Europe and in which Optiver is the #1 ranked market maker in on-screen volume. As can be seen, the on-screen trading of the benchmark is further developed than the ESG product, with over 60% still trading off-screen. Here, there is room for improvement to attract more volume to screen.

Review the spread difference of ESG contract vs. benchmark

The spread of a product reflects a cost of trading for investors. A tighter spread lowers transaction costs which should attract more volume to screen.

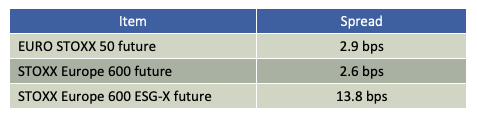

The spread in the traditional benchmark futures is most often 1 tick wide, whereas the ESG-X futures is often quoted 2 ticks wide at close to 14 bps spread.

Exhibit 2

Even at 1 tick wide, the cost of trading would be more than twice as high compared to the benchmark. One takeaway of this is that Eurex could lower the tick size to reduce the cost of trading, but overall this is a tricky problem as liquidity providers are able to tighten their spreads as volume and liquidity increases, as it changes the risk/reward profile on their quotes, but volumes are only more likely to increase with healthier order books and a tighter quoted product. One thing exchanges can do to incentivise the right behaviour is to implement attractive fee and rebate/revenue share schemes for their ESG products.

Fee, rebate and revenue share comparison of ESG contract vs. benchmark

Competitive fee schemes and rebate/revenue share models lower both the direct and indirect costs of trading for end investors and incentivise liquidity providers to show tight prices. Besides that, it can serve as a proxy for how committed an exchange is in making the product a success.

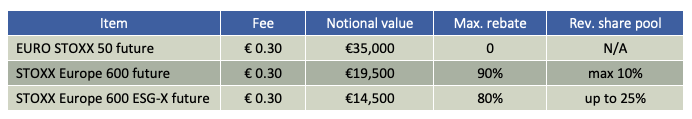

Exhibit 3

Exhibit 3 gives an overview of how Eurex incentivises liquidity provision in the ESG product vs. the traditional benchmark futures. As can be seen, standard fees are the same, but the contract value of the STOXX 600 future is roughly 30% higher, which means the cost for getting the same notional exposure is lower. Additionally, higher rebates can be obtained in the benchmark future, but the revenue share pool percentage is significantly higher for the ESG future. The latter is a great incentive for liquidity providers when a product needs to build volumes. To ensure long-term commitment from both the exchange and liquidity providers, it’s important that these revenue share pools will remain in place also when volumes start to grow.

European performance vs. US

Europe prides itself on being ahead in the ESG transition globally. To check if this is reflected in the capital markets, we assessed the market share of the most traded ESG future (STOXX Europe 600 ESG-X on Eurex and the S&P ESG future listed on CME) vs. the traditional benchmark product in both Europe and US.

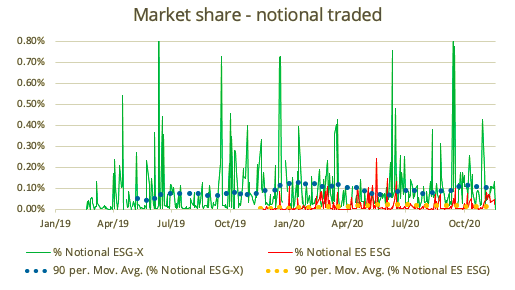

Exhibit 4

What is clear is that Europe is ahead in terms of market share of notional traded in the ESG future. Relative market share compared to the benchmark is highest in roll periods.

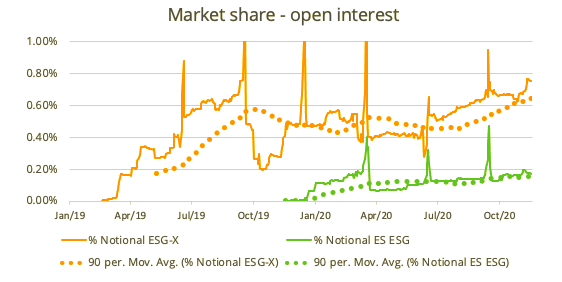

As ESG products are still very much in a development phase, one could argue they are not so much a ‘trading’ product, but more a ‘buy-and-hold’ product. Therefore, we run a final comparison of Open Interest between the two regions (Exhibit 5).

Exhibit 5

It’s evident that Europe is ahead of the US and it is positive that over a longer time frame, the open interest market shares of ESG products seem to be trending up in both regions.

Conclusion

As can be seen from the ESG pulse check, on-screen trading volumes in the ESG futures still need to develop, which will also improve the liquidity picture and spreads. The fee and incentive scheme implemented by Eurex for the ESG-X future is competitive and comparable to the benchmark. Besides that, the market share in volume and open interest in the most traded ESG futures is slowly increasing over time, and we can see that Europe outperforms the US in terms of relative adoption in this area.

In summary, it can be concluded that there’s progress to be found in supporting the ESG transition through capital markets, but there is also still plenty of room for improvement in further growing and developing the ESG derivatives space. To accelerate change, we need to continue the dialogue as an industry, but also put our words into action and consider that it’s more important to keep taking steps in the right direction than for every step to be 100% right. This means for exchanges to launch ESG products with competitive fee and rebate schemes, based on end-investor demand and for market makers, including Optiver, to support these products through liquidity provisions and building trust in the market.

1 Optiver is a leading technology-driven market maker, with more than 1000 employees in offices around the world. The company provides liquidity on multiple exchanges across the world, trading a wide range of products: listed derivatives, cash equities, ETFs, bonds and foreign currencies. An original version of this article can be found here.