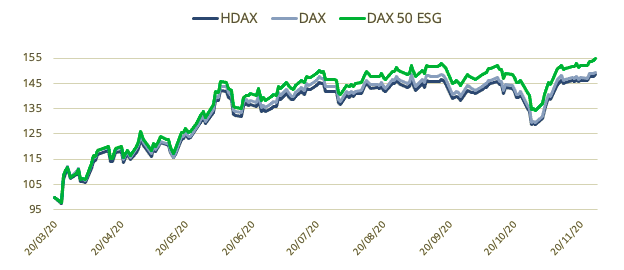

Amid the economic disruption brought about by the COVID-19 pandemic this year, portfolios guided by sustainability principles have outperformed their benchmarks across regions.

The DAX® 50 ESG Index, introduced this year, is no exception. The index beat the broader HDAX® by 6.3 percentage points between Mar. 20, 2020 and Nov. 27, 2020. It outpaced the flagship DAX® by 5.3 percentage points in the same period, while exhibiting lower volatility (Figure 1).

The DAX 50 ESG Index applies exclusionary screens and uses environmental, social and governance (ESG) parameters in its stock selection methodology within a universe of German equities. Companies involved in undesirable or controversial activities from a responsible investing perspective are excluded, while companies with the highest ESG scores are prioritized for inclusion over laggards.

Figure 1 – Index returns since Mar. 20, 2020.

Factor and stock selection analysis

A new whitepaper1 from Ladi Williams and Anand Venkataraman at Qontigo’s Index Product Management team uncovers just what drove those additional returns and does so by looking at the outperformance through various angles.

Among the authors’ findings, factor-based performance attribution shows that style exposures resulting from exclusions actually weighed returns down, and that the outperformance was generated by idiosyncrasies attributable to individual stocks (specific return).

The authors conclude that the application of ESG criteria and the consequent exclusion of certain securities had a positive impact on returns in general. However, they stop short of attributing this purely to ESG and note the coincidental nature of some of these exclusions, as they relate to industries that were impacted heavily by the pandemic.

The report also shows that exclusions based on military production, controversial weapons and nuclear power added to returns relative to the HDAX during the period considered. The removal of companies involved with thermal coal and those that failed the Global Standards Screening was a drag on relative performance, the authors write.2

New derivatives

The analysis is timely as futures and options on the index were listed on Eurex last month, providing investors a key tool to efficiently and economically hedge and manage flows in sustainable portfolios and as interest and demand for ESG portfolios continues to grow steadily.

For a similar study on the EURO STOXX 50 ESG® Index, click here. For an analysis of the STOXX® Europe 600 ESG-X Index, click here.

Resilience

The coronavirus outbreak produced an unprecedented shock to equity markets in February and March this year. Equally strong has been the recovery in share prices, as central banks and governments stepped in to sustain economic growth. The outperformance of ESG portfolios during this period has partly been linked to the operational and management efficiencies of holding companies. According to this premise, investors have looked more closely to businesses that may be better suited to fend off the type of social and economic problems seen in 2020.3

We invite you to download the whitepaper here and learn more about the benchmark for German sustainable portfolios.

1 Williams, L., Venkataraman, A., ‘DAX® 50 ESG Index Outperforms as Markets Recover,’ Qontigo, Dec. 2020.

2 Global Standards Screening identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co- operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

3 For a comment on the link between COVID-19 and inflows into ESG funds, see ‘COVID-19 accelerates ESG trends, global investors confirm,’ Principles for Responsible Investment, Sep. 3, 2020.