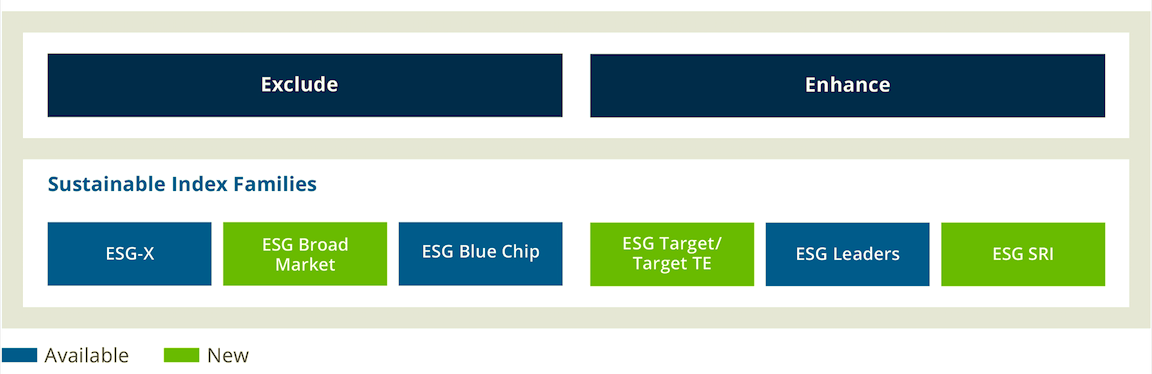

Qontigo has expanded its flexible framework of STOXX sustainability index solutions, designed to meet diverse levels and types of ESG investment objectives.

In a post last week, we reviewed this solutions framework and its two categories – ‘Exclude’ and ‘Enhance’ (Figure 1).

Today’s post delves deeper into the indices that constitute the first category, Exclude, which is a starting point in responsible engagement and risk mitigation.

Figure 1 – STOXX’s two ESG categories

> ESG-X Indices

The first index family in this category consists of the STOXX ESG-X indices, which implement standard negative exclusions that remove companies in activities deemed undesirable from a responsible standpoint.1

The full-fledged ESG-X family is truly comprehensive: almost 100 indices covering regions, countries and even factors help responsible investors target a vast array of strategies. The family includes the EURO STOXX 50® ESG-X Index, the EURO STOXX® Banks ESG-X Index and the STOXX® USA 500 ESG-X Index. Some of these indices underlie popular futures on Eurex that facilitate the trading and hedging of sustainable portfolios.

According to STOXX research, exclusions such as those in the ESG-X indices do not materially affect the risk-return performance relative to traditional market-capitalization-weighted benchmarks.2

| Download our whitepaper on the STOXX ESG-X Indices here. |

> ESG Broad Market Indices

The Exclude category also counts our latest offering in ESG, the STOXX ESG Broad Market Indices, introduced this month. The indices eliminate 20% of the parent index through a combination of negative exclusions (compliance and product involvement) and the removal of the poorest-scoring securities per industry in terms of ESG criteria.3

The initial ESG Broad Market indices cover the Global, Europe, Eurozone, Asia/Pacific, Japan, US and North America regions.

> ESG integration

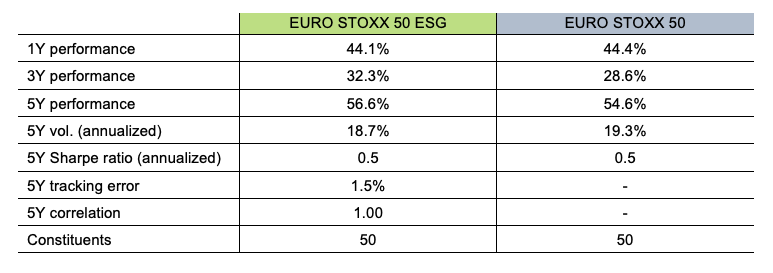

Finally, our growing family of ESG blue-chip indices within the Exclude category are derived from some of the world’s most iconic benchmarks. They implement ESG exclusions and positive integration of ESG scoring to remove companies with the lowest ESG grades and replace them with better-ranked peers. The EURO STOXX 50® ESG Index and the DAX® 50 ESG Index belong to this family.

The EURO STOXX 50 ESG Index’s methodology is straightforward: it uses a combination of negative exclusions (compliance and product involvement) and the removal of the poorest-scoring securities per industry in terms of ESG criteria from the benchmark EURO STOXX 50® Index. All exiting securities are replaced with more sustainable peers from their same supersector group.4 The result is an index that seeks a risk and return profile close to that of the flagship EURO STOXX 50, with a higher ESG profile.

ESG leaders have historically added to returns

The EURO STOXX 50 ESG Index performed broadly in line with its benchmark in recent years but leaped ahead during the COVID-19 pandemic in 2020.

Figure 2 – EURO STOXX 50 ESG’s risk and return characteristics

| Download here our whitepaper ‘EURO STOXX 50 ESG: Liquidity and Tradability Characteristics.’ |

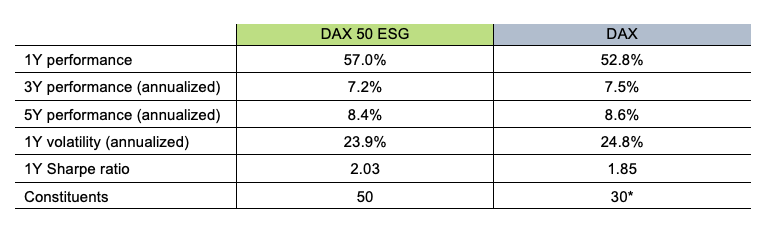

The DAX 50 ESG Index, for its part, was designed as a new standard for the growing pool of investors embracing sustainable principles in Europe’s largest economy.5 The index removes those companies from the initial universe of the HDAX® that are involved in undesirable activities, while equities with the highest ESG scores are prioritized for inclusion over laggards.

Qontigo’s analysis shows the DAX 50 ESG has provided better risk-adjusted returns since backtested data begins in September 2012. Similarly to the EURO STOXX 50 ESG index, the DAX 50 ESG outperformed during the pandemic.

Figure 3 – DAX 50 ESG’s risk and return characteristics

| Download our whitepaper ‘DAX 50 ESG – The New Standard in German ESG Investments’ here. |

Both the EURO STOXX 50 ESG and DAX 50 ESG indices underlie futures and options on Eurex.

“The indices in our Exclude category were designed to incorporate a responsible element to portfolios without significantly altering the risk-return profile relative to benchmarks,” said Hamish Seegopaul, Managing Director, Research & Development for ESG and Quantitative Indices at Qontigo. “Derived from well-known benchmarks and built using STOXX’s capabilities, they are efficient tools to help investors optimize their impact.”

Open architecture

Qontigo’s ESG framework offers access to curated databases that allow for cutting-edge index creation. Through our open architecture, we select and integrate best-of-breed, third-party data from leading providers including Sustainalytics, ISS ESG and CDP.

Our DNA and philosophy

All indices in the STOXX and DAX ESG families are guided by the principles of transparency, simplicity, liquidity and tradability. They are product-focused, versatile and ready for business, be it for benchmarking or to underlie products, with our APIs supporting the interoperability with clients and partners.

As more investors adopt sustainability mandates, they bring their own, specific needs and expectations. Qontigo’s flexible framework of innovative sustainability solutions aims to support investors along their entire ESG adoption journey. This comprehensive range combines the rules-based methodology of STOXX and DAX indices, thoughtfully selected data from leading partners, and Axioma’s state-of-the-art portfolio construction capabilities. With the right solution and your own differentiated approach, we can help you optimize your investment impact.

1 The norm- and product-based screenings of the ESG-X Indices are based on standard policies of leading asset owners and allow the indices to keep a similar financial risk and return profile to benchmarks, while reducing ESG-specific risks. The filters exclude companies that are non-compliant with Sustainalytics’ Global Standards Screening, or are involved in controversial weapons, tobacco, or thermal coal production or consumption.

2 See Venkataraman, A. and Williams, L., ‘STOXX ESG-X Indices,’ STOXX, August 2019.

3 STOXX ESG Broad Market Indices: Companies that are non-compliant based on the Sustainalytics Global Standards Screening assessment or are involved in Controversial Weapons are not eligible for selection. Additional exclusion filters are applied, screening companies for involvement in tobacco production, thermal coal and military contracting. The remaining securities are ranked in descending order of their ESG Scores, sourced from Sustainalytics’ ESG Rating dataset, within each of the 11 ICB Industry groups. The STOXX ESG Broad Market Indices select the top-ranking securities in each of the ICB Industries until the number of selected securities reaches 80% of the number of securities in the underlying index.

4 The EURO STOXX 50 ESG Index is made up of all EURO STOXX 50 components minus the 20% ESG laggards based on an ESG score, as determined by scores from STOXX’s research partner Sustainalytics. In a second step, a set of standardized ESG exclusion screens based on the responsible policies of leading asset owners is applied on the entire EURO STOXX® Index, the EURO STOXX 50 ESG’s selection universe. This clears the ESG index’s constituency pool of activities broadly considered to be controversial from either a norm- or product-based perspective. All excluded securities are replaced by companies from their same ICB supersector with higher ESG scores.

5 The selection universe for the DAX 50 ESG Index is the HDAX® Index, which groups all equities that belong to either the DAX, MDAX® or TecDAX® indices. From the universe, a set of filters are applied to exclude companies deemed to be non-compliant with the Global Standards Screening assessment, as well as those involved in controversial weapons, tobacco, thermal coal (extraction and power generation), nuclear power and military contracting. The remaining securities are screened for their individual ESG scores, as calculated by Sustainalytics’ transparent ESG performance rating model. The DAX 50 ESG Index is composed of all remaining stocks with the highest rank in three parameters: order book volume, free-float market capitalization and ESG score.