Qontigo has introduced the iSTOXX Single Stock Decrement Indices, an innovative suite designed to underlie structured products.

The family initially consists of 69 indices that replicate the gross returns of 23 liquid global stocks and assume a constant dividend markdown, or decrement. There are three indices per stock, with each one showing a different decrement level to cater to different objectives.

The indices have been exclusively licensed to Citi and may be used as underlying for an array of structured products and autocallables that bring single-stock exposure to some of the most popular companies in Europe and the US.

Dividends as a crucial factor for pricing efficiency

Decrement strategies have become popular among issuers of structured products as they allow them to lower replication costs and keep competitive terms for the client. Until now, the decrement treatment of dividends has mostly been used in global, regional or thematic index exposures.

Traditionally, structured-product investors are exposed to the price returns of the underlying through so-called synthetic replication. Since the investor doesn’t actually hold the underlying assets, any dividends paid during the lifetime of the structured product are not due to them. Instead, they go to the structured product issuer, who holds the underlying assets as a hedge. The expected value of these dividends is embedded into the pricing of the product. Where higher dividends are anticipated, the investor receives a pricing benefit such as a higher coupon or better capital protection.

Exceptional event

Pressured by the COVID-induced economic slump and by regulators, many companies were last year forced to slash dividends at a pace rarely seen in history. Janus Henderson has estimated that one in five companies made a cut in 2020 and one in eight cancelled their pay-out altogether. The value of European dividends tumbled 32% from 2019.1

Structured-products manufacturers and investors acutely felt this pressure too. Because of the technical construction behind the popular autocallable structured products, whenever there is a market downturn such as in 2020, trading desks need to buy more shares to offset their product liabilities. Therefore, they build an even higher long exposure to implied dividends that are falling, exacerbating the negative backdrop.

“The most challenging risk to manage for exotic desks in March 2020 proved to be their single-stocks dividends exposure, drastically impacting today’s overall appetite from dealers for this idiosyncratic risk with very limited liquidity on the hedging side,” said Alexandre Isaaz, Global Head of Equity and Hybrid Payoff Structuring at Citi. “This aversion has translated into much higher charges – or even no quote at all – resulting in less attractive products for the end customer, without removing the risk from books. A kind of ‘lose-lose’ situation.”

Value for money

Decrement indices remove the dividend risk while, as mentioned, they can boost the product’s potential returns for investors.

The decrement mechanism involves deducting a pre-determined amount in absolute or percentage terms from the underlying’s level or total return on a daily basis — a sort of fixed, synthetic dividend detachment. By selling a structured product based on a total-return index with a decrement, the issuer eliminates the unpredictability of dividends and is protected against any dividend shortfalls. The structured product investor, in turn, receives better pricing terms in exchange for being exposed to the realized dividends.

“The rising momentum we have seen for decrement products across new regions and distributors has so far been on the index side only,” said Isaaz. “We believe single names are the next step, with even more value to extract for the investor. Pricing-wise, you can easily increase the coupon by 30% relative to traditional structured products.”

An extensive menu of single stocks

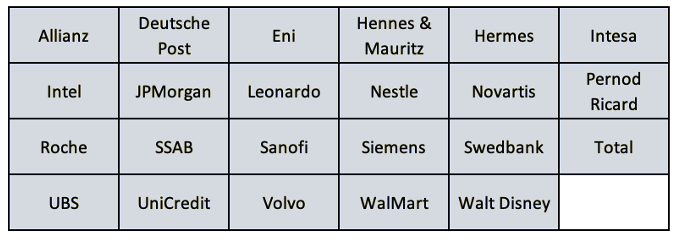

The single-stock decrement indices are especially important for issuers as individual companies have by nature a higher dividend risk than do an index or basket of stocks. Exhibit 1 shows the stocks tracked by the iSTOXX Single Stock Decrement Indices.

Exhibit 1: Available single stock indices

The indices include three decrement levels on each stock:

- ‘Defensive (Fixed point)’: Equal to the minimum cash dividend paid by the company over the last five years (at the time of the index launch)

- ‘Balanced (Fixed point)’: Equal to the average cash dividend paid over the last five years (at the time of the index launch)

- ‘Balanced (%)’: Equal to the average dividend yield paid over the last five years (at the time of the index launch)

For example, three indices track the shares of French pharmaceutical company Sanofi. They incorporate, respectively, annual decrements of 3 euros, 2.85 euros and 3.8%.

This offering gives buyers more chance to express their dividend view. Importantly, the decrements are based on the actual payment history of the company, rather than being arbitrarily chosen.

Collaboration in innovation

Qontigo has a history of supporting structured-product issuers with indices that improve the products’ terms amidst challenging backgrounds such as one of low interest rates.

We strive to develop products that open up new investment possibilities, facilitate trading and assist with portfolio management. This latest launch also further showcases the versatility of index construction, which best comes to light when teaming up with our clients to find the right solution for each case. The iSTOXX Single Stock Decrement Indices family is likely to expand with new stocks in the near future.

“Our ambition is to create effective and efficient index solutions for each individual need, and the Single Stock Decrement Indices are a good example of that,” said Armelle Loeb, Managing Director, Head of EMEA Sell-Side Sales at Qontigo. “We are very pleased to have worked with Citi at such a challenging time for the industry, in delivering a transparent and robust methodology to their structured-product clients.”

1 Janus Henderson Global Dividend Index, Edition 29, February 2021.

This blog article is for information purposes only. Investors should read the full terms and conditions of the indices (available here) and the relevant product documents in full prior to making an investment in any product linked to them. Investing involves risk and any evaluation of an investment should be made after seeking advice from independent professional legal, tax, accounting and other advisors. The indices are published, compiled and calculated by STOXX Ltd., and all the information in respect of the indices is provided by STOXX Ltd. The indices are not sponsored or endorsed by Citi.