On September 20, DAX® Index will expand from 30 to 40 constituents. This enlargement will be reflected as well in the DAX® ESG Target Index, an ESG-enhanced version of the flagship German benchmark.

The DAX ESG Target Index aims to mirror the risk and return characteristics of DAX while applying ESG screens, integrating ESG scores and reducing the portfolio’s carbon intensity by at least 30%. The index has the same number of constituents as DAX, replacing those stocks that fail to meet the ESG selection criteria with stocks in the HDAX® universe.1

The DAX ESG Target Index has an ex-ante tracking error target versus the DAX of <1.5%. For a description of the indices’ selection methodology and the review calendar, please click here.

On September 6, Qontigo’s index provider STOXX Ltd. announced the ten new components of the ESG index:

| Beiersdorf AG | Qiagen NV |

| Hannover Rueck SE | Sartorius AG (Pref. shares) |

| HelloFresh SE | Siemens Healthineers AG |

| Porsche SE | LEG Immobilien SE |

| Puma SE | Knorr-Bremse AG |

Source: Qontigo

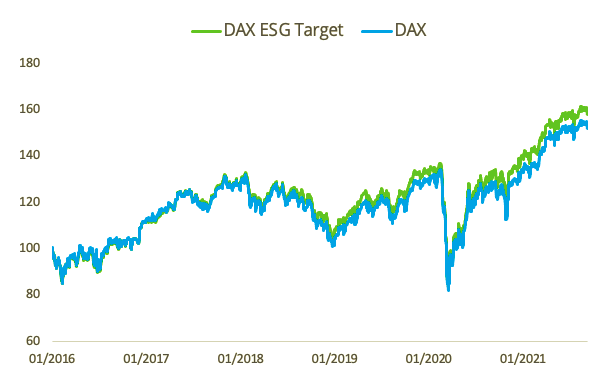

No demotion was announced among current index constituents. All changes will take place on September 20 and will mean that four constituents of the benchmark DAX — Airbus SE, E.ON SE, MTU Aero Engines AG and RWE AG — will not be in the DAX ESG Target index. The ESG gauge, which underlies an iShares ETF managed by BlackRock, has advanced 90% since the pandemic-induced trough in mid-March 2020, compared with a total return of 85% for the benchmark2 (Figure 1).

Figure 1 – Total returns

For a full list of components in the DAX ESG Target, click here.

| Read more about Qontigo’s ESG Target indices in a whitepaper here. |

Thorough overhaul of DAX indices

A comprehensive overhaul of rules covering the DAX Selection Indices was announced in November 2020 that took into account the responses of more than 600 participants in an extensive market consultation. The changes have been gradually introduced since last November and were designed to strengthen the quality of the indices and to align them with international standards. They include:

- Elimination of the exchange turnover criterion in the selection ranking process and introduction, in its place, of a minimum liquidity requirement. Free-float market capitalization stays as the only criterion for selection ranking into indices.

- DAX candidates must have a positive EBITDA in their two most recent annual financial statements.

- Index base universe was extended to all issuers in the Frankfurt Stock Exchange’s Regulated Market, from just its Prime Standard segment previously.

- All constituents are now required to produce audited annual financial reports, semi-annual financial reports and quarterly statements (comparable to current Prime Standard requirements).

- Introduction of alignment requirement with the German Corporate Governance Code with respect to the formation and duties of an audit committee in the supervisory board.

- Addition of a regular DAX review in March.

DAX 50 ESG

The DAX ESG Target sits alongside the DAX® 50 ESG Index, which is a broad market-cap sustainability benchmark that tracks the performance of the 50 largest, most liquid German stocks that have passed standardized ESG negative screens and feature comparably good ESG metrics.

The DAX 50 ESG Index was impacted from the DAX reform in general — as of the September 2021 review, selection into the index is solely based on free-float market cap and ESG scores — but not from the increased membership in the benchmark DAX. The starting universe of the DAX 50 ESG Index is the HDAX, which consists of DAX, MDAX® and TecDAX®, meaning there is no change in the list of eligible stocks.

For a complete look into rules for the DAX Strategy Indices, visit the index guide here. The next scheduled index review is December 3, 2021.

1 This is achieved by ranking the screened HDAX companies in terms of free-float market capitalization and ESG score.

2 Total returns in euros through September 9, 2021.