Asset Owners

ETF Providers

Summary

APG Asset Management (APG), based in the Netherlands, is one of the largest pension providers in the world. Like other asset owners, APG requires custom capabilities in order to accurately capture the sustainability objectives of their pension fund clients including integrating sustainable development investments (SDI) and low carbon targets.

The Need

APG’s desire was to help clients steer more capital towards solutions contributing to the United Nation’s Sustainable Development Goals (SDG). Existing benchmarks did not reflect the unique sustainability criteria developed by APG, making it more challenging to execute on clients’ investment objectives and accurately measure progress towards clients’ sustainability targets. APG needed a customized investable index solution that fully and transparently reflected a range of sustainable investment policies.

The Challenge

To accurately reflect the pension funds’ sustainable goals, we needed to meet several requirements: Benchmarks that incorporated unique ESG criteria and proprietary data; minimization of tracking error relative to the broad developed market by managing unintended bets including sector, country, and factor exposures that might emerge as an outcome of the sustainability targets; and the ability to measure and report on the impact of the risk budget on each of the ESG criteria or constraints. To meet all of these objectives, APG required a flexible and nimble partner with expertise in sustainable investing, index design and portfolio construction.

The Solution

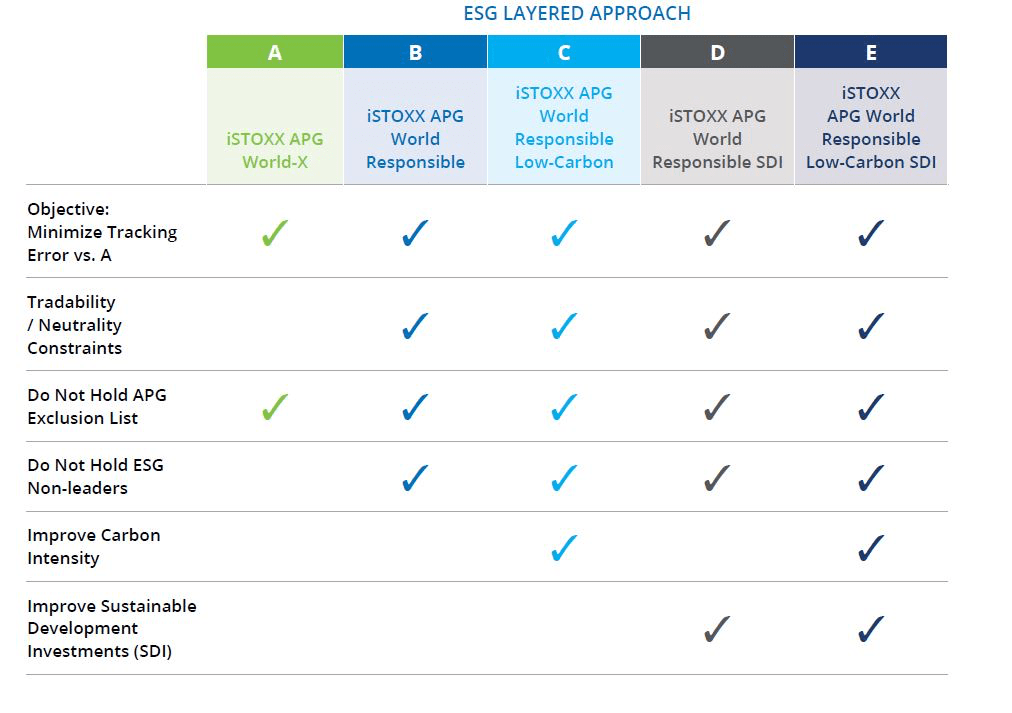

Using the power of the Axioma Portfolio OptimizerTM and our leading index construction capabilities, we collaborated with APG to develop a set of customized indices that ‘layered in’ various sustainability criteria to meet the sustainable investment goals of APG’s clients and allow for the measurement of risk impact across various ESG criteria and other constraints. Starting with the iSTOXX World A Index (a developed markets index covering more than 1,700 companies), each layer or index incrementally added in ESG criteria: ESG exclusions, ESG leaders, lowering carbon footprint and enhancing SDI exposure. In this way, we were able to quantify the risk impact (measured by tracking error to the broader developed market) of each sustainability parameter all while being mindful of any unintended sector, regional and factor bets.

Through our open architecture approach, we were able to ingest data from APG which included data derived from the Sustainable Development Investments Asset Owner Platform (SDI AOP) data to accurately reflect APG’s pension fund clients’ sustainable investment objectives. Overall, the collaboration resulted in an innovative series of layered indices that reflect APG’s and its clients’ responsible investment and risk measurement goals.

iSTOXX APG Responsible Index Family: Constraints & Objectives