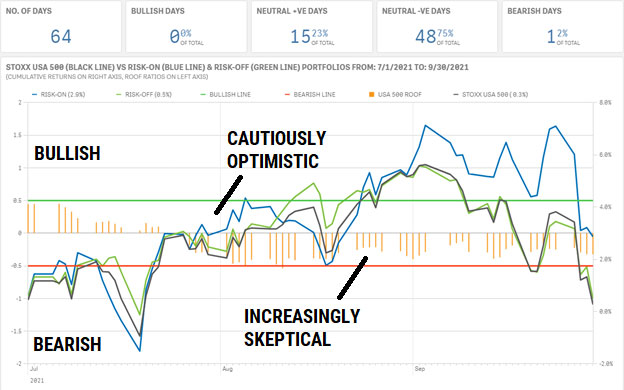

The mood of investors in Q3 2021 was decidedly undecided—and increasingly skeptical. Questions about the strength of the economic recovery, persistent inflationary pressures, the world’s ability to overcome the pandemic, and the timing of any tapering efforts by major central banks kept sentiment (orange bars in chart below) on the negative side of the neutral zone. As the quarter unfolded, investors lost the cautious optimism of early July, as they became increasingly skeptical that these issues would be resolved in the short-term. This lack of conviction—in either direction—kept the STOXX USA 500 index (black line) in a tight range, ending the quarter flat (+0.3%).

Both of our ROOF portfolio variants—the Risk-On variant (blue line) and Risk-Off variant (green line)—hugged the market for the first two months, with neither getting the upper hand. As investors returned from the summer holidays, a short-lived liquidity rally helped the Risk-On variant hold on to earlier gains better than both the Risk-Off variant and the index. But as volatility rose in the second half of September, it started a sharp correction, too.

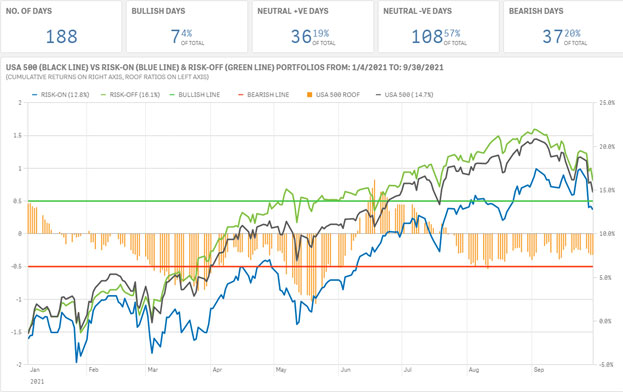

Year-to-date, investor sentiment remains more negative than positive, with 77% of the days spent in either negative (57%) or bearish (20%) moods (orange bars in chart below). This negative sentiment was reflected in investors’ preferences for defensive styles and sectors, which helped maintain the outperformance of the Risk-Off portfolio (green line) over both its Risk-On peer (blue line) and the underlying index (black line). All three portfolios are still up year-to-date—by 16.1%, 14.7%, and 12.8%, respectively—but the mood remains that these are somehow ill-gotten gains (i.e., you’re up but you know you shouldn’t be—or more accurately, you’re not quite sure why).

Against all odds, 2020 was the year of ‘go-big-or-go-home‘. Will 2021 be the year of the skeptics? To be skeptical is not to be merely ‘undecided‘, it is, rather, a decisive admission of forecasting fallibility born from the prevailing uncertainty in the market. All a skeptic really knows for sure is the extent of his or her own lack of certainty (which, to me, is still the best definition of a prudent investor).

Of course, being a skeptic, you could have decided to sit this year out. But doing so would have meant giving up on the market’s almost 15% YTD return. A better idea would have been to simply invest in a portfolio that reflects your sentimental views, in this case a Risk-Off portfolio (i.e., invest how you feel). This alignment between your portfolio’s exposures and your sentiment would have rewarded you with a YTD return of over 16%, outperforming both the Risk-On portfolio and the index. Confirmation bias is the white noise that fills the vacuity left behind by imperfect research. Sentiment is the marriage of this confirmation bias with daily news events that produces an emotional response: buy or sell (or what to buy and sell). In times of heightened bullish or bearish emotional states, investors seek alignment between news events and their own research bias by looking at only half the data, and sometimes even less. In more tempered times, they will be emotionally evolved enough to beware of following every biological prompting and adopt a more neutral state, temporarily free of confirmation bias. The concept of portfolio optimality should include a reflection of the state of mind of investors. This is the purpose of the ROOF market portfolios described in this note.