State Street Global Advisors is changing the underlying index for the SPDR® STOXX Europe 600 ESG Screened UCITS ETF, the fund that launched the firm’s sustainability ETFs offering in 2019, from the STOXX® Europe 600 ESG-X Index to the STOXX® Europe 600 SRI Index.

The STOXX ESG-X indices apply standard norm- and product-based exclusionary screens to a starting benchmark universe, a strategy known as negative screening.1 From there, the STOXX SRI (Socially Responsible Investing) indices are a step up in the sustainability ambition. They expand on the list of the exclusionary product-based screens and apply two additional filters: the poorest ESG performers and the highest carbon emitters are excluded from the indices.2

The change of underlying index in the SPDR ETF, to take place on November 30, comes at a time of increasing investor commitment towards ESG and growing awareness among the broader public about the power of investments as drivers of change. In parallel, European policymakers have introduced rules such as the Sustainable Finance Disclosure Regulation, around which funds can be labelled as ESG.

The ETF will be renamed SPDR® STOXX Europe 600 SRI UCITS ETF.

To find out more about the index switch and its effect on the ETF’s underlying portfolio, we caught up with Rebecca Chesworth, Senior Equities Strategist at State Street Global Advisors SPDR ETFs; and Hamish Seegopaul, Head of R&D for ESG and Quantitative Indices at Qontigo.

State Street Global Advisors

Qontigo

Rebecca, why is State Street changing the index for this ETF, and why now?

“It responds to a natural evolution of several factors, the main one being client demand. The SPDR STOXX Europe 600 ESG Screened UCITS ETF was SPDR’s first foray into ESG funds. At that time, most investors sought a simple, first step into sustainability. They wanted ESG exposures that were close to the core benchmark and therefore automatically kept a low tracking error. This first step reflected a common move in responsible investing: to cap the very unpopular stocks from a sustainability perspective. That includes companies involved in controversial weapons, thermal coal or tobacco, as well as any stock that infringed global norms.

“But demand for ESG has grown and become more sophisticated, and the responsible ambition of many of our clients has increased. As this ESG uptake grows, so does our desire as an asset manager to explore further. We are keen to respond to changing demand and newer index opportunities. As a result, we think ‘best-in-class ESG’ as applied in the STOXX SRI indices is a fitting strategy for the next step in the responsible investing journey.

“Regulation is also evolving together with investor demand. Impending new requirements on ESG reporting and activity from SFDR have received much attention, as have regulations from investment bodies such as France’s Autorité des Marchés Financiers (AMF). We want to be ready for these changes.”

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >And what exactly are clients demanding amidst this ESG evolution?

Rebecca: “Over the past two years, we’ve seen that the end investor has become more demanding, more sophisticated and better educated around what they want in ESG.

“If exclusions represented a quick way into ESG, investors now want to move up and integrate ESG criteria as an additional layer of portfolio construction. At the beginning, there was nervousness about strategies such as best-in-class or ESG leaders and what they mean for tracking error and for returns. But that has changed. There is more willingness among clients to accept more risk, simply because they want more ESG. They prioritize having a better ESG score.”

Hamish: “Indeed. Benchmark-oriented investors may often think about ESG integration as a spectrum, where there is a clear trade-off between the level of integration versus tracking error, or active risk. As investors shift from exclusion-focused strategies towards embracing best-in-class approaches, as Rebecca said, that focus on active risk will naturally decrease. As an index provider, our goal is to support investors’ choice along the full breadth of that spectrum.”

Hamish, what are some of the specific portfolio changes that will take place in the SPDR STOXX Europe 600 SRI UCITS ETF as a result of the index replacement? What are some examples of large stocks that will be removed?

“The STOXX Europe 600 SRI index goes a few steps beyond the ESG-X index along the spectrum of ESG integration, based on both exclusions and a best-in-class approach.

“On the exclusions front, there are additional screens for military contracting, small arms, adult entertainment, alcohol, gambling, oil and gas (conventional and unconventional), nuclear power and high carbon emitters. These screens are based on some of the more stringent European labels that reflect a Socially Responsible Investing approach.

“With regards to the best-in-class approach, the SRI indices select the top 200 securities based on their ESG score and industry.

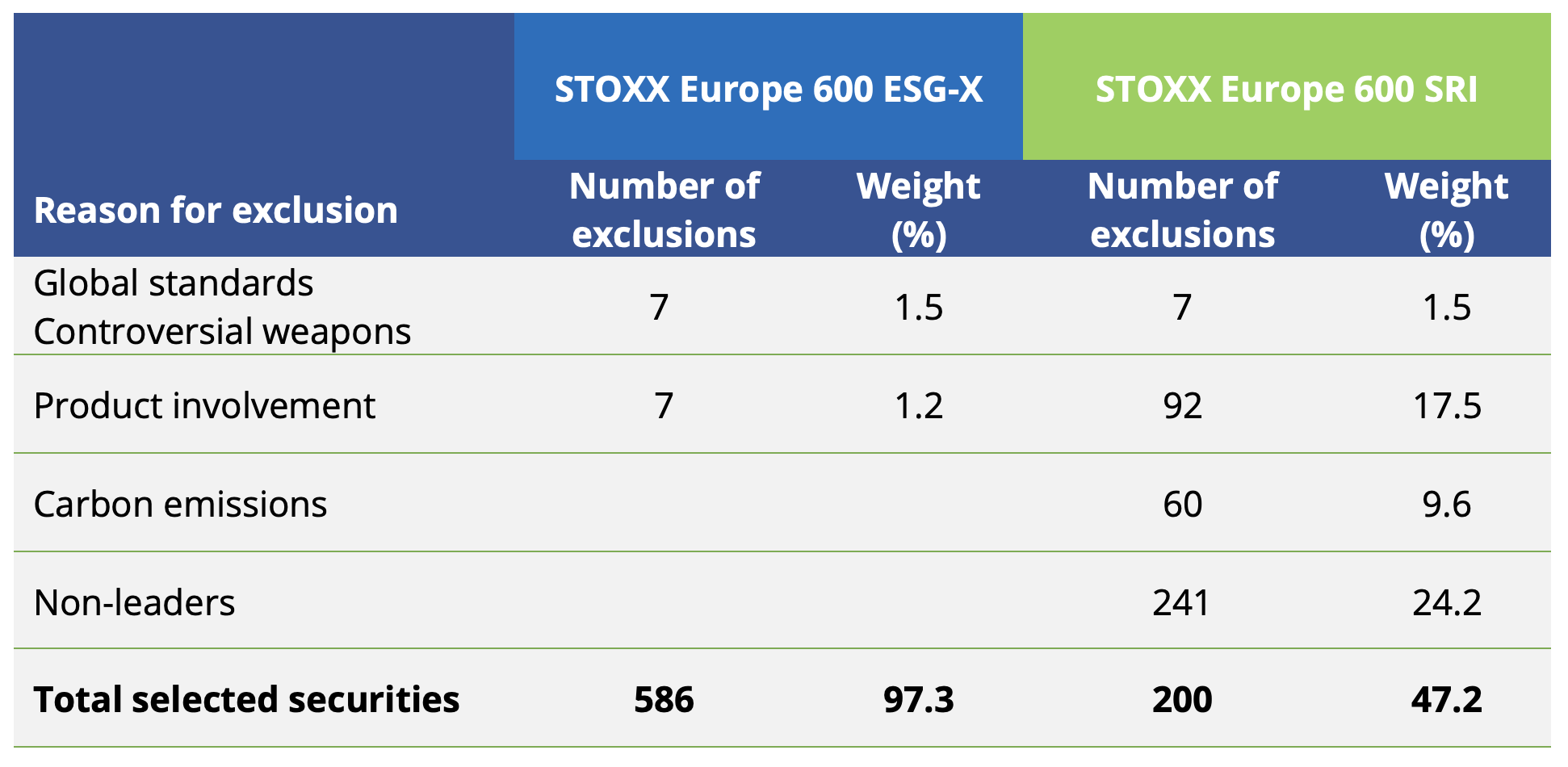

“The results can be seen in Table 1. Relative to the ESG-X, the SRI index excludes an additional 145 companies due to product involvement and carbon emissions. Another 241 companies are screened out due to their ESG scores. In terms of the larger stocks, some of the benchmark’s constituents that are not selected are LVMH, Linde, TotalEnergies, Diageo and HSBC.”

Table 1 – Composition comparison: STOXX Europe 600 ESG-X vs. STOXX Europe 600 SRI

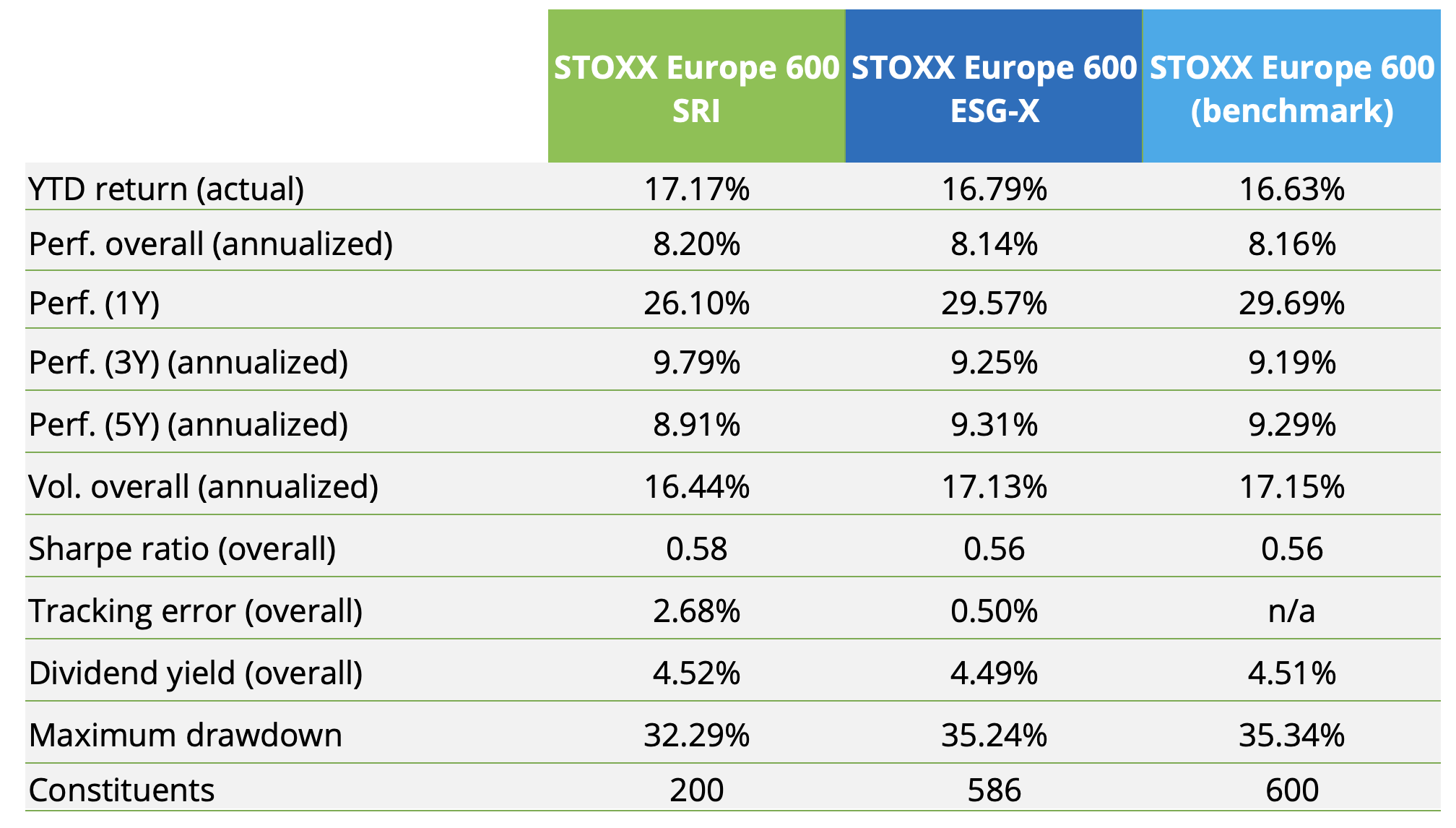

And, Hamish, how does the SRI index stack up against the ESG-X index and the benchmark in terms of performance?

“Given a level of ESG integration that results in a selection of only half the market capitalization of the benchmark, we would naturally expect the SRI index to run a higher level of tracking error than does the ESG-X index. This has indeed been the case, with the tracking error for the SRI index over a backtest period since 2014 resulting in 2.7%, compared to 0.5% for the ESG-X. As we said earlier, this level of tracking error is becoming more acceptable for benchmark-aware investors as they meet higher sustainability objectives.

“From a performance perspective, however, returns over the full period considered are not significantly different to those of either the ESG-X index or the benchmark.

“We also observe a lower level of overall risk, with the volatility of the SRI index at roughly 16.4%, versus 17.1% for the ESG-X index and 17.2% for the benchmark. These results align with the thinking that sustainable companies are inherently less risky, a claim that’s also supported by a narrower maximum drawdown for the SRI index.”

Table 2 – Risk and returns

You have both explained how clients’ ESG needs are shaping product development. How do you see this demand evolving in the next few years?

Rebecca: “ESG demand will continue to grow and change, and regulation will keep pace. At State Street Global Advisors, we take information and signals as guidance of how the market is moving, and we take it into account as we shape our offerings. We want to ensure that existing and new products respond to this evolution, and the change in the SPDR STOXX Europe 600 SRI UCITS ETF methodology is a good case in point. We are excited about the strong interest that ESG ETFs have attained in the last couple of years, and that interest keeps gathering pace. No doubt we’ll see more innovation and progress in this space.”

Hamish: “Investors’ ESG ambition continues to grow because their portfolios’ impact matters increasingly more. For many, impact is now another important consideration when analyzing performance, as are risk and returns. Yet each investor will see and approach ESG in a different, individual way. I mentioned earlier the spectrum where an investor can choose between ESG integration versus tracking error. At Qontigo, we have built an entire suite of sustainability indices to cater to this wide range of client needs. I agree with Rebecca: when it comes to ESG, more innovation and sophistication lies ahead in ESG index investing.”

1 The STOXX Europe 600 ESG-X index is based on the STOXX Europe 600 index, one of Europe’s key benchmarks, with standardized ESG exclusion screens applied. The screens will exclude companies that Sustainalytics considers to be non-compliant based on Global Standards Screening, or are involved in controversial weapons, are tobacco producers or that either derive revenues from thermal coal extraction or exploration, or, have power generation capacity that utilizes thermal coal.

2 The STOXX SRI (Socially Responsible Investing) Indices track the performance of a selection of STOXX Indices after a set of emission intensity, compliance, involvement and ESG performance screens are applied. Companies that rank in the highest 10% in terms of their emission intensities are not eligible for selection. Thereafter exclusion filters screen out companies for compliance based on Sustainalytics’ Global Standards Screening assessment and involvement in controversial weapons, tobacco, alcohol, adult entertainment, gambling, weapons (small arms and military contracting), thermal coal, oil and gas, and nuclear power. The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking securities in each ICB Industry until the number of selected securities reaches a third of the number in the parent index.