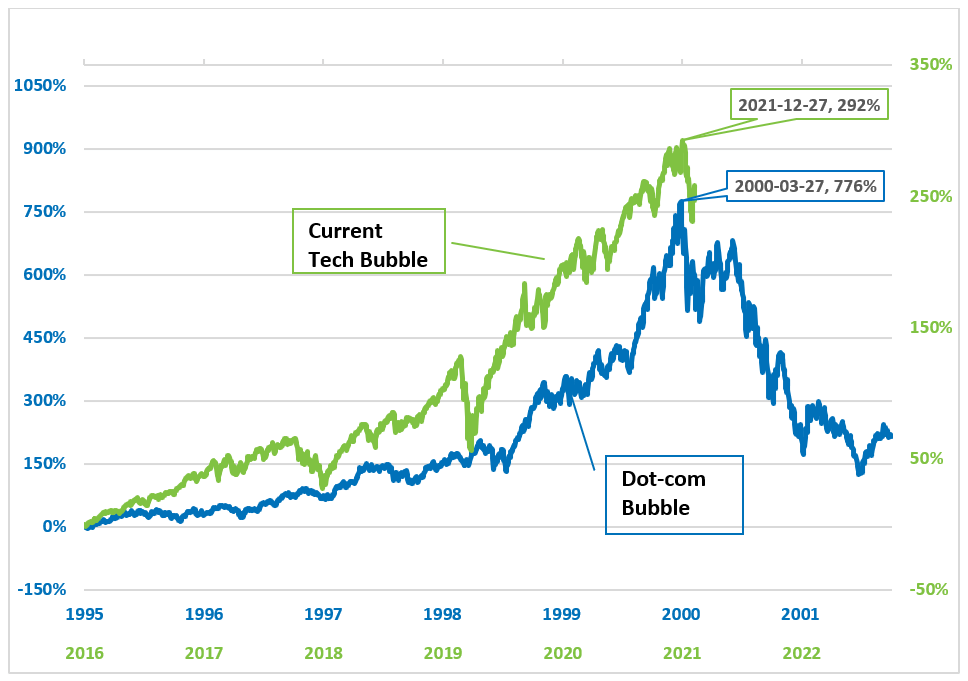

The collapse of technology stocks this past month may signal the end of another tech bubble, similar to the bursting of the dot-com bubble. In search of some insights, we compared the conditions that led to the formation of both the current technology bubble (2016-2021) and the dot-com bubble (1995-2001). In addition, we looked into the drivers of the dot.com burst, while also postulating on what may lie ahead, given the present-day profile of the US technology sector (Info Tech1).

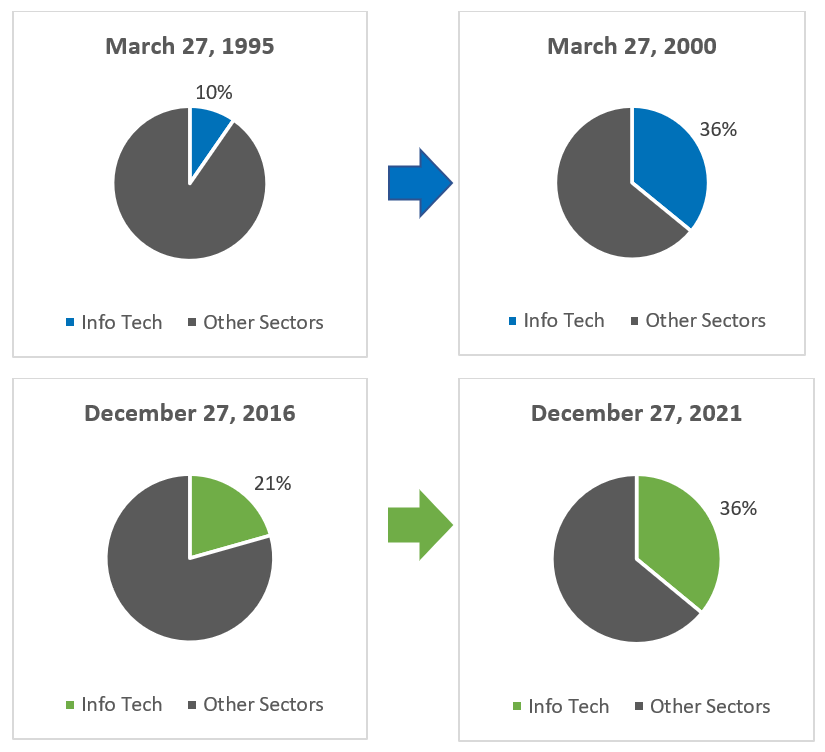

Technology stocks rose exponentially in the two years prior to the peaks of both the dot-com bubble (Mar. 2000) and the current bubble (Dec. 2021), resulting in the Info Tech sector representing about a third of the US market at the height of each bubble.

Figure 1. Info Tech cumulative daily return

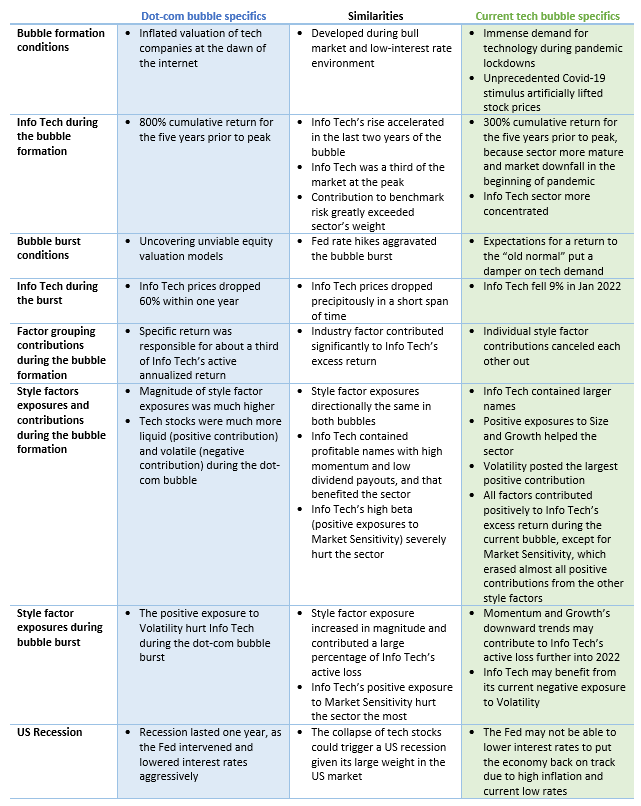

While the dot-com bubble was caused by unrealistically high stock valuations and lack of earnings, the current bubble was triggered by the pandemic restrictions and influx of liquidity from Covid relief packages. Fed measures had a significant role in the rise and demise of the tech sector during the dot-com bubble and the pattern now seems to be repeating. The table below summarizes the similarities and differences between the dot-com bubble and the current bubble.

The most alarming commonalities between the two bubbles are the weights of the Info Tech sector in the US market at the peak of each bubble, and the style factor exposures during the downturn. Given that Info Tech represents more than a third of the market, it alone could send the US into a recession if it collapses.

Info Tech weight fluctuations

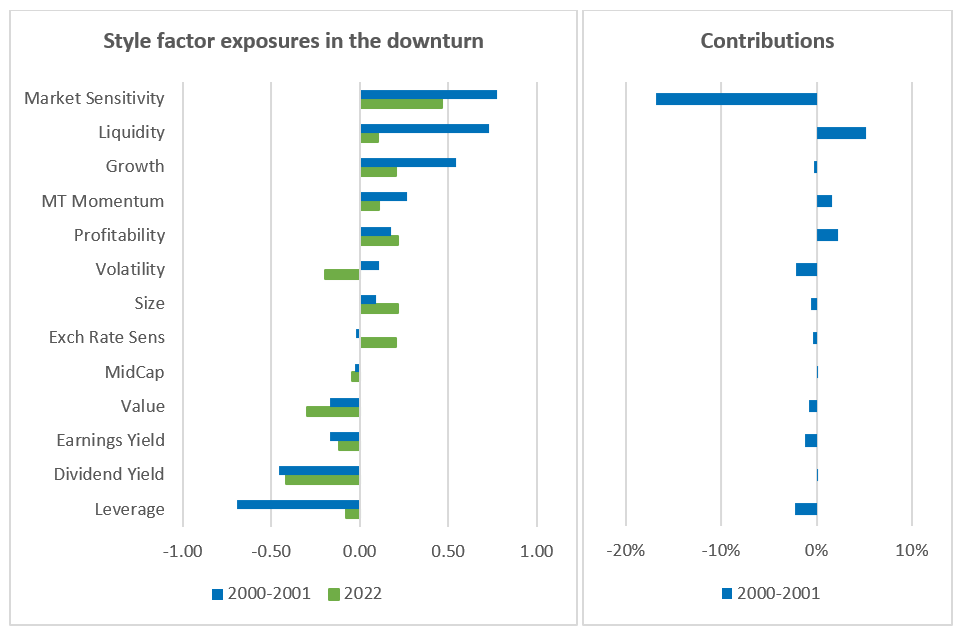

Style factor exposures increased in magnitude and contributed a large percentage of Info Tech’s active loss in the dot-com bubble and the current sector downturn.

Momentum and Growth’s downward trends may contribute to Info Tech’s active loss further into 2022, given the sector’s large positive exposure to these factors. Value and Earnings Yield could also to hurt Info Tech, since the sector’s exposures to both factors are negative, while the two style factors took off this year.

On a positive note, Info Tech may benefit from its current negative exposure to Volatility, because one would expect lower volatility stocks to perform better in a market downturn.

Style factor exposures and contributions during bursting bubbles

In conclusion, in the event of a US recession caused by the further collapse of Info Tech, the economic impact could be worse this time, because the Fed cannot use interest-rate cuts to put the brakes on the market decline, due to the current record-high inflation and low interest rates.

For a more detailed analysis of the characteristics of the two bubbles, see our paper: Another tech bubble about to burst? (Yes, and this one could be even worse…).

[1] This is the Information Technology sector in the Axioma US Top 1000 Market Portfolio using historical GICS for an accurate comparison.