The war in Ukraine has affected equity sectors in different ways. In recent articles, we have looked at the winners (Basic Resources) and losers (Financials, Consumer Discretionary) across industries since February 24.

There have also been divergent performances within same sectors. Take, for example, Technology, where chipmakers have profited from supply shortages, but manufacturers further down the value chain have fallen on concern that skyrocketing prices for those same input components will squeeze their margins.

If macroeconomic disruptions can cause havoc on the traditional sector-focused portfolio allocation, can they similarly affect thematic portfolios? The latter, after all, stride across industries as they target long-term, structural themes.

A new whitepaper1 from Christoph Schon, Senior Principal at Qontigo’s Applied Research team, argues that thematic investing can provide a more focused investment approach and even benefit in times of big macro shifts. Schon reviewed the performance of the STOXX® Thematic Indices during the three weeks starting on February 24, 2022 and found four indices stand out — both for their returns and because the themes they target have gained precedence over the period. These are:

- STOXX® Global Broad Infrastructure

- STOXX® Global Digital Security

- STOXX® Global Smart Cities

- STOXX® Global Smart City Infrastructure

Bucking the trend

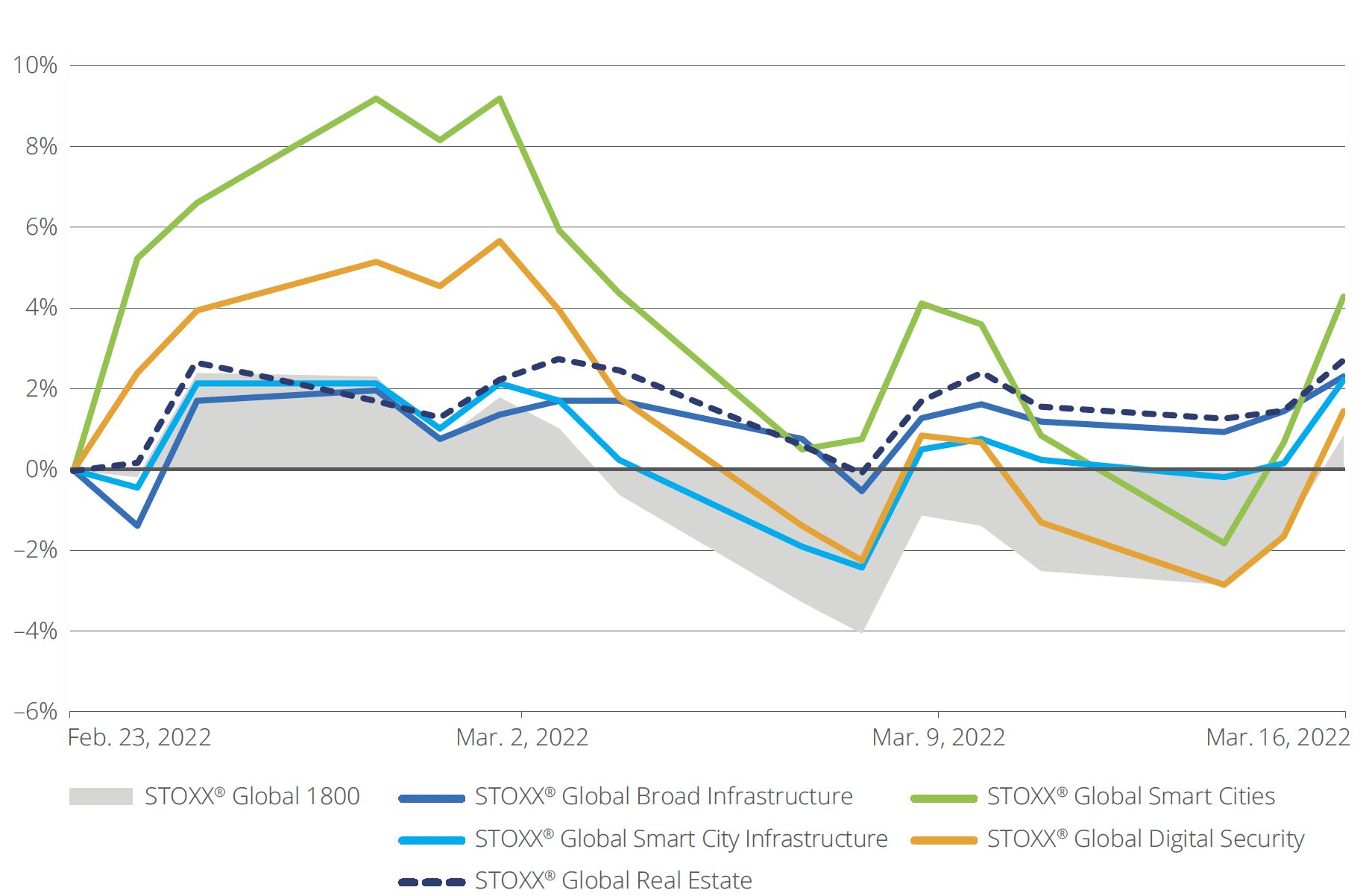

Figure 1, taken from the whitepaper, shows the returns of the four thematic indices since the start of the Ukraine war. The benchmark STOXX® Global 1800 Index is featured as a solid, light grey area.

Figure 1: Thematic index performance since close of February 23, 2022

The thematic indices’ outperformance, explains Schon, reflects emerging concerns triggered by Russia’s military offensive against its neighbor. These include an acceleration in consumer prices, the threat of cybersecurity attacks, a potential worsening of the backlog in the global supply chain and a spike in oil and gas costs.

The STOXX Global Digital Security and STOXX Global Smart Cities both have significant exposures to security software and equipment providers. The Smart Cities index has also profited from holdings in manufacturers of microchips and renewable energy equipment.

A blend of subthemes

The STOXX Global Smart City Infrastructure, additionally, incorporates a large exposure to real estate – a sector that has attracted investors’ interest as a hedge against inflation. As the whitepaper notes, the 10-year US Treasury break-even rate, which reflects the market’s inflation expectations, jumped from 2.6% on February 23 to nearly 3% on March 11. Other themes in the index that have strong momentum include waste management and recycling, cybersecurity and semiconductors.

“Thematic strategies offer the advantage of focusing on longer-horizon, structural changes – sometimes referred to as ‘megatrends’ – that cross the established boundaries of more conventional region-, country- or sector-based offerings,” writes the author.

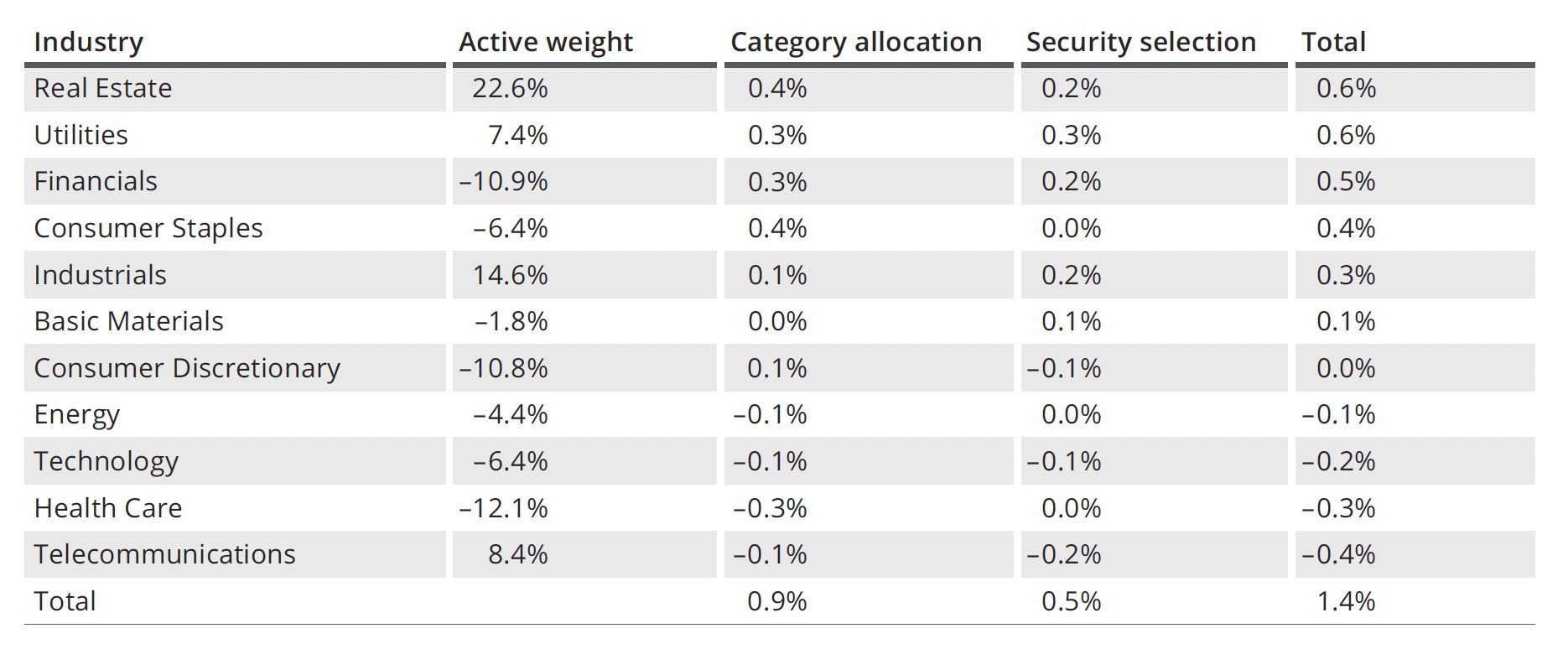

Schon examines the relative returns attribution of the STOXX Global Smart City Infrastructure by industry, to show that a winning theme can generate alpha from its sector allocation. The analysis appears in Figure 2 below. It shows that the total active return for the Global Smart City Infrastructure index in the 15 sessions through March 16 was 1.4 percentage points, of which 0.9 points came from sector over- and underweights, and 0.5 points from the securities chosen and their weightings.

Figure 2: Performance attribution of STOXX Global Smart City Infrastructure vs. STOXX Global 1800

Beyond Real Estate, the overweight to Utilities was accretive to active returns (positive industry allocation) as the STOXX Global Smart City Infrastructure index is exposed to the best-performing segment of the industry: waste and disposal services providers (positive security selection).

The underweight in Financials, meanwhile, also helped relative returns as the sector suffered from cuts in interest-rate expectations and concerns about loans and assets write-downs relating to the sanctions on Russia.

Stress test

It is said that thematic portfolios are future-proofed as they track structural megatrends that are less dependent on the cyclicality of the global economy. Yet, in the short term, macroeconomic swings can alter investors’ risk appetite. Schon runs a stress test2 on the Global Smart City Infrastructure Index to assess the hypothetical effect by sector of five macro shocks:

- a rise of 0.5% in the 10-year US Treasury nominal yield

- a rise of 0.5% in the break-even inflation rate

- an additional 25-basis point hike in the Fed Funds target rate beyond what is priced through 2022

- a 20% drop in the oil price

- a 10% decline in the cost of non-energy commodities

The stress test results show that most of those shocks would drive further gains in the Global Smart City Infrastructure Index. Readers can find the outcome of that analysis in the whitepaper — including which sectors would likely generate the strongest returns.

Conclusion

The macroeconomic and financial repercussions of the developments in Ukraine have presented an opportunity to analyze the diverging performances of sector-based and thematic portfolios. Many thematic strategies allow investors exposure to specific industries while profiting from structural changes taking place over long periods. Qontigo’s latest whitepaper shines a light on the differences between the two approaches and brings out the tools available to visualize the equity exposure and risks in both instances.

1 Schon, C., ‘Thematic investing in the current climate – A more focused approach to sustainable and future-proof investing,’ Qontigo, March 2022.

2 The stress tests and simulated returns were run with Axioma Risk. The betas and covariances for the analysis were calibrated using the daily returns since September 21, 2021.