Kiwoom Asset Management has launched an ETF that invests in US companies most exposed to the booming global ETF industry.

The fund tracks the STOXX® USA ETF Industry, an index of 20 American companies with the highest revenue derived from businesses involved in the design, issuance, sale and trading of ETFs around the world.

The global ETF industry ended 2021 with a record USD 10.3 trillion in assets and all-time high net inflows of USD 1.29 trillion, according to ETFGI. Inflows last year represented a 69% increase from those in 2020. Global ETFs gathered USD 123.4 billion of net inflows in March 2022, the 34th consecutive month of positive flows.

BlackRock Inc., the world’s largest ETF issuer, reported on January 14, 2022 record ETF flows and a 20% increase in earnings for 2021. The asset manager has forecast the ETF industry may reach USD 14 trillion in assets under management by 2024.1

Far from slowing, growth in the ETF industry continues unabated, fueled by renewed drivers and as more investors, retail and institutional alike, turn to the cost-efficient and practical vehicles to implement investment strategies and manage portfolios. Among the latest developments spurring growth are factor-based and thematic strategies, funds covering fixed-income markets, new strategies following ESG principles and so-called active ETFs.

Selection criteria

Stock selection into the STOXX USA ETF Industry index starts with all securities in the STOXX® USA Total Market Index that belong to the following ICB sectors: Asset Managers and Custodians, Financial Data Providers, Diversified Financial Services, Investment Services, Professional Business Support Services and Software.

From there, stocks that have an aggregated revenue exposure of at least 50% from the following 12 RBICS2 associated sectors are chosen:

- Alternative Exchanges and ECNs

- Diverse Asset Management and Financial Advisors

- Equity Fund Managers

- ETFs and Unit Investment Trust Managers

- Financial Reference Data Content Providers/Sites

- General Professional Content Providers and Sites

- Institutional Financial and Research Content Sites

- Multi-Type Financial Data Content Providers/Sites

- Other Clearing and Settlement Services

- Other Traditional Investment Product Managers

- Retail Advisory and Brokerage Services

- Securities Exchanges

Subscribe to receive related news and announcements

This revenue-based investment approach and the use of a very granular dataset that provides a detailed examination of companies’ business lines accurately captures the targeted theme. The largest 20 constituents on the selection list, based on free-float market capitalization, are selected for final index composition.

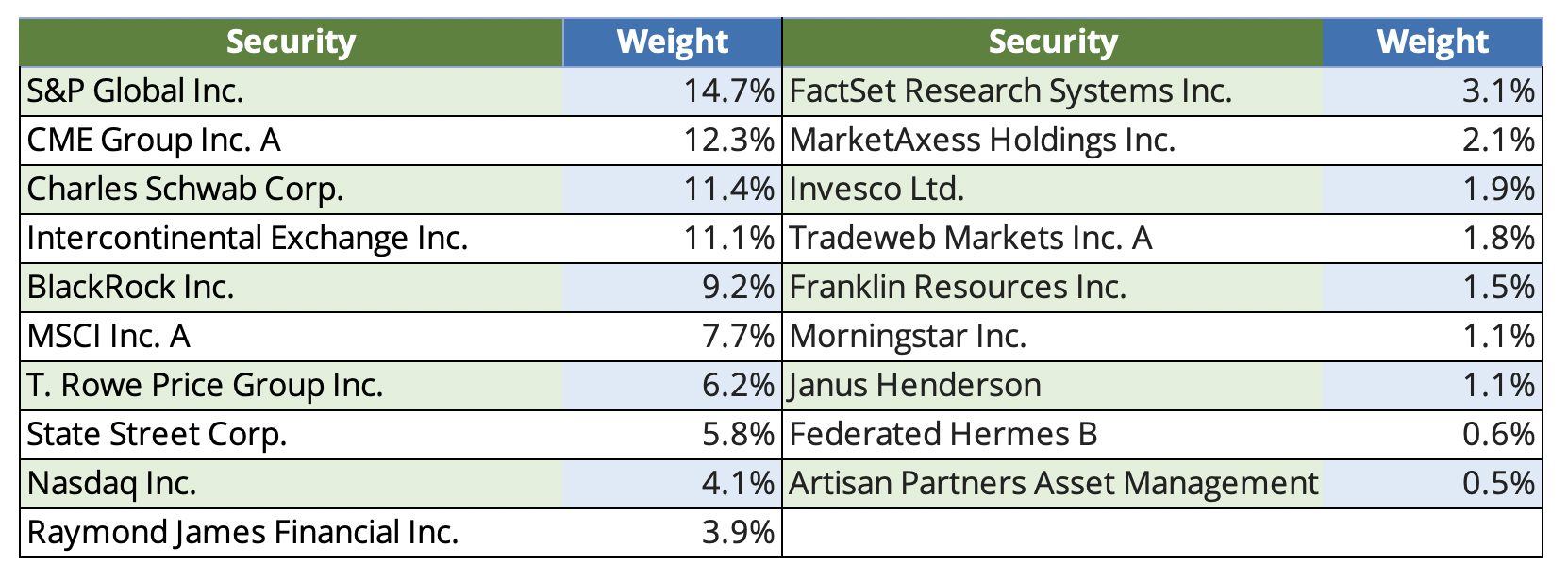

Figure 1: STOXX USA ETF Industry — Composition

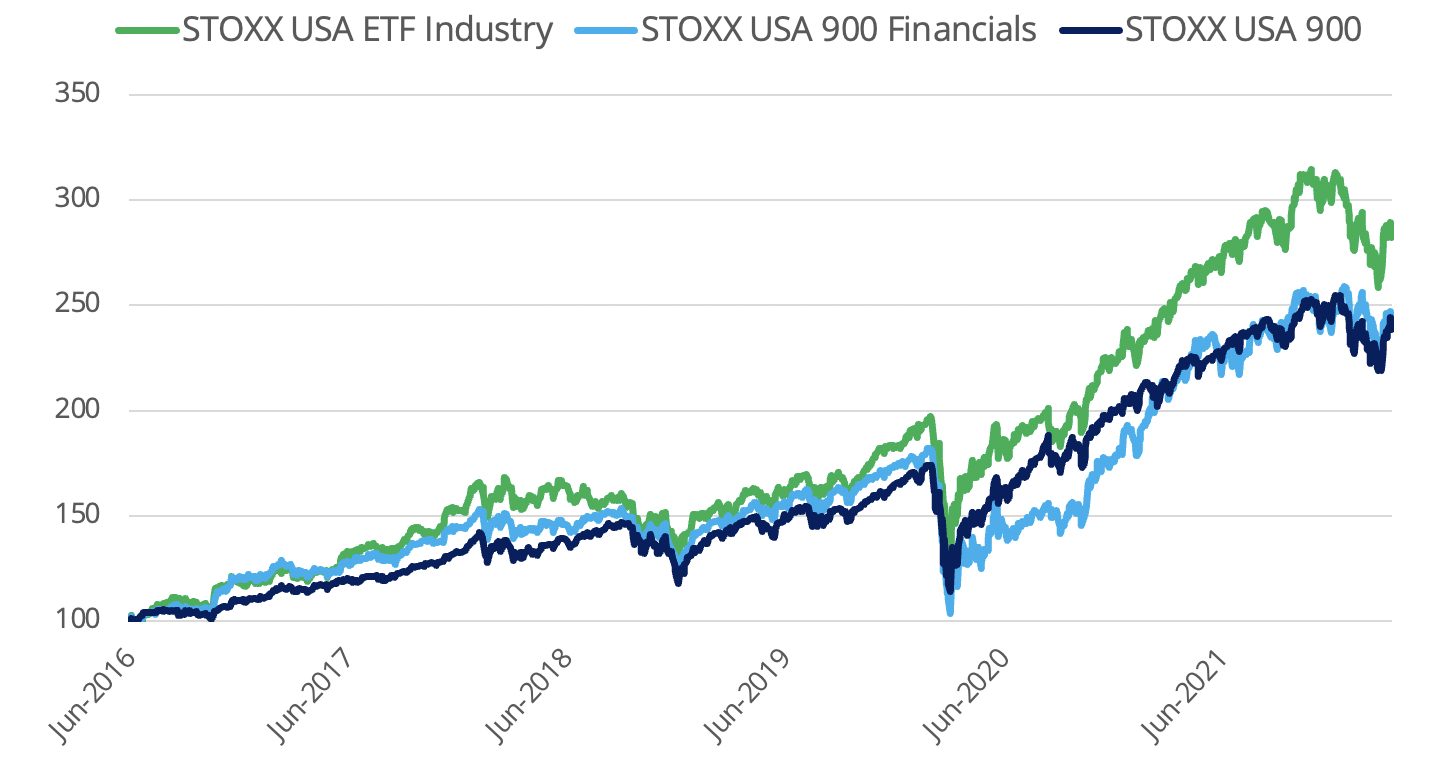

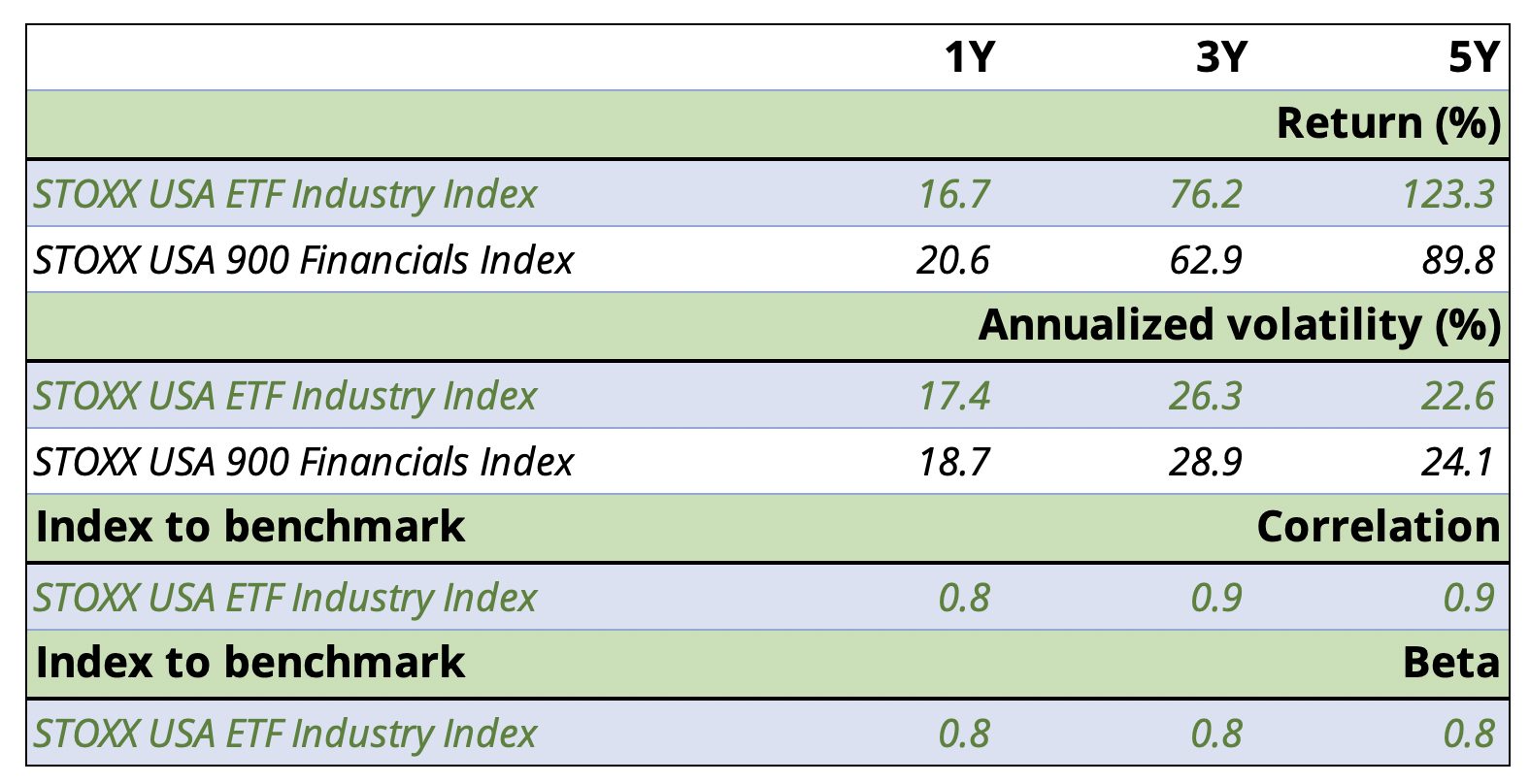

Figures 2 and 3 show the ETF industry has outperformed the broader US financial sector in the past three and five years — and has done so with lower volatility.

Figure 2: Performance

Figure 3: Risk and return comparison

“Thematic strategies continue to offer efficient ways to target trends with potential above-market economic upside and which cannot be replicated using traditional sector indices,” said Charlene Low, Senior Principal, Strategic Partnerships & ETPs at Qontigo. “As is the case with our entire thematics range, the STOXX USA ETF Industry’s portfolio construction relies on a systematic methodology that is rules-based and transparent. We are excited to have developed this unique solution with Kiwoom, for its clients.”

“ETFs have been the fastest-growing investment vehicle in recent years, and we expect this global trend to continue as more investors seek out ETFs for their convenience, cost efficiency and transparency,” said Kihyun Kim, Chief Investment Officer at Kiwoom Asset Management. “Amid this trend, we are very excited to launch an ETF that is the first of its kind in Korea and provides exposure to US companies leading the flourishing ETF industry worldwide. Beyond this second collaboration with Qontigo, we expect many more innovative products to come from this partnership.”

Last December, Kiwoom licensed the DAX® from Qontigo to issue South Korea’s first ETF tracking Germany’s blue-chip benchmark.

ETF leader in South Korea

Established in 1988, Seoul-based Kiwoom Asset Management has USD 38 billion in assets under management. The company has ventured into the ETF space under the brand name ‘KOSEF’ since its launch of South Korea’s first ETF in 2002 — a fund that tracks the benchmark Kospi200. Kiwoom Asset Management provides a full range of financial management services for clients in the Asia/Pacific region. With its investment capability, Kiwoom Asset Management has been a pioneer in providing innovative investment solutions to both individual and institutional investors.

1 Source: BlackRock, Global Business Intelligence, as of June 2021.

2 The FactSet Revere Business Industry Classifications System (RBICS) is a comprehensive structured taxonomy giving users a precise classification of global companies and their individual business units.