Trading in STOXX and DAX derivatives on Eurex had one of the busiest periods in the past decade during the first half of 2022, as investors turned to the instruments to hedge and manage portfolios amid a broad market sell-off.

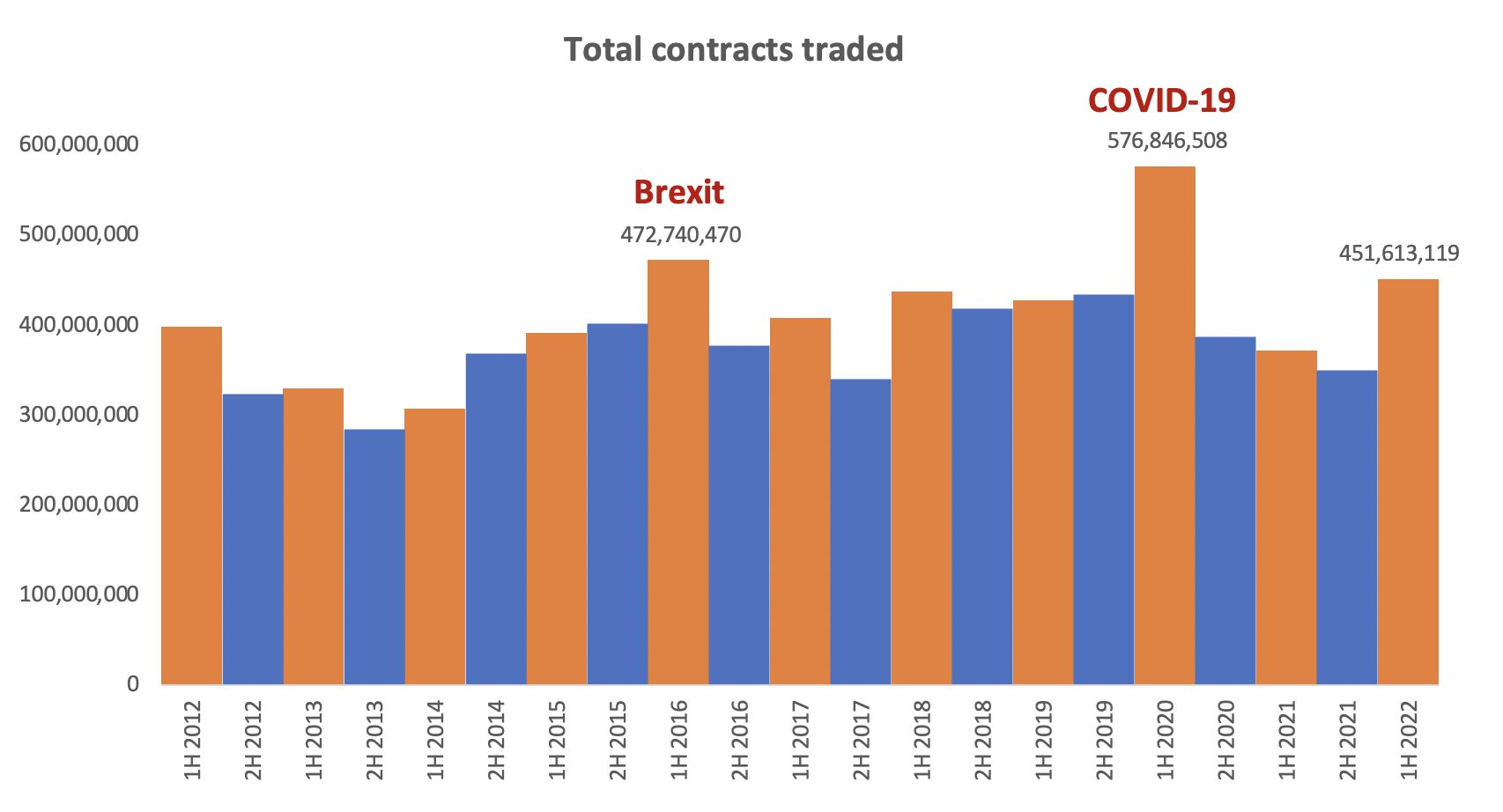

Over 450 million futures and options linked to a STOXX or DAX index traded between January and the end of June this year, the third-highest volume for any calendar half-year period going back to 2012. Only the first half of 2020, when COVID-19 hit markets, and the first half of 2016, when Brexit shocked market participants, saw more activity in the contracts, Eurex data show.

Figure 1: Half-year STOXX and DAX derivatives trading volume on Eurex

Highly liquid instruments such as futures and options on the EURO STOXX 50® index, EURO STOXX® Banks index and DAX®, allow investors to take directional views on markets with all the benefits of a centrally cleared market. Spurred by a 21% decline in global markets this year1, the derivatives were also used to protect portfolios from the downtrend.

“When markets hit a snag of the type we saw this year, deep liquidity and transparency become of paramount importance,” said Sean Smith, Managing Director for Index Licensing at Qontigo. “Futures enable precision hedging, and options give investors an easy way to gain leverage and buy insurance in markets undergoing larger-than-average swings. In essence, derivatives tend to be the go-to market for both strategic and tactical moves in such an environment.”

A total of 451.6 million STOXX- and DAX-branded derivatives traded in the first six months of 2022, 21% more than in the year-earlier period, the data show.

Trading in EURO STOXX 50 index futures, the most widely negotiated instruments on Eurex, jumped 23% to 145.3 million contracts in the first half of this year from a year earlier. The number of EURO STOXX Banks index futures that exchanged hands over the period rose 26% to 46.6 million. Turnover in DAX futures climbed 30% to 9.9 million contracts.

The number of traded futures on the EURO STOXX 50® Volatility (VSTOXX®) rose 7% to 7.7 million relative to the first half of 2021. The VSTOXX tracks prices on EURO STOXX 50 options and hence reflects market expectations of near-term up to long-term volatility.

1 As measured by the STOXX® Global 1800 index in total returns and in dollars.