- The Japanese yen and Swedish krona have fared worse than the pound, but their volatilities have retreated

- UK Exchange Rate Sensitivity Returns have been highly negative

- UK leads the pack in 12-month return, but only in local currency

With the British pound in the spotlight this week as it hit record lows against the US dollar, this week’s highlights will focus on UK markets, in particular the currency’s move, its impact on the Exchange Rate Sensitivity style factor as well as UK Equity Index returns

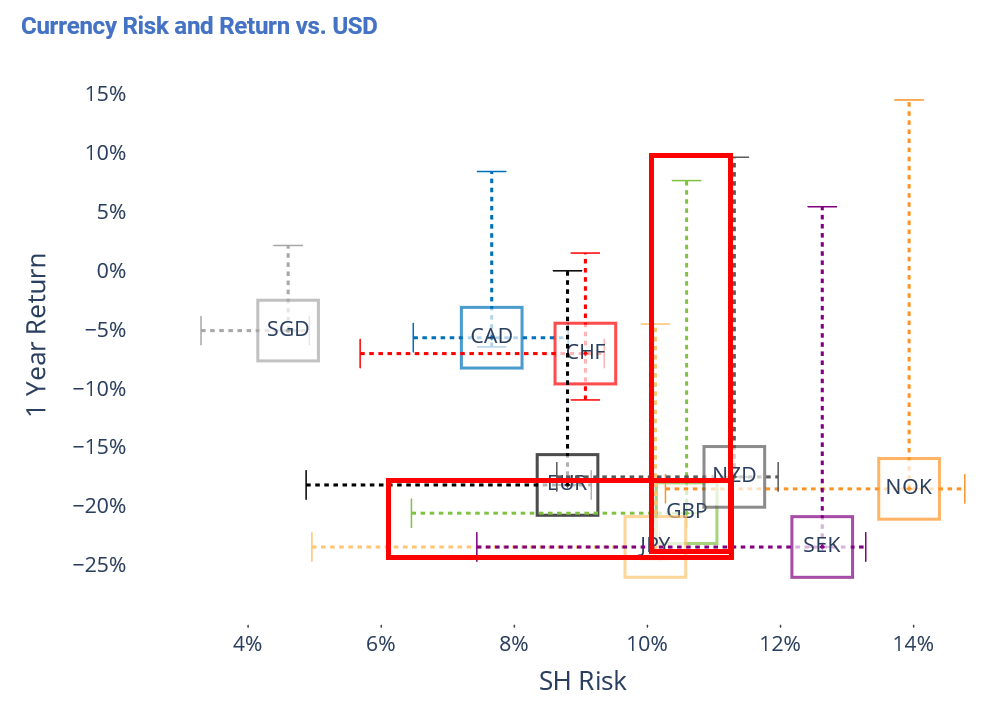

The Japanese yen and Swedish krona have fared worse than the pound, but their volatilities have retreated

While the pound’s decline led it to new low territory versus the dollar, JPY and SEK have actually seen worse returns over the past 12 months. Interestingly, most developed and emerging market currencies have retreated from the high end of their 12-month volatility ranges, including SEK and JPY (slightly). But GBP, although less volatile than a few other currencies (NOK, SEK and NZD), hit a 12-month volatility high last week. All currencies remain down versus the dollar as compared with a year ago. My colleague Christoph Schon also addresses recent currency moves in his weekly multi-asset-class highlights. [insert link]

See graph from the UK Equity Risk Monitor as of 23 September 2022:

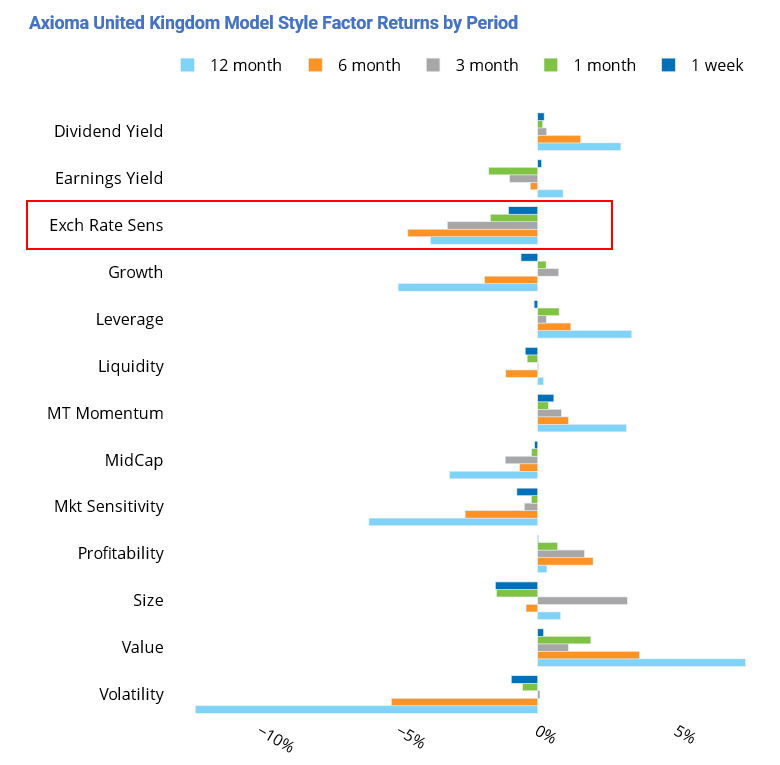

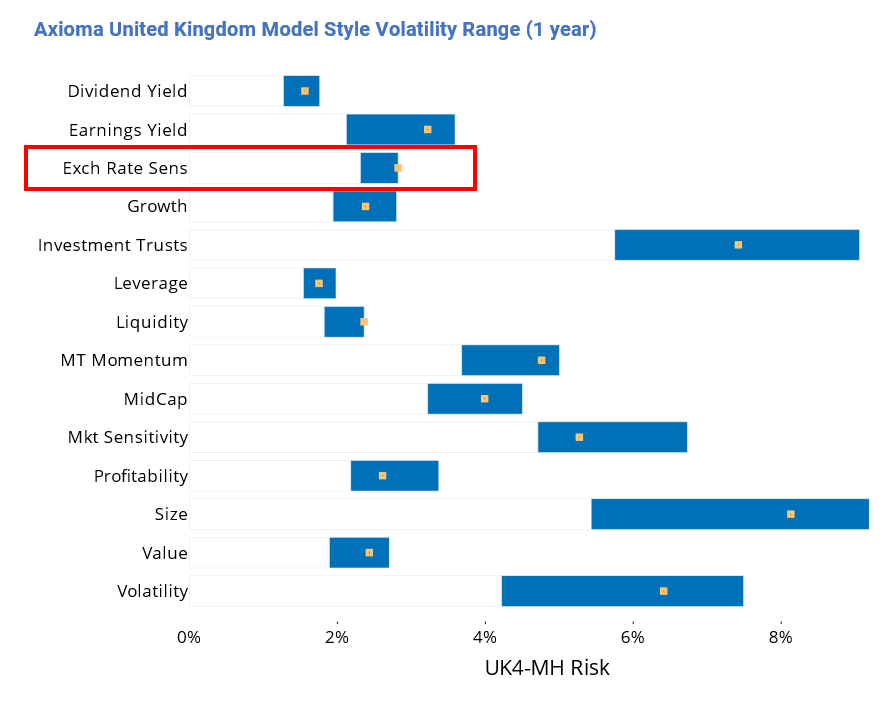

UK Exchange Rate Sensitivity Returns have been highly negative

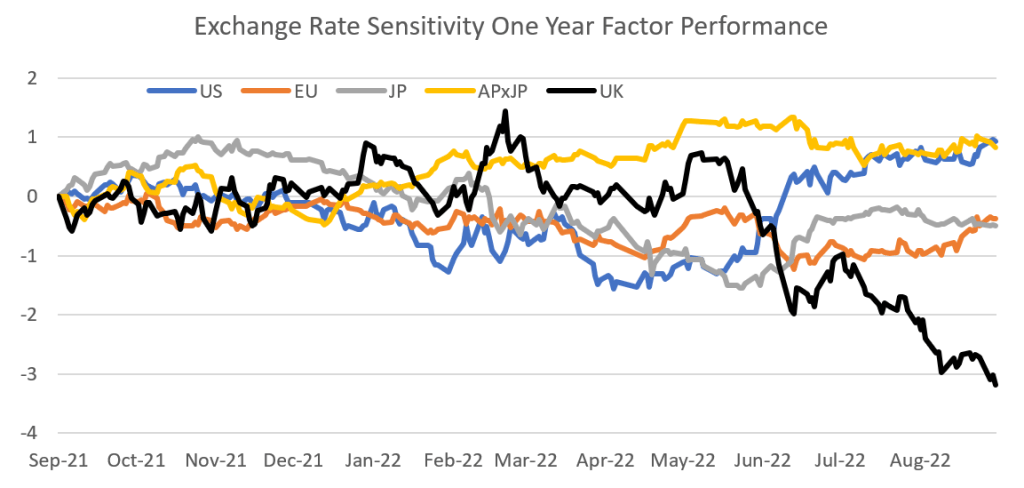

A few weeks ago we wrote about this factor’s performance in the US, (see here) but now we turn to how it has fared in the UK. The factor measures a stock’s sensitivity to movements in its home currency relative to a basket of currencies, and in a way can be thought of as the distinction between returns of exporters and importers. A strong currency should favor importers, whereas exporters should benefit from a weaker currency.

Returns to the UK model’s Exchange Rate Sensitivity factor have been highly negative over the past week, month, three months, and six months. In each of those periods, the return has been more than two standard deviations below the long-term average. In addition, the factor’s return has been far worse in the UK than in other major regions, especially in the last five or six months. Its volatility has also hit a 12-month high, whereas volatilities of other factors have retreated.

See graphs from the UK Equity Risk Monitor as of 23 September, 2022:

The following chart does not appear in the equity risk monitors, but is available on request:

UK leads the pack in 12-month return, but only in local currency

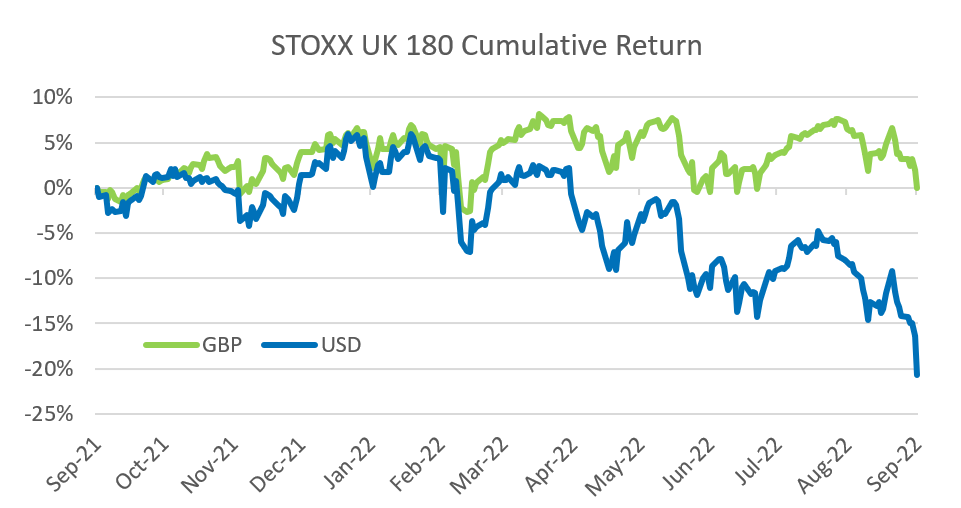

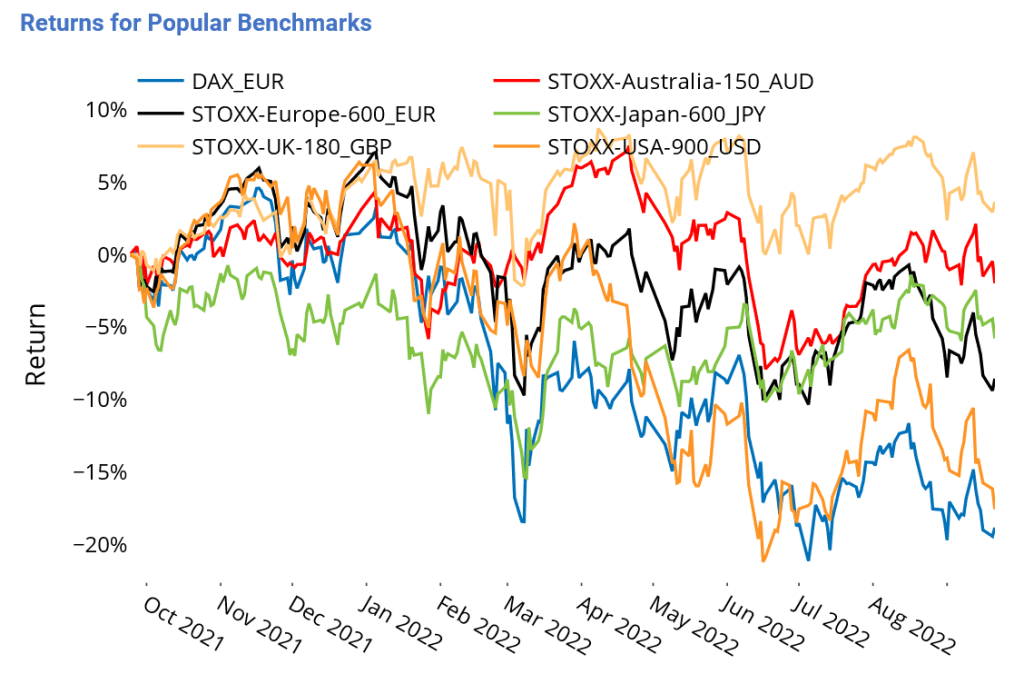

The UK leads many of its large-country peers in 12-month return despite the uncertainty in the UK driven by the declining pound, political turmoil and prediction of an upcoming recession by the Bank of England,. The UK equity market in GBP is actually up over the 12-month period, although it is down a bit year to date. Local investors may be wondering why the market has not reacted to turmoil as many other markets in their local currency have.

The picture becomes quite different for an investor with a different base currency. The STOXX UK 180 Index denominated in USD is down more than 20% over the past 12 months. In addition, the level of predicted volatility according to the Axioma Worldwide medium-horizon fundamental model is currently about five percentage points higher when based in USD as compared to when it is based in GBP. Investors in the UK market may want to be aware of these discrepancies as they evaluate their performance this year.

See graph from the UK Equity Risk Monitor as of 23 September, 2022

The following chart does not appear in the equity risk monitors, but is available on request: