European investors increased their use of exchange-traded funds (ETFs) further last year, according to an annual survey from Greenwich Associates,¹ with more of them resorting to the funds to pursue environmental, social and governance (ESG) and smart-beta strategies.

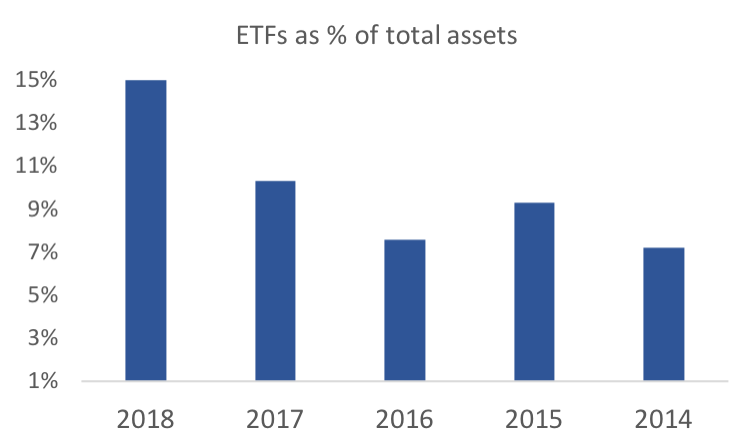

The average ETF allocation among institutions participating in the 2018 European Exchange-Traded Funds Study increased to 15% of total assets, from 10% in 2017 and 7.6% in 2016, according to the study. (Table 1)

Table 1 – European institutions step up ETF investments

A total of 44% of participants in the 2018 study use ETFs as a primary vehicle to address ESG — up from one third in 2017. Previous surveys did not collect data on the topic. Nearly half of all respondents expect to have at least 50% of their assets managed with ESG criteria within the next five years.

Fast-changing market environment

For 2018, Greenwich highlighted three drivers behind increasing ETF utilization: ESG adoption, the desire to lower costs, and a volatile market that prompted demand for quick and liquid portfolio construction to prioritize risk management as opposed to single-stock or active-fund investing.

“Institutional allocations to exchange-traded funds rapidly grew last year, driven in large part by investors repositioning their portfolios in the face of an increasingly volatile and fast-changing market environment and the continued shift of institutional assets from active management to index strategies,” Andrew McCollum, managing director at the research firm, which is based in Greenwich, Connecticut, wrote in the study.

Continued growth for smart beta

For the survey’s fifth edition, Greenwich Associates interviewed a total of 127 institutional fund investors, asset managers, insurance companies and discretionary wealth managers between October and December 2018.

The growing popularity of factor investing was also reflected in the survey. Two thirds of study participants invest in factor-based or so-called smart-beta ETFs. That compares with 31% of institutions in 2017, 26% in 2016 and 21% in 2015.

While 63% of smart-beta users in the latest survey said they expect to hold allocations stable in the coming year, 35% expect to increase them. Only 2% foresee reductions.

A total of 52% of asset managers and 38% of institutional investors who use smart beta are invested in multi-factor ETFs, the most popular strategy for both investor categories. For insurance companies, the most popular smart-beta ETFs are minimum volatility and other single-factor ETFs. For wealth managers, it is single-factor other than low volatility, and dividend funds.

Versatility drives usage

The latest survey is in line with findings from previous years, showing that investors are turning to ETFs to gain traditional exposure to markets and for tactical or transitional tasks. The share of investors reporting average ETF holding periods of one year or longer — which Greenwich said is a general threshold for an investment to be considered ‘strategic’ — increased to 49% from 47% in 2017.

Indeed, last year the share of those using ETFs for ‘strategic’ reasons surpassed those who use them for ‘tactical’ goals, the survey showed.

Passive investing has grown across regions in recent years as investors search for low-cost and versatile investment platforms. According to Greenwich calculations, ETFs lured $316 billion globally in 2018, the second-biggest year ever, only behind the $467 billion recorded in 2017.

The value of money invested in the funds grew to a record $4.79 trillion at the end of December, from $4.76 trillion in 2017, according to data from BlackRock.2

No sign of abating

Institutions mentioned ease of use, speed of execution/exposure, market access, attractive fees and liquidity — in that order — as top reasons for buying ETFs.

Growth in ETF usage seems poised to continue in 2019. Almost 40% of European institutions currently investing in ETFs plan to add to allocations in the coming year, the Greenwich Associates survey found.

1 Greenwich Associates, ‘In Turbulent Times, European Institutions Turn to ETFs,’ Feb. 18, 2019.

2 BlackRock Global ETP Landscape,’ December 2018.