Potential triggers for sentiment this week1 :

- US: Earning reports from BoA, Goldman Sachs, J&J, P&G, Netflix, Tesla, AT&T, Amex, Snap, and Verizon.

- Europe: UK inflation data.

- APAC: The 20th National Congress of the Chinese Communist Party takes place; Chinese Q3 GDP growth date, industrial production and retail sales for September. Japan inflation data.

- Global: Russia seems to be at a crossroad in Ukraine; one road leads to investors’ best-case scenario, the other one to their worst-case.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

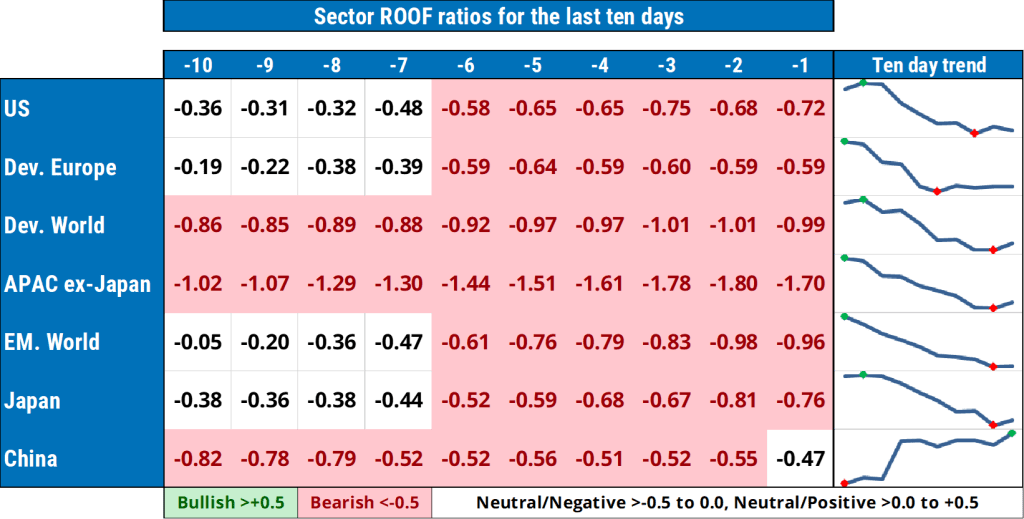

Summary of changes in investor sentiment from the previous week:

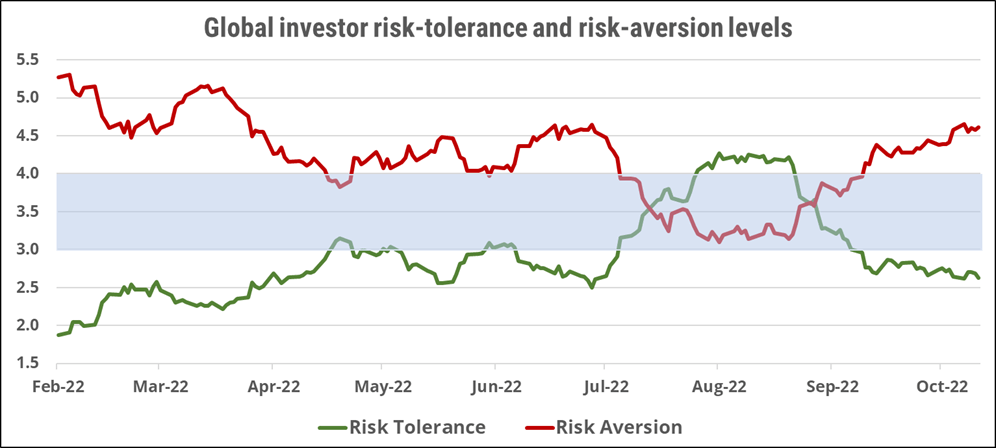

- Investor sentiment ended the week deeply bearish in all markets we track except China, which managed to recover (just) to very negative levels by Friday. As we have seen before, a bearish sentiment combined with negative news results in overreaction. Market activity since the US CPI data release was like watching a video of Jackson Pollock drip-painting, then watching it in reverse as he tries to get the spillage to flow back into the jar.

- According to Dow Jones Market Data Services, last Thursday was the first time in its history that the Dow Average both “fell at least 500 points and rose at least 800 points in a single day”. It was also a frightening demonstration of the way very emotional (bearish) investors, in a highly uncertain environment, can abandon the cherished ideals of prudent investing and plunge, willingly and unwittingly, into the darkness of the herd instinct.

- Investing is forecasting, but every forecast suffers from the forecaster’s temporal bias, sometimes reflecting their sentimental state rather than the reality of the situation. For bearish investors, tragedy is the preferred genre when reading the news, and while time traditionally takes care of unpleasant memories, those of the COVID-19 drawdowns have not yet left the collective unconscious.

- Put another way, the less visibility there is, the harder investors look for signals, and the more they react to them. But really, they are just second-guessing the Fed while shooting the monetary breeze, forgetting that speculation is not an equal opportunities employer. Last Thursday, the rigor of investment discipline appears to have been merely optional. An uncertain investment environment, combined with extreme volatility and a bearish sentiment, meant stock prices were no longer driven by the demands of a once plausible investment thesis (a.k.a., caveat emptor).

- Risk tolerance cannot be taken out of context and should be judged by the circumstances of its timing. At times of high uncertainty, risk-taking resembles gambling, and when predictability is confidently achievable, risk-taking is more akin to investing. In the current environment, as last Thursday’s market action demonstrated, nothing can be turned and worn inside out with greater ease than an investment thesis. Don’t believe every rally you see.

- On the bright side, volumes remain subdued, indicating that most (prudent) investors remain, as they say in the submarine world, at periscope depth. They have concluded that there are simply too many unknown unknowns, with potentially large binary consequences on their portfolios, for them to be anything but risk-averse for the time being.

Jump to a specific market

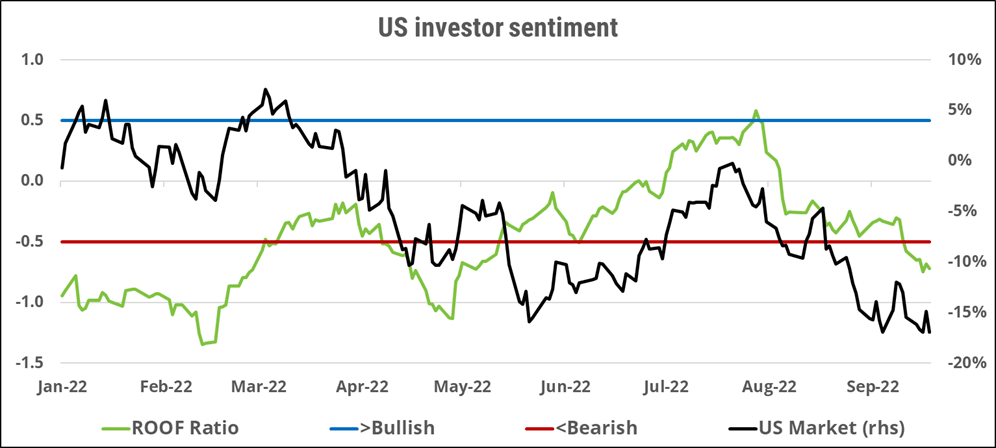

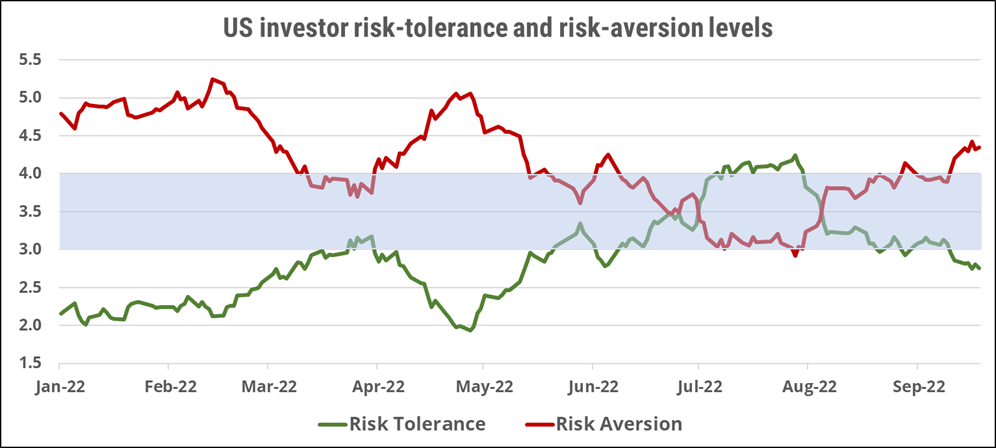

US investor sentiment

Sentiment among US investors (green line) fell deeper into a bearish mood last week following a worse-than-expected inflation report. As the (global) macro and geopolitical picture continues to disappoint investors, it will be up to corporate CEOs to try and lift the mood back up with their earnings report and, more importantly, their forward guidance. Company-specific news will dominate sentiment this week, along with a few speeches from central bank officials. At this heightened sentimental stage (very bearish), investors need more visibility, not more uncertainty – pleading the Fifth is not an option for CEOs, who will need to lift the veil of ignorance and reassure investors that they have a plan for navigating through the unchartered waters of stagflation and geopolitical conflict. Risk aversion is now substantially higher than risk tolerance, increasing the likelihood of further downside overreactions to negative news in the coming days. And with the next rate fixing meeting only two weeks away, most investors are likely to remain on the sidelines, unless forced to react to an unexpected, negative news.

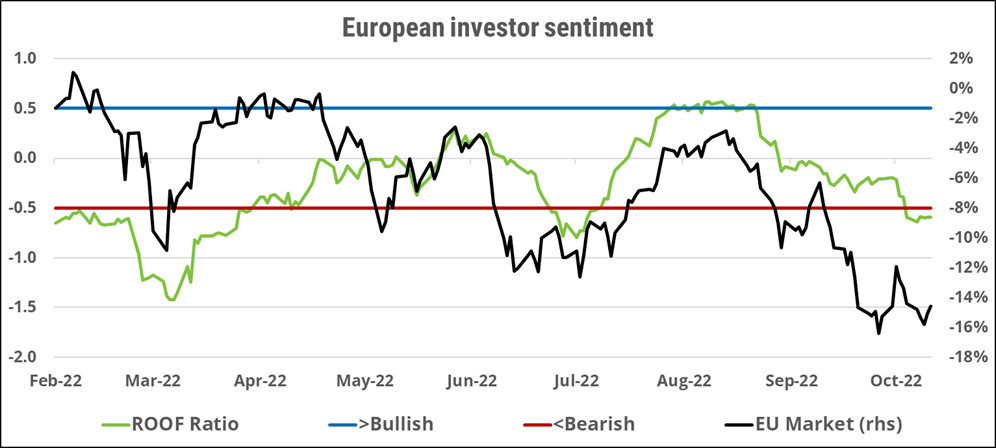

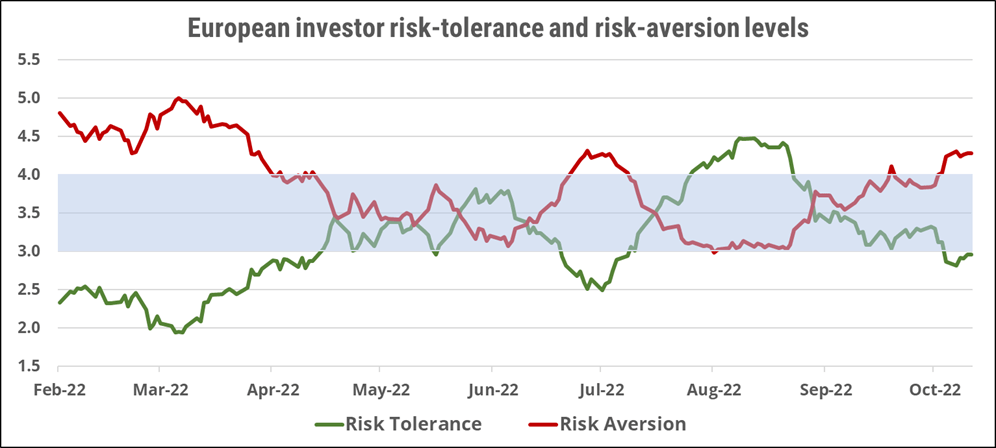

European investor sentiment

European investors’ sentiment (green line) ended last week bearish for the second week in a row, but the level of bearishness didn’t worsen. Volumes indicate that most investors are still choosing to sit on the sidelines until more visibility returns to both the macro and geopolitical picture. The ongoing fiscal saga in the UK, social unrest (strikes) in France, surprising oil production cuts by OPEC+, and a recent escalation in the war in Ukraine is keeping uncertainty levels at a record high. Unhealthy rumblings in the bond market, and repeated warnings about the global economy from the IMF and the World Bank, are helping to keep investors at bay. The danger for markets in the short term is that the macro picture becomes clearer, and investors do not like what they see. We could then experience similar selling volumes as those in February and March of this year.

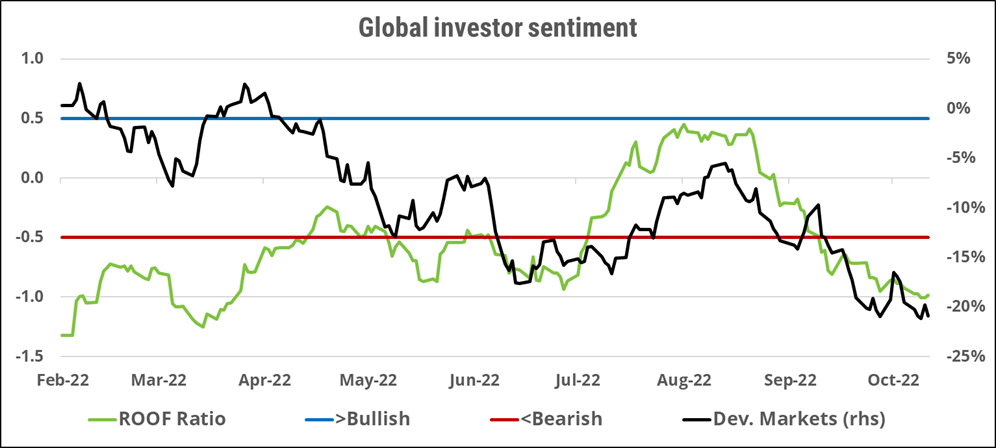

Global developed markets investor sentiment

Sentiment among global developed-markets investors (green line) ended last week slightly more bearish than the previous week as they continue to contend with increasing currency volatility and higher hedging costs. Risk-aversion levels remain well above risk-tolerance ones, increasing the probability of a downside overreaction to further negative news. As with European markets, volumes remain much lower than at the start of the year and have been on a declining trend since April, meaning that in the near term, there remains a large downside risk for markets if those investors on the sideline get triggered into selling their risk assets by a negative surprise. The latter could come from too many sides: earnings, monetary policy, energy crisis, or further escalations in the war in Ukraine. Caution remains the modus operandi at this time as sentiment has not yet reached peaked bearishness.

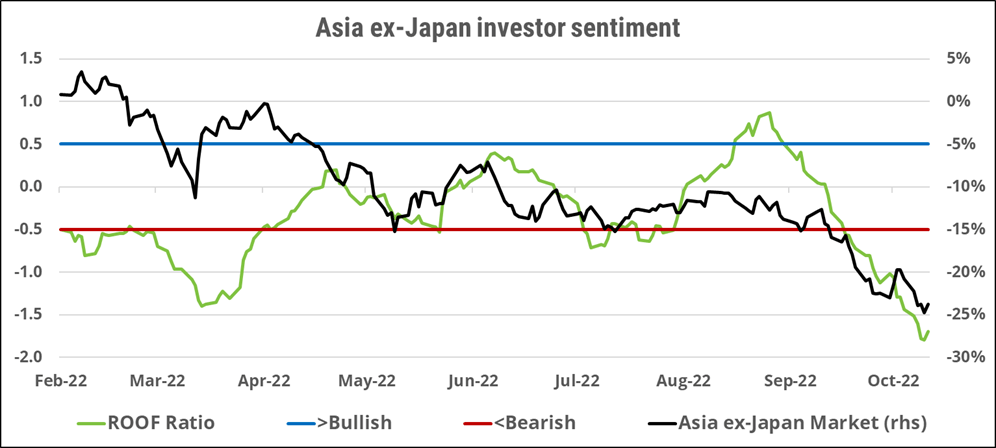

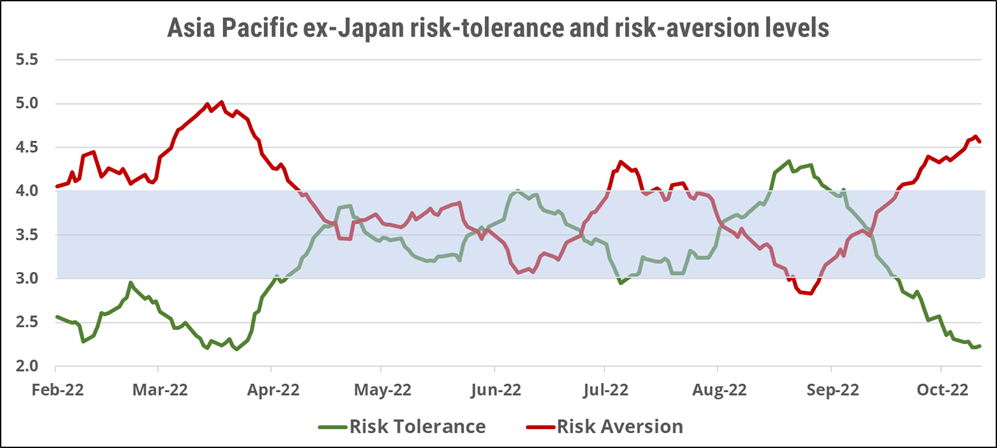

Asia ex-Japan markets investor sentiment

Sentiment among Asia ex-Japan investors (green line) continued to decline last week, to the most bearish of all markets we track. Sentiment in the region has seen the most rapid and dramatic turnaround, falling from bullish at the start of September to new year-to-date bearish lows last week. In addition to global stagflation fears, Asian markets are also hurt by the strong US dollar and higher US interest rates, both of which increase USD-denominated debt payments. Increased fears of renewed COVID-19 lockdowns in China as new infections cases rise in key cities, along with the strained US-China relationship, is also weighing on investor sentiment. Risk aversion is now much higher than risk tolerance, resulting in more than two potential sellers for each potential buyer, and raising the downside risk for investors. In this bearish state, the best we can hope for is that nothing comes to unleash a return of the volumes from Q1.

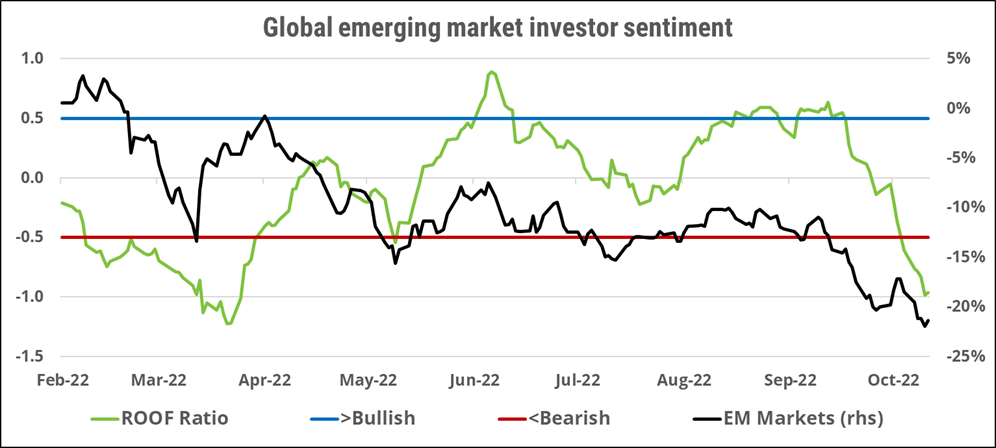

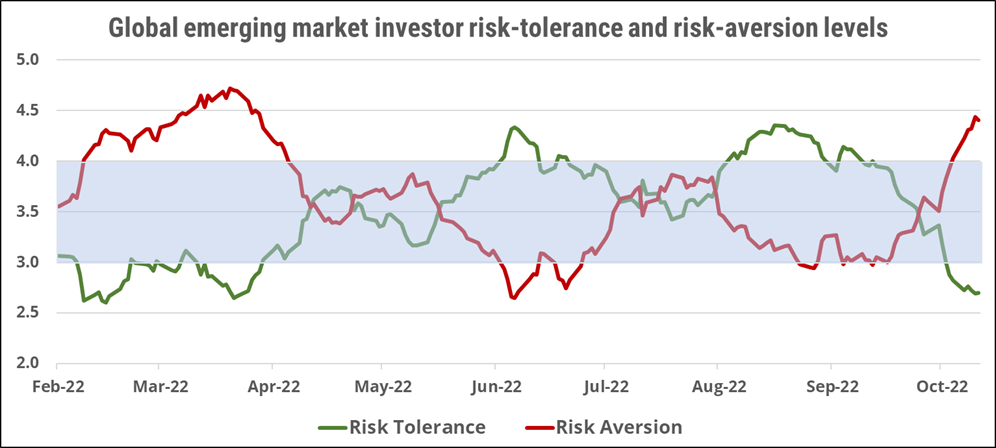

Global emerging markets investor sentiment

Sentiment among global emerging-markets investors (green line) continued to decline last week, ending strongly bearish as investors’ mood catches up with that among global developed investors. Year-to-date, the volatility of emerging markets has risen (much) less than for developed markets, but with sentiment now reaching new lows, the increased potential for downside overreaction means that volatility could easily gather pace. Volumes have also been much lower than at the start of the year, pointing to potential heavy selling pressure if investors’ bearish sentiment is triggered into action (i.e., selling). Risk-aversion levels are dominating risk-tolerance levels and represent a threat to current market levels in the near term.

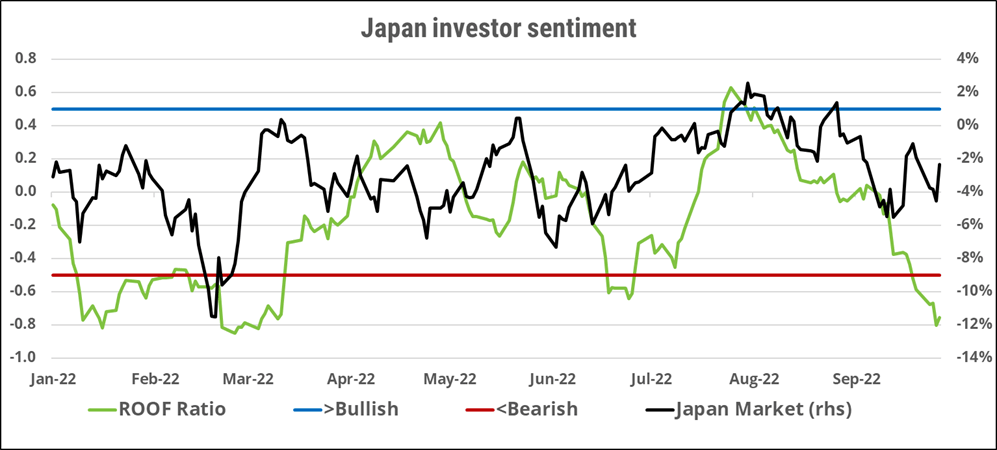

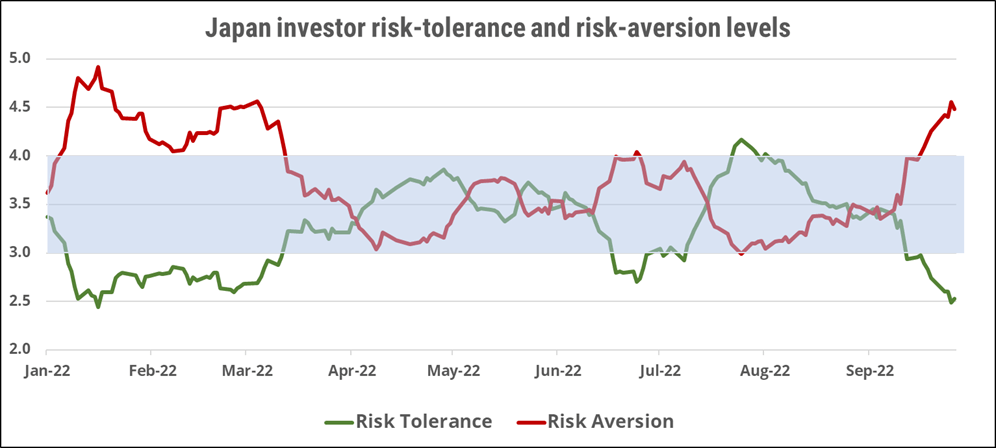

Japan market investor sentiment

Sentiment among Japanese investors (green line) became increasingly bearish last week, reaching lows last seen in March of this year after the invasion of Ukraine by Russia. The decline in sentiment from neutral to very bearish was accompanied by rising volumes, indicating that Japanese investors are increasingly worried about the damage to the economy from a weak yen and rising inflation. The stock market has been supported by the promise of strong corporate earnings thanks in large part to the currency translation effect from a weaker yen, which leaves it with a lot of downside risk if investors conclude that the damage to the economy from a weak currency will outweigh the benefits for exporters. Rising COVID-19 infection cases at home and overseas ahead of the coming winter is also weighing on sentiment with the prospect of renewed travel restrictions, which would hurt the tourism industry. Risk aversion levels are almost at new highs while risk tolerance levels hover just above year-to-date lows, and with the market still some 10% higher than its March bottom, there is a lot more downside risk than upside potential in the near term.

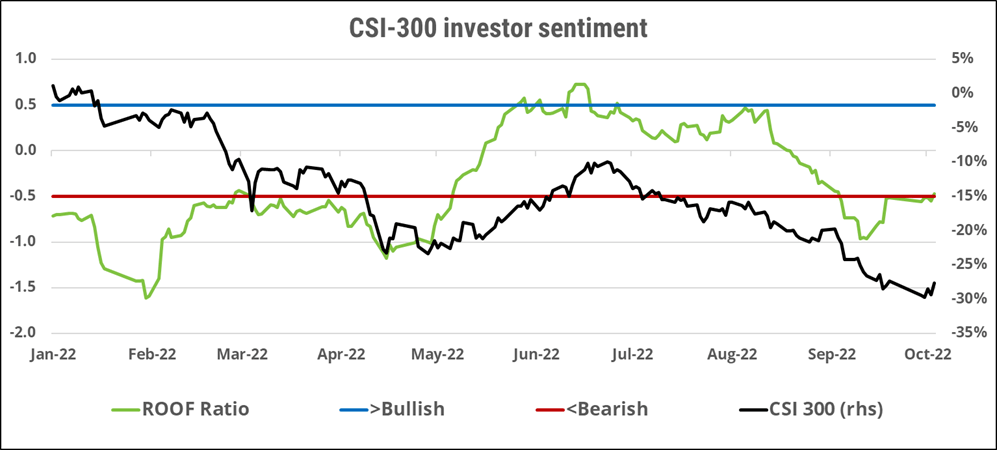

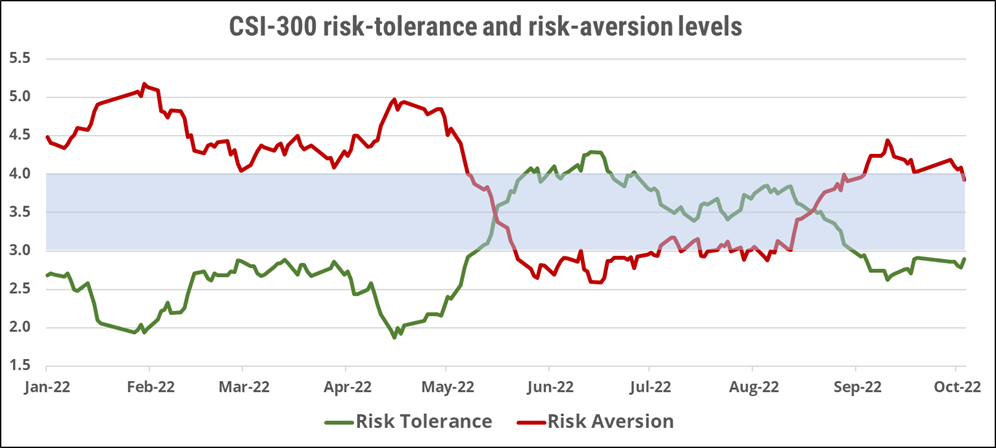

China (domestic) investor sentiment

Sentiment (green line) among Chinese (A-shares) investors recovered slightly last week, ending just above the bearish levels of two weeks ago, and managing to close Friday at a very negative but no-longer bearish level. Part of the recovery in sentiment can be attributed to market-supportive comments made during the annual Party Congress but as those were short on specifics, they may not be enough for the recovery in sentiment to last. The Chinese economy is decelerating sharply, the US-China relationship is at its worst, and new COVID-19 infections raise the prospect of renewed lockdowns during the winter months. The Chinese market, meanwhile, has been one of the worst performers year-to-date, but volumes there have been declining all year and are now less than half of their January level. News of lockdowns or defaults in the property sector could trigger a new wave of selling by pulling bearish investors off the sidelines and into the market.