In our latest paper “Minimum Variance: A Leg Up on Geopolitical Risk?”, we examined the impact of recent market risk events on a range of STOXX® minimum-variance indices vis-à-vis their corresponding global and regional broad benchmarks. We noted that geopolitical considerations—most prominently the trade war between China and the US—seemed to have a much bigger impact on portfolio performance than ‘regional’ issues, such as Brexit or the French presidential election. Even monetary policy appears to have become more and more dependent on the expected effect of political decisions. As expected, the minimum-variance portfolios outperformed their core benchmarks in down-markets but lagged behind in the more optimistic scenarios.

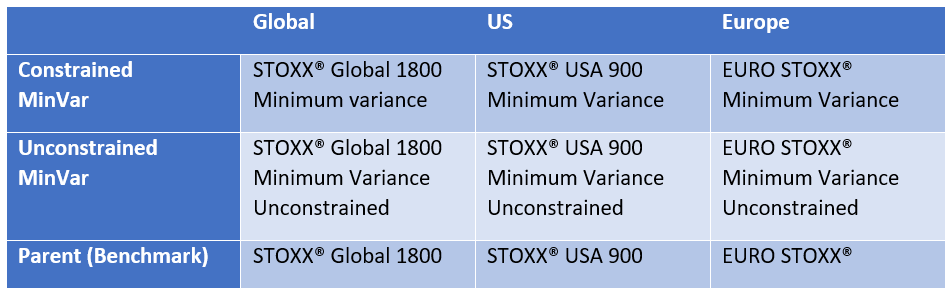

STOXX® offers a range of minimum-variance indices, all designed to achieve the lowest return volatility in a given investable universe (the parent index). Theses indices are constructed via an optimization process using the Axioma Portfolio Optimizer™, risk models, and an estimated covariance matrix. Each index comes in two flavors: an unconstrained version, where the optimizer is (almost) free to achieve the maximum possible risk reduction; and a constrained version, where a number of index-construction rules is imposed to avoid extreme positionings arising from the risk minimization objective. For the present study, we selected three variants each from the STOXX® family of indices, for the US, the Eurozone, and global-developed markets.

Figure 1: Minimum Variance and Parent (benchmark) Indices

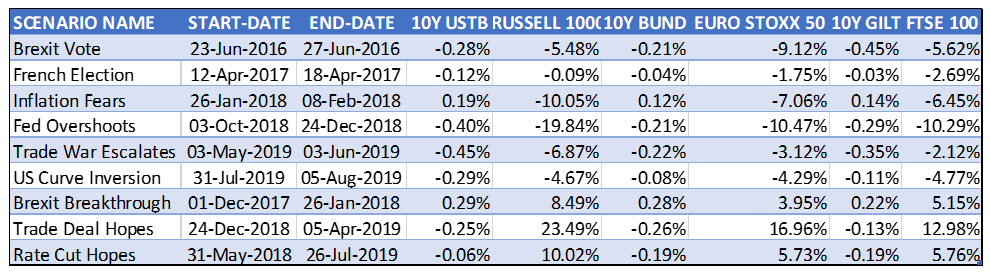

To analyze the impact of recent geopolitical risk events on the different indices, we constructed nine historical stress tests in our Axioma Risk™ platform. The table below shows the date ranges for each scenario, as well as the performance of the relevant financial time series in each sub-period. A more detailed description of the individual scenarios can be found in the paper.

Figure 2: Historical Scenario Summary Information

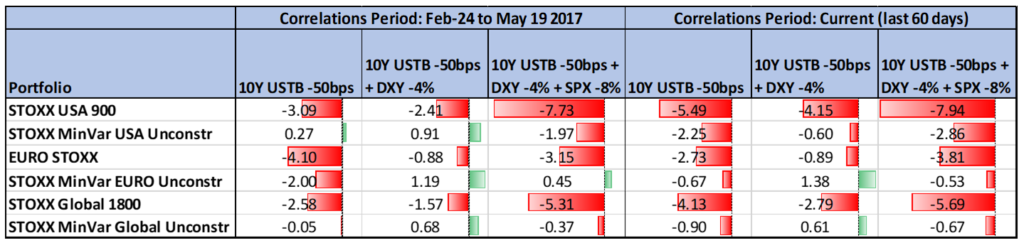

Figure 3 summarizes the results across all nine scenarios and indices. We note a strong sensitivity to both the Fed Overshoots and Trade Deal Hopes scenarios. The direction of US interest rates and the resolution of the US-China trade war seem to be top-of-mind for investors across all regions, trumping even local concerns (Brexit and French Elections) in Europe.

Figure 3: Stress Test Result Summary

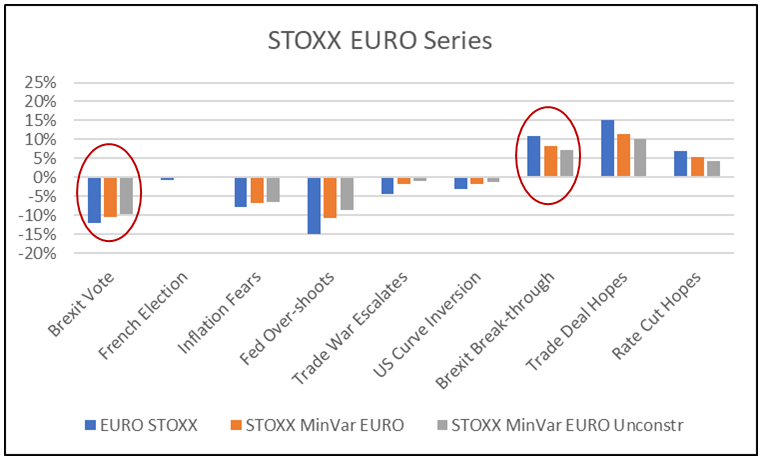

The dominance of the global and US scenarios also becomes apparent when visualizing the returns for the EURO series. We can see that the Fed Overshoots and Trade Deal Hopes scenarios produced the biggest losses/gains in each direction, although the two Brexit stress tests also had a significant impact—much bigger than on the US and Global variants.

Figure 4: Historical Stress Test Results for STOXX EURO Series

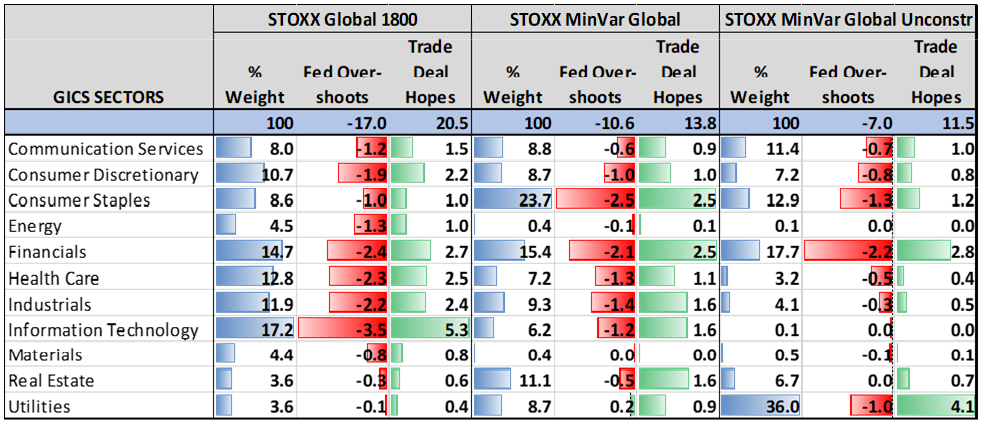

A breakdown by sector for the STOXX® Global Series highlights how the relative allocation of the two minimum-variance portfolios—in particular, the bias toward defensive sectors—affected the comparative performance vis-à-vis the broad benchmark in both down-market and up-market scenarios. The Fed Overshoots stress test replays an event that led investors to become bearish on the US (and global) economy. It is therefore not surprising to see that the parent index’s large allocations to cyclical sectors, such as consumer discretionary, information technology, and industrials, hurt it a lot in this scenario. Conversely, this allocation helped the parent portfolio perform better in the more bullish Trade Deal Hopes environment. Financials retained their influence on portfolio outcomes, while information technology traded places with consumer staples and utilities as key contributors to expected loss/gain in the minimum-variance portfolios.

Figure 5: Sector Allocation/Contribution for STOXX Global Series

The study shows that the current unpredictability of US economic and monetary policy creates considerable uncertainty for investors around the globe, not just those with a focus on North America. The recent US yield curve dynamics, which seemed to be driven more by what happened in the trade negotiations with China than by what the Fed did, are further proof of that. Also, the fact that European stock markets skyrocketed alongside the US in the first half of the year, despite all leading indicators forecasting a recession, underpins the one-sided influence of the US economy and monetary policy on other parts of the world. This was confirmed by the (lack of) impact of the French Election and Brexit scenarios on the US portfolios versus the outsized impact of the trade war and Fed-related scenarios on the European and Global ones. Having said that, the analysis also showed that minimum-variance strategies can provide superior risk-return characteristics in such an increasingly uncertain geopolitical world.