With just nine days of factor returns for 2019 at this writing, we have already seen sharp reversals of fortune in some factors, and an abundance of larger-than-expected returns in the US.

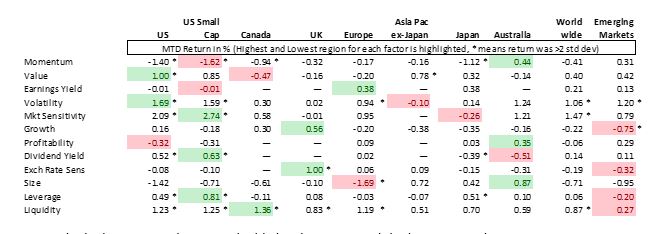

The table below shows January 2019 returns (through the 14th) for most factors in a number of Axioma’s medium-term fundamental models. Asterisked returns indicate “outsized” returns—that is, more than two standard deviations above or below the long-term average nine-day return, with the standard deviation based on the expected volatility for the factor at the end of December 2018.

Seven of 12 factors in the US model, and six of the 12 in the US small-cap model, have month-to-date returns that seem large by historical norms. Other regions saw far fewer outliers.

We noted in the Fourth-Quarter Risk Review report that while most US style-factor returns for the full quarter fell within risk expectations, there were far more days than usual in which returns were outsized.

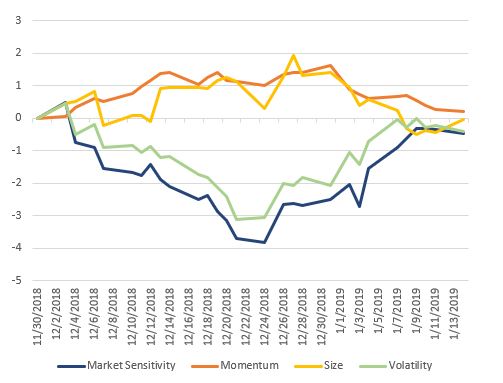

Two factors—Market Sensitivity and Size—saw a continuation of many days (five of the 9 for both) with returns that were 2, 3, even 9 standard deviations away from the expected level of return (with the standard deviation based on the risk forecast at the end of the prior day). Whereas the month-to-date return for US Size has reverted to being negative, the direction that would be expected based on Size’s long-term average return, Market Sensitivity has pivoted, turning in an unusually positive return as investors seem to be seeking higher risk once again. This stands in sharp contrast to its on-average negative performance.

Like Market Sensitivity, Volatility’s return has also experienced a reversal from December and has been quite positive in January, although this represents a cumulate effect of daily returns that remained within their expected range.

This is true for Momentum, too; it had only one day so far this year (the first trading day of the year) in which its return was well below expectations, but its return has been negative in all but two days, again a reversal from late last year.

Finally, Leverage and Liquidity have also produced month-to-date performance that was 2-3 standard deviations above their long-term averages, and this may be even more surprising to managers, who may not pay sufficient attention to their exposures to these factors.

Month-to-Date Factor Performance

Source: Axioma

Cumulative Factor Return – Factors with Big Reversals from December