For a factor-tilt-based manager, Axioma’s new US Small-Cap Fundamental Model (USSC4) should confer an attribution benefit versus the all-cap US4 when factor performance diverges between the two models. As I noted in the “Just How Disappointing Has Momentum Been Recently?” blog post about the recent performance of Momentum[2], “A small-cap manager who tilts on Momentum but uses the US4 model for attribution may have found that Momentum’s contribution to active return was inflated early in the year (with the difference likely going into specific, or unexplained return), whereas more recently the return may have been understated (and specific return overstated). In neither case does the manager get the “credit” he or she deserves for factor bets.”

Today’s task is to dive into that assertion a little more deeply. For at least one fund for the year-to-date period, we found that the small-cap model did indeed give more accurate attribution information. The fund we chose was Invesco’s DWA SmallCap Momentum ETF (ticker DWAS). We ran attribution analysis for the period for January through May, when Momentum’s returns were positive for both models, but much higher in the all-cap model, and again from June 1 through July 10, when Momentum’s slight gain in USSC4 far outpaced the negative return in its all-cap counterpart. In both cases we used the short-horizon version of the model.

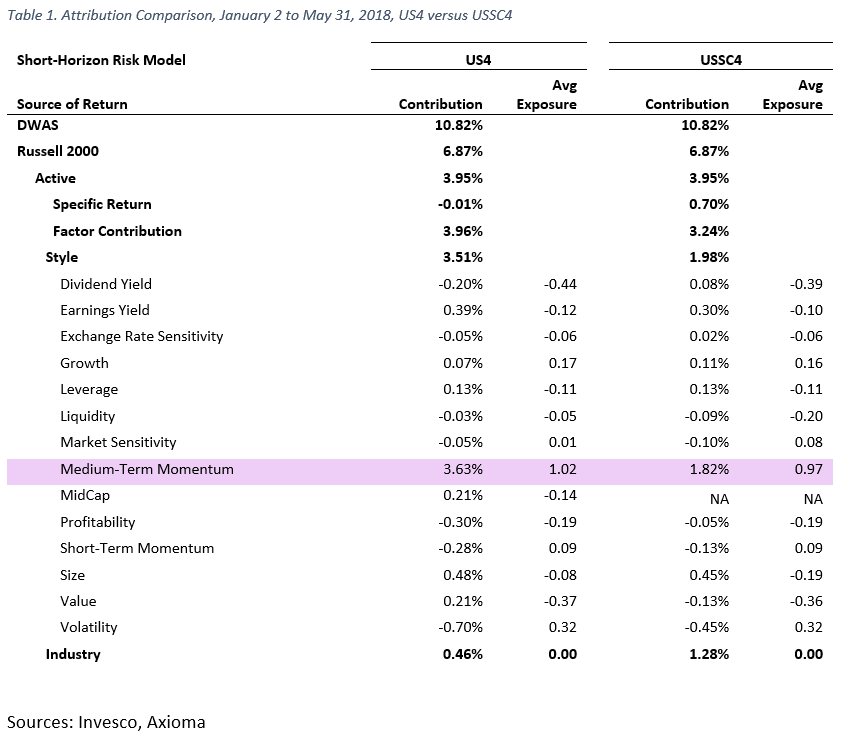

For the first five months of 2018, DWAS substantially outperformed the Russell 2000, returning 10.82% versus the index’s 6.87%. Attribution using the two models of this return reveals what we hinted at in our earlier post. Momentum’s contribution from US4 was almost twice as high as it was from USSC4, although exposures were quite similar. If the Momentum return that was “available” to the small-cap investor was, in fact, less than what he or she could have earned investing across a broader universe (where a number of internet names probably drove a lot of that large-cap return), then its contribution was indeed overstated. While the difference (in this case a negative number) did indeed show up in specific return as expected, it also resulted in a lower industry return.

You might say “this is a Momentum fund, and therefore we are happy with the bigger contribution from Momentum during this period,” but we would argue that the contribution from Momentum was overstated for the reasons mentioned above. More importantly, for the second part of our test period, when Momentum’s return was ever-so-slightly positive in the small-cap model but quite negative in the all-cap version, the attribution benefit was much more apparent.

In the period from June 1 to July 10, 2018, DWAS again outpaced the Russell 2000, as the two returned 4.76% and 3.87%, respectively. In this period, US4 shows Momentum detracting more than 100 basis points from return, with the (positive) difference appearing to move into specific return (note that again the exposures were similar). In contrast, USSC4 shows a very small positive return from Momentum and a lower specific return, which once again does a better job of reflecting the contribution from Momentum that the manager could have obtained. In addition, the difference in contribution from the other factors, including industries, was small. We believe the USCC4 attribution gives a more accurate picture of attribution.

Attribution helps asset owners to understand the sources of excess return generated by their managers, and to distinguish luck from skill. Attribution also helps managers understand the impact of the bets they take, and through that understanding potentially make changes to the portfolio-management process. Attribution results should also be intuitive. If I know a factor has “worked” in my universe, I want to ensure attribution tells that story.

For both asset owners and managers, the more accurate and intuitive the results the better. As Axioma has articulated and documented with clear examples such as this for many years, we believe that using a risk model appropriate to the mandate for attribution can improve accuracy, and therefore lead to better understanding of returns and possibly even better outcomes.

[1] With thanks to Leon Serfaty and Chris Canova, both of Axioma, for their help.

[2] For the purposes of this article, when we refer to Momentum we mean Axioma’s Medium-Term Momentum factor, defined as the return over the last 12 months excluding the last month.