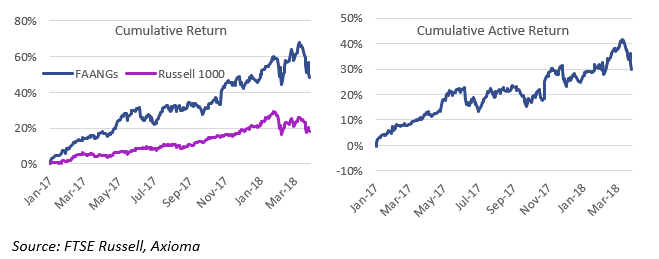

Tech stocks, particularly “FAANGs,” have had a rough go of it over the past few days. This setback, however, comes after a long stretch of positive performance. Because of those previous gains, these stocks have become an important part of the overall US stock market—and their loss has contributed to the overall market decline.

While you don’t need us to tell you about performance, perhaps we can shed a bit of light on the risk side of the equation.

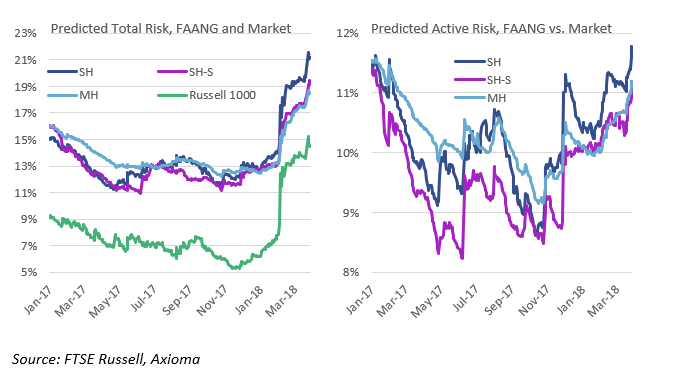

Russell 1000 short-horizon fundamental risk[1] reached an all-time low of about 5.6% late last year, but that risk has almost tripled, to 14.5% as of March 28. Over that same time period, risk of the FAANG stocks[2] —an important component of overall market risk—also rose. The FAANG increase was similar in percentage-point terms, but less in percentage terms (from 12.2% to 21.3%, so up about 64%). In addition, the active risk of a FAANG portfolio relative to the Russell 1000 index also rose, from about 9% to 11%, suggesting that these stocks are less like the overall market now than they were four months ago.

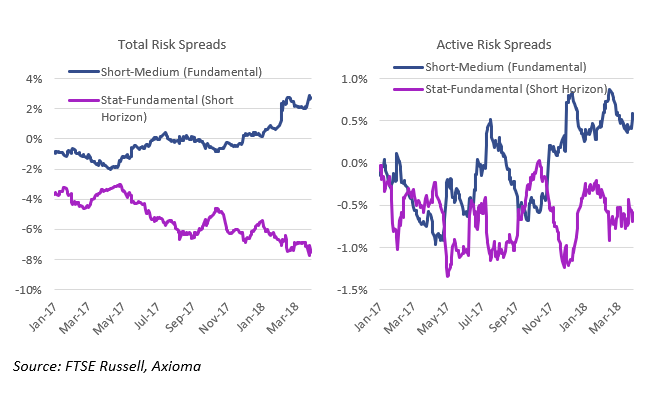

While short-horizon statistical risk and medium-horizon fundamental risk also rose, their increases were not as large as what we have observed from the short-horizon fundamental model. In addition, short-horizon total risk is increasing relative to the medium-horizon at an increasing pace, suggesting that we will also see medium-horizon risk go up. The short-medium spread in active risk has been somewhat more volatile (along with the short-horizon active risk level). What may be a bit of good news for both total and active risk is that the statistical forecasts remain below their fundamental counterparts at the short-horizon, which suggests there is not an additional force driving statistical risk that is not evident from the fundamental perspective. (The inclusion of industry factors in the fundamental model likely allows it to see that particular driver of risk more clearly than the statistical model).

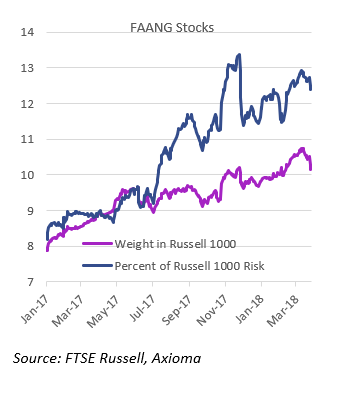

Of course, as the FAANG stocks soared in recent months they comprised a bigger and bigger part of the index. What could be a little more interesting—and potentially an issue for managers who include these stocks in their portfolios—is how their contribution to overall Russell 1000 risk has risen, far in excess of their weight. So as FAANG stocks were soaring they also became relatively riskier than other stocks in the index, which drove their contribution to risk up even more than their weight, after the two were approximately equal in the middle of 2017. At the end of November last year, this difference reached a near-term peak, but the ratio has since eased off. That spread tells us something. Obviously, the model could not predict the Cambridge Analytica fiasco for Facebook or disparaging comments from the White House about Amazon, to name a few issues, but as the difference widened it suggested that bad news would likely be punished more than “usual”. And that is exactly what we have seen in recent days.

[1] Based on Axioma’s US4 Short-Horizon Fundamental model.

[2] We created an index by re-weighting Facebook, Apple, Amazon, Netflix and the two classes of Alphabet (aka Google) based on their Russell 1000 weights.