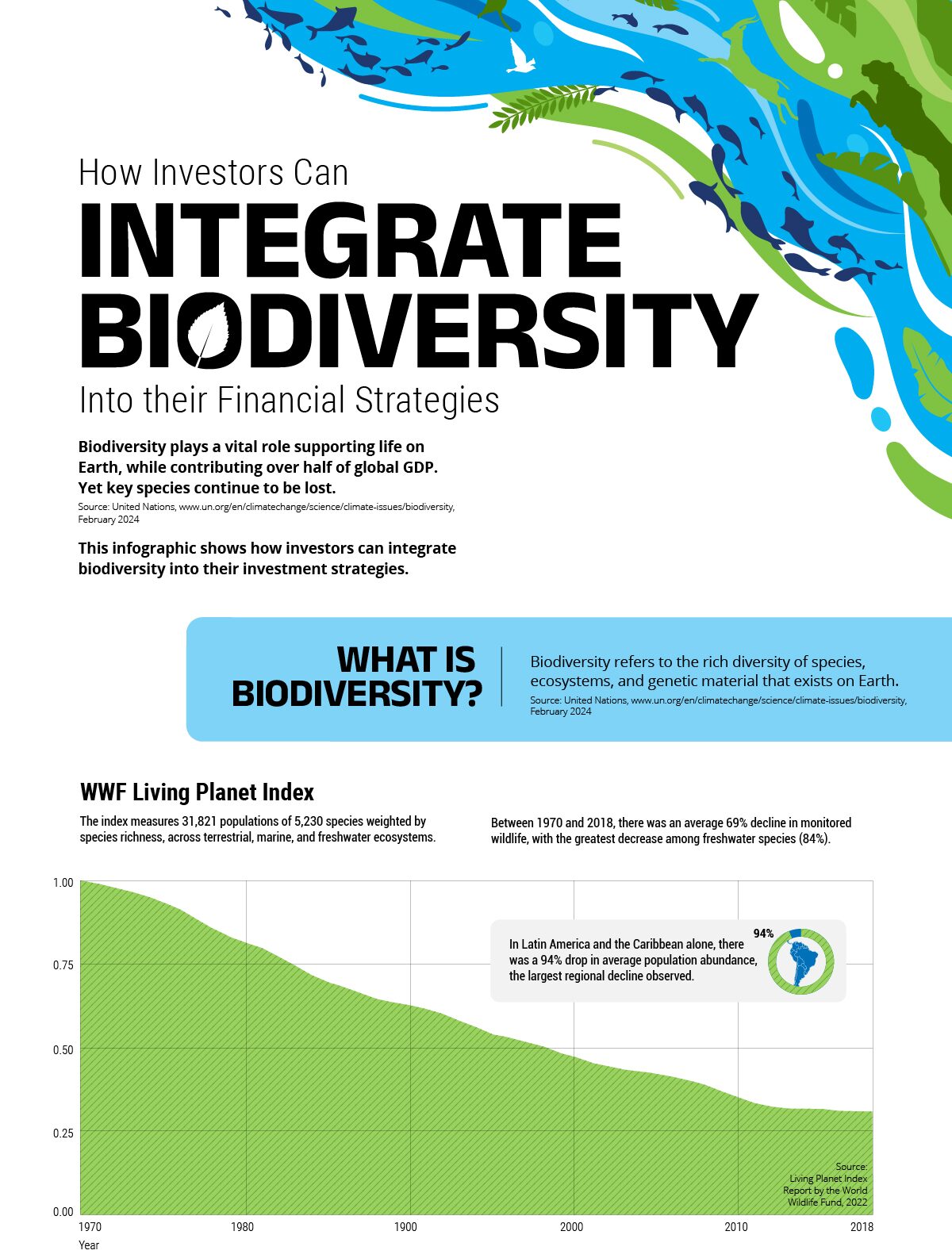

Why protect our biodiversity?

Biodiversity helps maintain the balance of ecosystems by allowing different species to coexist and interact with each other in complex ways. A resilient natural capital ensures the delivery of services that are vital for our lives and is better able to adapt to changing environmental conditions. A healthy economy depends on a healthy planet.

What is biodiversity impact investing?

Besides significant economic consequences, biodiversity loss can also create physical, transition, systemic and regulatory risks for companies and investors. Allocating capital to companies that prioritize sustainability and biodiversity conservation may offer opportunities for investors to manage risks and generate positive returns. The ISS STOXX Biodiversity indices provide a robust toolkit to build such impact portfolios, tailored to specific needs.

How can biodiversity impact be measured?

Assessing a company’s biodiversity impact involves evaluating the effect that its operations and activities have on the local and global ecosystems. Biodiversity footprint, habitat loss, species impact and stakeholder engagement are some methods in which an organization’s impact on biodiversity can be quantified and qualified through scientific and carefully-researched data systems. In general, measuring a company’s biodiversity impact is complex and requires a robust methodology to provide a thorough assessment.

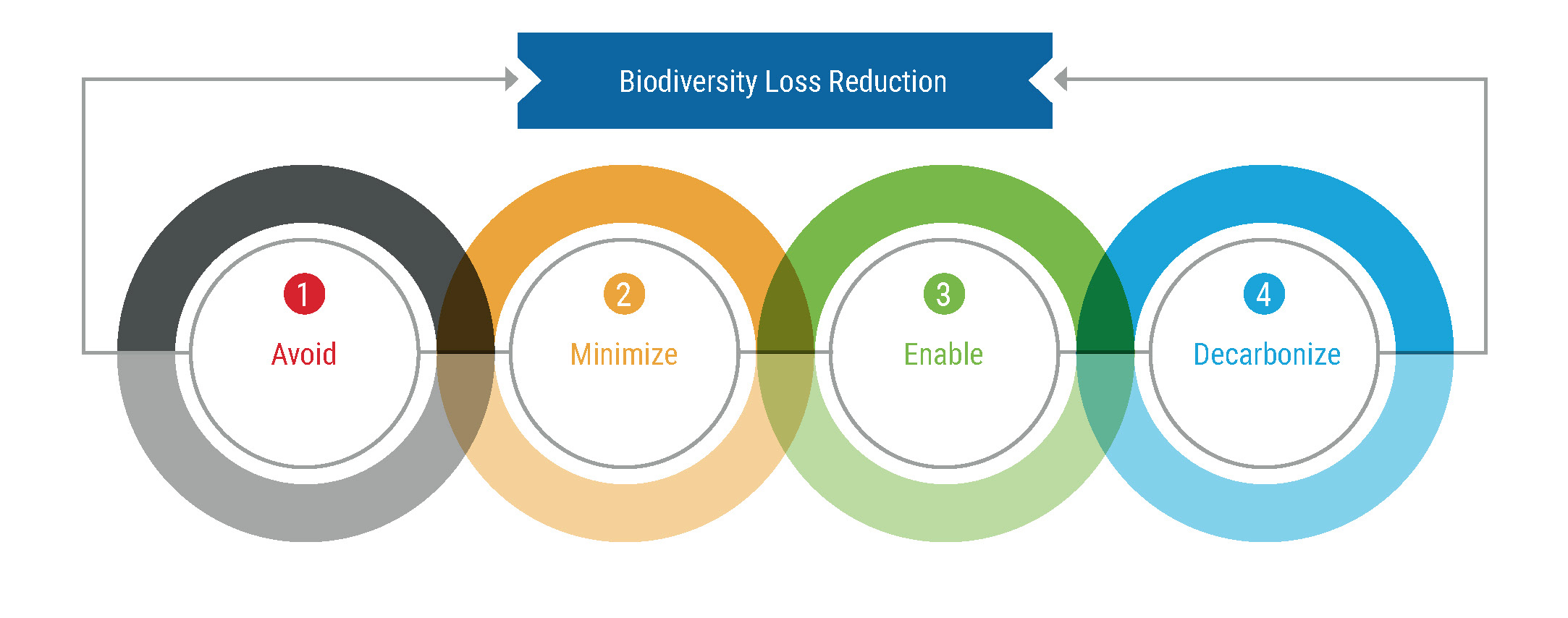

How are the ISS STOXX Biodiversity indices built?

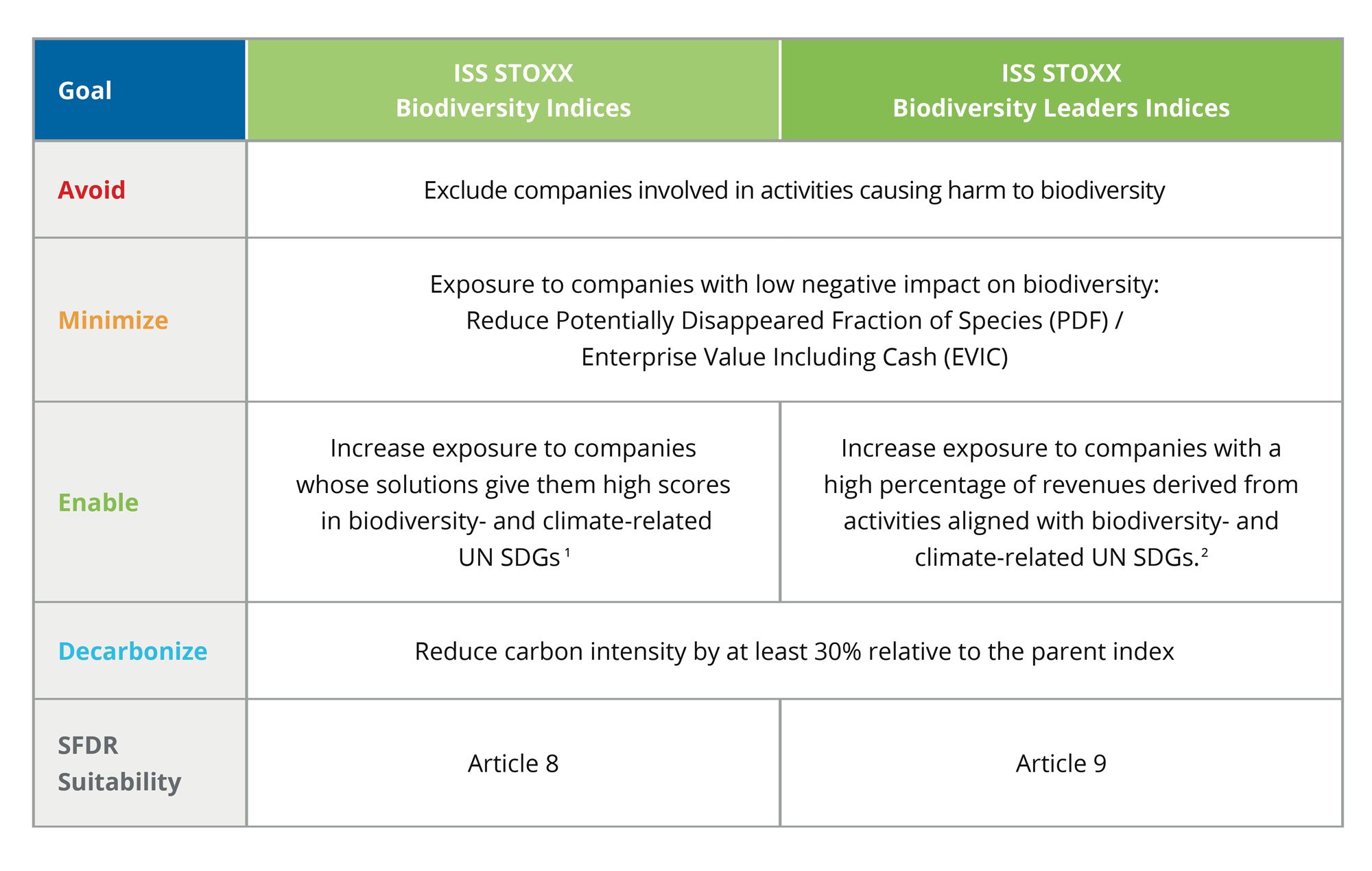

The ISS STOXX Biodiversity indices include three screens, plus an additional layer that reduces the portfolio’s carbon footprint. The index suite consists of two categories: the ISS STOXX Biodiversity indices, which track companies with high biodiversity- and climate-related Sustainable Development Goal (SDG) scores, and the ISS STOXX Biodiversity Leaders, which include companies with high revenues from specific SDG-related activities.

Key benefits

Capital alignment with long-term goals, risk management and investment opportunities

Comprehensive, multidimensional framework with two levels of targeted impact and option to customize and optimize strategies

Stock selection based on biodiversity exclusionary screens, Sustainable Development Goals (SDGs) and carbon emissions targets

ISS STOXX Biodiversity indices framework

1 For each of the sustainability objectives an Objective Score is calculated. These company-specific scores assess the overall impact of a company’s product portfolio on the achievement of a given objective. They are calculated by multiplying the net sales shares generated with relevant products/services with the numeric scores assigned to them. All Objective Scores range on a scale from -10.0 (i.e., 100% of net sales are generated with products/services classified as having a significant obstructing impact) to 10.0 (i.e., 100% of net sales are generated with products/services classified as having a significant contributing impact).

2 This is based on the share of revenues a company derives from products and services identified as contributing to the achievement of a given objective and ranges from 0% to 100%.

ISS STOXX Biodiversity indices metrics

| Metrics | STOXX World AC | ISS STOXX World AC Biodiversity | ISS STOXX World AC Biodiversity Leaders |

| Components | 3,705 | 1,732 | 90 |

| Components screened | 1,973 | 3,615 | |

| PDF Score | 2,235,891 | 1,497,684 | 381,535 |

| PDF Score Reduction | -33% | -83% | |

| PDF/EVIC | 24.84 | 6.79 | 18.31 |

| PDF/EVIC Reduction | -73% | -26% | |

| Biodiversity SDG Rating | 0.85 | 2.10 | 2.80 |

| Biodiversity SDG Rating Improvement | – | 1 | 2 |

| Revenue exposure to Biodiversity SDGs | 5.73% | 4.81% | 79.52% |

| Revenue exposure Improvement | – | -0.91% | 73.79% |

| Scope 1 + 2 + 3 CO2 emissions | 53,005,860 | 23,801,248 | 6,416,011 |

| Scope 1 + 2 + 3 CO2 emissions reduction | – | -55% | -88% |

| Overall Tracking Error | – | 1.84% | 8.42% |

Source: STOXX, ISS ESG, as of 15th February 2024. Overall tracking error was computed against STOXX World AC for the time period March 20th 2017 to February 15th 2024 using daily data.