Investors can use sustainability data as signals to generate excess investment returns or to optimize traditional investment factors such as Quality or Value, according to Dr. Andrew Ang, Head of Factors, Sustainable and Solutions for BlackRock Systematic.1

In BlackRock’s analysis, information on topics such as carbon emission targets, green patents or even the number of war veterans employed at firms, has shown a relationship with the relative performance of stocks as well as correlation with some popular factors. Such ESG signals can be crucial at a time when investors increasingly need to observe responsible-investing goals as well as financial returns.

“Certain sustainability parameters are so correlated to traditional factors that they can reinforce them,” Dr. Ang told the audience at the Qontigo Investment Intelligence Summit in London on May 5. “We can use that fact to our advantage.”

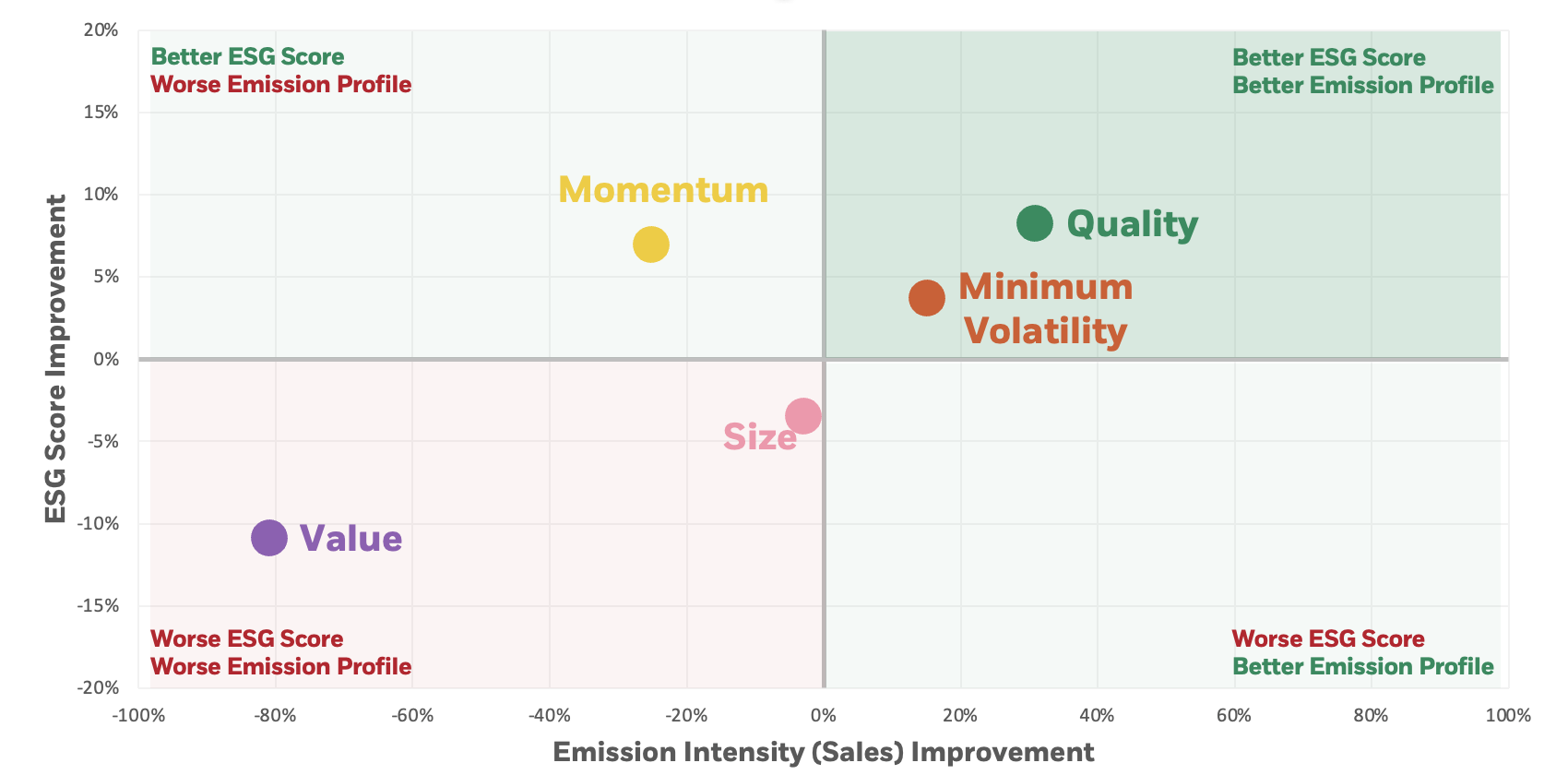

A clear correlation exists, for example, between the Quality and Minimum Volatility factors on the one hand, and higher ESG scores and lower carbon emissions on the other, said Dr. Ang, who called these pairs “best friends.”

Figure 1: Active ESG exposure in European index

“We can create products that have factor exposures that we desire and also seek outcomes for sustainability,” said Dr. Ang. “We can have our cake and eat it too.”

ESG imposed as a constraint on an optimization

It is often believed that ESG objectives can weigh on returns. However, a lot of those sustainability constraints may be tilting investments towards traditional factors that have been proven to generate excess returns, Dr. Ang explained.

This is a phenomenon observed in many of Qontigo’s sustainability and climate indices. The STOXX® Global 1800 Paris-Aligned Benchmark Index, which follows an optimization process to reduce the benchmark’s greenhouse gas intensity by at least 50% and to meet a year-on-year 7% decarbonization target, has had a higher Sharpe ratio than its benchmark for the past three years. A Qontigo whitepaper in 2020 showed that the Paris-Aligned strategy increases the exposure to the Profitability and Earnings Yield style factors.

“What is happening here is that as you impose those constraints, other interactions are also going on,” said Dr. Ang. “As those constraints become more binding and onerous, they interact with each other and they push you towards factors that perform well.”

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Signals and the integration into factors

Companies with lower carbon emissions or scientifically-proven carbon targets have also done relatively well, suggesting both parameters are signals for outperformance.

“What is really going on is that this manifests as an attitude of these companies towards higher efficiency,” Dr. Ang said. “If we want to get the most value for our buck, all companies today would wish to produce more goods and services with lower energy input costs.”

“This is a form of the Quality factor,” he added. “We integrate these sustainability signals into the definitions of our factors. It is a non-financial, non-balance-sheet metric for Quality.”

Another signal comes from patents filed in various green technologies. Green patents are a valuable asset that doesn’t appear in earnings statements or balance sheets. Yet, they are a measure of intangible capital that can be integrated into proprietary versions of the Value factor, Dr. Ang said. In integrating complementary ESG metrics into historically rewarded sources of returns, the latter can become more robust.

“This is part of a longer journey for our investors,” said Dr. Ang. “We continuously want to push the definitions of these factors.”

Other ESG signals

An additional example of a climate alpha signal can be found in companies with the most LEED-certified,2 or carbon-efficient, buildings. These companies have significantly lower operating costs and their shares have had higher-than-average returns. LEED data is available to anyone and can be turned into investable data, Dr. Ang said.

Investors can find sustainability alpha within the Social pillar of ESG, too. For example, BlackRock’s Systematic team has applied natural-language processing techniques to measure corporate culture by scouring conference-call transcripts for key words such as ‘accountability’ and ‘honesty.’ This process is an example of how a qualitative Social concept such as ‘culture,’ can be transformed into a viable, quantitative metric — a non-financial version of the Quality factor.

Similarly, companies that have hired the most war veterans have outperformed during sample periods.

“This is a great signal because not only does a company benefit from hiring experienced and hard-working people, but also because it helps re-integrate veterans into the labor market and decreases state expenditures,” Dr. Ang said. “We have both an ESG outcome that is measurable as well as a positive effect on financial performance.”

‘Real opportunity’

Investors have long been aware that taking a view on ESG may lead to specific factor exposures, and vice versa. Dr. Ang’s presentation showed how sustainability signals can be an important part of factor investing – where the former can, through a quantitatively-driven and systematic investment process, complement or reinforce a factor strategy.3 The result should lead to excess returns and improved climate or ESG scores.

“This talk was all about sustainable alpha,” Dr. Ang concluded. “That is the real opportunity for all of us. If we, as investors, use ESG or sustainable data for outperformance, all of society will be better off.”

1 Part of the world’s largest asset manager, BlackRock Systematic’s team employs combined technology, scientific research and human capabilities that span factor-based and alpha-seeking approaches across various asset classes to deliver tailored investment solutions.

2 LEED, or Leadership in Energy and Environmental Design, is a ‘green’ building rating system.

3 For more on ESG integration into factors, visit ‘ESG in Factors,’ Ying Chan, Ked Hogan, Katharina Schwaiger, Andrew Ang; The Journal of Impact and ESG Investing, Aug 2020, 1.