Whether it’s optimizers of patient treatment or hybrid bio-chemical drugs, many healthcare stocks are inventing the future.

In the West, people are getting older, living longer and spending more on healthcare, a trend we touched upon in a recent article on ageing populations.

With changes to life expectancy, increasing purchasing power and technological discoveries, medicine and wellbeing will look very different in coming years from what we know now. Siddharth Saha, an analyst at consulting firm Frost & Sullivan, mentions four categories of breakthrough healthcare technology. These are cited below and followed by specific examples:

- Diagnosis: biomarkers.

- Interventional medicine and therapy: cell therapy, nanorobotics.

- Analytics and clinical decision support: quantum computing and artificial intelligence.

- Patient management: wearable biomonitoring devices, virtual patient visits.

With each new treatment, investment opportunities arise in the innovative and disruptive field of breakthrough healthcare.

What are breakthrough healthcare stocks?

Transformational healthcare stocks are quite different from Big Pharma, the household names that dominate industry benchmarks. While the latter have been fine investments, they face potential headwinds due to their sheer size, competition from generics manufacturers and patents expiration.

The U.S. Justice Department has also started an industry-wide probe into possible price fixing by major generic drug makers.1 Attempts at mega-mergers to boost scale, like Pfizer Inc.’s proposed combination with Allergan Plc, have foundered.

By contrast, breakthrough healthcare stocks are much smaller and more focused, and often game-changers for a particular niche. At the cutting edge of technology, they have the potential to disrupt existing products – such as making traditional drug therapies obsolete – or, more importantly, create whole new markets.

Often highly speculative, breakthrough healthcare can lose money for years before becoming very profitable – and takeover targets as Big Pharma looks to supplant maturing or old products.

An index to track the megatrend

Breakthrough healthcare is one of the big themes covered by the STOXX® Thematic Indices, which track global, disruptive and modern megatrends defining our era. The STOXX® Global Breakthrough Healthcare Index features 83 stocks, all of which get at least 50% of their revenue from 32 subsectors linked to the megatrend, and identified as having the most opportunity for explosive growth.

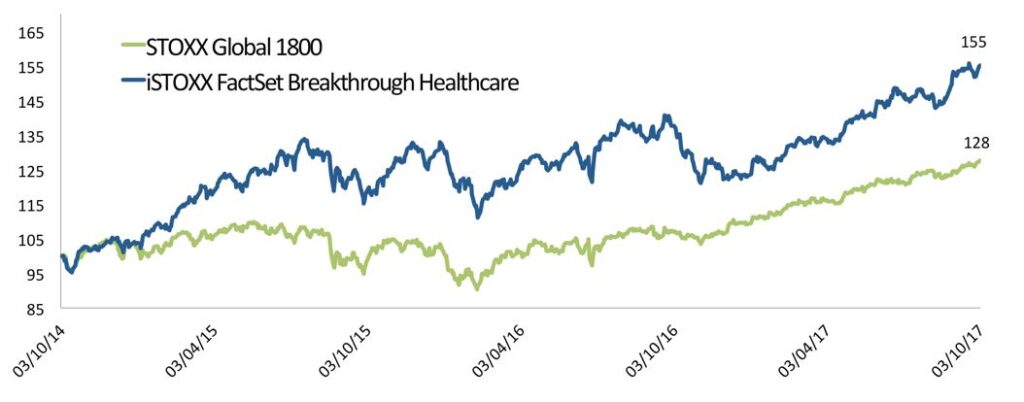

The Breakthrough Healthcare Index has already outperformed significantly its parent benchmark, the STOXX® Global 1800 Index, in the past three years (Chart 1).

Chart 1

Enriching immune cells and engineering proteins

The 32 subsectors that make up the Breakthrough Healthcare Index range from oncology and neurology devices, to drug-delivery systems, to biopharmaceuticals that treat immune deficiency disorders.

The latter niche is possibly best explained by looking at a specific index constituent. Seattle-based Juno Therapeutics weaponizes a patient’s own blood against cancer. Juno is part of a wave of companies making treatments that genetically modify the body’s own immune cells to direct them against hostile agents.

Juno’s stock shot up recently after the US Food and Drug Administration granted one of its therapies orphan drug status for its treatment of follicular lymphoma. One of Juno’s competitors, Kite Pharma, was just bought for $12 billion by pharmaceutical major Gilead Sciences – also a component of the Breakthrough Healthcare Index.

Allscripts Healthcare Solutions Inc. attacks another kind of challenge: how doctors and hospitals administer and manage patient care. At the heart of its service is an open-architecture health data exchange that helps clinicians get full electronic health records and facilities for their patients and community, including a medication’s price at competing pharmacies and the cost of alternative therapies.

Samsung Biologics Co. is another member of the Breakthrough Healthcare Index. The company is an arm of the well-known Korean conglomerate, and its stock has doubled so far in 2017. Biologics are genetically engineered proteins derived from human genes, as opposed to chemically synthesized drugs. One application: inhibiting the immune system from stoking the painful inflammation suffered by people with arthritis.

Accessing megatrends through passive products

The STOXX Thematic Indices are a way for investors to zero in on the long-term beneficiaries of convulsive changes, while spending less than they would on active fund management.

Four of the indices in 2016 became the underlying for respective exchange-traded funds (ETFs) managed by BlackRock’s iShares and listed in London, making index-based thematic investing more accessible to all.

New horizons in medicine and patient care

Be it biologics or innovative cancer treatments, breakthrough healthcare is at the forefront of industries and businesses that have the potential to explode as previously unimagined discoveries propel medicine and patient care treatment to new horizons.

More on investment megatrends

Featured Indices

STOXX® Global Breakthrough Healthcare Index

1 ‘U.S. Generic Drug Probe Seen Expanding After Guilty Pleas,’ Bloomberg, Dec. 14, 2016.