Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Most Recent Index spotlight

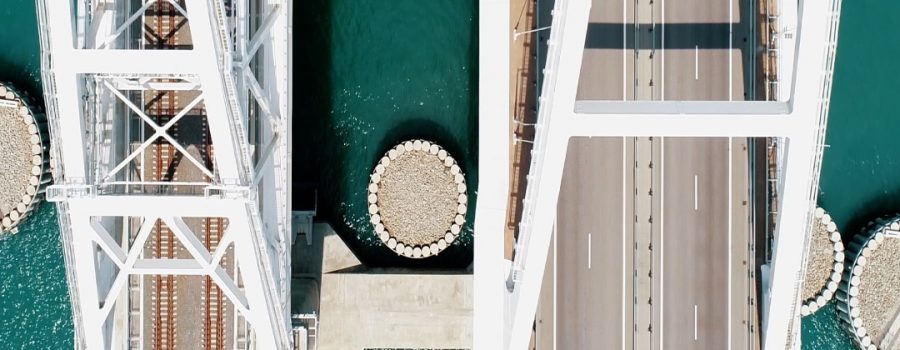

Technological advancements are at the core of many disruptive economic trends harnessed by the STOXX Thematic indices. We look at seven of the strategies — from automation to electric vehicles and smart city infrastructure — designed to track the companies shaping our digital future.

Analytics | Index | Factor Investing

Macroeconomic exposures of style indices: What you don’t know could hurt you

We look into the economic risks of employing factor-style strategies such as those in the STOXX Factor Indices, by screening them through Axioma’s Macroeconomic Projection model. The findings show that some styles have more economic exposure than others, and that macro variables can be correlated with industry, country and style factors, to different degrees.

Index | ESG & Sustainability

iSTOXX APG World Responsible Indices: significant sustainability with low active risk

This article aims to provide an update on the responsible-investing characteristics of the iSTOXX APG World Responsible Indices, and reaffirm that the process continues to create indices with substantial improvement in sustainability criteria without straying too much from the parent benchmark.

In modifying how DAX composition changes are fixed and publicized every quarter, Qontigo is providing index trackers more visibility and a more stable base upon which to trade the changes and replicate the index.

Index | ESG & Sustainability

Q&A with WTW’s David Nelson: Managing a portfolio’s climate transition risk with a forward-looking focus

“Counting molecules of carbon is the essential first step to tackling climate change, but it’s only the start,” says the director at WTW’s Climate and Resilience Hub. He explains why investors should focus on a company’s current climate-transition risk by understanding what the impact will be on its future cash flows.

Investors can access three different German benchmarks that follow an ESG strategy designed to meet specific needs and responsible objectives, and that have the same rules and transparency characteristics as the blue-chip DAX index.

A new Qontigo white paper analyzes the effect of changes in term spreads, or the difference between long- and short-term sovereign bond yields, on the performance of the iSTOXX Developed and Emerging Markets ex USA PK VN index. The findings show a rise in term spreads has, overall, helped returns for the global real estate index since 2019, but the relationship varies depending on regional exposure and period.

A new Qontigo white paper runs the numbers on the iSTOXX Developed and Emerging Markets ex USA PK VN, a global real estate index, to understand the relationship between expected inflation in the US, Europe and the UK, and index returns. The findings show that the sector has represented a good overall inflation hedge over the last couple of years, although regional and portfolio considerations can create exceptions.

The market volatility and macroeconomic disruptions of 2022 have raised a challenge to the thematic investing boom, but also offer a chance to reappraise the benefits of the investment approach.

For years, factor investing has demonstrated its potential to outperform the general market.

As the outlook for Technology stocks appears uncertain, we look at the risk-management benefits for Korean investors of adding a little DAX exposure to a KOSPI portfolio.

Index | Factor Investing

The diversification benefits of a multi-factor approach: the STOXX Europe 600 Industry Neutral Ax Multi-Factor Index

For the past 20 years, a multi-factor strategy as targeted by the STOXX Europe 600 Industry Neutral Ax Multi-Factor Index has fared extremely well, and much of that consistent performance can be traced to the benefit of diversifying across different sources of return premia.