Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Most Recent Thematic Investing

Global equity indices retreated in May, dragged lower by European and Asian shares. In the US, better-than-expected earnings from technology companies overshadowed concerns about a government default and ongoing interest rate hikes.

Thematic indices can offer diversification and market-beating returns, in some cases by using innovative index methodologies, says Christoph Schon at Qontigo.

The ISS STOXX Biodiversity Index Suite, launched this week, aims to take a more holistic approach to biodiversity than existing market offerings, Antonio Celeste, Director for Sustainability Product Management at index, analytics and risk solutions provider Qontigo, told ESG Investor.

Index | ESG & Sustainability

New ISS STOXX indices use comprehensive framework to help investors address biodiversity challenges

The fight to preserve our nature’s systems is intensifying, presenting both additional risks and opportunities for investors. Qontigo’s ISS STOXX Biodiversity indices offer a multi-step framework to address biodiversity challenges while employing state-of-the-art datasets.

ISS ESG, the sustainable investment arm of Institutional Shareholder Services Inc. (ISS), and Qontigo, a leading global provider of innovative index, analytics and risk solutions, today announced the release of the ISS STOXX Biodiversity Index Suite to mark the U.N.’s International Day for Biological Diversity.

Index | ESG & Sustainability

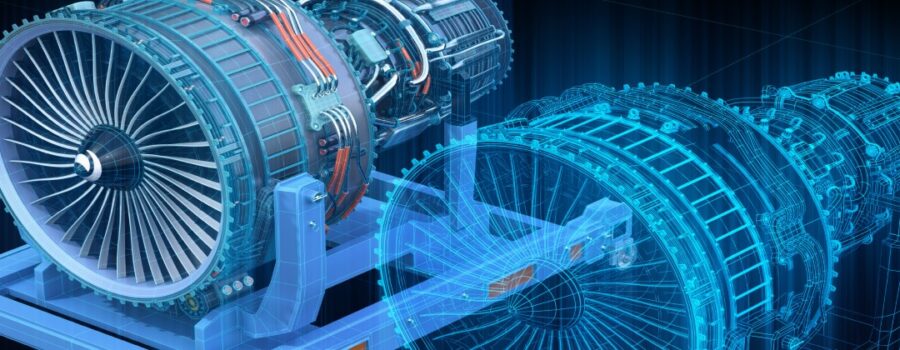

The future of mobility: thematic investing in the clean transport revolution

The goals of the Paris Agreement depend inexorably on the decarbonization of the transport sector and, therefore, on the widespread adoption of electric cars. Investors can join the clean transportation megatrend through targeted thematic strategies.

Index | Thematic Investing

Luxury goods: the finer things in life are also shining in the equity market

As the luxury goods industry experiences a post-pandemic boom and its companies become some of the largest in the world, a new thematic index and ETF offer investors an opportunity to track this business segment in a targeted way that would not be possible through a traditional sector strategy. The Kodex European Luxury Top 10 ETF was listed in Korea on Apr. 25 and tracks the STOXX Europe Luxury 10 index.

Stocks rose in April following better-than-expected economic and earnings reports, and amid signs that inflation in key regions continues to cool.

Index | Thematic Investing

Q&A with EconSight: translating patent information into measurable technologies and innovation scores

EconSight’s sophisticated patent classification system helps determine which companies are likely to lead in future technological markets. The company’s indicators and deep know-how is employed in the stock selection process of the STOXX Global Metaverse index.

Index | Thematic Investing

New STOXX thematic index tracking Europe’s booming luxury-goods industry licensed to Samsung Asset Management for first-of-kind ETF

The index’s targeted focus allows investors to accurately capture one of the strongest-growing themes of late, as Gen Z and Asian consumers increase spending on luxury products.

Index | Index / ETFs

Qontigo licenses the STOXX® Europe Luxury 10 index to Samsung AM, as European luxury goods market rebounds

Qontigo has licensed the STOXX® Europe Luxury 10 index to Samsung Asset Management, to serve as an underlying index for an inaugural ETF listing on the Korean Exchange. The index comprises ten of the largest European companies in the luxury goods sector, including some of the world’s most iconic premium brands: Dior, Hermès, LVMH and Moncler.

Despite its main association with online gaming and social media, the Metaverse is also providing a virtual platform for industries to employ technologies aimed at improving efficiency, controlling supply chains and monitoring risk-management processes. The STOXX Global Metaverse Index is designed to capture the pioneers developing those applications.