On Feb. 12, China will usher in their New Year with festivities across the country. In spite of the grim news that marked this past year, or perhaps because of it, they will have plenty of reasons to celebrate.

Just over one year after a lockdown in the city of Wuhan foretold the bleakness of a global COVID-19 pandemic that was to come, the nation may look at the year that starts with justifiable optimism. After all, virus-related deaths are uncommon these days, the economy has leapt ahead of those in the rest of the world, and financial markets are roaring back.

China’s gross domestic product expanded by 2.3% in 2020, the government said Jan. 18. That compares to a 3.5% contraction in the US and a 6.8% decline in the Eurozone.1 China was the first major economy to emerge from the COVID-19-induced activity slump and the only one to grow last year.

The yuan has strengthened almost 10% against the US dollar since last May. There is an improved political background too: a new US administration bodes well for the Chinese economy, as it may put behind a major trade spat between the two nations that marked much of Donald Trump’ Presidency.

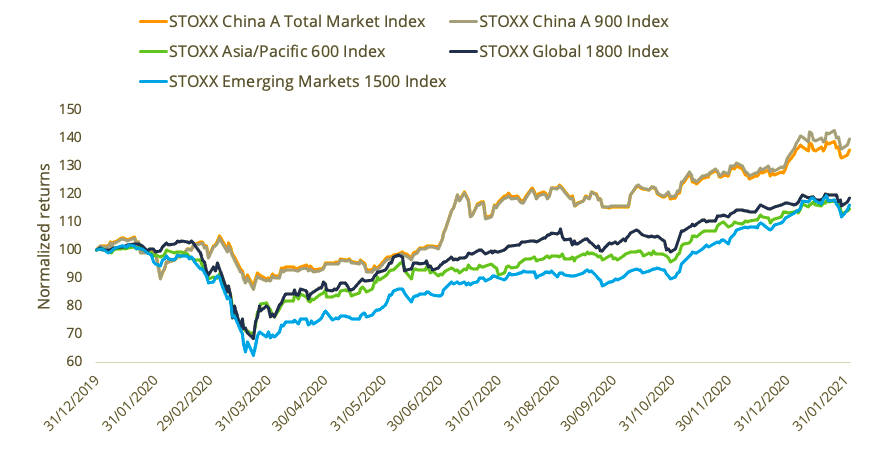

The local equity market is also giving other nations reasons for envy. The broad STOXX® China A Total Market Index, which tracks companies that are incorporated and operate in the People’s Republic of China (mainland), has gained 36% since the start of 2020.2 The benchmark STOXX® China A 900 Index has fared even better – rising nearly 40%. By comparison, the STOXX® Global 1800 Index has advanced 19% and the STOXX® Emerging Markets 1500 Index has added 16%.

China’s A shares make up the country’s biggest market and are traded in renminbi on the Shanghai and Shenzhen stock exchanges. The market is dominated by retail investors and has therefore been susceptible to bouts of volatility, in fact crashing in 2015.3 International investors can access it under special arrangements such as the Stock Connect program.

Exhibit 1 – China A shares outperform

Different markets, different picture

Outside the A segment, there is a varied list of other markets that offer exposure to China. Ten STOXX indices reflect the heterogeneity of these markets, with specific and dissimilar company structures, revenue source, economic and corporate regulation, market access and currency. A closer look at them shows that the rally hasn’t been widespread.

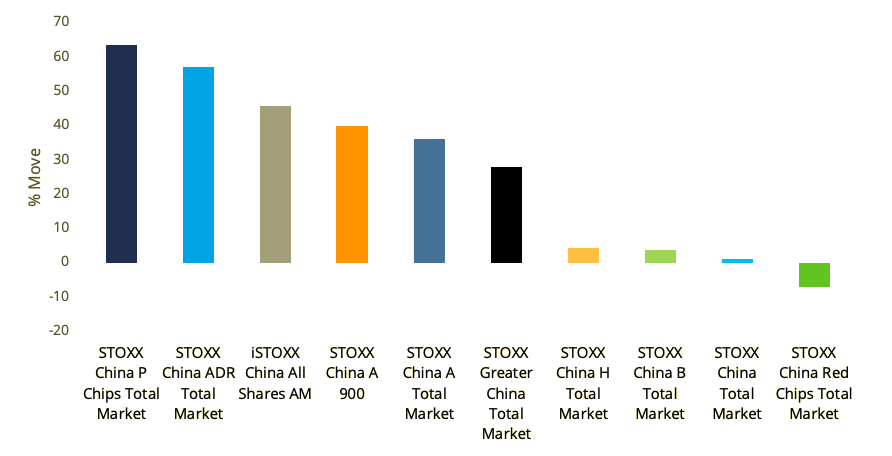

Exhibit 2 shows the entire suite of China-focus indices, where two types emerge based on their returns since the start of 2020. On the one hand, the strong performers with advances between 28% and 64%. On the other, four indices show relatively muted gains and even a loss. Below, we define each one of them.

Exhibit 2 – China index family returns since 2020

Let’s review what each index covers.

The STOXX® China B Total Market Index tracks companies that are incorporated and operate in mainland China and whose stocks are quoted in foreign currencies in Shanghai and Shenzhen. The B-share market is, however, small. The index has gained only 3.8% since the start of 2020.

Hong-Kong listed stocks, ADRs

While onshore investors have appeared bullish, offshore markets that offer exposure to Chinese companies show a more diverse performance.

The STOXX® China H Total Market Index (Hong Kong-listed companies that are incorporated and operate in mainland China), has risen only 4.4% since January 2020. The STOXX® China Red Chips Total Market Index (Hong Kong-listed companies that are incorporated outside of, but operate in, mainland China) has lost 7%.

On the other hand, the STOXX® China ADR Total Market Index has jumped 57.2%. The index tracks American depositary receipts (ADRs) of companies that are not incorporated in China but derive the majority of their revenues from mainland China. The STOXX® China P Chips Total Market Index has surged 63.6%. The index tracks companies listed on the Hong Kong Stock Exchange, and are incorporated outside of, but derive the majority of revenues from, mainland China.

The iSTOXX® China All Shares AM Index has climbed 45.7% during the period analyzed. AM stands for Accessible Market, as the index combines shares that are available to international investors: B, H, Red Chips, ADRs, P Chips plus A shares trading through the Stock Connect program.

Finally, the STOXX® Greater China Index covers 95% of the entire China B, H, Red Chips, Hong Kong and Taiwan markets. The STOXX® China Total Market Index covers 95% of all China B, H and Red Chips markets. They have climbed 27.9% and 1.1% since 2020, respectively.

Risk profile improves

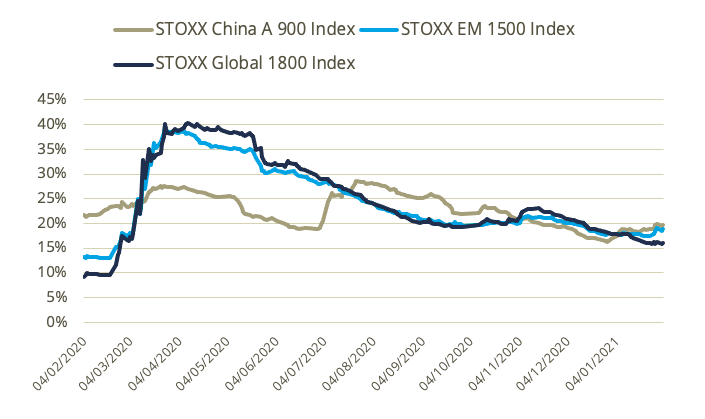

Turning back to the A-share market, the Axioma Equity Factor Risk Model Suite can help shed light on the Chinese market’s risk profile. What we see is that there has been a reduction in the expected volatility of domestic stocks — as shown by the short-horizon fundamental risk forecast — from its high in August but also relative to other regions in the past year (Exhibit 3).

Exhibit 3 – 12-month variation in fundamental risk

The Axioma short-horizon fundamental risk forecast is designed to produce a prediction of index volatility over the next one to three months. The gauge uses patterns of volatility and correlation amongst industries, style factors and the global market, along with countries and currencies for multi-country benchmarks.

Exhibit 3 shows that while the forecast risk for the STOXX China A 900 Index has fallen by about 2 percentage points from a year ago, the readings for the Emerging Markets 1500 Index and the STOXX Global 1800 Index have, respectively, increased 5.8 and 7 points. The fact that China entered the COVID-19 crisis before the rest of the world may explain its higher risk starting point in early February 2020.

At the same time, however, the Global 1800 and Emerging Markets indices saw their risk drop in half since the peak in April, whereas China’s proportional decrease was lower. What is perhaps most interesting is that the risk of the A-share market, usually far higher than that of the Global 1800 in data going back longer in time, is now roughly equivalent.

Please visit our blog on an analysis of investor sentiment on Chinese markets.

Market outlook

Enthusiasm about the Chinese market seems to be broad-based these days. Investment banks such as Goldman Sachs and Morgan Stanley have predicted double-digit growth for the A market in 2021, as they expect the local economy will continue leading the rest of the world in the rebound from the pandemic.4

For many investors, that certainly adds to the New Year celebratory mood.

1 Eurostat, Preliminary flash estimate for the fourth quarter of 2020, Feb. 2, 2021.

2 All performances are gross returns in dollars through Feb. 2, 2021.

3 After rising 268% in the preceding 12 months, the STOXX China A 900 Index nearly halved in value in six weeks starting in June 2015. The central government was forced to intervene to contain the selling. For more on the 2015 crash, see Financial Times, ‘China’s struggle to control stock bubble offers lessons in investor mania,’ Feb. 4, 2021.

4 Reuters, ‘Global investors see China stocks bull run lasting well into 2021,’ Nov. 30, 2020.