A new STOXX index combines a thematic approach with responsible criteria and low-volatility/high-dividend screens, highlighting the versatility of passive investing.

The iSTOXX® Global Cities of Tomorrow Select 30 Index aims to capture the economic upside of companies exposed to the powerful transformation and growth of smart cities in the digital era. These companies provide a diverse set of solutions, whose demand is driven by an expanding population, limited natural resources, technological advancements and an increasing focus on environmental sustainability.

Marrying megatrends and sustainability

At the same time, the index selects those companies with best environmental, social and governance (ESG) practices, and excludes those linked to activities considered harmful to the environment or societies, or with unsatisfactory business behavior, thus meeting the standard responsible principles of major asset owners.

A final screen selects companies with the highest dividend yields and lowest price volatility, characteristics that are of particular interest to issuers of structured products.

In this way, the index meets some of the most common needs of investors these days, rolled into one systematic strategy supported by STOXX and two of its world-leading data partners — Sustainalytics and FactSet. The index is suitable as underlying for mandates, passive funds, exchange-traded funds and structured products.

Selection process – step by step

The selection process starts by ranking all stocks in the STOXX® Developed and Emerging Markets Total Market Index in descending order according to their ESG score as calculated by Sustainalytics. The 50% lowest-rated companies are excluded. A liquidity filter is applied to remove shares with low trading volume and to ensure index replicability.

Thereafter, a norms- and product-based filter removes companies that Sustainalytics considers are non-compliant with the United Nations Global Compact principles of human and labor rights, the environment and anti-corruption; or that are involved in activities with negative ESG implications, such as tobacco and oil & gas.

Detailed sector exposure to theme

Finally, only companies that generate a quarter or more of their revenue from the aggregate of 293 sectors associated with the Cities of Tomorrow theme remain in the selection list. These sectors make up a comprehensive catalogue of modern-day urban activities, from wireless services to metal recycling, and from passenger rail transportation to mortgage loan servicing, that results from the granular segmentation of FactSet’s Revere Business Industry Classification System (RBICS).

Optimizing for the structured-products space

The final index composition is derived from the following two steps: firstly, all remaining stocks are sorted by their volatility. From the 50% of stocks with the lowest volatility ratios, the 30 with the highest dividend yield are selected for the index, with industry, region and country caps and neutrality filters applied to ensure diversification. Constituents are weighted by the inverse of their historical volatility.

These last two screens are a staple of the Select family of STOXX indices, which have proved popular with structured-products issuers as they bring down the price of packaging the securities.

Outperformance of ‘Cities of Tomorrow’ Theme

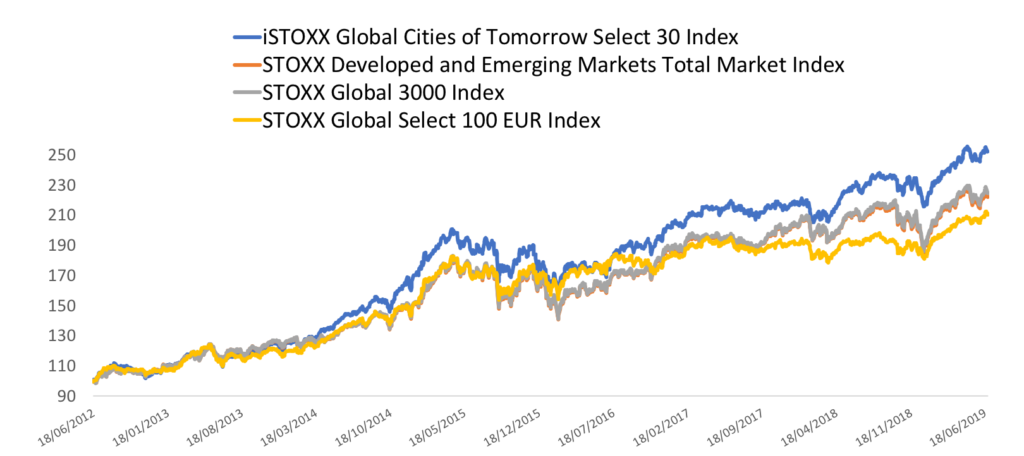

Chart 1 shows the performance of the iSTOXX Global Cities of Tomorrow Select 30 Index, in blue, against its benchmark. Also featured are the STOXX® Global 3000 Index and the STOXX® Global Select 100 EUR Index. The latter employs a low volatility/high dividend selection approach.

Chart 1

The iSTOXX Global Cities of Tomorrow Select 30 Index has been licensed to Citigroup Global Markets Ltd. to underlie a structured product.

Responding to multiple investor objectives

The iSTOXX Global Cities of Tomorrow Select 30 Index provides a responsible way to target an economic theme closely linked to megatrends of today. Its distinctive approach is designed to serve investors who may want to address several principles and objectives in their portfolios, aiming to recoup the benefits of different strategies as well as the advantages of passive investing.