The cloud is “in.” In fact, being in the cloud is fast becoming de rigueur for investment managers who want to send a message to all constituents—clients, investors, partners, competitors, you name it—that they are technologically “with-it.” But dig a little deeper, and you often find that firms have simply switched to a cloud-hosted infrastructure, rather than a thoroughly modern cloud-native environment. Granted, both approaches offer technology with benefits, but as Fabien Couderc, Chief Strategy Officer of Axioma, explains here, the advantages of cloud native far exceed those of cloud hosted.

Q. In the simplest terms, Fabien, what’s the difference between cloud hosted and cloud native?

Couderc: Basically, cloud hosted—often associated with infrastructure-as-a-service—is the same thing as having your own data center. The difference is that you are running on the cloud provider’s virtual hardware, rather than your own. It’s purely an infrastructure play—a way to simplify and speed up the provisioning of new hardware. It’s also, as an aside, the fastest way to secure bragging rights to the cloud, but that’s another story. Cloud native, on the other hand, is all about leveraging the technologies that are built on top of that virtual hardware.

Q. But aren’t there cost benefits to cloud-hosted systems?

Couderc: There can be, but not always. If you consider only the hardware costs, it’s more expensive to run in the cloud—always. The only way it becomes less expensive is by investing in technology and development that automates the management and deployment of your virtual machines—because that will allow you to reduce your IT workloads and operations headcount. If you don’t go that route, you’ll still be doing a lot manually, just as you did with your old data center.

Q. OK, let’s shift gears and talk about cloud native. You said earlier that cloud native is about taking advantage of technologies built on top of the virtual hardware. So what exactly are we talking about here?

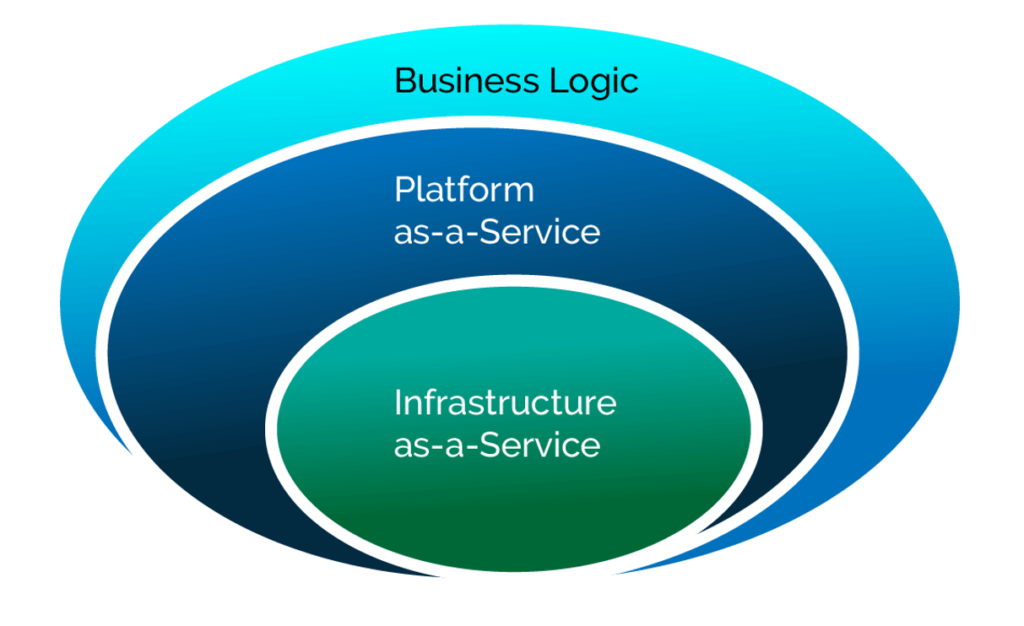

Couderc: The biggest advantage to cloud native comes from going beyond infrastructure-as-a-service to platform-as-a-service. Platform-as-a-service means that the cloud provider has totally abstracted the hardware into a dedicated technology to provide you with the environment to run directly your workloads and store your data as needed. It’s like an onion. The core is the hardware. One layer outside of that is the infrastructure-as-a-service. The next layer is the platform-as-a-service, which provides you with the automated management of the virtual hardware. Finally—and ideally—you would have a business-logic layer, one that applies specifically to your own industry, that abstracts it all. But that, of course, has to be built separately, because no cloud provider has that kind of domain expertise.

Needless to say, going cloud native isn’t easy. It requires extensive reengineering, at the very least, or making bold investments to build new solutions from the ground up. But ultimately, cloud native allows you to focus exclusively on your own business tasks, instead of wasting time managing your technology infrastructure. And that’s huge.

Q. OK, but boil it down for us. When you think in terms of cloud native platform-as-a-service, what’s the big payoff? What are the key user benefits?

Couderc: In my mind, there are three big ones. The first is that you now write far less code, because the foundational code is already embedded in the platform-as-a-service technologies. As a result, your development team can now focus on writing code that supports your own unique solutions, because the other stuff is being handled by the cloud provider. The payoff is reduced development lifecycles, which enables firms to deliver new business functionality quickly and efficiently. So unlike cloud hosted, cloud native actually allows you to enhance your products. And that, at the end of the day, translates to competitive advantage.

The second benefit of platform-as-a-service is that it decouples your business logic from what’s under the hood, technologically speaking. So if something starts to run inefficiently—or maybe your clients want something new—deploying a different technology isn’t a problem. There are no big risks and it’s not a titanic undertaking. Platform-as-a-service gives you a lot more flexibility because your business logic is no longer chained to your technology, which means that you can iterate, adapt and evolve much more easily as conditions change, with no interruptions to your operations. By the way, a lack of flexibility is precisely why firms in the past always ended up with monolithic systems.

The final big benefit involves the management of the solution itself. With cloud native platform-as-a-service, if you work hard to leverage it, you can do a lot to reduce your total cost of ownership, while simultaneously delivering more value to your clients. And for investment managers today, with competition ratcheting up and margins shrinking, that is a critical objective. For example, platform-as-a-service lets you provide high availability and full redundancy for disaster recovery at a fraction of the traditional costs—and you don’t need to spend resources making sure that any code changes are implemented in multiple data centers. With cloud hosted, you don’t automatically get that.

There’s just one catch to fully capturing all these benefits: your firm has to embrace cloud native. Because designing, developing, and changing pieces of your system in real-time requires a completely different mindset. Taking advantage of the breadth of innovation that cloud-native infrastructure can provide requires highly qualified staff with out-of-the-box thinking, tremendous business expertise, and a different approach to managing your projects and costs. But, again, the benefits are huge.

Q. Got it… As an aside, may I ask how you became so knowledgeable about the cloud?

Couderc: That’s a good question! And in response, let me quote Albert, who said, “The only source of knowledge is experience!” Axioma, in fact, was an early adopter of the cloud—at least in the realm of investment risk management. Five years ago we launched Axioma Risk, an enterprise-wide, multi-asset class risk solution. Back then, many financial institutions dismissed cloud computing as too vulnerable from a security perspective. While other industries have embraced the cloud more quickly, things are now changing in the world of finance. A recent study shows that over 50% of buy-side firms will be increasing their investment in cloud technologies in the next 12 months.

We embraced the cloud for its scalability, on-demand computing power and lower cost of ownership. We started from scratch, building a cloud-native solution that capitalized fully on the advantages of cloud-based technologies. And we leveraged Microsoft Azure to do it. Unlike other providers, Azure offered a platform as a service from the outset, and it allowed our development process to progress much more quickly, because we would have had to write far more code otherwise. I would estimate that Azure saved us about two years of development time.

Bottom line, to create Axioma Risk, we had to modernize our technology infrastructure in much the same way that investment firms with cloud aspirations must now modernize theirs. And we’re now in the process of sharing it all and enabling our clients to leverage it.

Q. How so?

Couderc: All of our cloud knowledge and experience is built into axiomaBlueTM, the open, cloud-native platform that we launched last October. axiomaBlue essentially provides a platform-as-a-service for investment management—the business-logic layer of the onion that I mentioned earlier. axiomaBlue provides interoperable and integrated access to Axioma’s best-of-breed solutions for multi-asset class enterprise-wide risk management, portfolio construction and optimization, portfolio attribution, custom risk models and analytics—all designed to be adapted and tailored to a firm’s own investment process. On top of that, axiomaBlue is an open system that will include third-party solutions, such as trade-order management systems, IBOR, data and accounting systems, giving firms access to a complete solution to drive their unique investment process.

For firms seeking to capitalize fully on the competitive advantages of a cloud-native platform, we think it’s not only an exciting option, but a short-cut for realizing the long-term benefits of leveraging the latest in best-of-breed solutions driven by modern technology. But that’s a topic for another interview…Learn more about evolution in buy-side risk management technology >