After a tough end to 2018 for factor-based managers, hopes were high for a turnaround this year. Unfortunately, the turn has failed to materialize. Many factors and associated portfolios continue to struggle. Beyond that, the duration of factor underperformance has been far longer than usual, the return correlation among factors on which managers commonly tilt appears to have gone up, and some portfolios may be lagging the factors on which they were built. In other words, many things have failed at once. We decided to try to find out why.

Axioma has been producing “sample factor portfolios” for a number of years. These Russell 1000-based long-only portfolios are rebalanced monthly at month-end, and maximize exposure on a given factor with a 3% active risk target. Most tilt on a single factor, but we also produce a multi-factor portfolio that uses an equal weighted combination of high Earnings Yield, Medium-Term Momentum, Profitability and Value, and negative Size and Volatility. The factors are equally weighted and for this post we will focus on those versions that constrain exposure to all industries and other style factors. Note that we do not consider expected transaction costs or limit turnover for these portfolios, and returns do not include realized transaction costs.

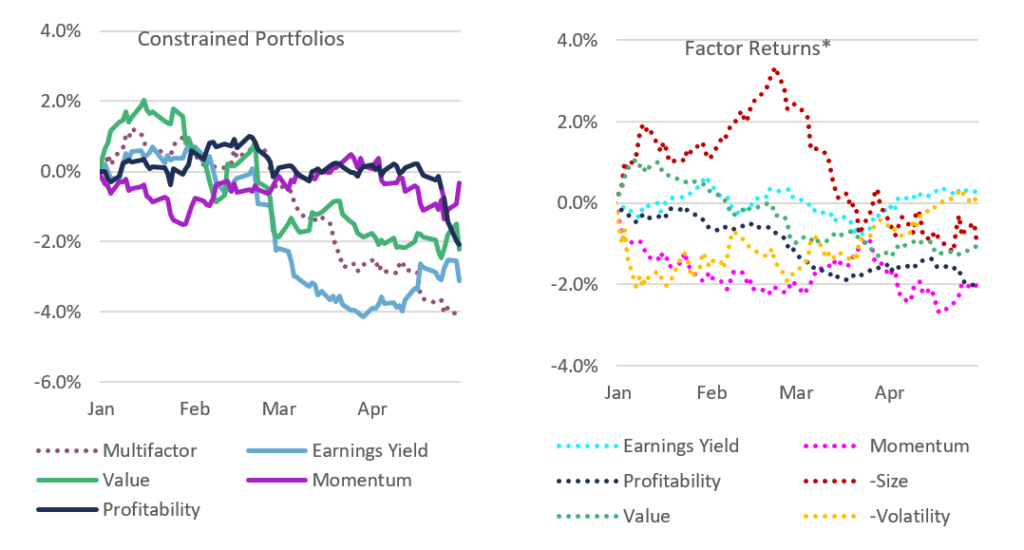

Exhibit 1 shows the year-to-date active return (through April) of the individual and multi-factor sample factor portfolios, along with the underlying factors. For the first four months of this year, all portfolios lagged the market (Momentum just slightly), with the multi-factor version faring worse than any of the individual factor portfolios. Obviously, this portfolio did not realize the assumed benefit of factor diversification, and. in fact. the concurrent failure of several factors seems to have heightened the underperformance. In addition, the individual factor portfolios generally fared worse than the associated factor.

Exhibit 1. Active Portfolio and Underlying Factor Returns

Source: FTSE Russell, Axioma

The factor returns above reflect unconstrained exposure to the factors. In our recent paper “What, Exactly Is a Factor?” [1]we showed that many of the decisions in how a factor portfolio is constructed have an impact on the performance of the factor itself, and that, in turn, could guide us on what has happened this year. Perhaps the performance of the portfolios relative to their underlying factor was the result of 1) the long-only constraint, 2) the large-cap universe limitation or 3) the monthly rebalance.

In the paper we describe how we constructed these alternative factor definitions, and the charts below show the impact of the three constraints described above for four of the factors, year-to-date through April. None of the portfolios has exposures to factors other than the target factor in question. In other words, we consider them to be “pure” portfolios. But they differ along the following dimensions:

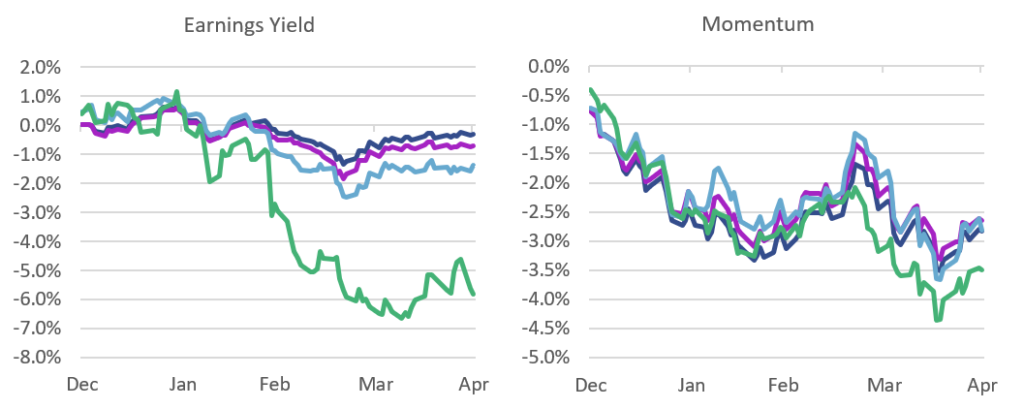

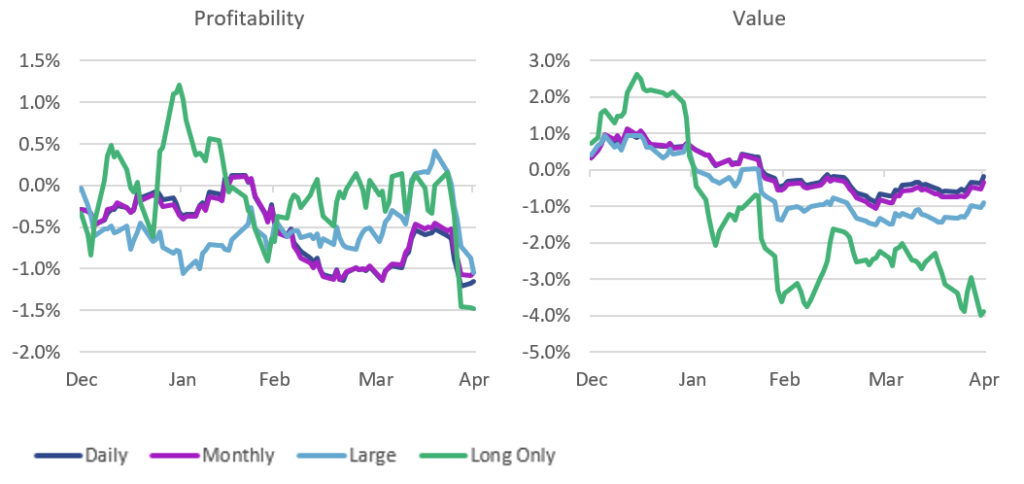

In Exhibit 2, the dark blue line (1) is the return of the portfolio that invests across a broad universe of stocks (similar to the Russell 3000), is rebalanced daily, and is long-short. In other words, this is a portfolio that is similar to what we call the “factor”.[2] The pink line is the same as (1) except it is rebalanced monthly rather than daily. The light blue line is also the same as (1) except the investment universe is limited to the Russell 1000 (so it comprises only large-cap stocks), and the green line shows the active return of a portfolio that is the same as (1) except that the total portfolio can only be short up to the benchmark weight (so the underlying portfolio is long-only).

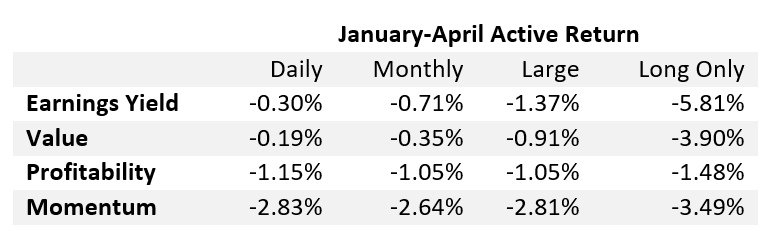

We thought we might see each of these constraints having a big impact, and were therefore surprised to see that with a few exceptions the various constraints did not have a big impact on the factor returns, and in some cases the constraint helped (albeit slightly) rather than hurt (a summary is in Exhibit 3). The most obvious harmful constraint was the long-only restriction in Earnings Yield. In other words, this suggests the factor worked far better on the short side (so high Earnings Yield stocks fared poorly), but cheaper stocks, according to this measure, did not necessarily outperform. The gap was similarly big for Value, but the long-only constraint was only a slight drag on Momentum returns. It hurt Profitability only in the last few days of April; until then the factor seemed to work better on the long side. The impact from the no-shorting constraint for Earnings Yield, Value and Momentum may have been another reason the multi-factor portfolio underperformed by so much.

The rebalance frequency did not have a big impact, whereas the portfolio constructed using the large-cap universe only lagged the broader-universe variant for Earnings Yield and Value, and was sometimes much better and sometimes much worse for Profitability.

Exhibit 2. Active Returns of Alternative Factor Construction Portfolios

Exhibit 3. Summary of Returns

Bottom Line

Factor-based investors who are long-only or universe-limited may have experienced the impact of these constraints this year, which likely magnified the impact of already-poor factor performance across many commonly used factors. As in the individual factor portfolios, the multi-factor version likely suffered from the long-only and universe constraints, with an added hit from the poor performance in the underlying factors. We suspect that, even with the ability to short portfolios, we would have seen the impact of the poor performance across factors. Shorting or not, the changing correlations among popular factors may have also made risk more difficult to manage.

This analysis doesn’t make performance any better, but we hope it helps add to the explanation of what happened. And in my long experience as a quantitative investor, I am confident performance will turn around, even if it is taking longer than usual this time around.

[1] Featured in Savvy Investor’s Best Recent Papers on Quant Strategies list

[2] Differences between this and the factor are the result of differences in the underlying universe and outlier handling.