On September 20, Germany’s flagship DAX® Index will expand from 30 to 40 constituents, concluding the biggest reform in the benchmark’s +30-year history.

The enlargement is the final step in a comprehensive overhaul of rules announced in November 2020 that took into account the responses of more than 600 participants in an extensive market consultation. Qontigo’s global index provider STOXX Ltd. announced last Friday the ten new constituents:

| Airbus SE | Qiagen N.V. |

| Brenntag SE | Sartorius AG (Pref. shares) |

| HelloFresh SE | Siemens Healthineers AG |

| Porsche SE | Symrise AG |

| Puma SE | Zalando SE |

Source: Qontigo

Launched in July 1988, DAX has always been made up of the 30 largest and most liquid German listed companies. The ten new constituents will increase the DAX’s representativeness of the domestic economy and foster its diversification. But what does it mean for the index’s profile in terms of market capitalization and equity turnover? In this article we’ll look at the effects of the change from these two perspectives

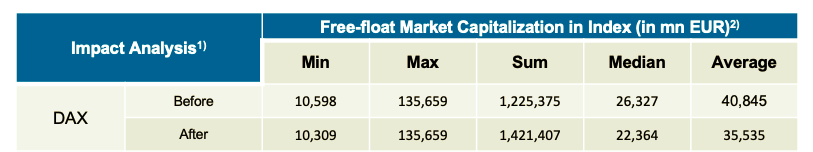

Figure 1 – Impact on free-float market cap

The addition of ten new companies in the index lowers the average free-float market capitalization of DAX constituents to EUR 35.5 billion from EUR 40.8 billion, Qontigo data show. While most entrants are smaller than existing constituents, there is one exception with Airbus SE. The maker of airplanes is the fifth-largest company on the Frankfurt Stock Exchange (FSE), but had up to now failed to enter the DAX as its local trading turnover was smaller than that of other candidate stocks.

Elimination of turnover requirement

That exchange turnover criterion, however, is being removed from the ranking process as of the current review, aiming to simplify the index rules. While members of DAX will now be ranked based on free-float market capitalization only, their investability will be warranted by a requirement to fulfil minimum liquidity criteria instead1.

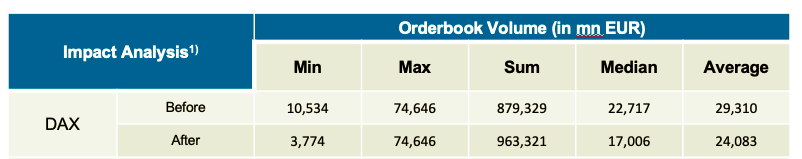

This will reduce the average 12-month turnover in DAX constituents to EUR 24.1 billion from EUR 29.3 billion before the changes (Figure 2).

Figure 2 – Impact on equity turnover

Further changes

Other rules that have been gradually introduced to DAX, MDAX and SDAX Indices since last November are listed below. They were designed to strengthen the quality of the indices and to align them with international standards:

- DAX candidates must have a positive EBITDA in their two most recent annual financial statements.

- Index base universe was extended to all issuers in the Frankfurt Stock Exchange’s Regulated Market, from just its Prime Standard segment previously.

- All constituents are now required to produce audited annual financial reports, semi-annual financial reports and quarterly statements (comparable to current Prime Standard requirements).

- Introduction of alignment requirement with the German Corporate Governance Code with respect to the formation of an audit committee in the supervisory board.

- Addition of a regular DAX review in March.

For a complete look into rules for the DAX Selection Indices, visit the Guide to the DAX Equity Indices. The next scheduled index review is December 3, 2021.

1 Initial eligibility: minimum trading volume over the last 12 months of either EUR 1 billion at the Frankfurt Stock Exchange or a turnover rate of 20%. Continued eligibility: a minimum trading volume over the last 12 months of either at least EUR 0.8 billion or a turnover rate of 10%.