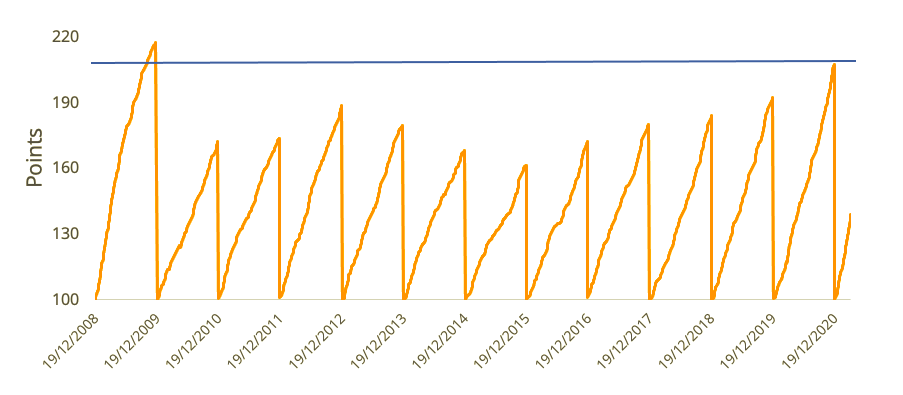

Last year was one for the history books in terms of realized dispersion. According to the EURO STOXX 50® Realized Dispersion Index, 2020 brought the highest realized dispersion in ten years, near the levels seen in 2009 (Exhibit 1). The divergence between ‘work from home’ and ‘reopening’ stocks was a dominant theme throughout the year and remains a hot topic to date.

Exhibit 1 – EURO STOXX 50 Realized Dispersion Index performance

For an overview of dispersion trading and the EURO STOXX 50 Realized Dispersion Index, visit a blog post we published last year together with Optiver.

Differences between U.S. and Europe dispersion

Trading U.S. and Europe dispersion isn’t really different. However, dispersion has become popular in Europe in the past years with a focus on over-the-counter (OTC) trades with volatility swap (VolSwap) packages, whereas in the U.S. dispersion is mainly traded using variance swaps (VarSwap).

A second difference is, of course, the composition of key indices. In Europe, the EURO STOXX 50® Index consists of 50 companies, with an important heterogeneity in terms of sectors. In the U.S., the S&P 500 Index has as many as 500 names, and with a high-tech component. That’s why Nasdaq 100 dispersion in the past two years has become more popular with respect to the S&P 500 as it allows for more precise dispersion trading.

The U.S. also has relatively natural demand for single-stock options, which especially in the past year has risen significantly. European dispersion trading desks have to play a bigger role in providing liquidity to books seeking to hedge single-stock and correlation risk.

Q&A with Optiver and Ellipsis AM

To find out more about dispersion trading, we reached out to three experts. Alexandre Ryo is portfolio manager at Ellipsis AM, while Anand Rathi and Jeroen Kleene are, respectively, partner and trader at Optiver.1 Below is our exchange.

What are the main differences between OTC and listed dispersion?

Alexandre: “There are important differences between OTC dispersion (VolSwap or VarSwap) and listed dispersion. In Europe, OTC dispersion is mainly traded in VolSwap. Because the VolSwap payoff can’t be replicated with listed options, it’s really not the same expected return.”

Anand: “Indeed, when you are trading listed dispersion, you are mainly looking for a covariance move, i.e.,not only a correlation move. You are looking for really important moves on single names compared to the index’s move.”

Alexandre: “Another major difference is the return profile: when you are trading OTC dispersion, you are mainly entering a carry trade, with a buy-and-hold strategy looking to capture the difference between the volatility of each component and the index volatility at maturity.”

Jeroen: “The daily return profile of a listed dispersion trade is totally different. You are mainly looking for a systematic strategy which is a mix of a value trade (implied spread between the basket and the index) and a carry trade. Because your risk profile isn’t stable (gamma, vega and dividends for example), you have to manage your position daily to maintain and manage your exposure. Because it’s not only a carry trade but also a value trade, listed dispersion offers the opportunity to close the trade before maturity and to reallocate the capital risk for a better return.”

What are the pros and cons of the two methods?

Alexandre: “OTC dispersion is historically the most common way of trading dispersion, most importantly because it is an easy way to manage the strategy. By trading OTC, parties know exactly what exposures they have and do not have to manage the book during the lifetime of the contract. It is practically a pure carry trade, with generally few options to easily trade out of the position. As mentioned, trading dispersion using listed single-stock and index options is the other notable variant. By trading single options versus each other, a trader invariably has to keep managing their book as the exposures continue to change.”

Anand: “But this changing exposure is also one of the strengths of the method, as it allows parties to hedge local exposures with precision, including dividends and gamma, and introduces a convex pay-off that the VolSwap does not offer. It is a method that fits very well with large single-stock exposures that have to be hedged, as by trading listed dispersion one gets the advantages of the reduced spreads in the listed space and the larger sizes of the OTC space.

“The listed space offers other advantages such as being centrally cleared and having individual components that can be relatively cheaply hedged, which are most important during times of market distress.”

Jeroen: “March 2020 showed clearly that when there is a great demand to hedge or rebalance exposures on sudden moves, this access to a more liquid market with no counterparty risk and great customizability and modularity of the strategy is a superb advantage.”

How would you trade listed dispersion?

Alexandre: “Dispersion trading is not really far from long/short equity trading. Instead of trading the valuation of a stock versus another one, we are trading the valuation of the average volatility of a basket compared to the volatility of the index with the same components.

“Like in long/short equity trading, it’s important to classify dispersion in terms of geographic dispersion, inter-sectorial dispersion, intra-sectorial dispersion and factorial dispersion. Indeed, it’s important when you are entering in a dispersion trade to understand which kind of dispersion you want to trade.

“Personally, I focus on intra-sectorial and inter-sectorial dispersion. For example, I am looking at the components of a sector vs. the sector index, or a basket of sectors vs. a large index. Over the past two years, factorial dispersion has become famous due to the important dispersion between, for example, growth or momentum against value.

“In terms of implementation, with listed dispersion you need to maintain your risks exposures. The best way is to be systematic and to roll/adjust your portfolio with systematic triggers. For example, you can trade 6-month at-the-money straddles, delta hedge every day, and adjust your portfolio every month or every 5-10% move on a component to keep your vega exposure. You can also trade out-of-the-money calls or puts instead of a straddle to trade the correlation smile premia.”

Anand: “Listed dispersion requires more maintenance. Most changes in vega or gamma exposure are most easily managed by trading individual single-stock options, with the listed space generally offering plentiful liquidity to make precise adjustments. For bigger changes you might want to trade bespoke dispersion baskets to trade the desired book. The cost of hedging deltas is easily reduced in hedging all outright deltas by trading the index futures and converting these to stocks via the liquid EFP (Exchange of Futures for Physical) market. This way, only the excess returns of stocks versus the index have to be hedged, dramatically lowering hedging costs.”

What has driven your interest in dispersion?

Alexandre: “Dispersion is a risk premium, which, as we described, is mainly the capture of the difference between the implied correlation and the realized correlation. Because correlation spikes when markets become ‘risk-off,’ shorting correlation gives a premium in normal market conditions, which disappears until becoming negative in a market downturn.

“Looking at dispersion could be interesting for many reasons. The first one is to look at dispersion levels (both realized and implied) as market indicators. For example, a recent article from Bloomberg2 described that low realized correlations are seen as a sign of weakening market breadth and have occurred before stock market corrections, including the ‘Volmageddon’ event in early 2018. Moreover, looking at implied correlations or implied dispersion spreads could be interesting indicators to time index volatility: a high dispersion spread could be a sign of low level of index volatility and vice versa.”

Alexandre: “The second point of interest in dispersion is to optimize your hedging for an equity portfolio. For example, when the dispersion risk premium is looking interesting, it could be better to buy a put on each component of an index than to buy a put on this index. On the opposite hand, when dispersion spreads are expensive, it could be better to look at index options.

“The last-but-not-least point is to look at dispersion as a risk premium to create a return in a portfolio. For example, sometimes it’s interesting to create a long basket of calls on single names versus a short position on an index call, to obtain the exposure on a market disruption and equity spikes on single names.”

Jeroen: “Dispersion allows market makers to trade a much larger size in one trade than on any single names, enabling us to provide liquidity to parties seeking to hedge large and possibly complex exposures in one go – while still providing tight spreads as the amount of risk is reduced in this vega-neutral trade. Books often trade implicitly into a dispersion position by hedging overall volatility risk with index positions, so offering to convert this to the desired single-stock exposure or hedge is something that suits us well as liquidity providers.”

1 Founded in 1986 with a single trader on the floor of Amsterdam’s European Options Exchange, Optiver is now one of the oldest market-making institutions and a trusted partner of exchanges. The firm provides liquidity to financial markets using its own capital, trading a wide range of products: listed derivatives, cash equities, ETFs, bonds and foreign currencies.

Paris-based Ellipsis AM specializes in convertible bonds, open funds and volatility overlay solutions. It ranks among the largest managers in convertible bonds. Via its Overlay & Global Macro Solutions division specialized in listed derivatives, Ellipsis AM has offered strategies to manage hedging of asset portfolios since 2008, as well as yield enhancement strategies since 2016.

2 Bloomberg, “Falling U.S. Stock Correlations Could Be Selloff Warning: Chart,” January 2021.