This year was supposed to mark the full return of European bank dividends as regulators lifted a ban on payments imposed during the COVID-19 pandemic. Then the Ukraine crisis hit.

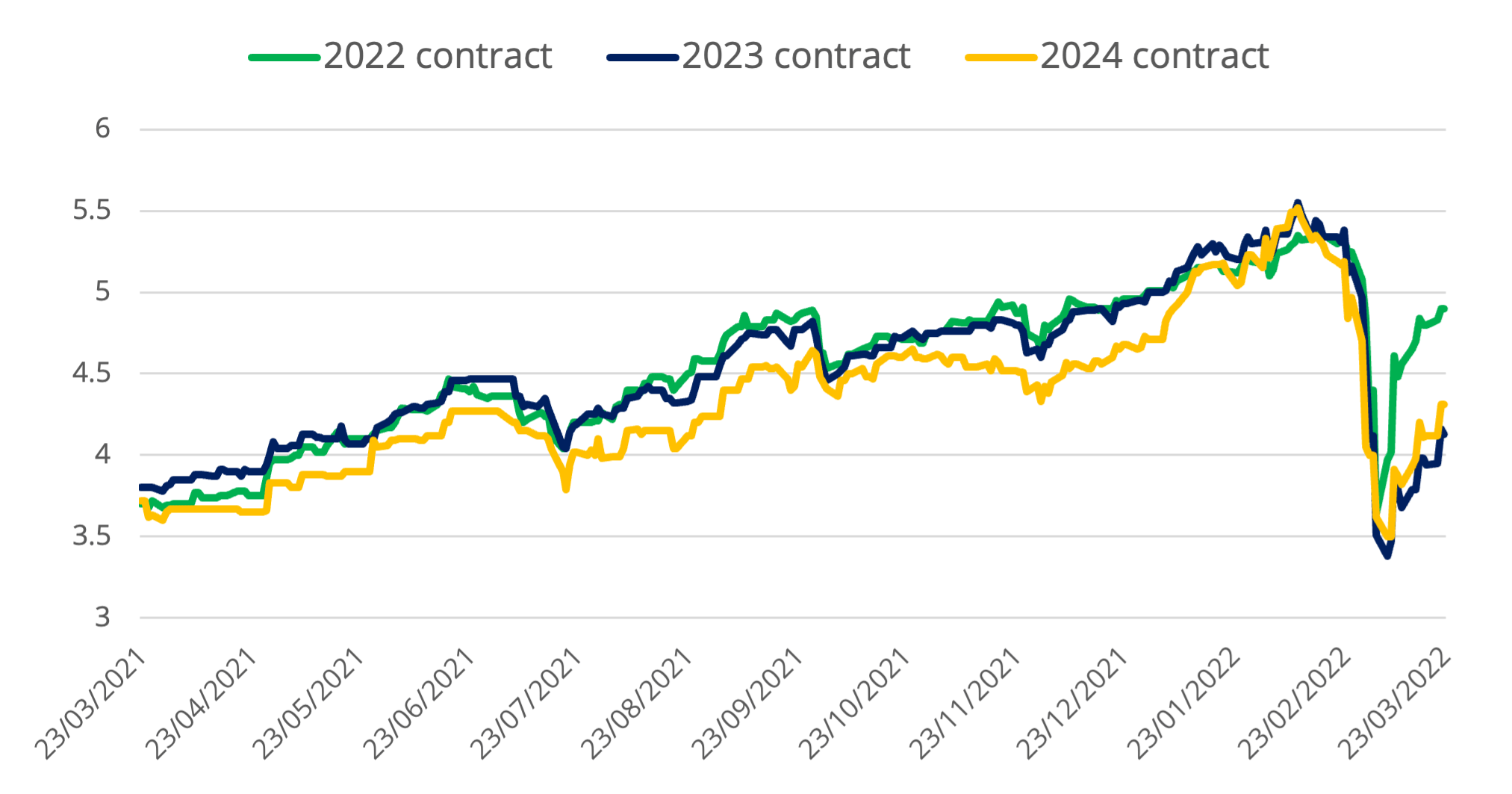

Figure 1 shows prices for futures on the EURO STOXX® Banks Dividend Points (DVP) Index expiring in December 2022, 2023 and 2024, over the past 12 months. All three contracts nosedived as Russia invaded its neighbor on February 24 this year, spurring concern that loans and assets linked to Russia may have to be written off following sanctions on the country, impacting reserves and the ability to pay dividends.

Since then, the 2022 contracts have partly recouped their losses, as most lenders have confirmed that their payouts for this year won’t be affected. One exception has been Austria’s Raiffeisen Bank International, which has suspended its dividend for 2021 and is considering exiting Russia. Yet, futures for 2023 and 2024 suggest dividend expectations are still significantly below the levels before the invasion of Ukraine started.

Figure 1: Futures on EURO STOXX Banks DVP Index

While the 2022 contracts closed on March 23 7.9% below their pre-war level, the 2023 futures are trading 23% cheaper. The 2024 contracts are 17% below their price on February 23. The cuts mean traders now expect dividends in the EURO® STOXX Banks Index will increase 19% this year from those paid out in 2021, compared with expectations for a 29% boost they had before the Ukraine conflict.

Cash markets recover

Uncertainty over dividends contrasts with what’s happening in the cash equity market, where prices have recovered all the losses since February 241 even as economists have warned that the risk of stagflation has risen. Investors have in recent days raised odds that a resolution to the conflict may be nearing.

Javier Manso Polo, a dividends analyst at Bloomberg, says several factors may be keeping dividend expectations for European banks at bay. Among them, a worsening macroeconomic outlook for the region and rising expectations that the European Central Bank may slow down interest-rate hikes to counter an economic slowdown.

“Surging prices of commodities, especially energy, are adding fuel to rising inflation and increasing the probability of a stagflation scenario in Europe,” Manso Polo said in an interview. “With global economic growth concerns, the European Central Bank’s hawkish policy could face delays, hammering the key catalyst for banks.”

Subscribe to receive related news and announcements

“The Russia-Ukraine conflict has led us to make major downgrades to our growth forecasts, but also upgrades to our inflation forecasts,” wrote economists at ABN Amro in a report to investors on March 30. “The primary impact of the conflict is to push inflation (even) higher. This raises the stakes for central banks, because while there is a pressing need to get ahead of the inflation problem, policy also needs to balance this need against the rising risk of recession in advanced economies.”

Selling pressure

Another factor dragging down the price of the futures may be demand for hedging dividend risk, particularly in the form of selling of contracts by issuers of structured products, said Bloomberg’s Manso Polo.

“This uncertain environment pushes traders to hedge further all their positions, and the strong presence of structure products in Europe squeezes dividend futures prices,” the analyst said.

EURO STOXX 50 dividends

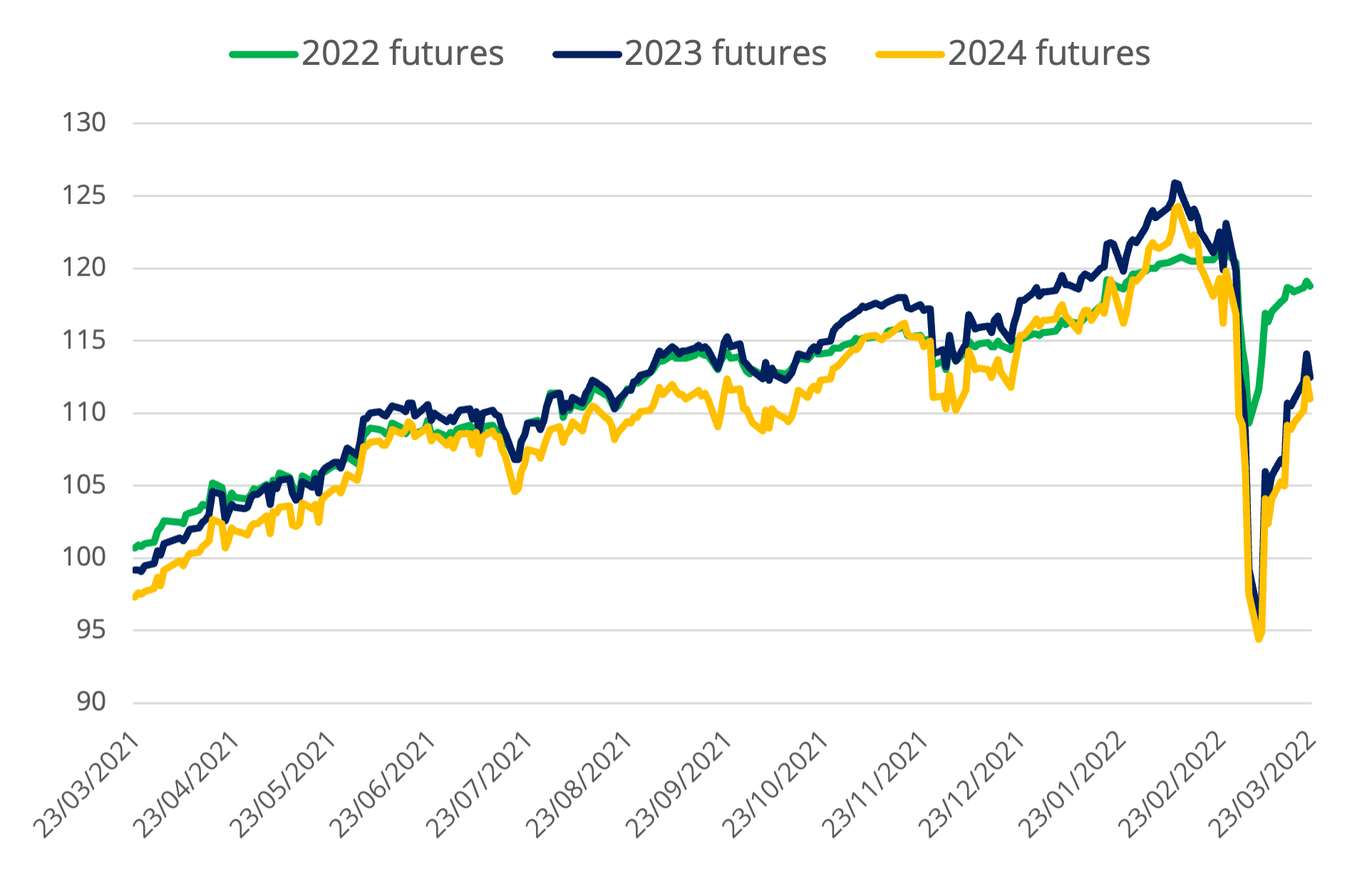

By comparison, dividend expectations for sectors outside banks have recovered more of their lost ground, trading in index futures shows. Figure 2 displays the 2022, 2023 and 2024 futures on the EURO STOXX 50® Dividend Points (DVP) index, which tracks payments from the 50 largest companies in the Eurozone.

Figure 2: Futures on EURO STOXX 50 DVP index

Futures on the EURO STOXX 50 DVP Index expiring in 2022 closed on March 23 2.3% below their pre-war level. The 2023 futures are trading 8.2% cheaper, while the 2024 contracts are 7% below their price on February 23.

To be sure, the 2022 contracts, which expire in December, reflect a 19% increase in payments this year relative to 2021.

“The dividend futures market is evolving as the natural selling pressure from new structured product issuance going forward is being throttled back due to the move of some issuance towards STOXX decrement indices,” said Stuart Heath, from Equity and Index Product Development at Eurex. “Current dividend levels are likely reflective of continuing uncertainty in banks’ ability to grow revenue, as well as specific sector impacts such as in autos, where supply-chain issues continue.”

Trading in EURO STOXX Banks DVP index futures on Eurex jumped 84% in February from the year earlier. Turnover in EURO STOXX 50 DVP index futures more than doubled.

1 Data through March 29, using the EURO STOXX 50® Index.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.