The well-publicized fall in equity markets may have overshadowed a potentially much more impactful risk from the corporate bond market – that of fallen angels. This issue was raised by our fixed income research team at our regular meeting yesterday and deserves its own blog post. In the last two years, both market pundits and regulators have been worried about the rising proportion of BBB-rated bonds – the lowest rank of investment grade – as a percentage of outstanding corporate debt. In some markets this proportion reached over 50%. How did we get there? The decade-long QE programs has created a binge on cheap credit and the strong economy meant that BBB issuers who were circling the drain of a downgrade to high yield, were given the benefit of the doubt by investors thinking they would be able to refinance, buy themselves some time, and the strong economy would eventually return them to profitability (i.e. default risk wasn’t correctly priced in).

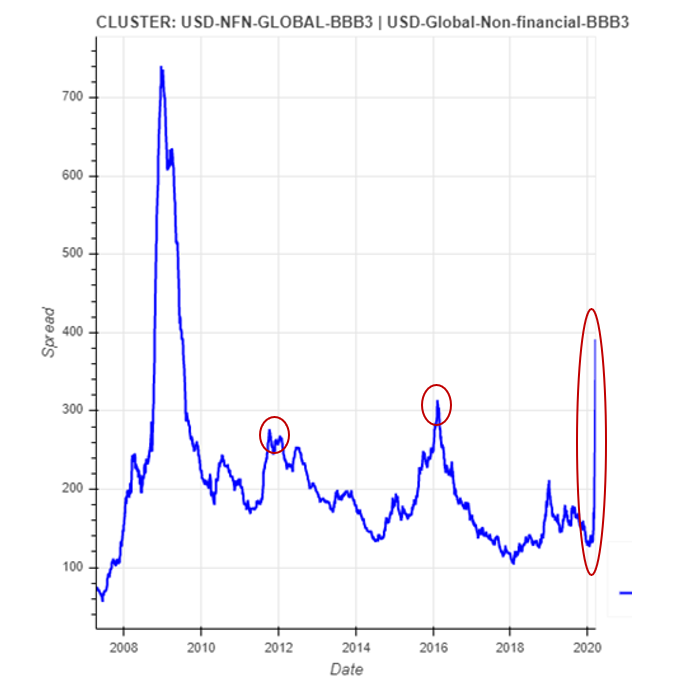

This all seems to have changed this past month! The sharp rise in BBB corporate spreads in the last 21 days is the fastest we’ve found in our history. In fact, it seems investors have gone from just worrying about profitability to worrying about insolvency within a single month. The chart below uses Qontigo’s new cluster curves – a component of the Axioma Fixed Income Spread Curves – to show the spread of the lowest BBB bucket for USD-denominated corporate bonds from global issuers for non-financial sectors with a 5-year tenor.

While the spreads are not (yet) as high as during the financial crisis of 2008, they are already higher than during the European debt crisis of 2011 and the Q4 2015 aftermath of the China crash in August of that year. More importantly, this rise happened in a fraction of the time of these other credit crises. The only other occurrence of such speed we could find was the rise in the corporate spread of a single issuer – Tokyo Electric Power, right after the March 2011 Tsunami disaster.

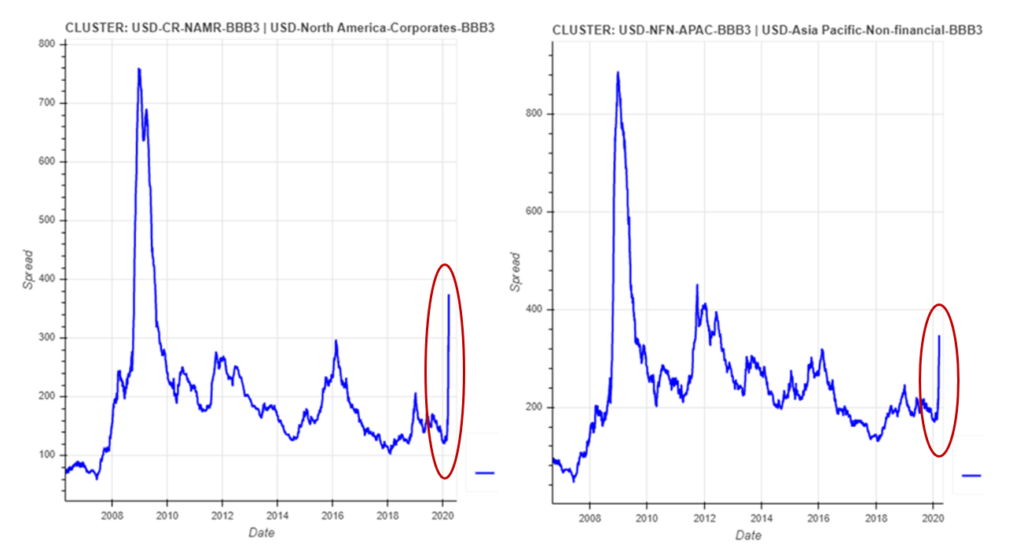

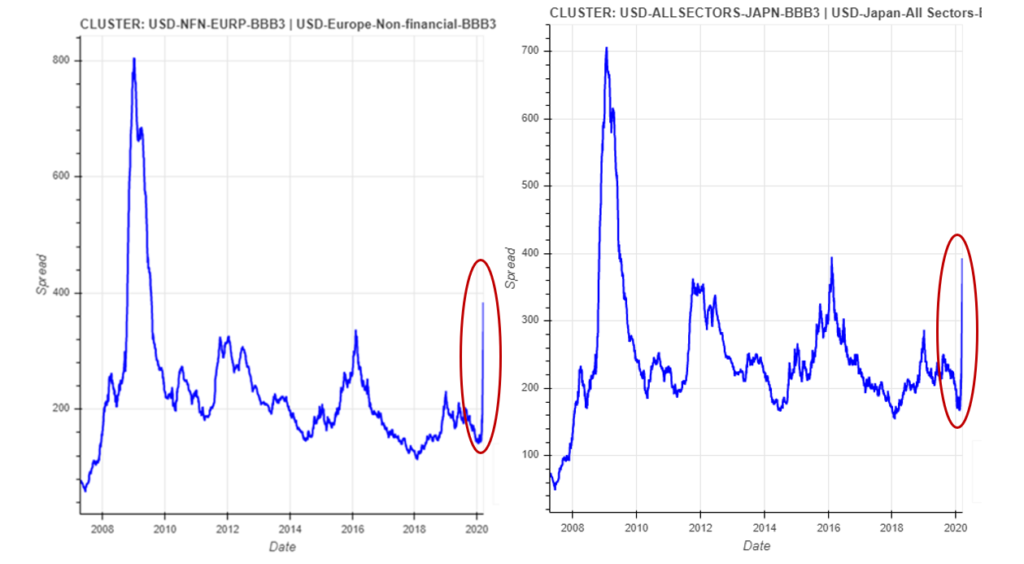

This same rise repeated across all major bond markets. The charts below show the same market segment for North American, Asian, European, and Japanese issuers. It seems the move to re-rate default risk is as contagious as the Coronavirus itself and is spreading fast across all markets.

Stories abound about the amounts of money lost in the recent equity market routs with headlines like “The Week That Wiped $3.6 Trillion Off the Stock Market” and “The US stock market has now wiped out the entire $11.5 trillion of value it gained since Trump’s 2016 election victory”[1]. Just to put this in perspective, the current size of the Fed’s balance sheet is a little north of $4.3 trillion dollars.

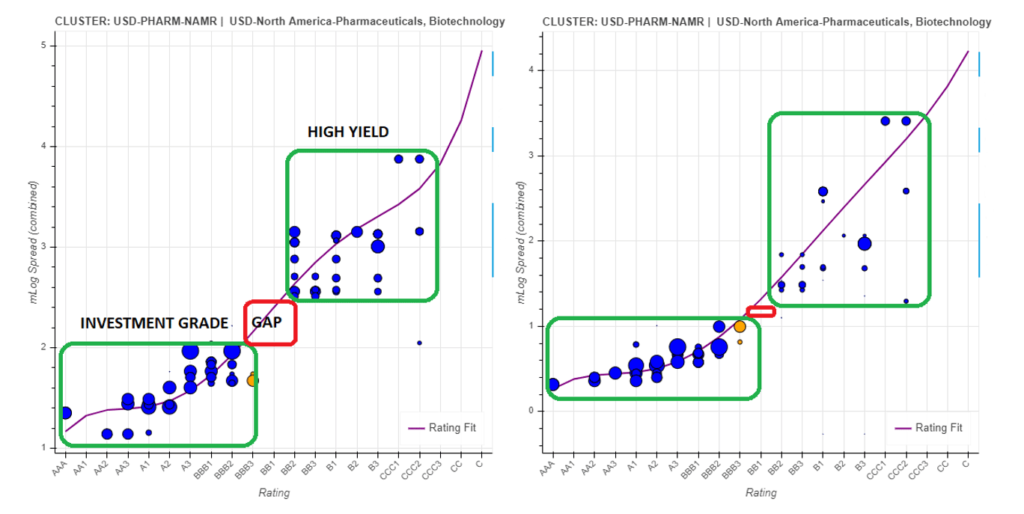

Another way to look at this default risk re-rating is to look at the entire credit curve for a market or sector. The chart on the left below shows the gap that has opened up between investment grade and high yields in terms of credit spread as of March 18, 2020. The chart on the right is the same sector but on February 17, 2020. Both market segments have seen increases in spreads, but a gap has opened up in the last month and is now big enough for even angels to fall into.

In a report on the corporate bond market released by the OECD, it stated that “the global outstanding stock of non-financial corporate bonds at the end of 2019 reached an all-time high of USD 13.5 trillion”[2]. It goes on to state that “Compared with previous credit cycles, today’s stock of outstanding corporate bonds has lower overall credit quality, higher payback requirements, longer maturities and inferior covenant protection. These are features that may amplify the negative effects that an economic downturn would have on the non-financial corporate sector and the overall economy”.

Putting together the sharp increase in the amount of outstanding debt of lower quality rating and the rising risk of defaults from the economic fallout of the Covid-19 health crisis, paints a pretty bleak picture for the corporate bond market – indeed financial markets. Perhaps this is what prompted the Fed to act so swiftly recently.

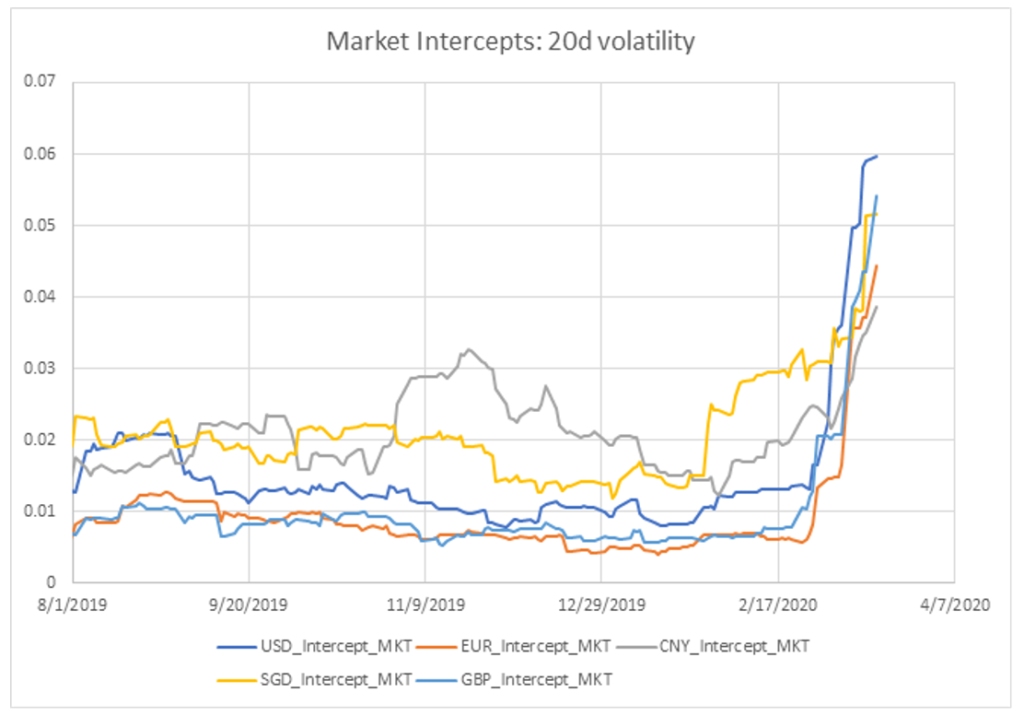

Is there any good news? Maybe. The chart below looks at the volatility of the market factor in the new Axioma Factor-based Fixed Income Risk Model. We can see that the volatility of the China market factor (grey line) started rising as early as November, then declined, and rose again in tandem with other markets recently but, as the Coronavirus narrative in that country starts to sound more positive, it ended last week with a lower volatility than other markets. Europe, the UK and the US saw their market risk rise later, as the pandemic started in these countries only in February. Singapore also provides an interesting example. Market risk there rose early as well, then plateaued but then rose again recently as a bout of new cases has hit the news. To date, Singapore has had zero deaths and most of the new cases are from residents returning home and can be traced to external sources. If Singapore’s market risk follows the example of China’s, as the number of new cases drops, it too should see a rapid fall in market risk. If this comes true, then that is potentially good news for other markets once new cases are under control.

In summary, the corporate bond market is giving strong hints that things could get a lot worse for financial markets in the coming months if we do not get Covid-19 under control fast enough to stave off a global recession.