- Benchmark risk in US and other Western markets falls, but not in Asia or Emerging Markets

- Energy’s style exposures have changed, altering characteristics of portfolios making Energy bets

- Volatility nears a 12-month high for several style factors

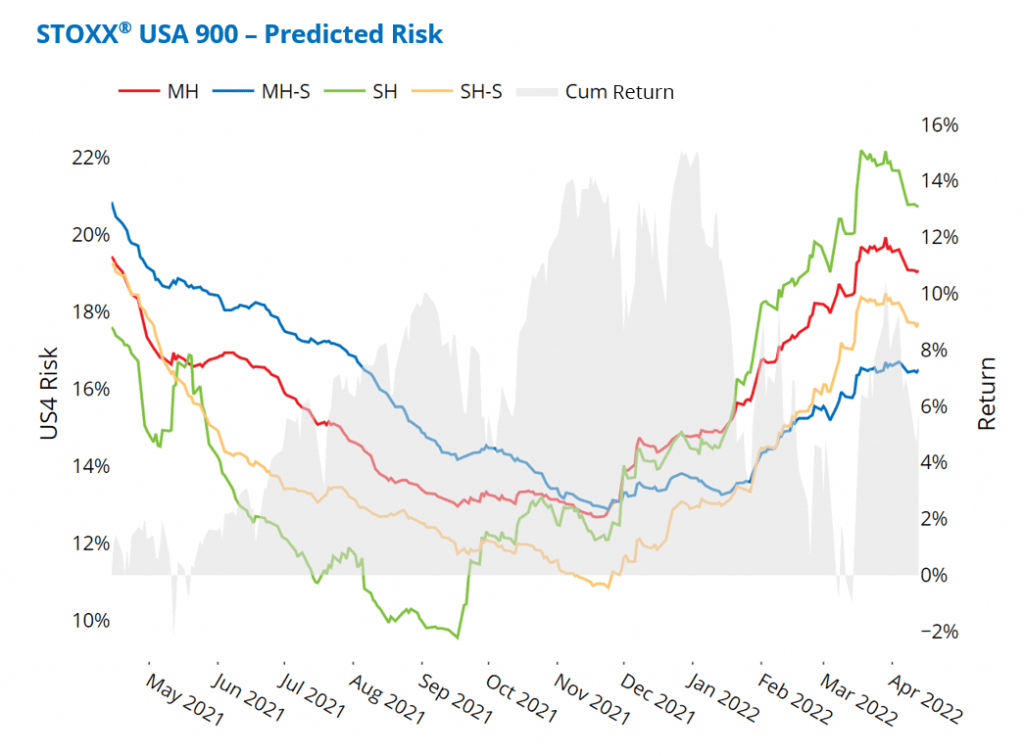

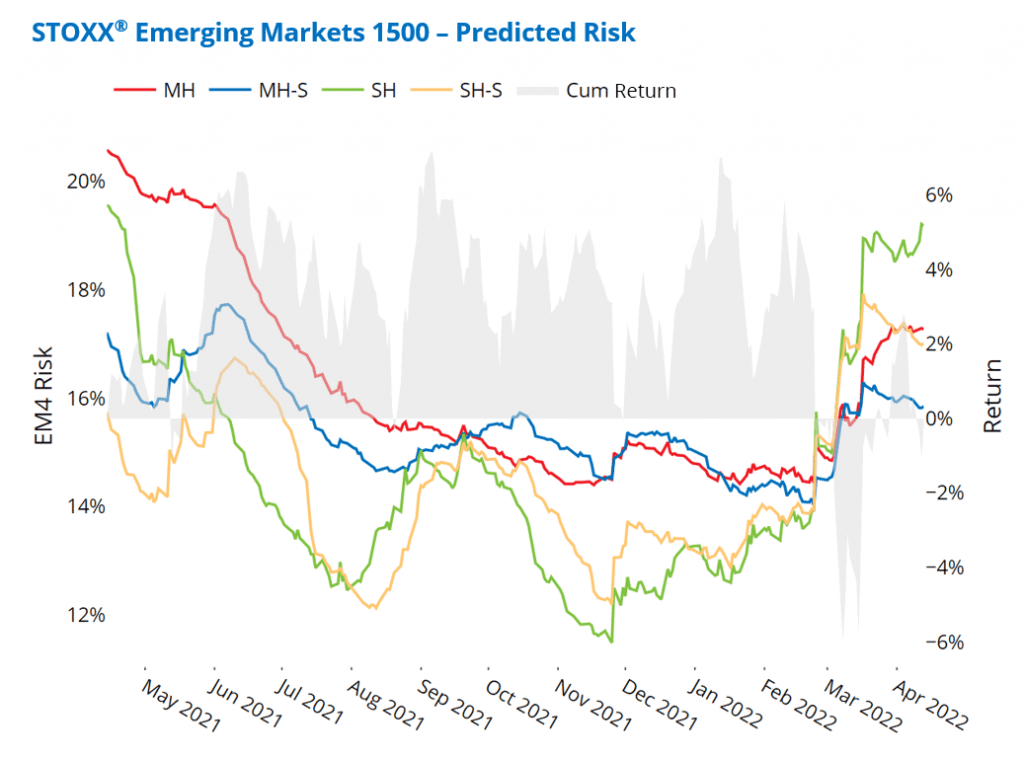

Benchmark risk in US and other Western markets falls, but not in Asia or Emerging Markets

After steadily rising since mid-September, US short-horizon risk measured using the STOXX USA 900® Index has finally started to retreat, after peaking at the end of March. Still, the current level of predicted volatility remains high relative to where it has been historically, with a reading in the 85th percentile versus its levels over the past 40 years. Short-horizon fundamental risk has also fallen in other Western markets we track closely, but has not retreated in Asia ex-Japan, Emerging Markets and China. In Asia ex-Japan and Emerging Markets higher asset-asset correlations are continuing to drive risk up, whereas in other markets correlations are down and therefore risk, has fallen. We typically expect medium-horizon forecasts to follow short-horizon, however the decline in equities we have seen recently may suggest that instead short-horizon risk will stop falling, or indeed rise again.

See graph from Equity Risk Monitors as of 13 April 2022:

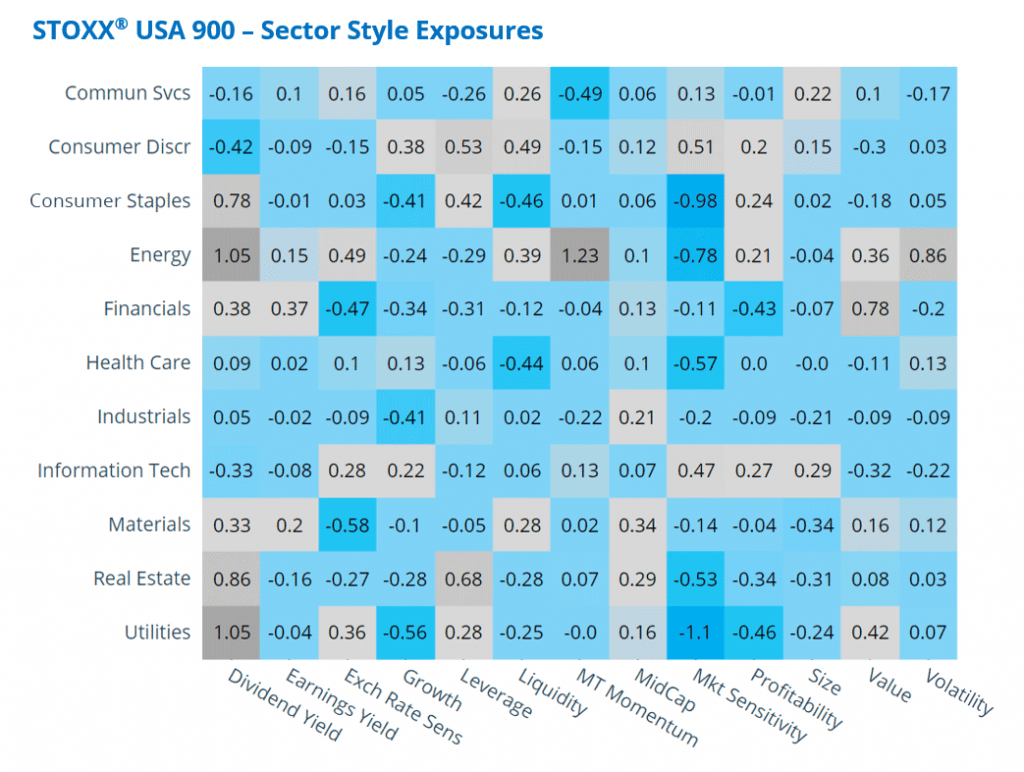

Energy’s style exposures have changed, altering characteristics of portfolios making Energy bets

Many style exposures in the US Energy sector have shifted since the end of the year. Most notably, the sector’s exposure to Medium-Term Momentum has risen substantially. Its current exposure is 1.23 standard deviations away from the estimation universe average, by far the best Momentum exposure of any sector; most of the other sectors’ Momentum exposures are very close to zero. Energy’s Profitability Exposure has also increased, and is now positive, whereas it was negative at the end of 2022 — not surprising given the increase in oil prices — but its exposure is now higher than all but Consumer Staples and Information Technology. At the same time, while Energy’s Dividend Yield and Value exposures are the highest among all sectors (it is tied with Utilities on Dividend Yield) they have declined substantially in the past three months. These exposure changes are notable because they may have led to unexpected changes in portfolio characteristics for investors making active Energy bets.

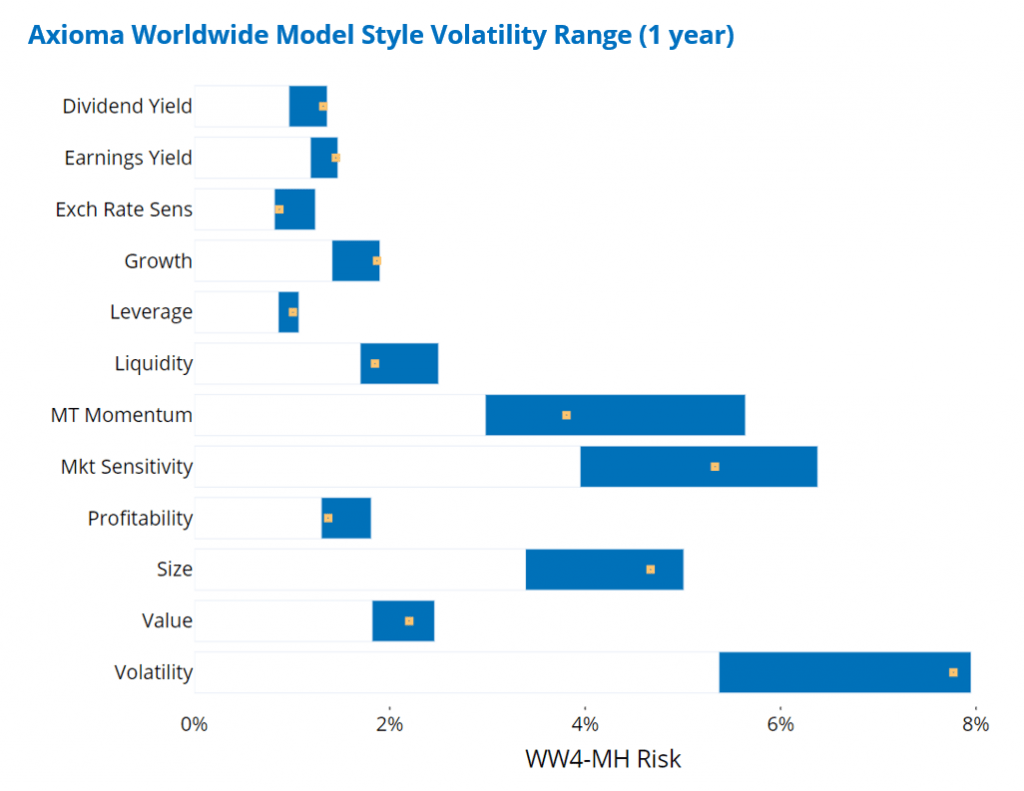

Volatility nears a 12-month high for several style factors

Medium-horizon predicted volatility for many of the style factors in Axioma’s Worldwide (WW4) model is at or near the high end of its 12-month range, likely driving active risk higher for those portfolios that bet on these factors and have not rebalanced, or lowered exposures to those that have. Volatilities of Dividend Yield, Earnings Yield, Growth and Leverage all stand at the high end of their range over the past year, and Size, Volatility and Value’s levels are close. At the same time, Exchange Rate Sensitivity, Liquidity and Profitability are at or close to the low end of the range, suggesting that not all factors have participated in the market-wide volatility surge of the past few months, at least in the WW4 model. Interestingly, other models are seeing different results. For example, Market Sensitivity’s risk in the US4 model is not only at the high end of its 12-month range, but it is far higher than that of any other factor in the model. In other markets such as Europe and Canada, the Volatility factor has higher risk than Market Sensitivity, and in Asia Pacific ex-Japan and Emerging Markets Size is the riskiest factor. These differences suggest it may be better to use a more-local model to manage active risk most effectively.

See graph from Equity Risk Monitors as of 13 April 2022: