- The US lags major equity markets in 2022

- UK becomes the least volatile market

- Asset diversification remains low

The US lags major equity markets in 2022

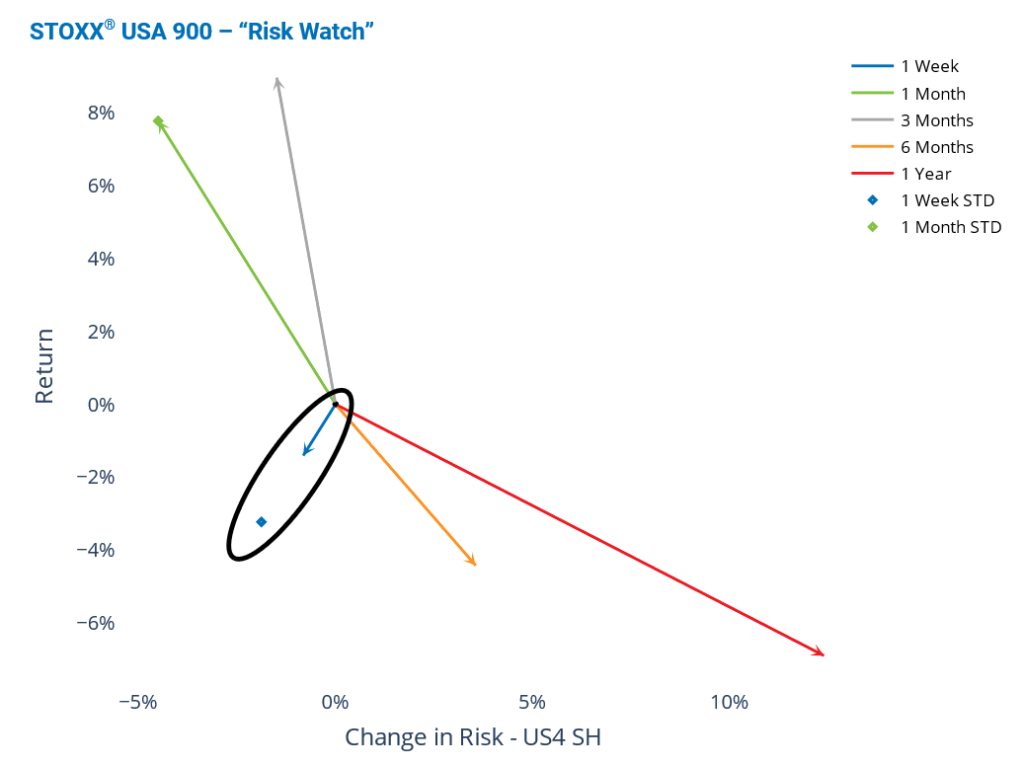

Despite strong performance in the third quarter, the US market is lagging major markets so far in 2022. The STOXX® USA 900 Index was down 1.4% last week as investors parsed earnings reports, the latest economic data, and the minutes from the Fed’s July meeting. However, last week’s decline remained within one standard deviation of the expectations at the beginning of the week, as measured by Axioma US4 fundamental short-horizon model.

Last week’s decline could also indicate the US market was just taking a breather. The STOXX® USA 900 Index recorded a four-week return of nearly 8% and a quarter-to-date return of 12% but it was still down 13% for the year. While also reporting losses so far in 2022, the STOXX® Emerging Markets 1500, STOXX® Europe 600 and STOXX® Asia Pacific 600, all outperformed the STOXX® USA 900 Index as of last Friday. In addition, the only major indices to see positive year-to-date returns were the STOXX® Canada 240, STOXX® Japan 600 and STOXX® UK 180 Indices.

See graph from the United States Equity Risk Monitor as of 19 August 2022:

The UK becomes the least volatile market

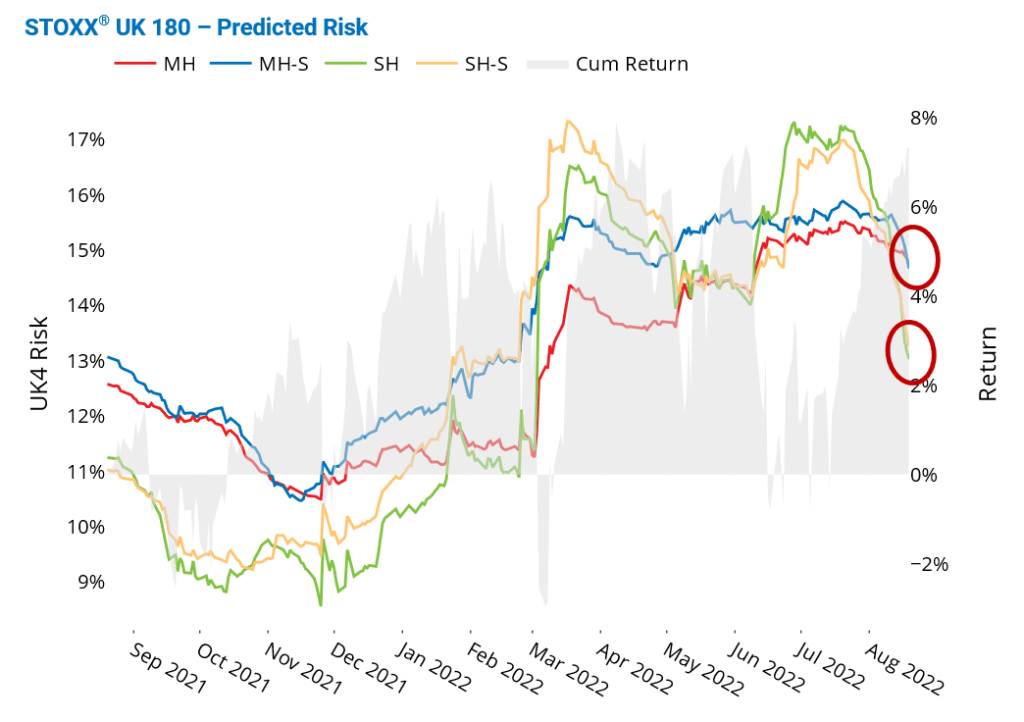

The short-horizon forecasts fell below their medium-horizon counterparts, indicating that the medium-horizon forecasts may continue to drop in coming weeks. Still, at about 13% last Friday, the STOXX® UK 180 Index’s short-horizon risk was still about 30% higher than its level at the beginning of the year.

See graph from the United Kingdom Equity Risk Monitor of 19 August 2022:

Asset diversification remains low

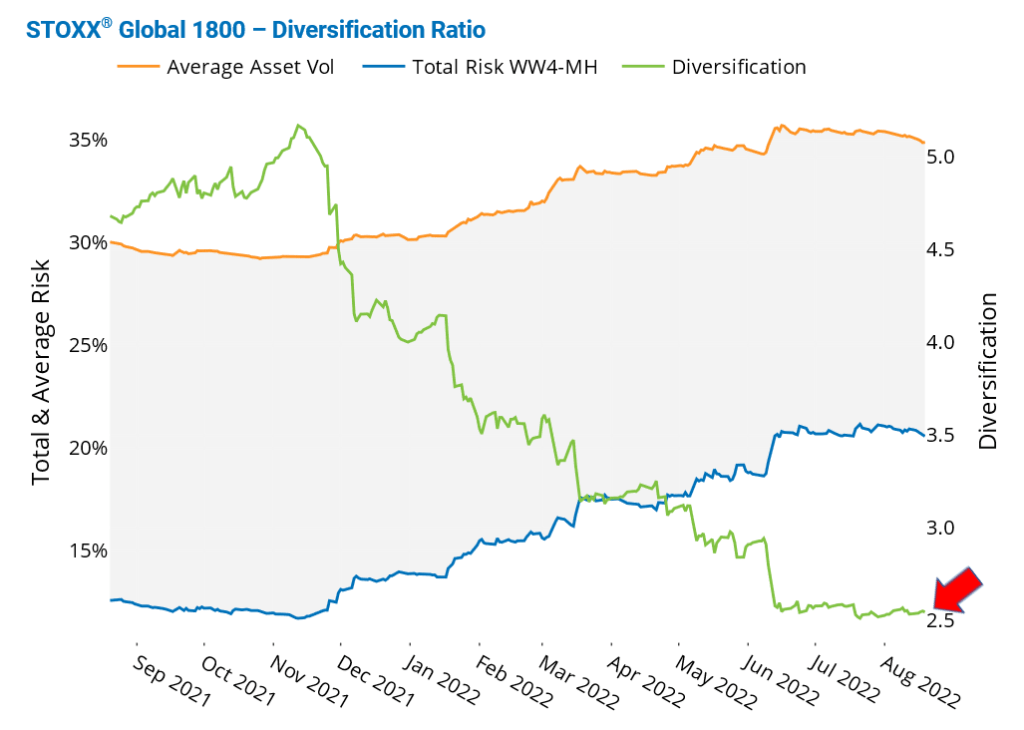

Asset diversification remained low, hovering around levels not seen in about one-and-a-half-years. That is, over the past couple of months, managers of equity portfolios have been in the worst position to diversify their portfolios since the end of 2020. After reaching a 12-month high in November 2021 when it exceeded 5.0, the asset diversification ratio in the STOXX® Global 1800 Index plummeted, and has stabilized around 2.5 since June, as measured by Axioma’s Worldwide median-horizon fundamental model.

The asset-diversification ratio is calculated as the weighted average asset variance for each stock in the index, divided by the total forecasted index variance, and measures the impact of correlations on total risk. A diversification ratio of 1.0 would indicate a perfect positive correlation among the stocks in the index, which is improbable for a large index such as the STOXX® Global 1800 Index. But it is notable that the diversification ratio for the global index has dropped into the bottom quintile relative to its 10-year range.

See graph from the Global Developed Markets Equity Risk Monitor as of 19 August 2022:

For more insights and research from the Applied Research team, please click here.