- Global Developed Markets on track for worst year since GFC

- Defensive style factors outperform worldwide

- Emerging Markets’ volatility remained below that of Developed Markets for much of 2022

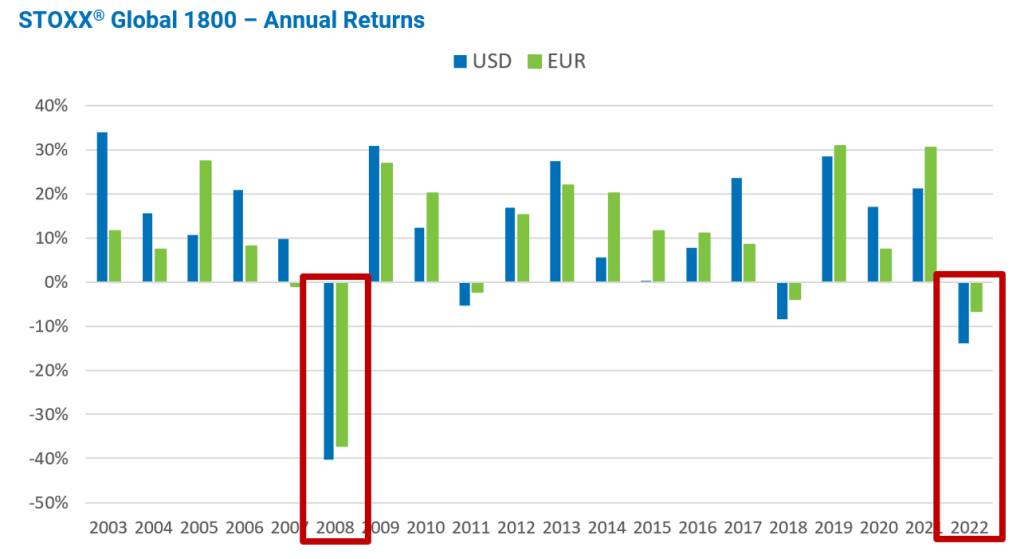

Global Developed Markets on track for worst year since GFC

Global Developed Markets are on track to finish the year with the largest annual losses since the Global Financial Crisis in 2008, despite equity markets continuing to march up last week, following two months of consecutive gains.

The STOXX® Global 1800 Index’s year-to-date loss denominated in US dollars neared 14%, and the loss denominated in euros was 7% as of last Friday. That is, euro-based investors had incurred a smaller loss than dollar-based investors so far this year. For more details on the STOXX indices’ performance as of Nov. 30, 2022, please see blog post Stocks rise for second straight month in November on hopes of peak inflation.

The chart below does not appear in our Equity Risk Monitors, but can be provided upon request:

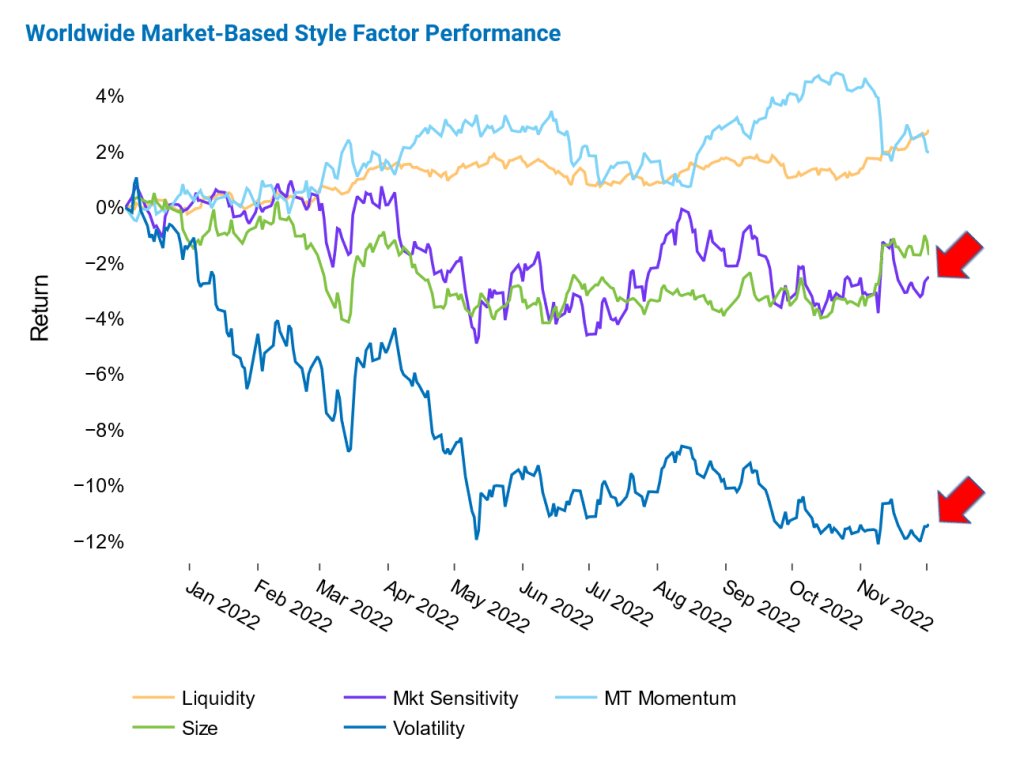

Worldwide defensive style factors outperform

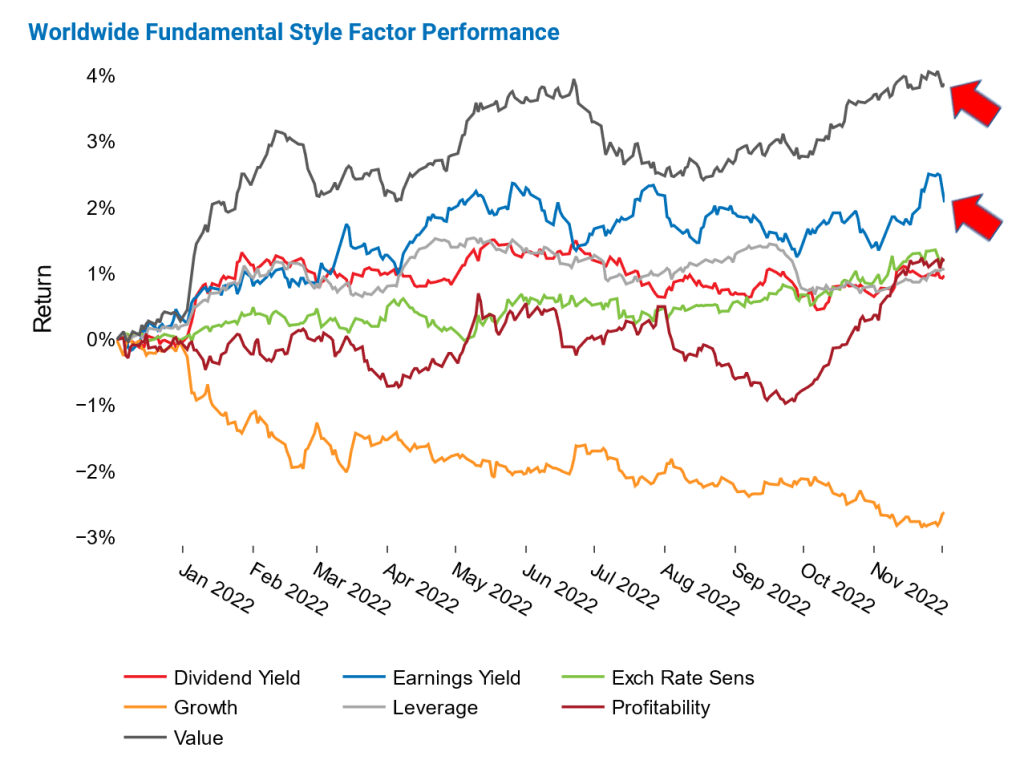

Defensive style factors such as Profitability, Earnings Yield, and Value are still outperforming more cyclical style factors such as Growth, Volatility, and Market Sensitivity. Market Sensitivity and Volatility,

both recorded negative 12-month returns, with Volatility’s 12-month negative return being 2 standard deviations below the expectations at the beginning of the period. That is, investors turned to low-beta and low volatility stocks, shunning higher-beta and higher-volatility alternatives.

Earnings Yield and Value were the best performers among the fundamental factors in Axioma’s Worldwide fundamental medium-horizon model. Value’s 12-month return was above 2 standard deviations of the expectations one year ago. Profitability also took off in the past three months, while Growth has been tanking for a year now. That is, investors preferred cheap, profitable companies, with high earnings yield to growth stocks.

See graphs from the Global Developed Markets Equity Risk Monitor as of 2 December 2022:

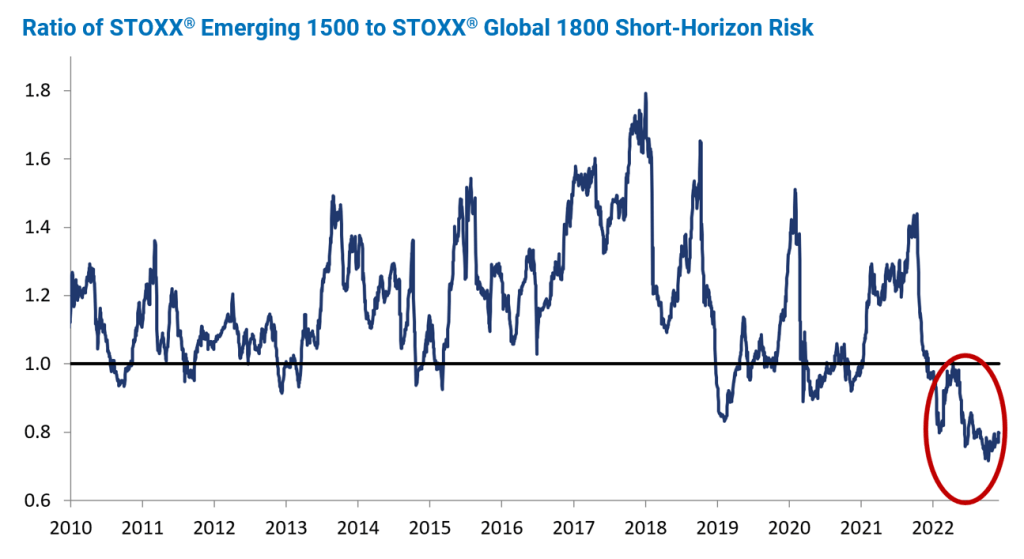

Emerging Markets’ volatility remained below that of Developed Markets for much of 2022

Developed markets became riskier than their emerging counterparts in 2022. The ratio of the STOXX® Emerging 1500 index risk to the STOXX® Global 1800 index risk, as reflected by Axioma’s Emerging Market and Worldwide short-horizon fundamental models, went up in recent weeks, after dipping to the decade low of 0.7 in October.

Still, the ratio was 0.8 last Friday, which meant Emerging markets were 20% less risky than developed markets. This is a fairly unusual development since Emerging Markets risk is on average about 20% higher than that of Developed Markets, and therefore investors should take note when they make their developed vs. emerging markets equity allocations.

The chart below does not appear in our Equity Risk Monitors, but can be provided upon request:

For more insights and research from the Applied Research team, please click here.