Developed Markets take a hit, as Emerging Markets remain flat; US tech shares dragged down by threat of rising interest rates; US asset diversification climbs to pre-pandemic levels

Developed Markets take a hit, as Emerging Markets remain flat

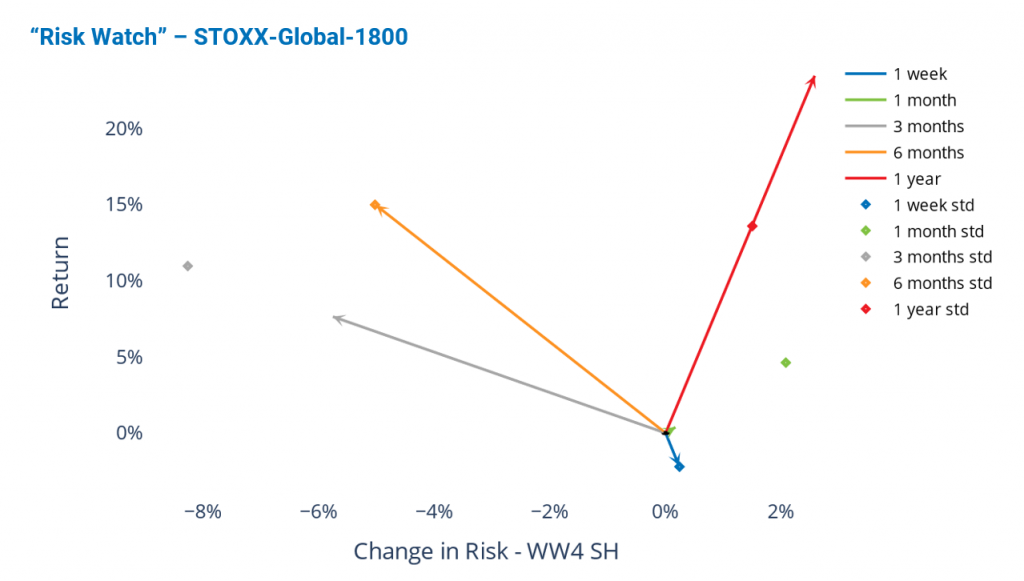

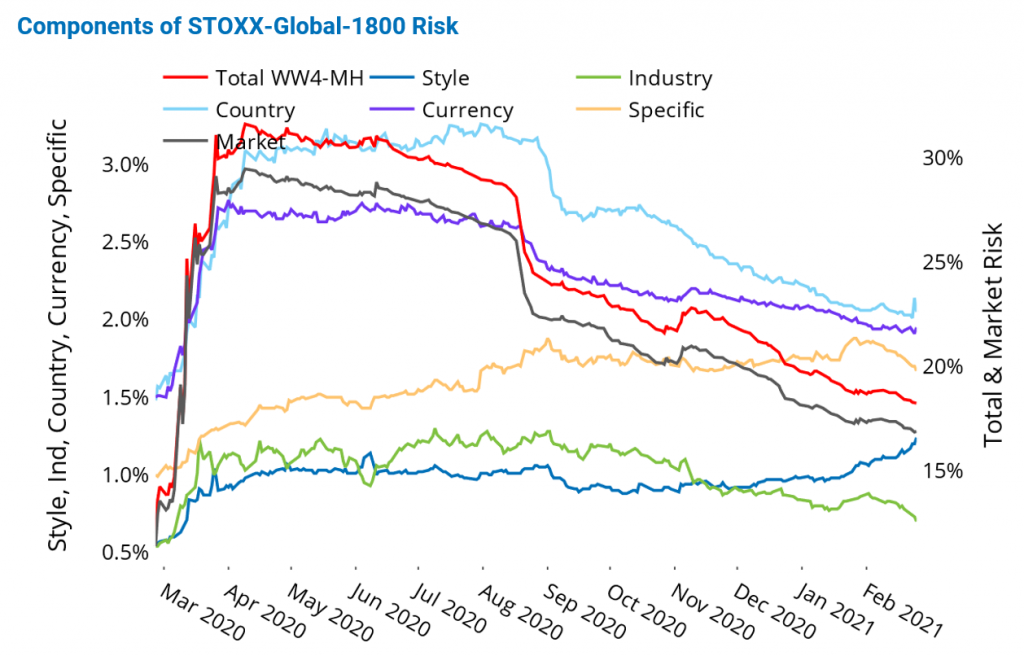

Equity markets around the globe stalled last week, with stocks falling in most geographies. The STOXX Global 1800 index posted a 2% weekly loss, which, although significant, remained within one standard deviation of the expectation five business days ago, as measured by Axioma’s Worldwide short-horizon fundamental model. The loss was driven by the decline in US stocks, as the STOXX Global 1800 ex-US remained flat. Emerging Markets stocks in aggregate were also flat, despite a large drop in the Chinese market last week.

Risk continued to decline for Global Markets and the US, but Emerging Markets saw an increase in risk last week, as measured by Axioma’s Worldwide, US and Emerging Markets models, respectively, at the medium horizon. Market, Style, Industry and Country risk were all up for Emerging Markets, with only emerging Currency risk falling for the week. For Developed Markets, Market risk led the decline while Industry and Specific risk boosted it. Only Style risk was up for Developed Markets, while Country and Currency risk remained relatively flat. Very short-horizon volatility seems to be on the increase, however, and we expect that to be reflected in our risk forecasts soon.

See graphs from the Global Developed Markets Equity Risk Monitor as of 25 February 2021:

US tech shares dragged down by threat of rising interest rates

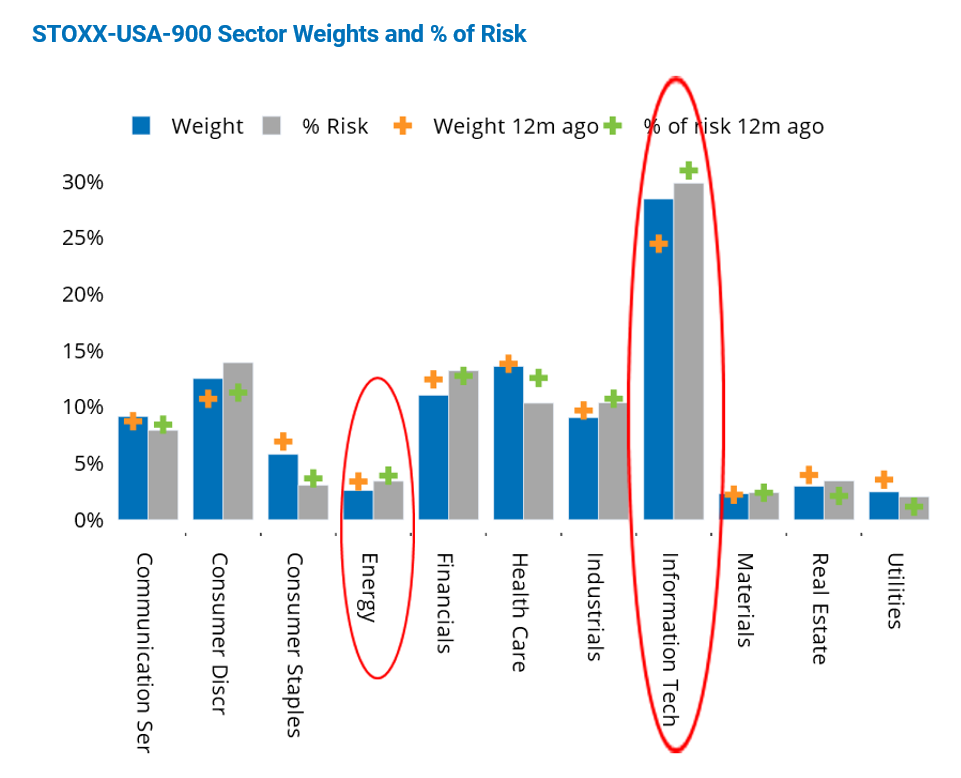

US tech stocks fell abruptly last week, as rising interest rates portended a potential slowdown in fast-growing companies (such as tech businesses). Concerns about rising inflation have been the main driver of the climb in long-term government rates. The decline in tech stocks started in mid-February, and last week’s tumble pushed the return for the Info Tech sector in the STOXX USA 900 index into negative territory. Info Tech posted a year-to-date return of -0.22% last Thursday. This is in stark contrast with Info Tech’s stellar performance in 2020, when tech stocks led the US market recovery. Despite the recent drop in tech shares, Info Tech still represents close to a third of the US index.

Energy is now the best performing US sector, rising 30% year to date, fueled by the recent surge in oil prices. Still, Energy’s weight in the STOXX USA 900 index remained below 3%. Keep in mind, however, that the recent oil price rally has had a much larger impact on the US market than the weight of the Energy sector may indicate, due to the US market’s overall sensitivity to oil prices. For more details see our blog Oil-price swings pushing your equity portfolios around? Consider using an Oil Sensitivity metric….

Info Tech is now the third riskiest US sector after Consumer Discretionary and Energy. This is a big change from the end of 2020 when Info Tech was among the least volatile sectors in the US. Even though Info Tech’s volatility was almost half that of Energy at the end of last week, Info Tech contributed 30% to the STOXX USA 900 risk due to its dominance in the index. In contrast, Energy’s benchmark risk contribution was less than 5%.

See graph from the United States Equity Risk Monitor as of 25 February 2021:

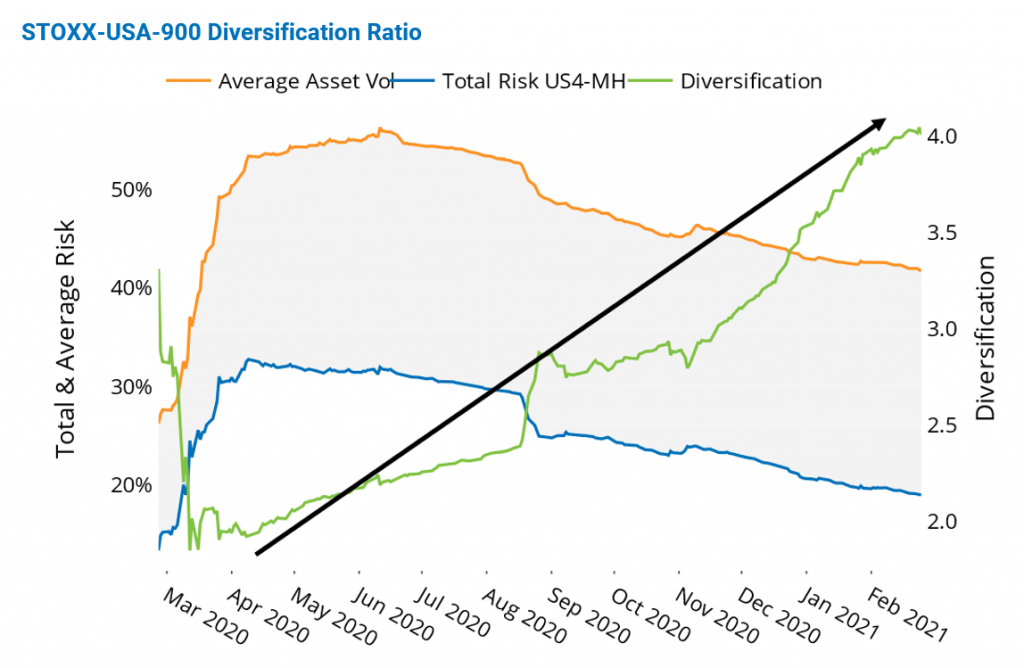

US asset diversification climbs to pre-pandemic levels

Asset diversification in the STOXX USA 900 index climbed to pre-pandemic levels, indicating that portfolio managers are in the best position to diversify their portfolios since the market turned down. Diversification is measured as the ratio of the weighted average asset variance to total index variance, as measured by Axioma’s US medium-horizon fundamental model. The ratio reflects the impact of correlations on total risk. The 60-day median correlation of assets in the STOXX USA 900 index dipped to a 12-month low in February. Asset diversification has improved since April of last year in all other regions Axioma covers closely. China stands out with the highest level of diversification.

See graph from the United States Equity Risk Monitor as of 25 February 2021: