One year into the pandemic, China is the big winner, but still the riskiest; Emerging Markets now riskier than Developed; US market rallies as stocks in the trading frenzy tumble

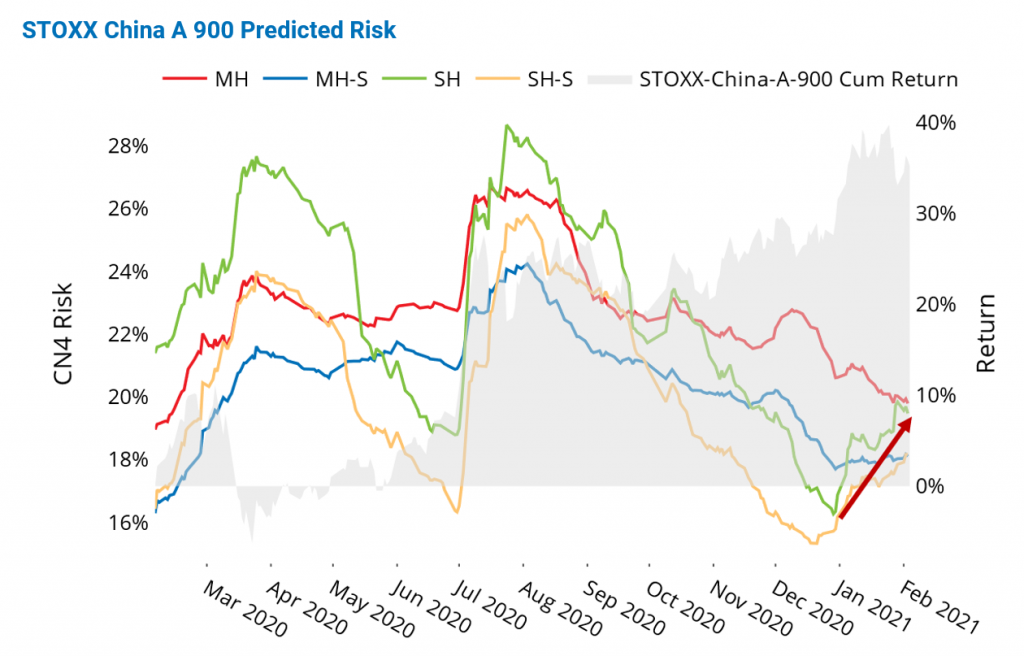

One year into the pandemic, the Chinese market is the big winner, but still the riskiest

It’s been a year since Chinese exchanges reopened after an extended Lunar New Year Holiday in 2020, and Chinese stocks slid nearly 8% in one day. The drop occurred because Chinese exchanges had closed just as the coronavirus began to spread worldwide, and upon reopening the Chinese economy was still partially closed, travel suspended, and borders shut. The Chinese market rebounded somewhat in February 2020, only to hit rock bottom a month later. But since then, the STOXX China A 900 has been on an ascending trend, recording a cumulative return of 30% between Feb. 3, 2020 and Feb. 4, 2021. It was the strongest rebound among the geographies we track closely, with the STOXX USA 900 and STOXX Global 1800 ex-USA indices gaining 18% and 9%, respectively, over the same period.

In terms of riskiness, China has gone full circle, retaking its place as the riskiest of all geographies Axioma models track closely. China started 2020 as the most volatile region and saw its risk shoot up following the reopening of the Chinese market in early February 2020. But by April, all other regions’ volatilities surpassed it, and for the entire second quarter of 2020 China had the lowest predicted risk, as measured by Axioma’s local short-horizon fundamental models. China’s risk jumped in July, as volatility in all other regions continued to decline, and it remained among the riskiest regions for the rest of last year. The increase in China’s risk in 2021 pushed it to the top, its volatility nearing 20%, as measured by Axioma’s China short-horizon fundamental model. However, the risk spread between China and the US has narrowed in the last 12 months, with the US becoming the fourth riskiest, while Developed Markets ex-US remained among the least risky regions.

See graph from the China Equity Risk Monitor as of 4 February 2021:

Emerging Markets now riskier than Developed

Emerging Markets have become 20% riskier than Developed, after starting the year at parity. Twelve months ago, the ratio between the STOXX Emerging Markets 1500 and the STOXX Global 1800 short-horizon risk forecasts was at its highest level (1.5) for 2020, but the ratio dropped dramatically in April and hovered around one for the rest of last year. Both indices have experienced sharp declines in risk since the start of the pandemic in the first quarter of 2020, but the STOXX Emerging Markets 1500 index saw much larger swings than its Developed counterpart in 2021. Year to date in 2021, emerging risk has climbed while developed risk has declined, as measured by Axioma’s Emerging and Developed fundamental short-horizon models, respectively, resulting in a spike in the risk ratio between the two indices. Still, the ratio remains well below prior peaks.

The chart below does not appear in our Equity Risk Monitors, but can be provided upon request:

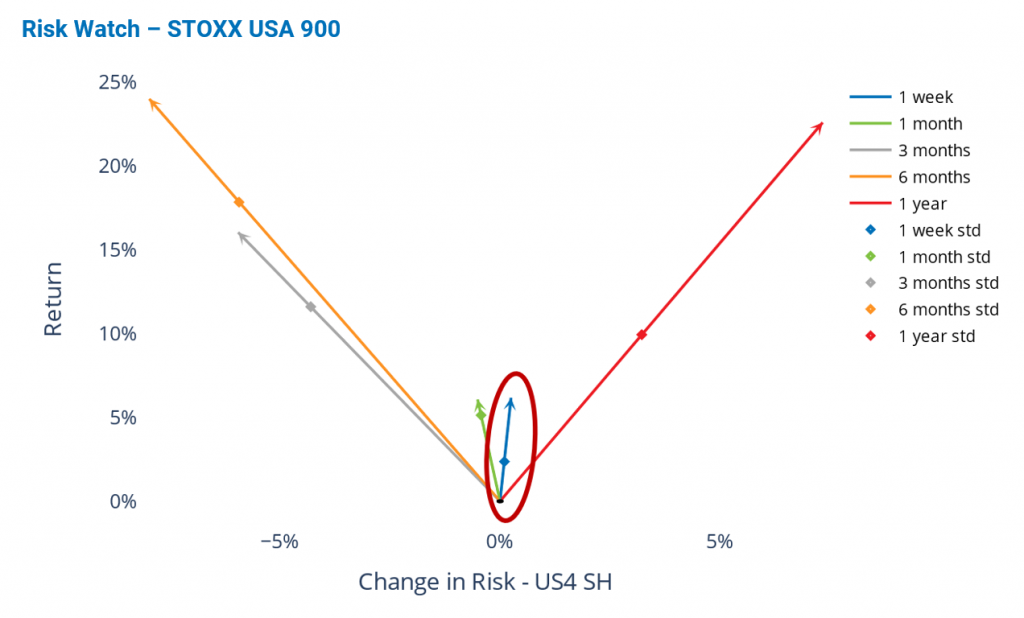

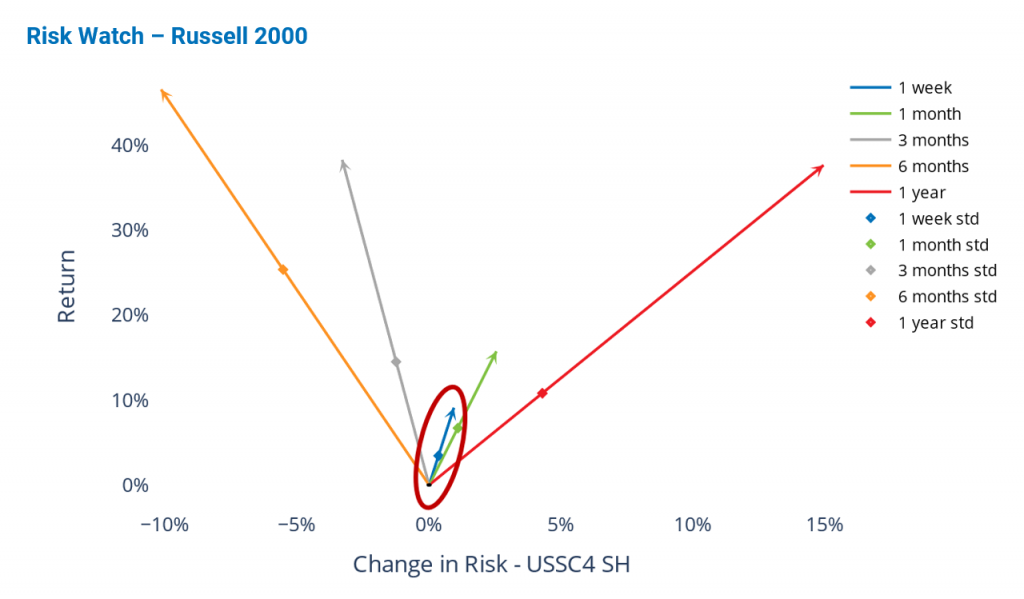

US market rallies as stocks in the trading frenzy tumble

Large and Small Cap US indices recorded strong gains last week, lifted by technology companies announcing better-than-expected corporate results. Undeterred by the tumbling of a handful of stocks popularized by retail investing, investors were emboldened by the rollout of vaccines, a decrease in jobless claims and the prospect of more fiscal spending. The Russell 2000 and STOXX USA 900 posted weekly returns of 9% and 6%, respectively. Each of these returns was well above the one standard deviation of the expectation at the beginning of the week, as measured by Axioma’s US Small Cap and US All Cap short-horizon fundamental models, respectively.

Risk for both US indices rose over the past five business days, driven by an increase in market risk. Style risk also contributed to the rise in the STOXX USA 900 risk, while industry and specific risk went down. In contrast, all components of risk—market, style, industry, and specific risk—contributed to the increase in the Russell 2000 total risk. For more information on the jump in specific risk triggered by the recent trading frenzy, see our blog post GameStop exposes the game: specific risk skyrockets amid trading frenzy.

See graphs from the US Small Cap Equity Risk Monitor as of 4 February 2021:

See graph from the United States Equity Risk Monitor as of 4 February 2021: