US stocks continue to rally in 2021; Growth keeps outperforming; Brazil—one of the hardest hit emerging markets

US stocks continue to rally in 2021

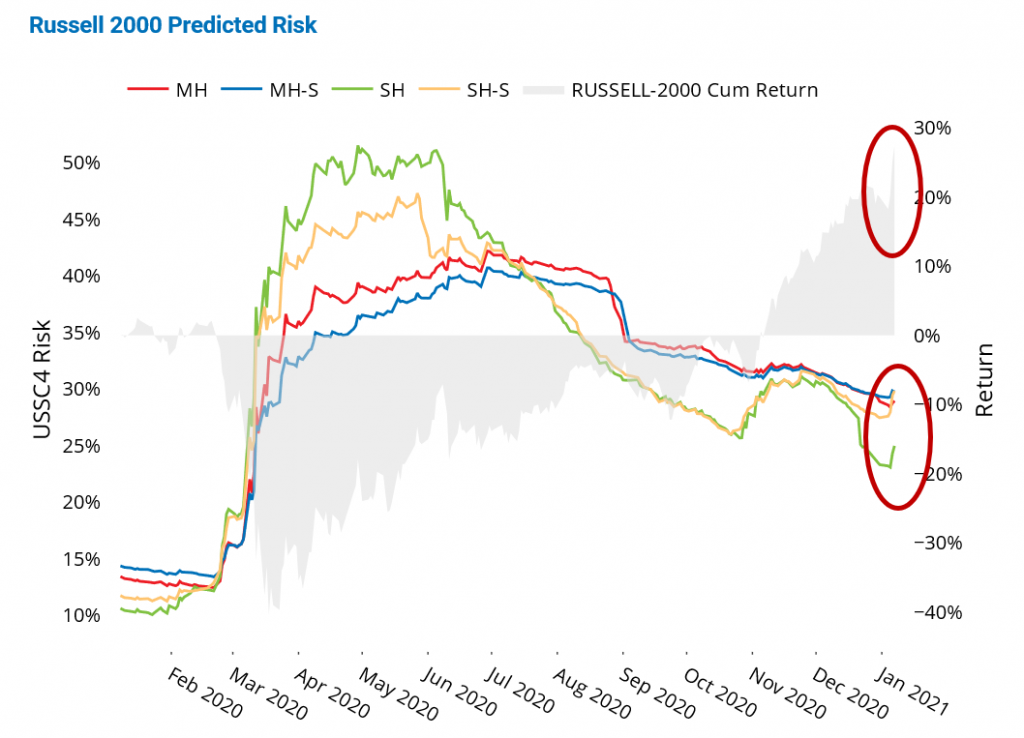

After major US indices closed at record highs in the last week of 2020, US stocks continued their rally into the new year, boosted by vaccine rollouts and expectations of new stimulus packages—political unrest notwithstanding. Small-cap stocks saw a much larger jump than their larger counterparts, with the Russell 2000 recording a 6% gain over the past four business days, while the STOXX USA 900 rose only 1.5% in the same period. Short-horizon risk ticked up for both indices, with the risk spread between small- and large-cap stocks widening. By Thursday, the Russell 2000 risk of 25% was 7 percentage points higher than that of the STOXX USA 900, as measured by Axioma’s US Small Cap and US All Cap short-horizon fundamental models, respectively.

See graph from the US Small Cap Risk Monitor as of 7 January 2021:

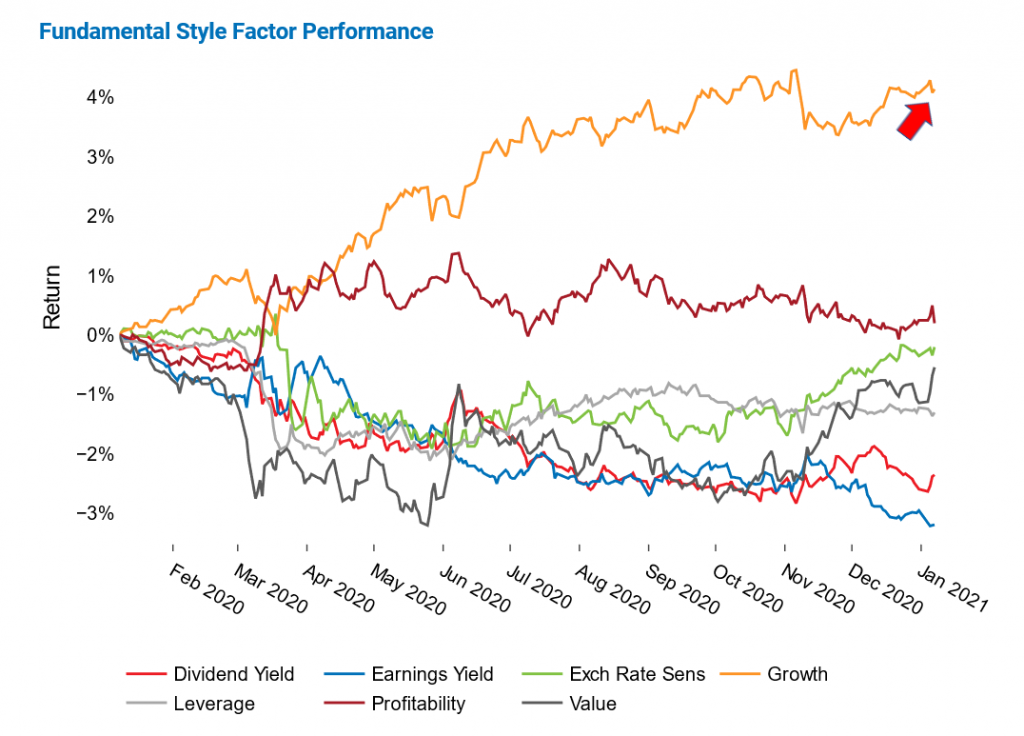

Growth keeps outperforming

Growth finished 2020 with outsized[1] positive annual returns in most geographies Axioma models track closely, and it carried that strength into 2021. Growth performed best in the US and China, with last year’s returns reaching 5.5% and 6.5%, respectively. In addition, Growth’s return over the past 12 months ending Thursday exceeded that of all other fundamental style factors in each region and it was also among the least volatile style factors in each model.

See graph from the Global Developed Markets Equity Risk Monitor as of 7 January 2021:

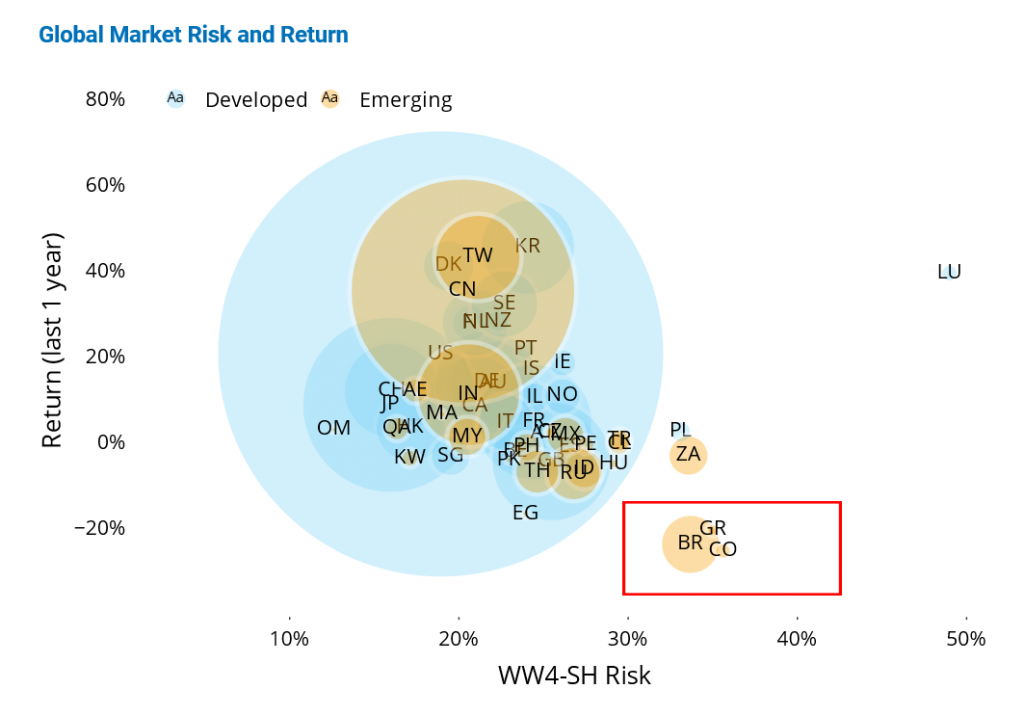

Brazil—one of the hardest hit emerging markets

Emerging markets in Europe and Latin America were among the hardest hit last year. STOXX Emerging Markets 1500 in aggregate posted gains of about 11% for 2020—lifted by stocks in Asian countries, particularly China, which not only had one of the best performances, but also dominated the index. Brazil, Colombia and Greece saw the largest losses—about 20%—over the past 12 months ending last Thursday. In contrast, South Korea, Taiwan, and China each saw gains of over 30% in the same period. The three largest losers were also among the riskiest emerging markets, with volatilities of around 35%. Oman and Malaysia started 2021 as the least risky emerging countries, as measured by Axioma’s Worldwide short-horizon fundamental model.

See graph from the Equity Risk Monitors as of 7 January 2021:

[1] We define an outsized return as one that is more than two standard deviations, based on the predicted volatility at the beginning of the period.