- Asset correlations spike as new coronavirus cases rise

- US market among the least risky countries

- Greenback strengthens against major currencies

Asset correlations spike as new coronavirus cases rise

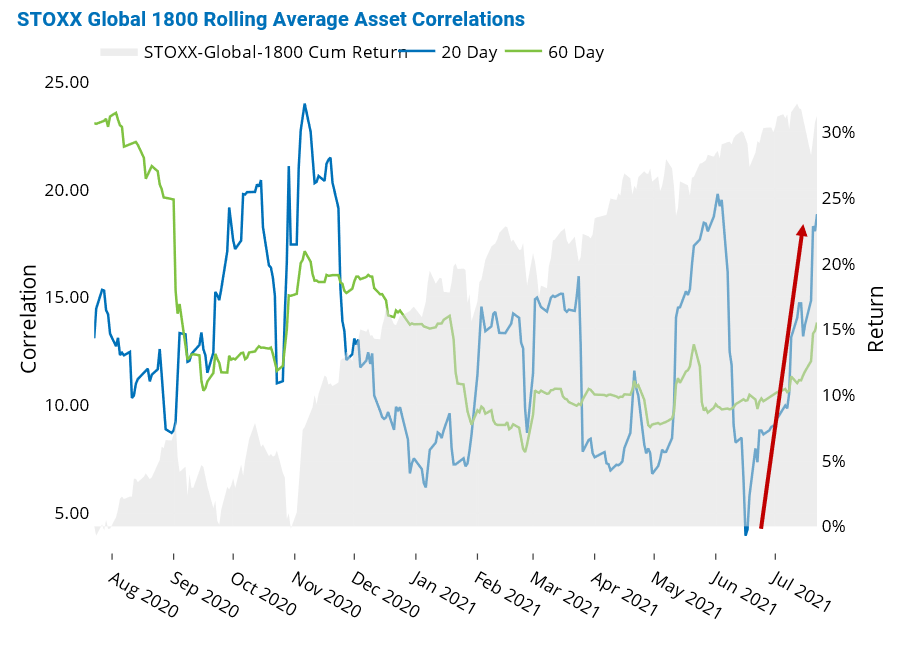

Asset correlations spiked worldwide as coronavirus cases surged, raising concerns about the potential impact on the global economy. The median pairwise realized 20-day asset correlation for the assets in the STOXX Global 1800 index shot up over the past month, after dipping to a one-year low in mid-June. An increase in correlations typically reflects concerns that macroeconomic and market events are driving stock prices rather than companies’ individual characteristics, a probable reflection of the uneasiness created by the coronavirus-related uncertainties. In addition, 60-day correlations started to tick up, and we expect them to continue to follow the path set by the 20-day figures.

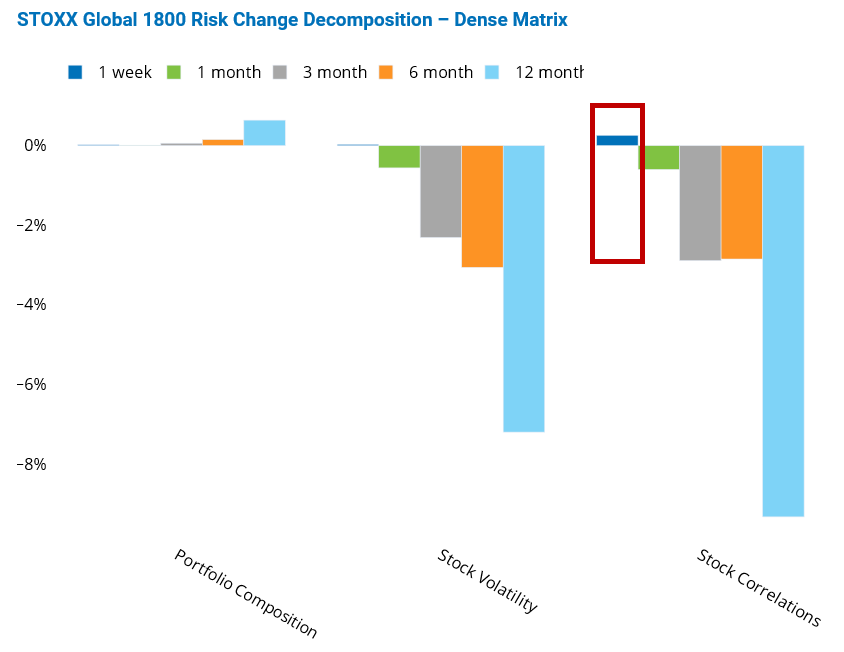

The decomposition of the change in risk from a stock-level perspective revealed that rising correlations were responsible for the small increase in the total risk of the STOXX Global 1800 index last week, as measured by Axioma Worldwide fundamental short-horizon model. We observed a similar pattern in most geographies Axioma models track closely, with the UK recording the highest level of 20-day median correlation (above 0.40).

See graphs from the Global Developed Equity Risk Monitor as of 22 July 2021:

US market among the least risky countries

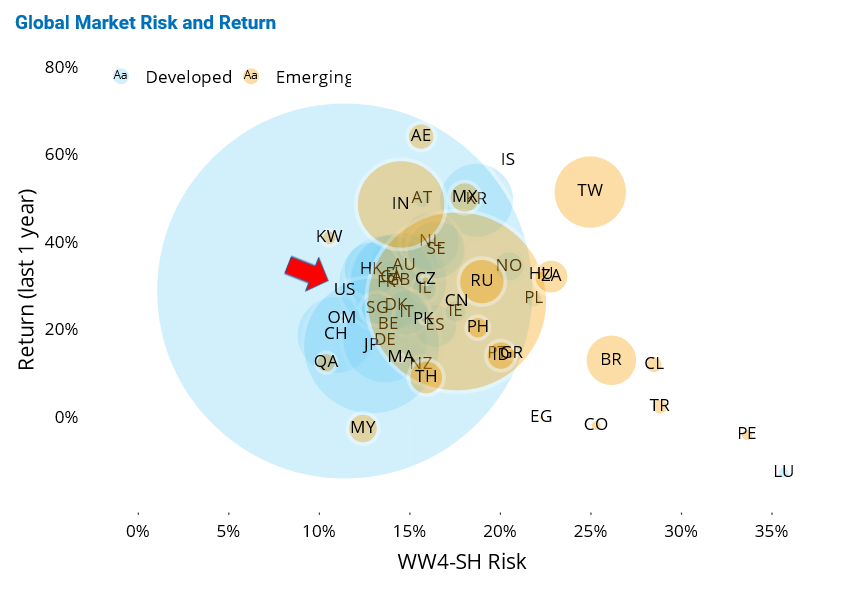

The US is now among the least volatile countries among both emerging and developed markets, in sharp contrast with the summer of 2020, when the US was among the riskiest countries, as reflected by the Axioma Worldwide short-horizon fundamental model. The US’s performance was average, with its one-year return of about 30% positioning it in the middle of the pack.

The United Arab Emirates recorded the highest 12-month gain (denominated in US dollars), while most losers were emerging market countries (Malaysia, Colombia, Peru, to name a few). Peru and Luxemburg stood out as the riskiest countries, with volatilities exceeding 30%.

See graph from the Equity Risk Monitors as of 22 July 2021:

Greenback strengthens against major currencies

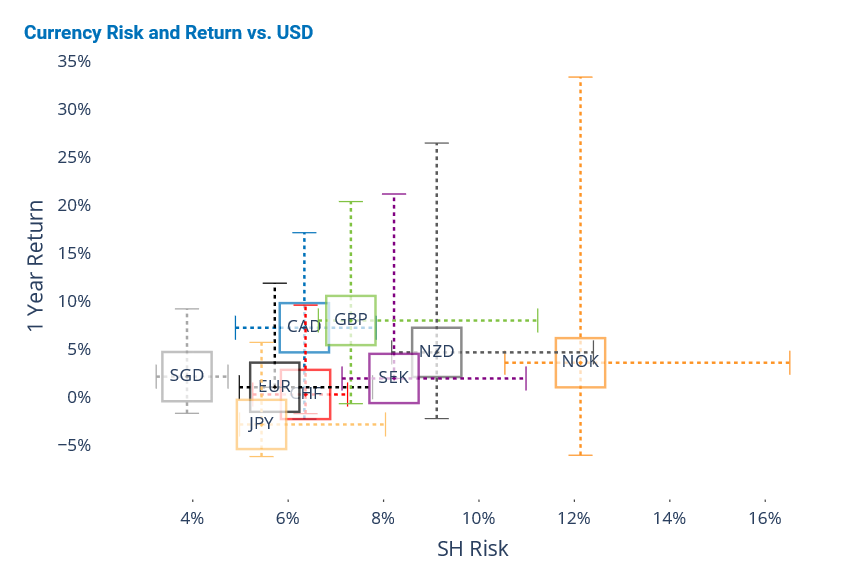

The US dollar strengthened against major developed currencies, as global fears of an economic slowdown mounted, pushing currencies to or near the low ends of their one-year return ranges against the greenback. Most developed currencies still posted positive 12-month returns against the greenback as of last Thursday, with the exception of the Japanese yen.

In terms of risk, the Singapore dollar remained the least volatile developed currency, while the Norwegian krone kept the top spot, as measured by Axioma Worldwide fundamental short-horizon model. Most developed currencies were positioned near the low ends of their one-year volatility ranges against the greenback as of last week.

See graph from the Global Developed Equity Risk Monitor as of 22 July 2021:

For more insights and research from the Applied Research team, please click here.