- US small-cap returns outpace large caps

- Russell 2000’s specific risk soars, led by AMC and GameStop

- US dollar strengthens

US small-cap returns outpace large caps

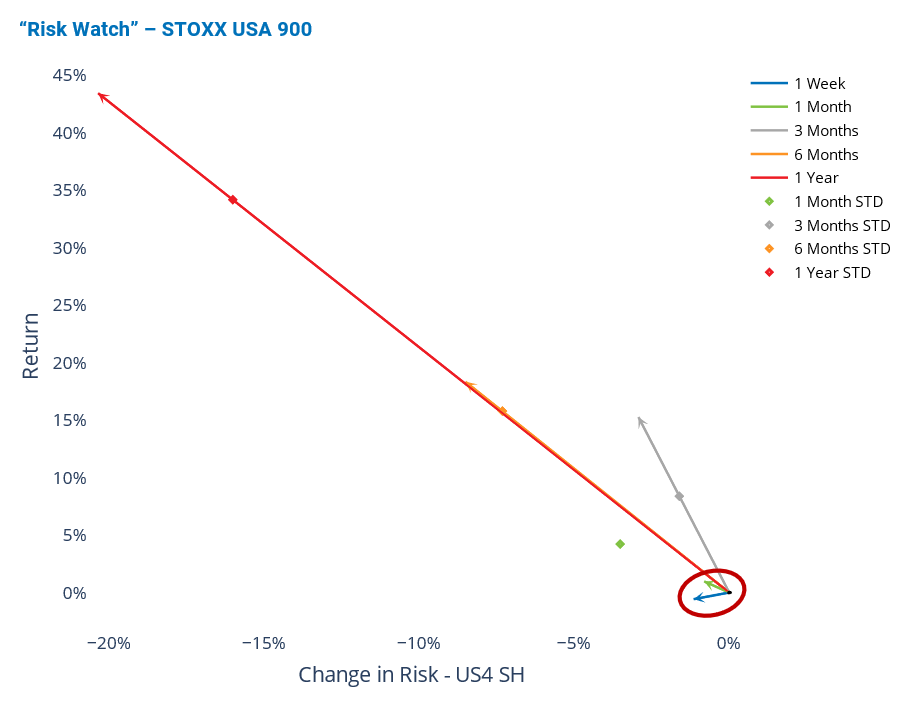

US large-capitalization stocks lost ground last week, as concerns heightened over inflation, the state of the labor market and the pace of manufacturing. The STOXX USA 900 index slipped about 0.60%, while the Russell 2000 index was up about 0.70% over the holiday-abbreviated week. Small caps have been outpacing large caps throughout 2021, with the Russell 2000 posting a year-to-date return of about 15%—close to six percentage points higher than that of the STOXX USA 900 index. Consumer Discretionary, followed by Financials and Industrials, have been the largest contributors to the Russell 2000’s success this year. The STOXX USA 900’s year-to-date gain was driven by Financials and Industrials.

However, risk fell for both US indices over the past four business days. The short-horizon risk of the Russell 2000 was more than 50% higher than that of the STOXX USA 900 index as of last Thursday, as measured by Axioma’s US Small Cap and All Cap fundamental models, respectively. Small caps became riskier than their larger counterparts, compared with the beginning of the year when the Russell 2000’s risk was only 30% higher than that of the STOXX USA 900 index.

See graph from the US Equity Risk Monitor as of 3 June 2021:

Russell 2000’s specific risk soars, led by AMC and GameStop

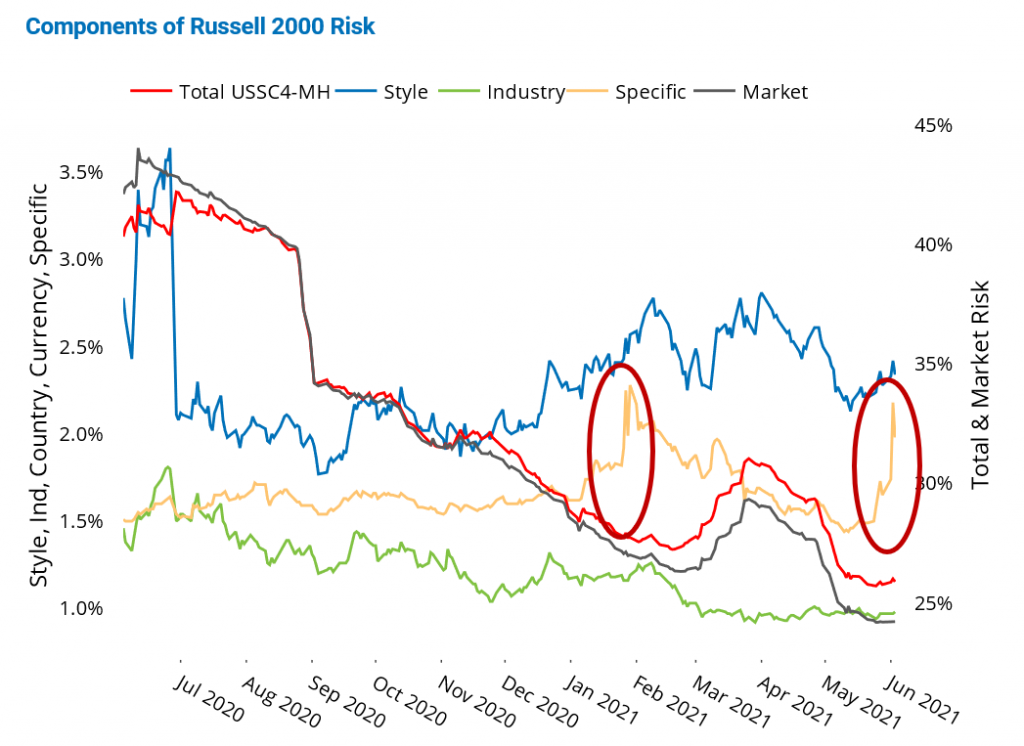

The Russell 2000’s stock-specific risk spiked over the past two weeks, in a move reminiscent of January 2021 when highflying stocks drove stock-specific risk to levels not seen since the dot-com bubble two decades ago. Both AMC and GameStop skyrocketed recently, posting year-to-date gains of about 2,400% and 1,400%, respectively, despite their declines in the second half of last week.

Highly weighted AMC and GameStop were responsible for nearly 60% of the Russell 2000 specific risk as of last Thursday, as measured by Axioma’s US Small Cap medium-horizon fundamental model. Specific risk was once again pushed above 2% (as it was in January), its current level at more than twice the long-term median. While specific risk is only a small part of total benchmark risk, it is likely to figure far more prominently in actively managed portfolios. Note that Russell 2000’s total medium-horizon risk was relatively flat over the past two weeks.

See graph from the US Small Cap Equity Risk Monitor as of 3 June 2021:

US dollar strengthens

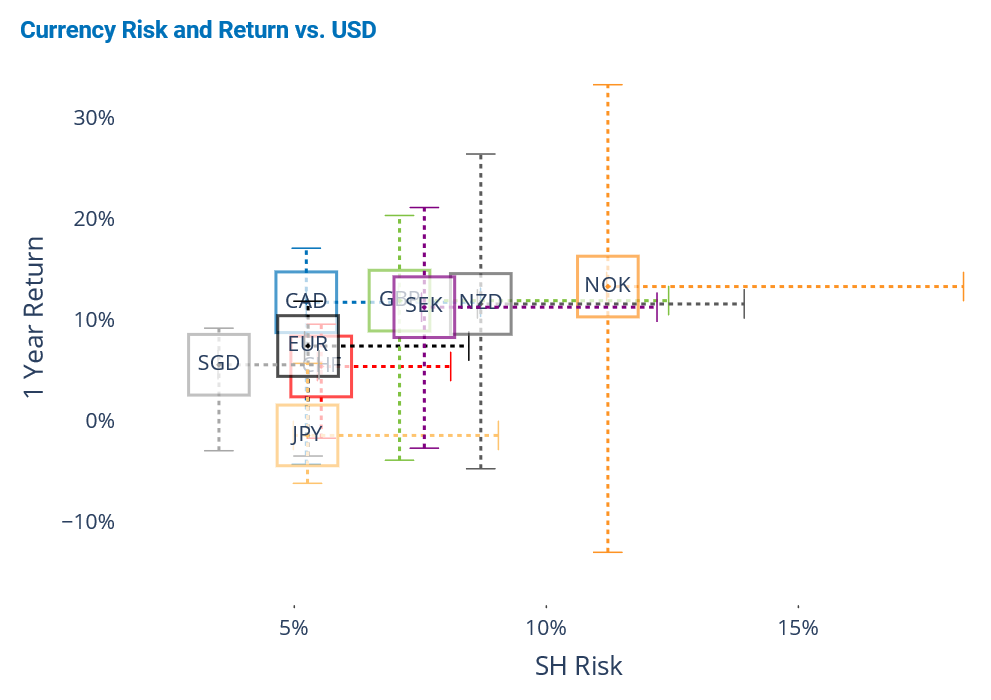

The US dollar gained ground against major developed currencies, pulling them down from the high ends of their one-year return ranges. The Norwegian krone, despite falling close to the middle of its return range, kept its leadership position as the most profitable currency against the greenback over the past 12 months, thanks to the increase in oil prices this year. The Japanese yen was the only currency to incur a loss over this period and was positioned near the low end of its return range. The Norwegian currency remained the most volatile among major developed currencies—all being positioned at the low-ends of their volatility ranges against the US dollar.

See graph from the Equity Risk Monitors as of 3 June 2021:

For more insights and research from the Applied Research team, please click here.