- Risk of US Financials jumps in the wake of SVB collapse

- US small caps more impacted by banking turmoil

- US dollar weakens as rate hike expectations fall

Risk of US Financials jumps in the wake of SVB collapse

The risk of the US Financials sector jumped in the wake of the biggest bank failure since the 2008 Global Financial Crisis. In a classic case of maturity mismatch, Silicon Valley Bank (SVB)—the 16th largest US bank—held a bond portfolio with a much longer duration than the bank’s deposits, which led to its collapse after a run on deposits last week.

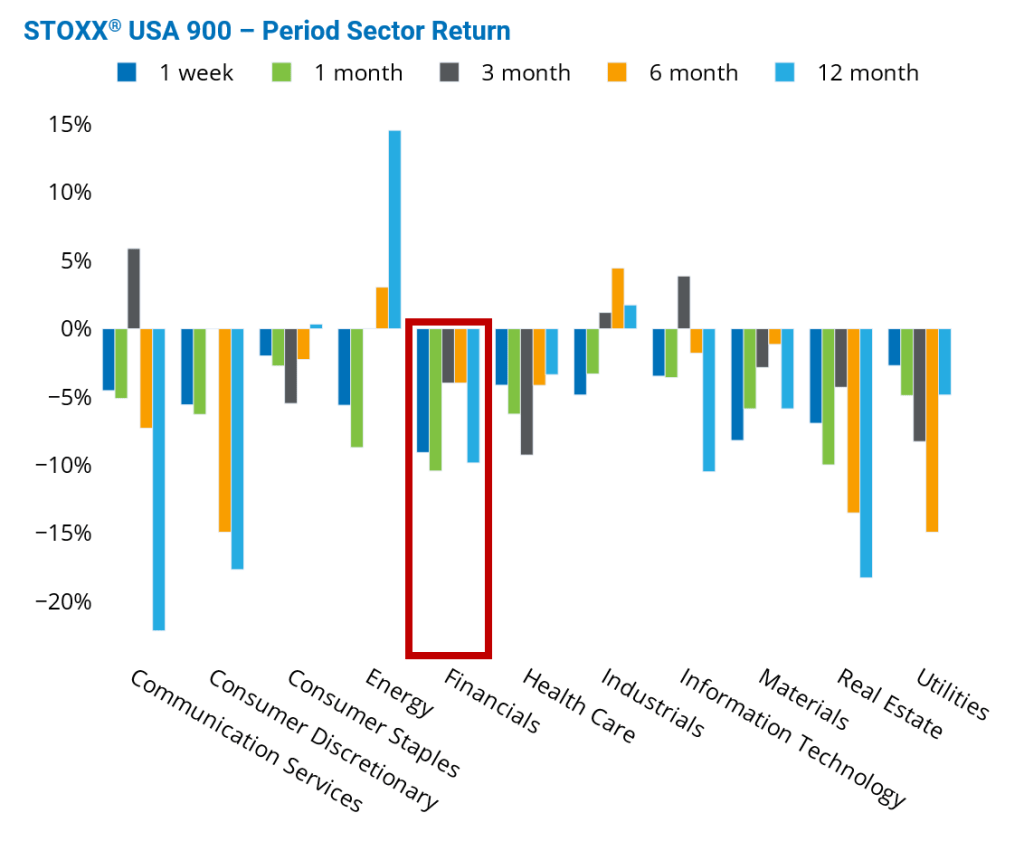

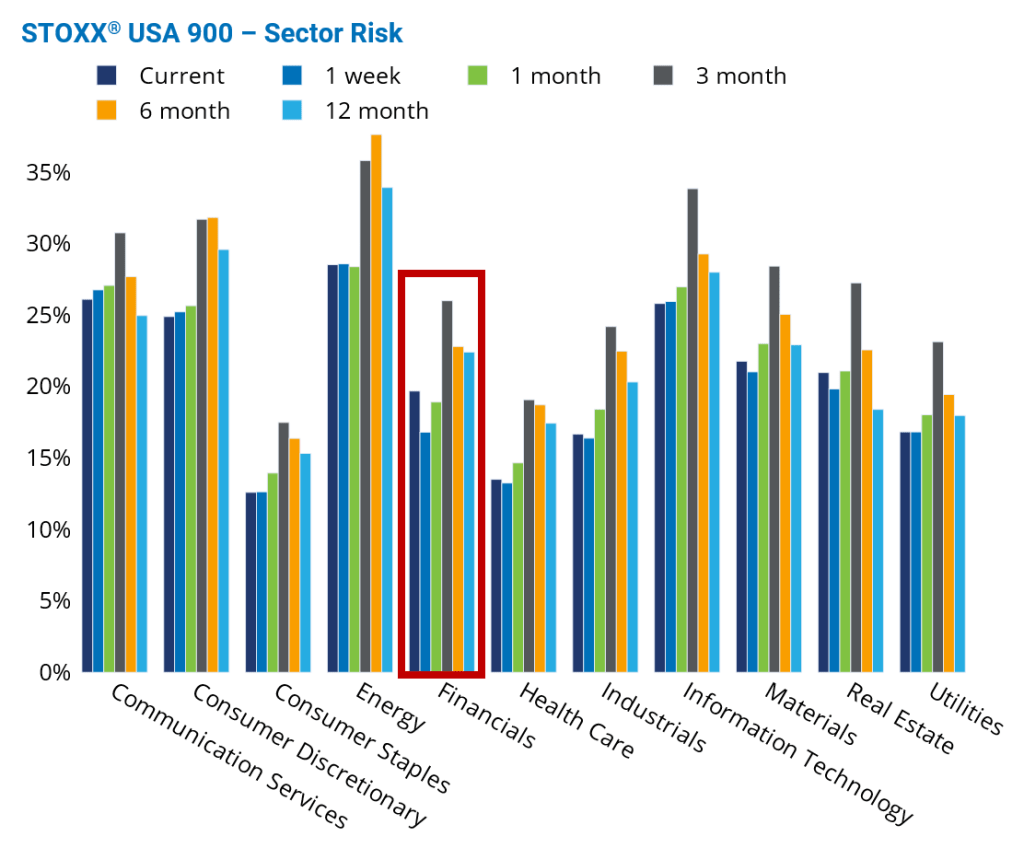

SVB’s turmoil pointed to potential systemic duration risk in the banking system coming to light as a result of the rapid interest rate hikes by the Fed. Bank stocks plunged last week, dragging down the entire US market, as investors were anxious about a contagion effect among banks and a cascading effect on other industries, despite regulators’ efforts to limit the damage from the SVB’s collapse. All sectors in the STOXX USA 900 Index fell last week, with Financials seeing the largest loss of 9%. The risk of Financials jumped 17% in five business days, but remained lower than the levels seen one year ago.

See graphs from the United States Equity Risk Monitor of 10 March 2023:

US small caps more impacted by banking turmoil

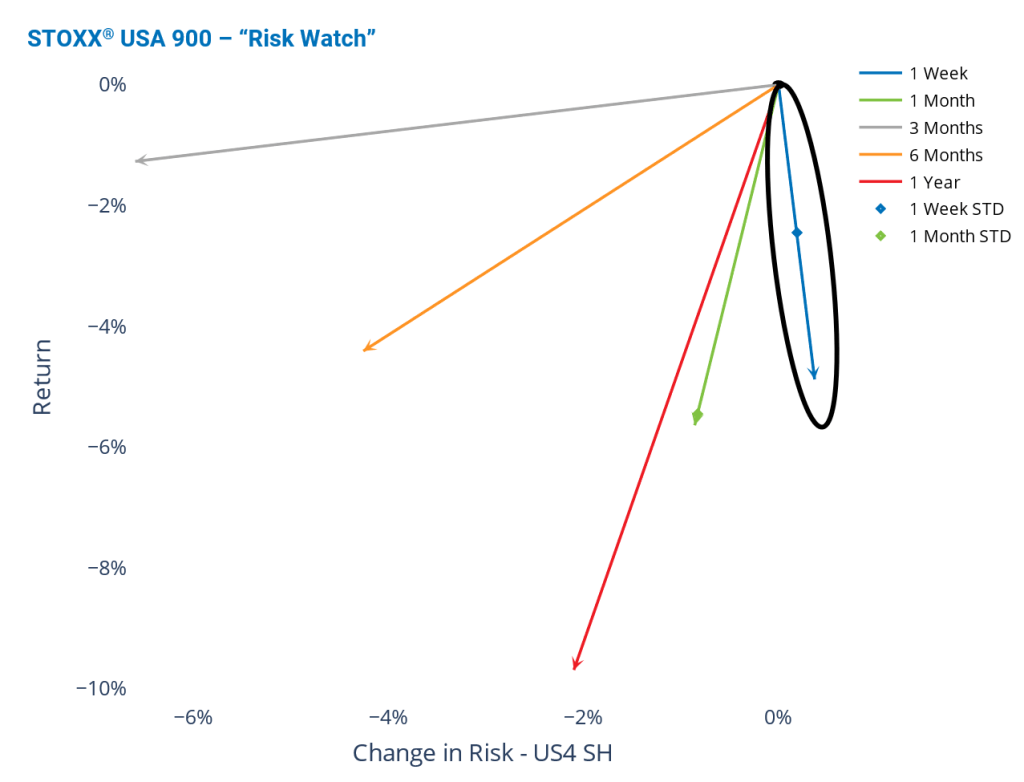

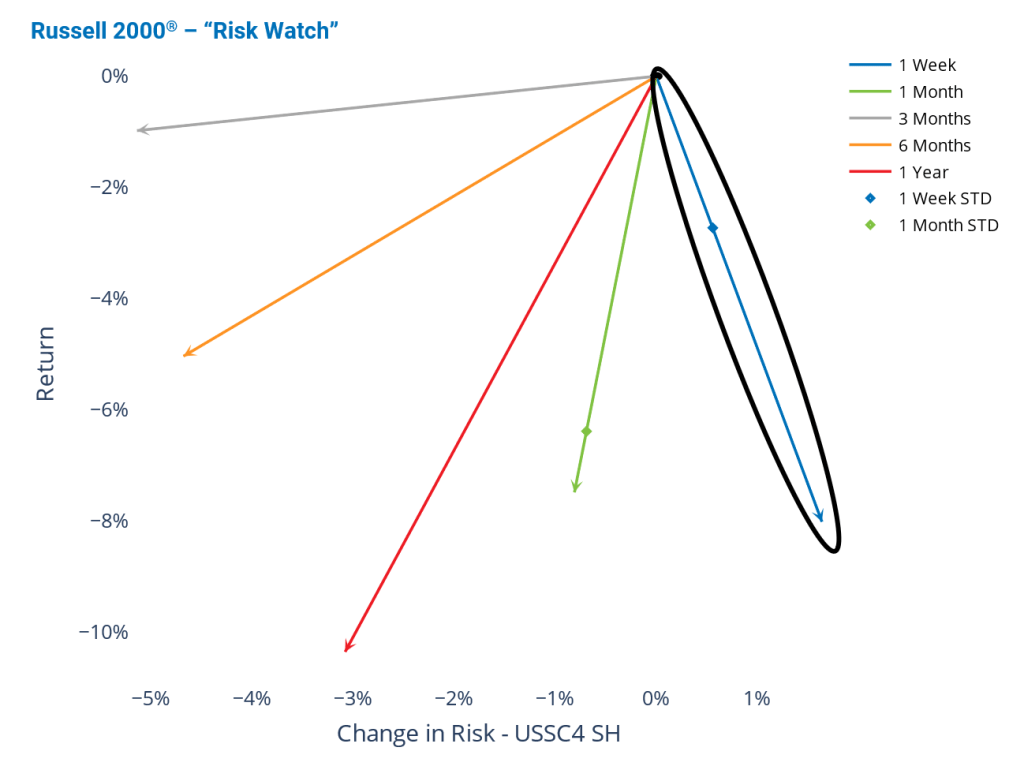

The banking turmoil along with fears of downstream effects have had a more severe impact on the US small cap market than on its larger-cap counterpart. The Russell 2000 fell 8% while the STOXX USA 900 Index fell 5% last week. The Russell 2000’s weekly loss was three standards deviations below the expectations at the beginning of the week, while the STOXX USA 900 Index’s loss was “only” two standard deviations below. Last week’s sell-off wiped out gains incurred earlier this year, which translated into one-, three-, six- and 12-month losses for both US indices.

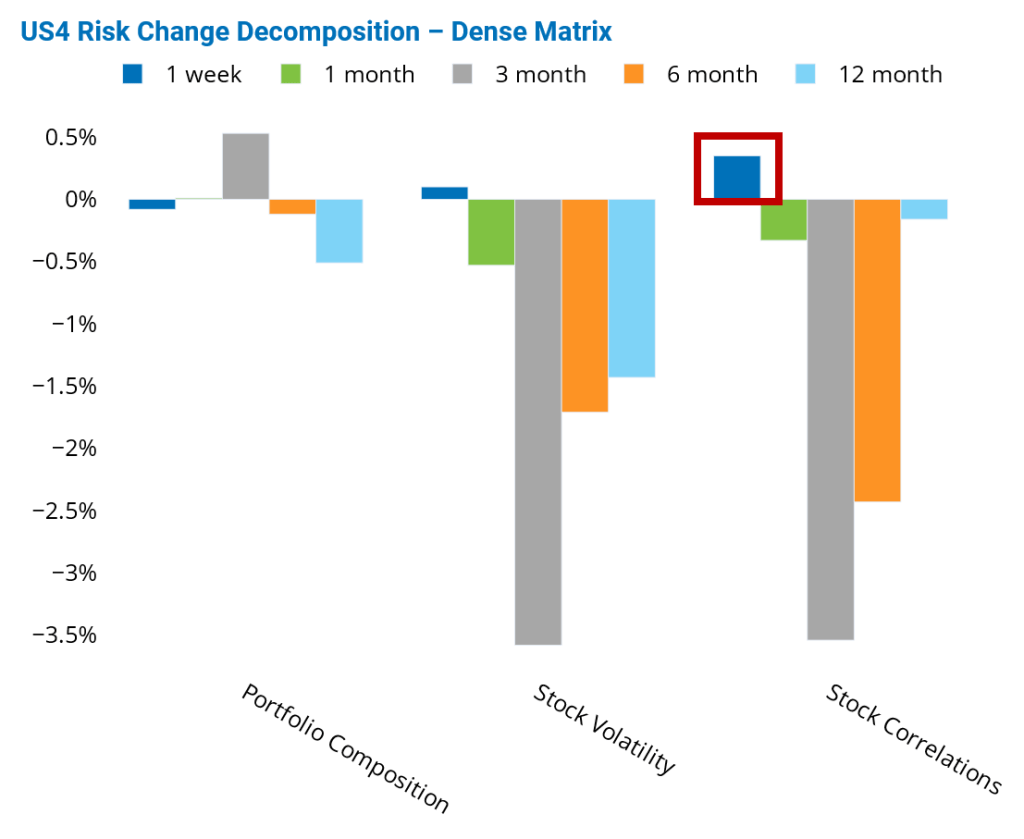

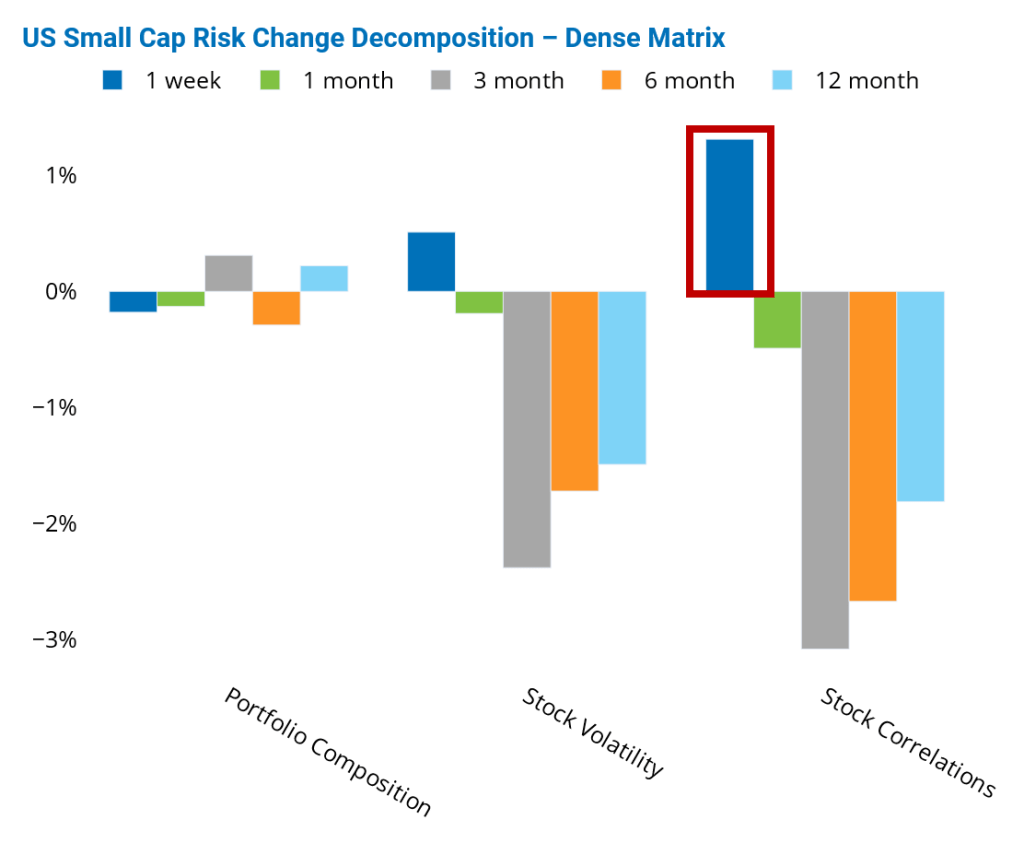

Risk forecasts for the US market reversed course, jumping 160 basis points for the small-cap index and 40 basis points for the large-cap index, as measured by Axioma US Small Cap and US All Cap (US4) short-horizon fundamental models, respectively. Stock correlations were the main driver of the rise in risk for both indices. The decomposition of the change in risk from the standpoint of a dense covariance matrix showed that the effect of the rise in stock correlations was more than double the effect of the increase in stock volatility on last week’s index risk jumps.

See graphs from the United States Equity Risk Monitor as of 10 March 2023:

See graphs from the United States Small Cap Equity Risk Monitor as of 10 March 2023:

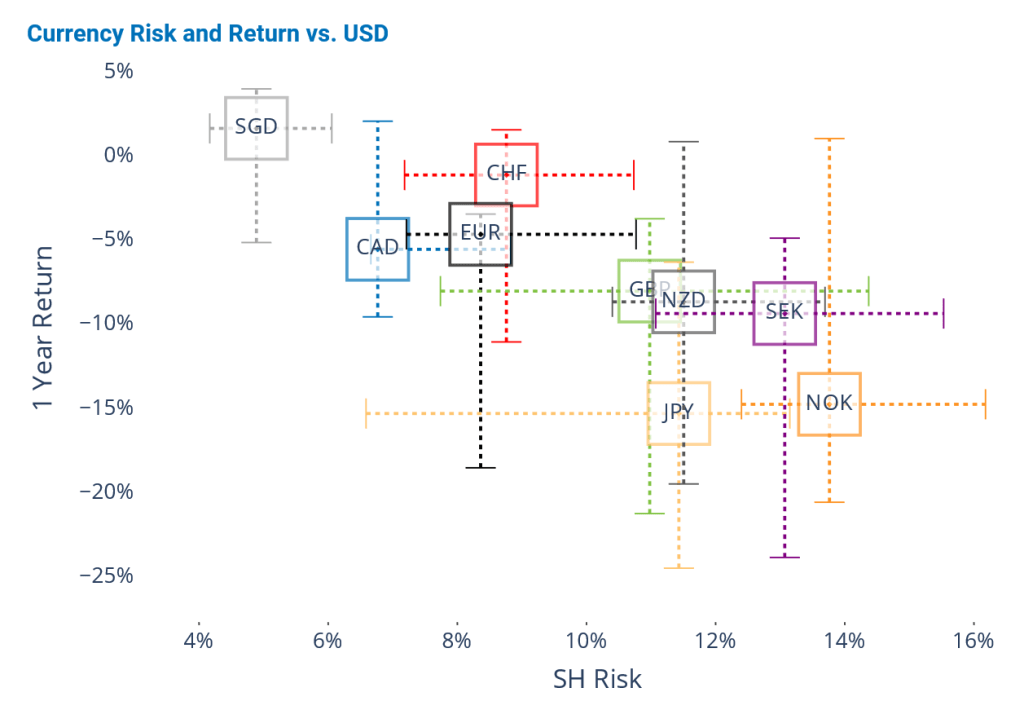

US dollar weakens as rate hike expectations fall

The US dollar weakened against major developed currencies. The expectation for interest rate increases had come down quite a bit, as the banking crisis is expected to alter the Fed’s interest rate plans for 2023. However, major developed currencies were still showing one-year negative returns against the greenback, as of last Friday. The Singaporean dollar was the only exception, with a one-year return of about 2%. The Japanese yen was still the biggest loser with a 15% yearly loss. The Singaporean dollar remained the least risky currency and the Norwegian krone the riskiest, as measured by Axioma Worldwide fundamental short-horizon model.

See graph from the Equity Risk Monitors as of 10 March 2023:

For more insights and research from the Applied Research team, please click here.