- Size matters in US Equity

- Financials matter more in DMexUS

Size Matters in US Equity

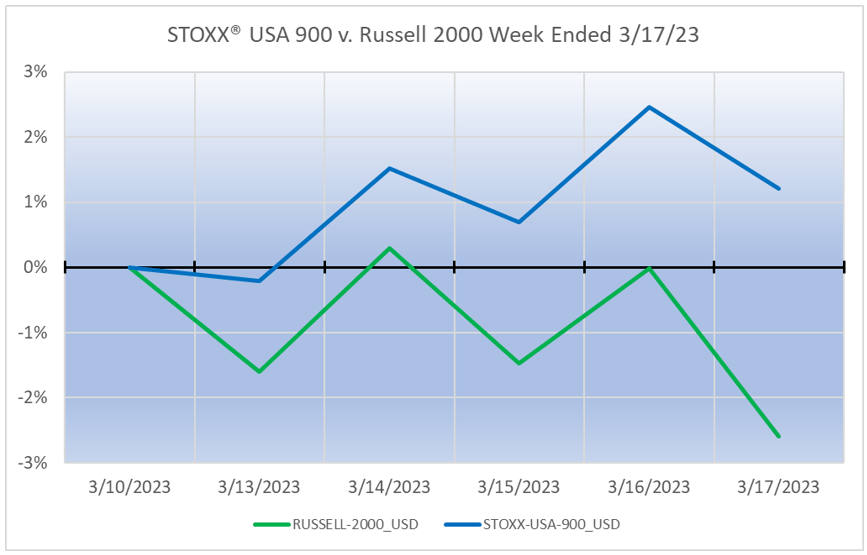

The contrast between the performance of the STOXX® USA 900 and the Russell 2000 index of small cap stocks was stark last week.

This Chart is not published in the Equity Risk Monitors but is available upon request:

The 381 bps spread in returns between these two capitalization segments was also reflected in the return of the US Size factor, which was in the 99th percentile all-time over the six days including the 10th of March (see blog post, Style factors: bank failures spur unexpected factor returns, 3/20/2023).

The US Bank industry factor (US4-MH variant) posted a weekly return of -6.16%, which is a 3.4-standard deviation return relative to the Bank factor’s forecast risk as of March 10. Diversified Financials (-5.29%), Consumer Finance (-4.33%), and Insurance (-4.45%) were other Financials-related industry factors that fared poorly, but Capital Markets (+0.46%) and Thrifts & Mortgage Finance (-0.4%) were within normal ranges. Other Industries did way worse than banks, with the Airlines factor down 8.94% and Energy Equipment & Services down a whopping 10.22% for the week.

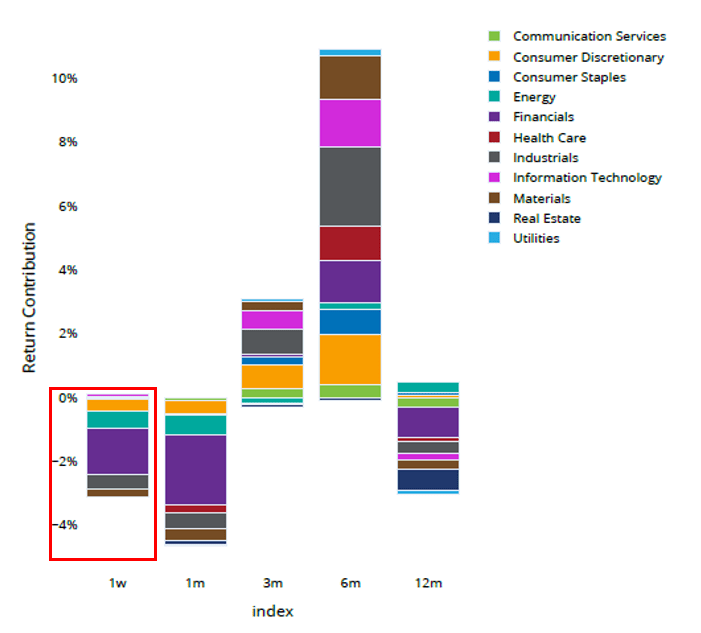

By contrast, Utilities, big Tech and Health care had strong weeks:

STOXX® USA 900- Sector Return Contribution (see Chart 32, United States Equity Risk Monitor, 3/17/2023)

This dispersion in industry/sector returns indicates that the risk from the regional bank failures in the United States appears to be well-contained, at least thus far.

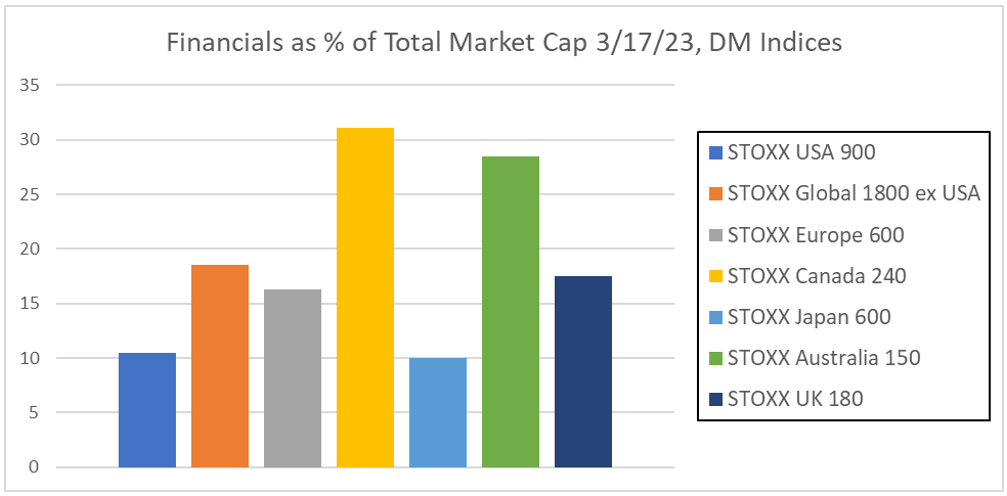

Financials Matter More in DMexUS

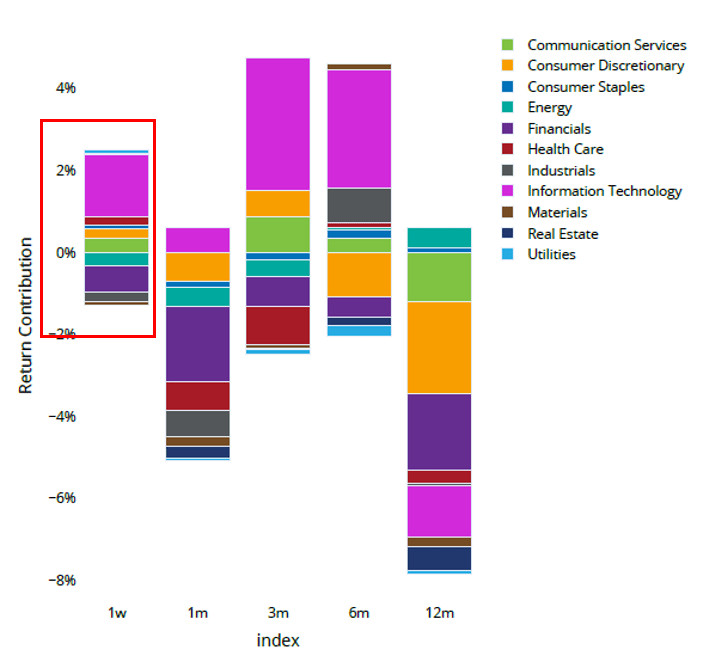

Despite the Banks factor in the DM exUS model (DMexUS4-MH) having a return half the magnitude of the US factor (-3.49%), Financials exert a greater pull over the market in other Developed markets (with the possible exception of Japan, which has a slightly lower allocation than the USA), as demonstrated by the percentage of market capitalization allocated to Financials.

This Chart is not published in the Equity Risk Monitors but is available upon request:

Even though the bank crisis appears limited to a single European bank, to the extent other banks sell off along with Credit Suisse, this will put more downward pressure on markets as a whole than it would in the United States.

STOXX® Global 1800 ex USA- Sector Contribution (see Chart 32, Global ex-US Risk Monitor, 3/17/2023)