- Market returns mixed as dispersion trends reverse

- Momentum leads, High Vol lags

Market returns mixed as dispersion trends reverse

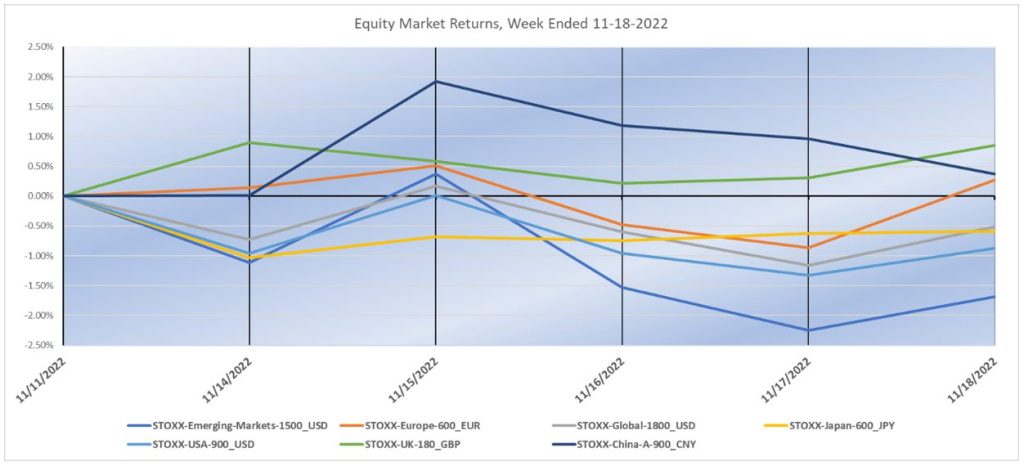

After a big rebound two weeks ago largely attributed to a weaker than expected CPI print in the US, equity markets globally were mixed with the US, Emerging Markets, and Japan down, while the UK , Europe, and mainland China slightly up:

The chart below does not appear in our Equity Risk Monitors, but can be provided upon request:

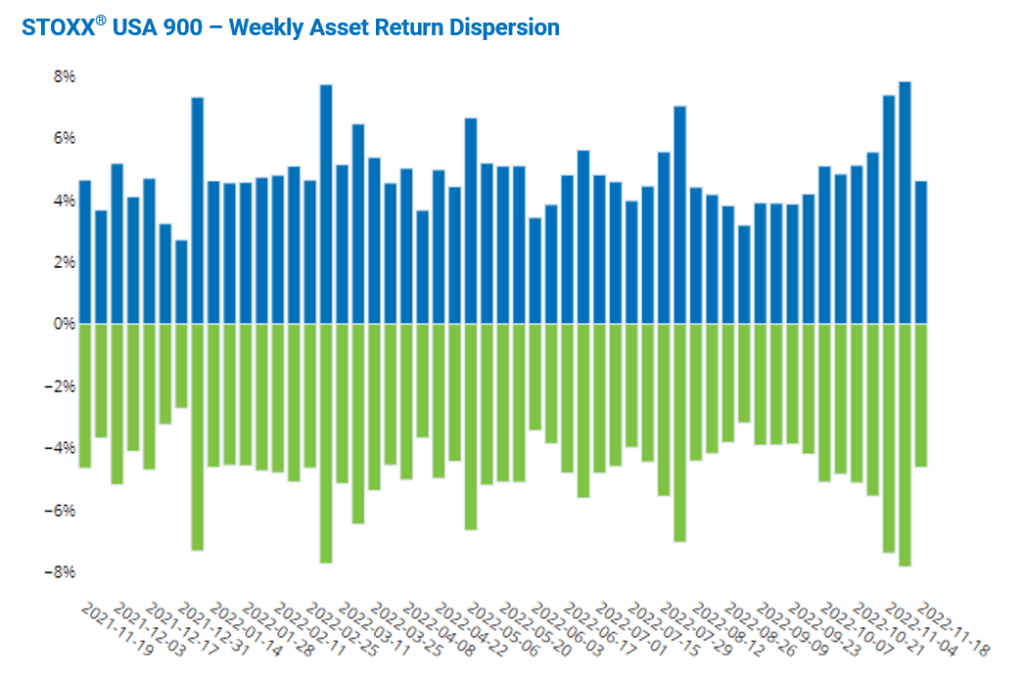

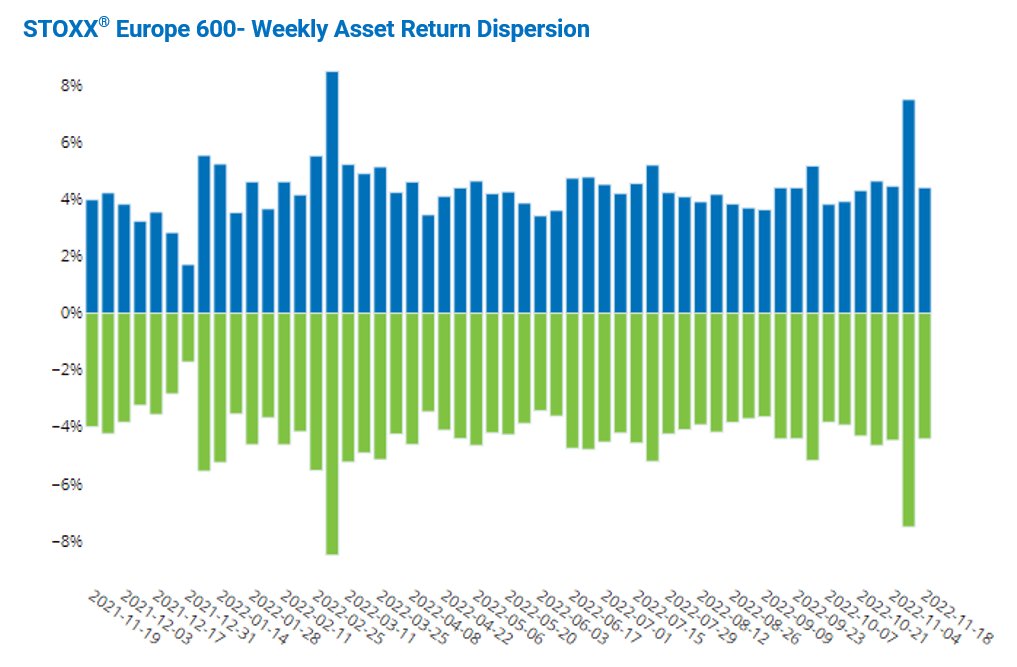

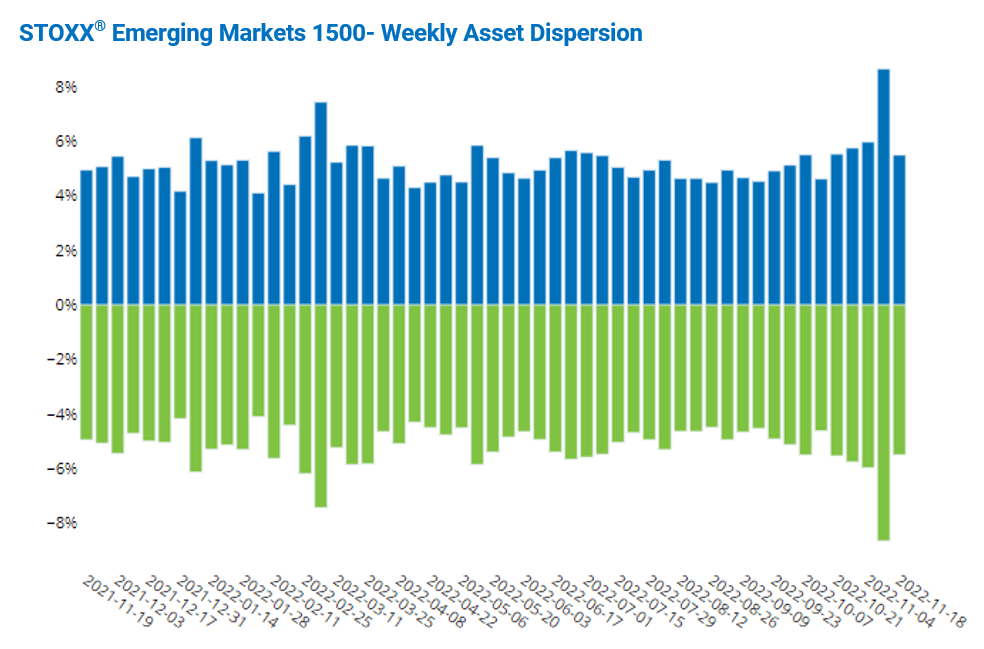

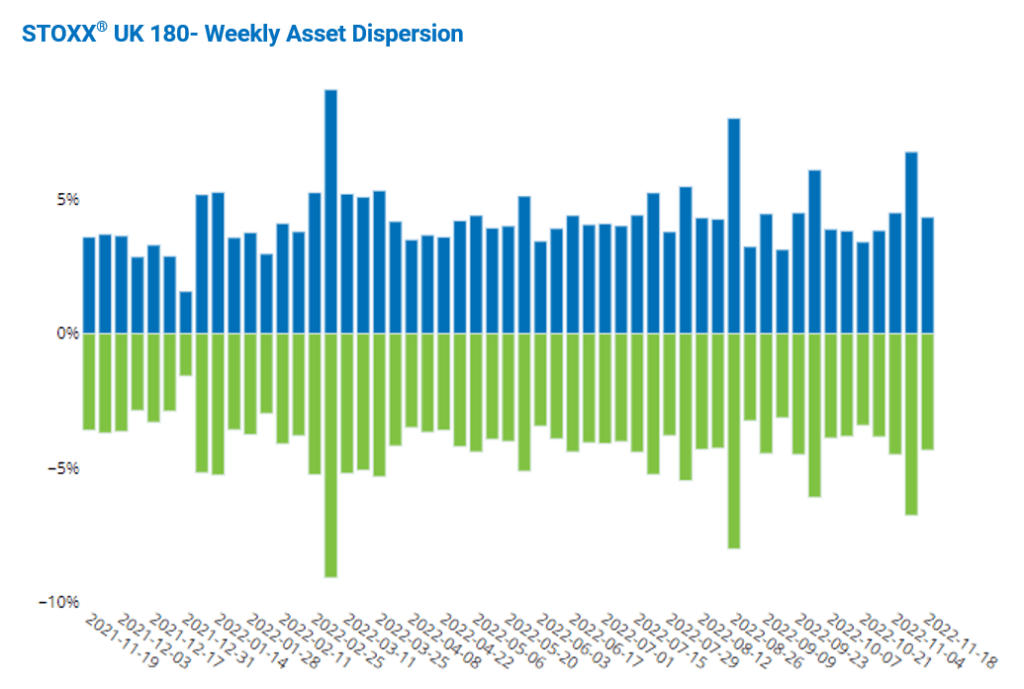

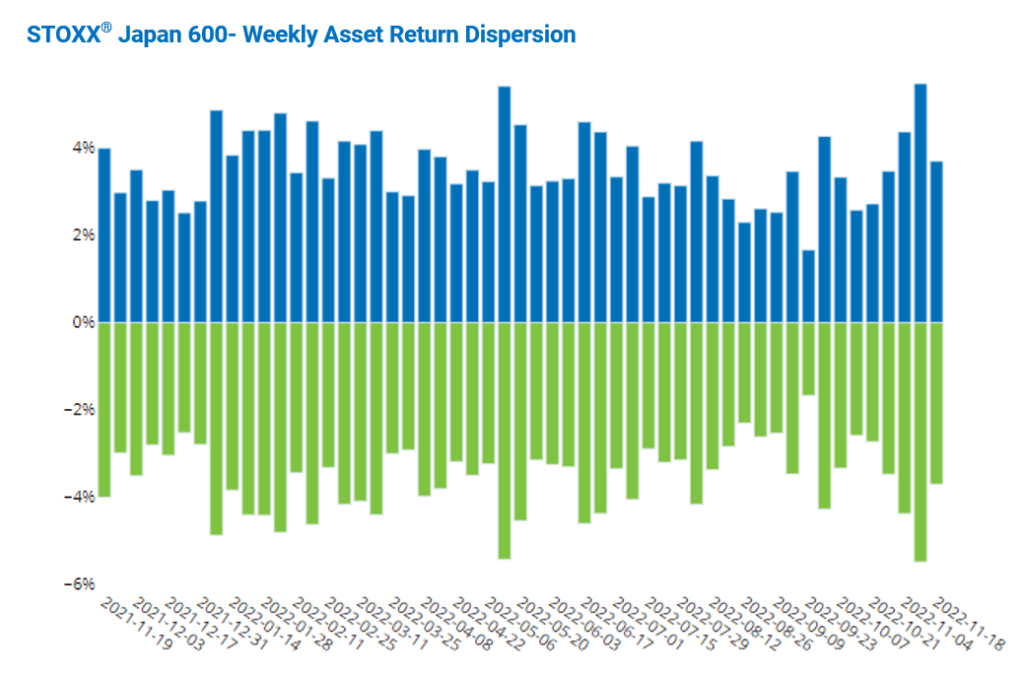

There were some interesting consistencies across markets, despite the lack of a clear directional signal in the overall returns. Primarily, after several weeks of increasing cross-sectional dispersion in returns, the trend appears to have reversed:

Lower dispersion implies smaller stock specific returns, so regardless of overall direction in the last week, stock returns were more homogeneous than they’ve been in quite a while. One week does not a trend break, however dispersion levels are worth watching as declining dispersion could signal more broad-based declines to come.

Momentum leads, High Vol lags

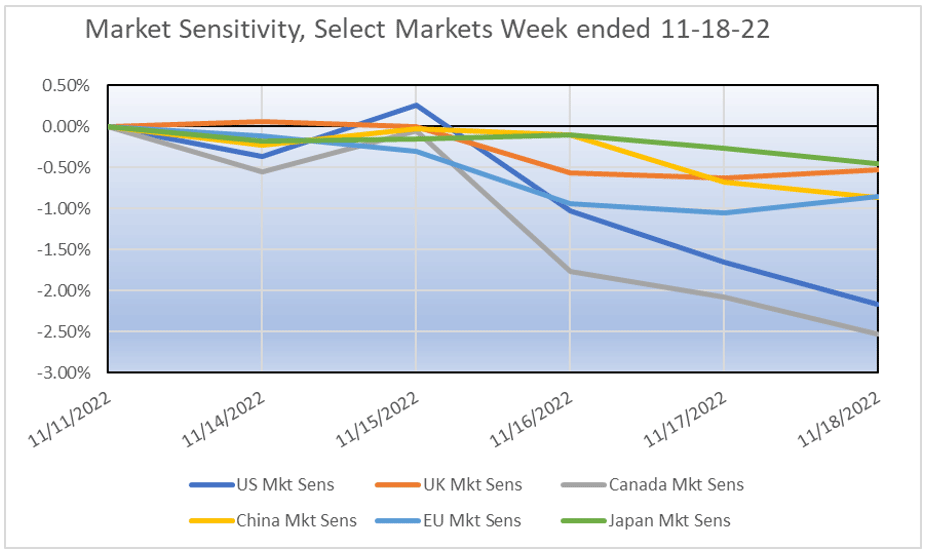

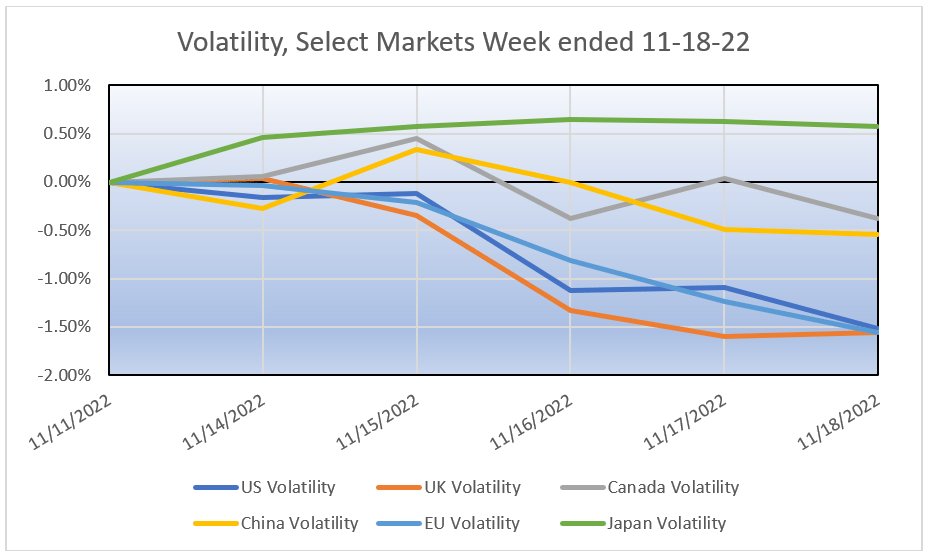

Several of the markets we model also exhibited style factor return behavior that prevailed during the more bearish periods this year, with Momentum up and Market Sensitivity and Volatility down:

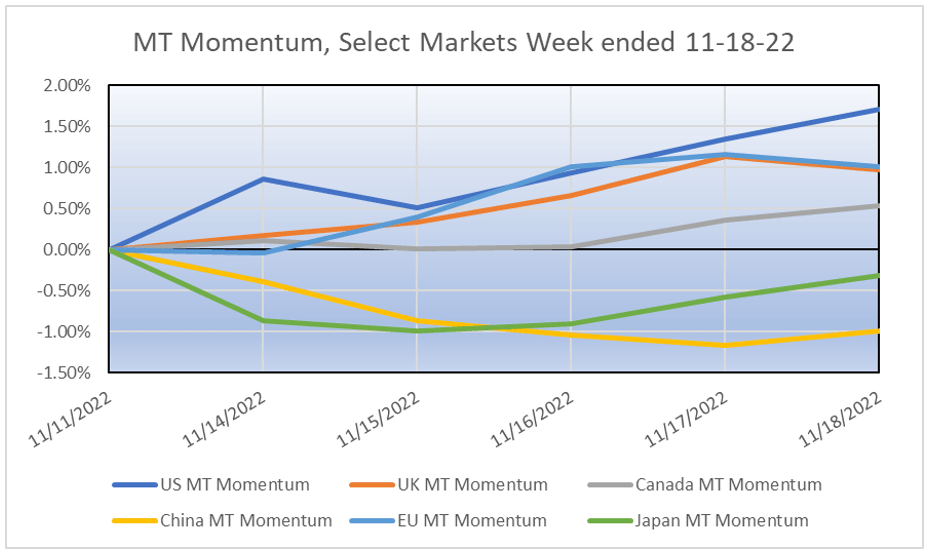

The charts below do not appear in our Equity Risk Monitors, but can be provided upon request:

To some degree this is back on trend as the prior week, these factor returns were reversed with Momentum down and Market Sensitivity & Volatility Up or flat in most markets. It would appear that the reprieve many saw in the better than expected inflation numbers was ephemeral after all.