US Small Caps soar on vaccine news; US Energy and Industrials strengthen; Investors push the risk envelope

US Small Caps soar on vaccine news

US stocks took off as reports of a second Covid-19 vaccine hit the market, pushing a number of US indices to new records in the beginning of last week. However, US equities gave back some of those gains later in the week, after US local authorities imposed fresh restrictions aimed at curbing the surge in coronavirus cases. When the dust finally settled, the US market finished with relatively muted gains, with the STOXX USA 900 index posting a five-day gain of about 2%, while the Russell 2000 index was up about 4%. So far this year, however, US Large Caps have recorded higher gains (13%), while the year-to-date return for US Small Caps stood at 7% as of last Thursday.

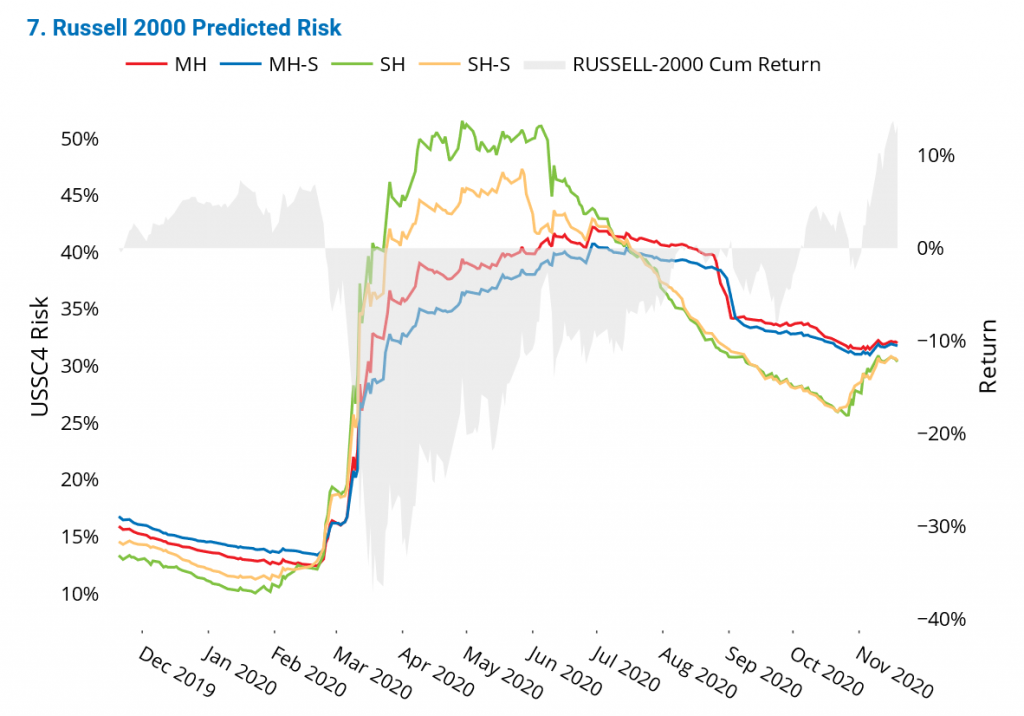

At the same time, the risk of US Small Caps remained flat, while the risk of US Large Caps declined 100 basis points last week, as measured by Axioma’s short-horizon fundamental US Small Cap and US All Cap models, respectively. After reaching a near-term low at the end of October, Small Cap risk rose the first two weeks in November and hovered around at 30% last week. US Small Caps were 7 percentage points riskier than US Large Caps, as of last Thursday.

See graph from the US Small Cap Risk Monitor as of 19 November 2020:

US Energy and Industrials strengthen

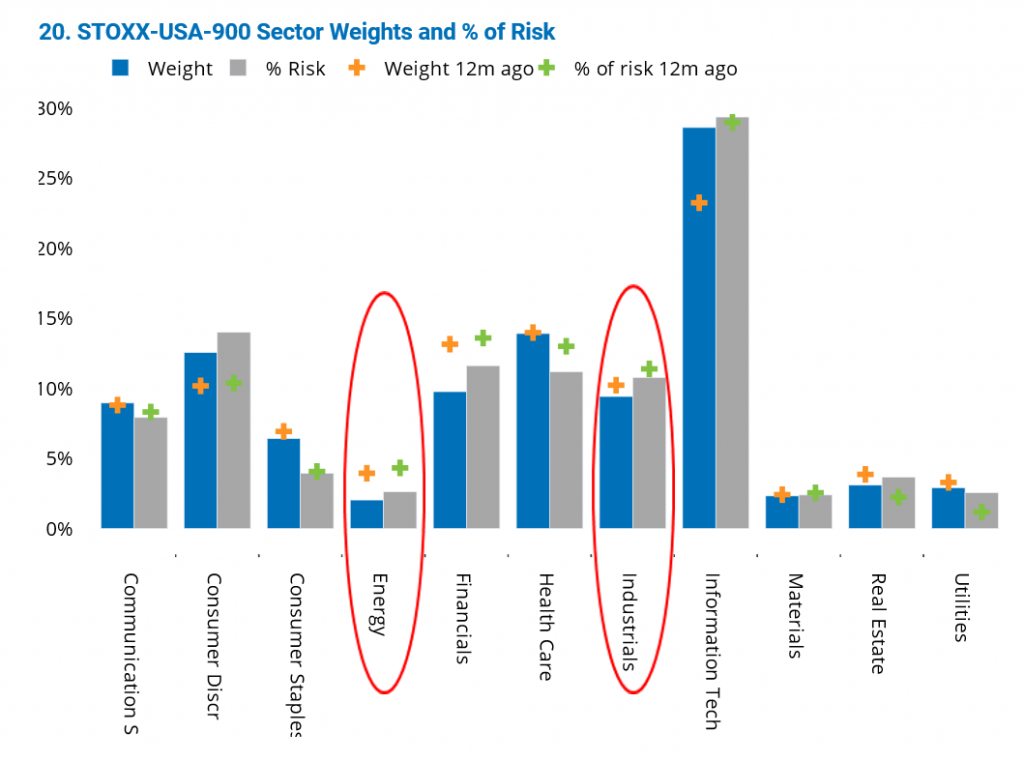

Energy and Industrials were the best performers last week among the 11 sectors in the STOXX USA 900 index, as news of a second potential Covid-19 vaccine lifted shares previously hard-hit by the pandemic. Energy is up 26% and Industrials 16% so far in November. These latest advancements in Industrial stocks pushed the sector into the black for the year, but Energy remained the biggest loser with a year-to-date loss of 38%. All US sectors went up last week, except Health Care and Utilities, which were also the only sectors to see an increase in risk over the past five days.

However, Energy was by far the riskiest US sector at 46% predicted volatility, as measured by Axioma’s US short-horizon fundamental model—double that of Health Care and Utilities, which remained the second and third least risky (after Consumer Staples) among the US sectors. Industrials’ risk was somewhere in the middle of the pack. Both Energy and Industrials contributed to the STOXX USA 900 index risk more than their weights would otherwise indicate.

See graph from the United States Equity Risk Monitor as of 19 November 2020:

Investors push the risk envelope

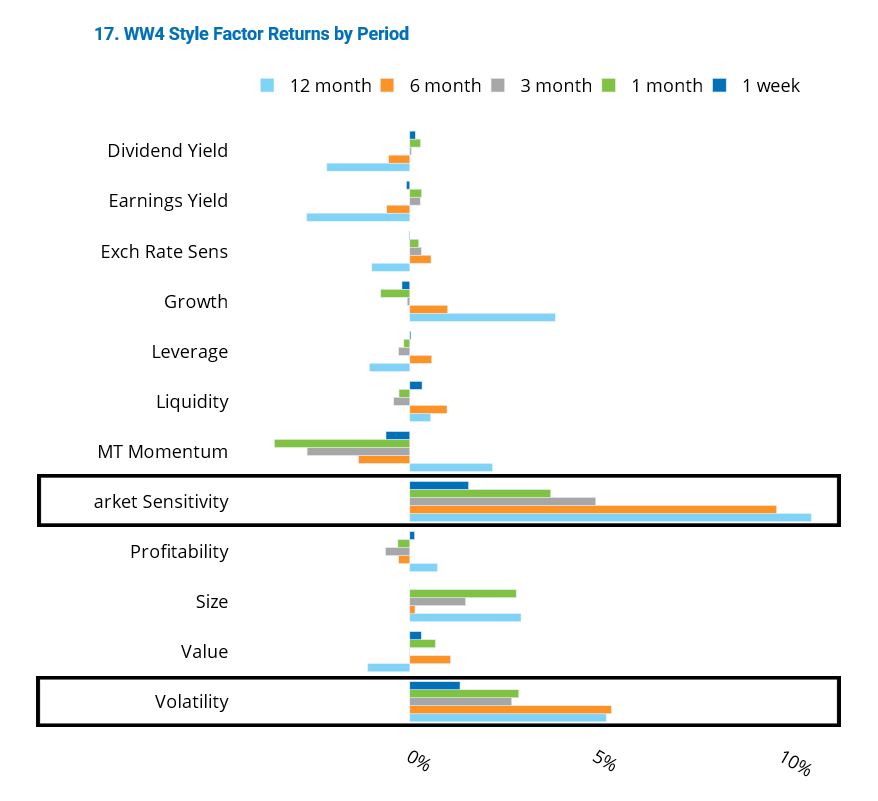

The Market Sensitivity and Volatility style factors saw large positive returns last week and over the past six months in most regions Axioma models track closely, as risk appetites increased worldwide. After large negative returns in March before the market bottomed out, the two factors have since become the top performers, with the highest 12-month returns among all style factors in Axioma’s Worldwide medium-horizon fundamental model. Volatility’s return remained relatively flat between June and October, but its recent spike made it the second-best style factor after Market Sensitivity, which has been on a continuous ascent since mid-April. These results run counter to expectations of many investors, who saw low volatility and market sensitivity stocks fare much better than their higher-risk counterparts.

See graph from the Global Developed Markets Equity Risk Monitor as of 19 November 2020: