- FAANGs lead market rout in the US

- Global Value keeps inching up

- Brazil turns second-riskiest emerging market after Russia

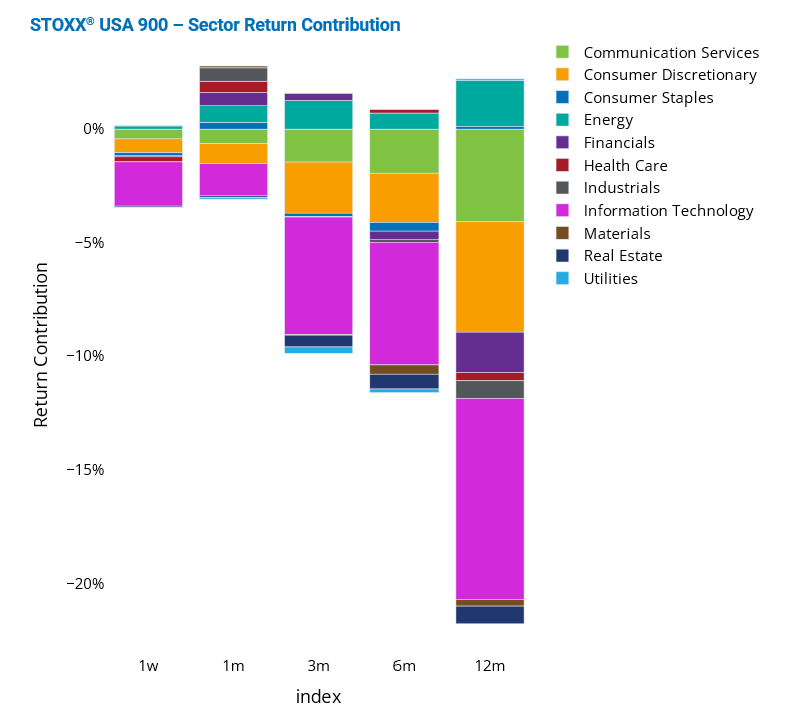

FAANGs lead market rout in the US

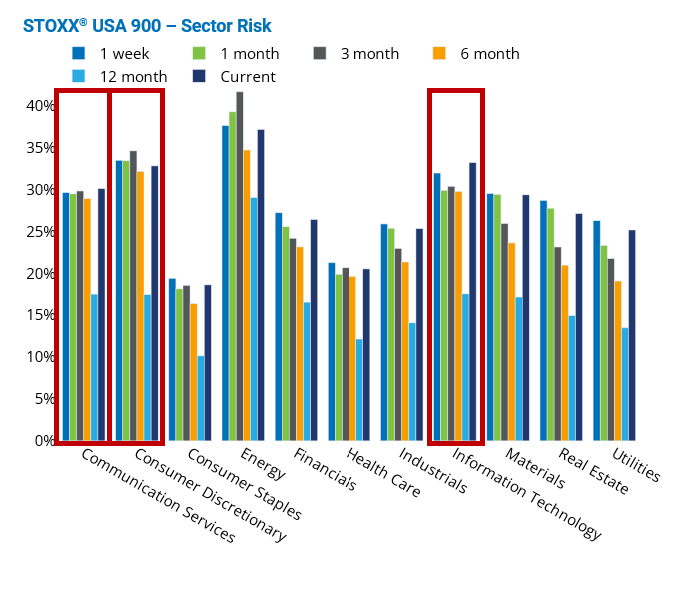

All three sectors containing FAANG stocks were the biggest losers among US sectors last week, after the Fed signaled higher rates—which heavily impact growth stocks such as technology stocks. While most US sectors fell last week, Communication Services (host of Facebook/Meta, Google/Alphabet and Netflix), Consumer Discretionary (host of Amazon), and Information Technology (host of Apple), saw the largest drops, sliding more than 5% over five business days. Info Tech and Communication Services suffered the most, each recording weekly losses of 7%. The FAANGs were responsible for 40% of the 4% weekly decline in the STOXX® USA 900 Index last week, while the three sectors in aggregate accounted for over 90% of the US Index weekly decline.

Communication Services posted the largest year-to-date loss (of 44%), followed by Consumer Discretionary (35%) and Information Technology (33%). The three sectors in aggregate amount to 42% of the US Index with the following index weights: Information Technology 25%, Consumer Discretionary 11% and Consumer Services 6%. As of last week, Consumer Discretionary, Information Technology, and Communication Services were the second, third and fourth riskiest US sectors (after Energy), respectively, and each of the three sectors contributed to the STOXX® USA 900 Index risk more than their weights would indicate.

For more information on the dominance of FAANGs—Facebook (now Meta), Amazon, Apple, Netflix, and Google—on the US market as a whole, see blogpost From pandemic profiteers to stagflation hostages: FAANGs stranglehold weighs on US market.

See graphs from the United States Equity Risk Monitor of November 4, 2022:

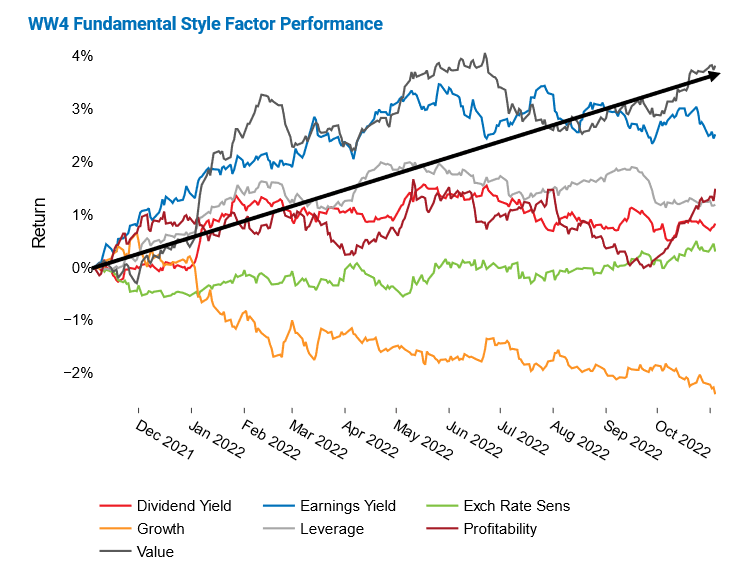

Global Value keeps inching up

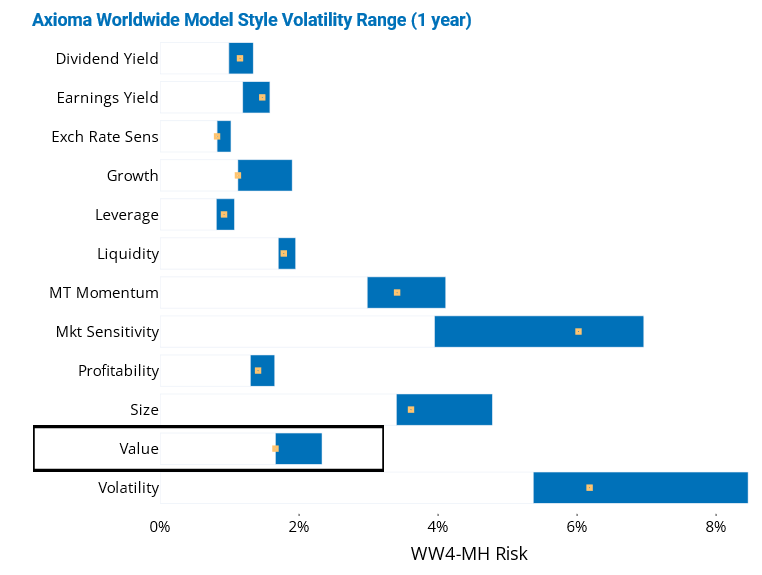

The global Value style factor continued to climb last week, maintaining the upward trend observed for value style investing over the past couple of months. In 2022, Value’s return was particularly strong through late June, fell during the summer, and has been rising again since September. Values’ 12-month return of nearly 4% made it the best performer among the fundamental style factors in Axioma’s Worldwide medium-horizon fundamental model. Value has also been thriving over the past 12 months in all other regions Axioma’s models track closely, except in China.

Global Value’s performance was slow and steady—with its one-, three-, six- and 12-month positive returns remaining within two standard deviations of the volatility expectation at the beginning of each period. This resulted in Value being pushed to the low end of its one-year volatility range (the yellow dot on the style factor volatility chart below).

See graphs from the Global Developed Markets Equity Risk Monitor as of November 4, 2022:

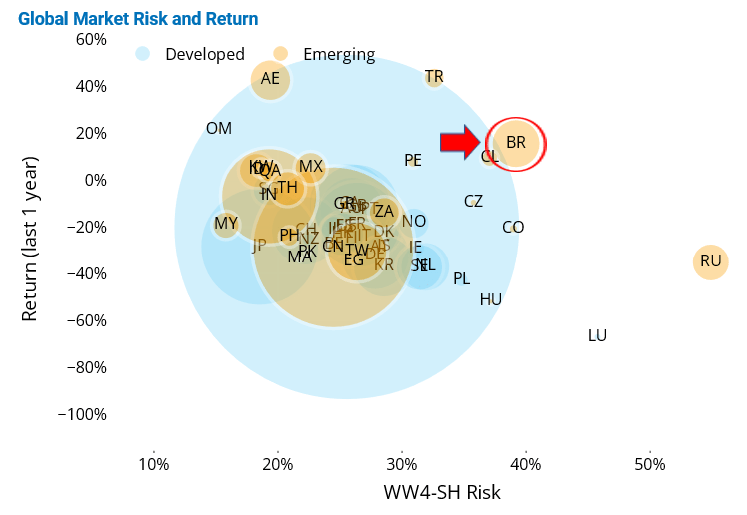

Brazil turns second-riskiest emerging market after Russia

Brazil became the second riskiest emerging market after Russia, while Brazilian stocks rose nearly 9% the week after Brazil’s Presidential Election. With a 12-month return of 16%, Brazil is now one of the best performers over the one-year period, when looking at country returns denominated in US dollars. As a net oil exporter, Brazil’s market has been pulled up by skyrocketing oil prices this year.

Brazil’s risk rose nearly 9 percentage points since the beginning of the year, nearing 40% last week, as measured by Axioma’s short-horizon Worldwide fundamental model. Brazil’s risk is now about 10 percentage points higher than the average risk across major emerging markets, but about 16 percentage points lower than that of Russia.

See graph from the Equity Risk Monitors as of November 4, 2022: