US market rises slightly, as risk inches up; Relative riskiness of US Small Caps declines; Industry risk slides in China

US market rises slightly, as risk inches up

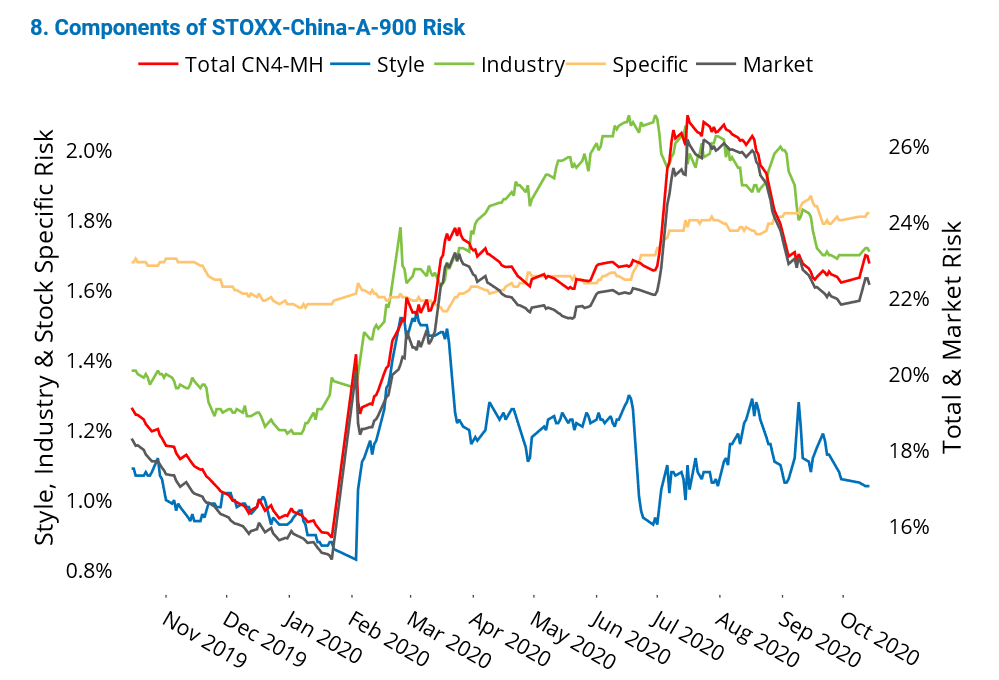

The US market finished the week with a small gain, lifted by megacap tech companies early on, and despite three consecutive days of declines ended on Thursday. It was a choppy week for US stocks, as investors tried to parse a host of issues, including US election forecasts, the effects of a second wave of coronavirus infections, delayed coronavirus aid, and earnings reports. The STOXX USA 900 index weekly gain remained within one standard deviation of the expectations five days ago. The forecasted risk of the US equity market continued to inch up, rising 30 basis point over the past five days, as measured by Axioma’s US short-horizon fundamental model.

Megacap companies have lifted the US market this year, with FAANGs and Microsoft representing 20% of the US market. For more information on the impact of FAANGs on US market risk and return, please see blog post The US market can thank its FAANGs even more now — just keep an eye on risk.

See graph from the US Equity Risk Monitor as of 15 October 2020:

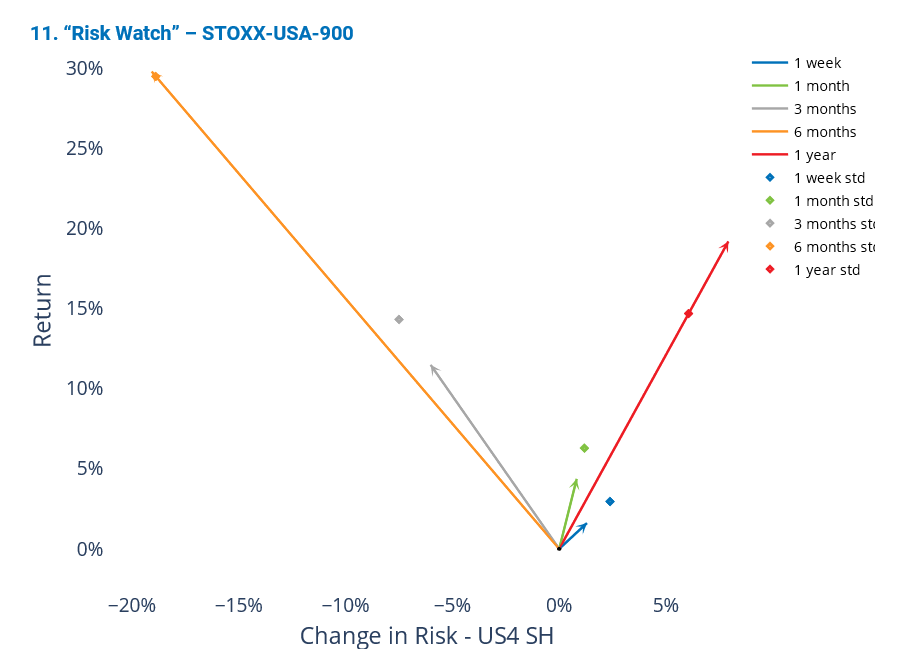

Relative riskiness of US Small Caps declines

Risk for both US Large Caps and US Small Caps dropped abruptly since April, but Small Caps’ relative riskiness versus their larger counterparts has seesawed. From April to July, Small Caps became much riskier relative to Large Caps, as measured by Axioma’s fundamental US Small Cap and US All Cap models, respectively, with the ratio between short-horizon risk forecasts for Small Caps and Large Caps reaching a year-to-date high of 1.6 in July. That said, the ratio has been edging downward ever since, ending last week at 1.3. In other words, Small Caps were about 30% riskier than Large Caps last week, down from 60% riskier in the beginning of July. For more details on the comparison between small-cap and large-cap risk, please see Qontigo Insight Q3 2020 Risk Review.

The chart below does not appear in our Equity Risk Monitors, but can be provided upon request:

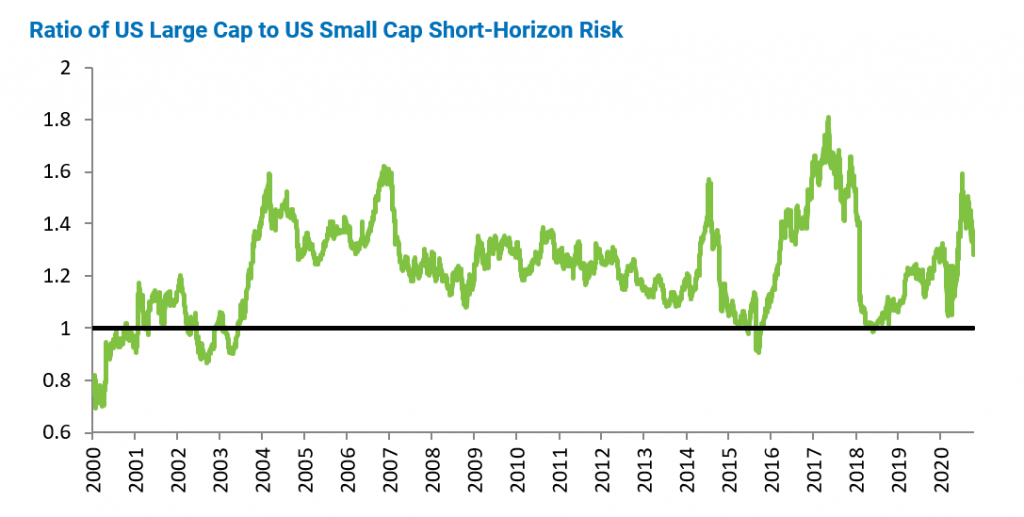

Industry risk slides in China

Industry risk in China has slipped and now plateaued at levels not seen since March in recent weeks, as Chinese exports exceeded expectations for the sixth month in a row in September. The trend points to a continuing recovery of the Chinese market and of worldwide equity markets, which boosted domestic and global demand. Industry risk rose in the first and second quarters of 2020, more than doubling its beginning-of-the-year level by June, when it reached its year-to-date peak of 2.1%. The fall in industry risk since June amounted to about 40 basis points last week.

The total medium-horizon risk of the Chinese market, as represented by the STOXX China A 900 index, reached its year-to-date apex in July, a bit later than industry risk, and has declined substantially since, driven by the fall in market risk. The recent decline in industry risk boosted the fall in total risk, which fell close to 400 basis points from its July peak of 27%, as measured by the medium-horizon forecast of Axioma’s China fundamental model. Stock-specific risk (which is only a small part of total benchmark risk) rose, while style risk remained relatively flat over the same period.

See graph from the China Equity Risk Monitor as of 15 October 2020: