Stock correlations drive uptick in US risk; Growth takes off worldwide; Airlines still among riskiest global industries

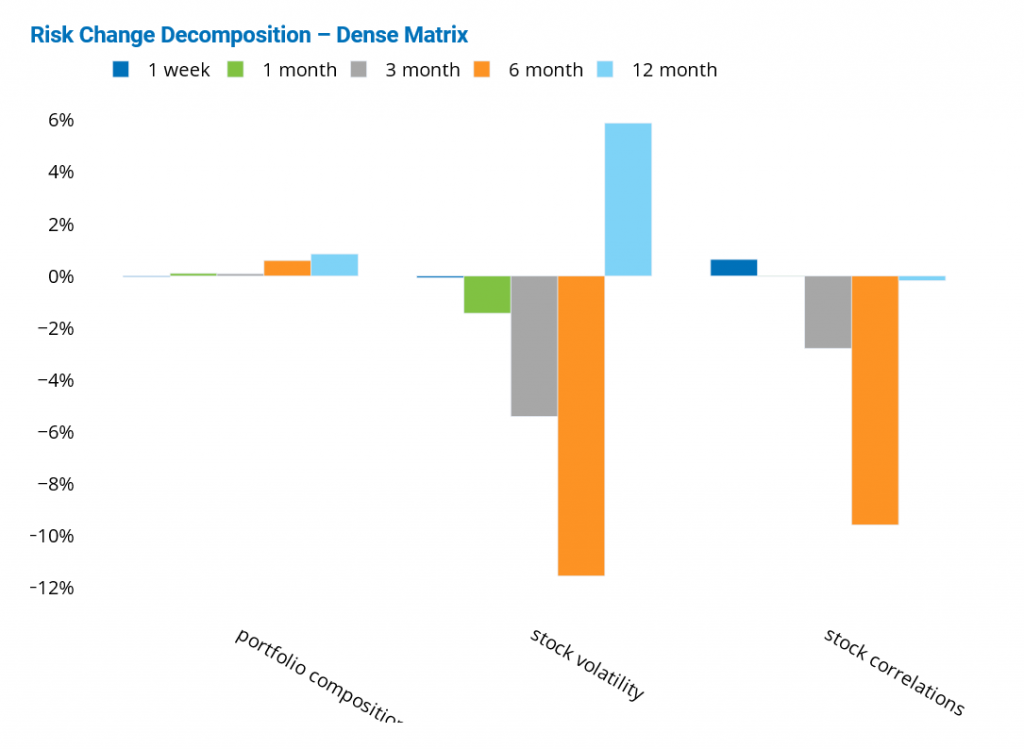

Stock correlations drive uptick in US risk

With political and economic uncertainty rattling US equity markets, US market risk rose slightly (about 60 basis points) over the past five days, as measured by Axioma’s US short-horizon fundamental risk. The decomposition of the change in risk from the standpoint of a full dense matrix revealed that the rise in risk was driven by the increase in stock correlations.

That said, just to put matters into perspective, US risk is down about 20 percentage points since April, despite a weakened economy due to pandemic-induced lockdowns, double-digit unemployment and social and geopolitical unrest. Both asset volatility and correlation declines were responsible for the six-month slide in US risk. By the end of last week, US market risk was still double its level of one year ago, with higher stock volatility solely responsible for the increased overall risk. For more information on the decomposition of the change in risk, please see Qontigo Insight Q3 2020 Risk Review {marketing please insert link}.

See graph from the US Equity Risk Monitor as of 8 October 2020:

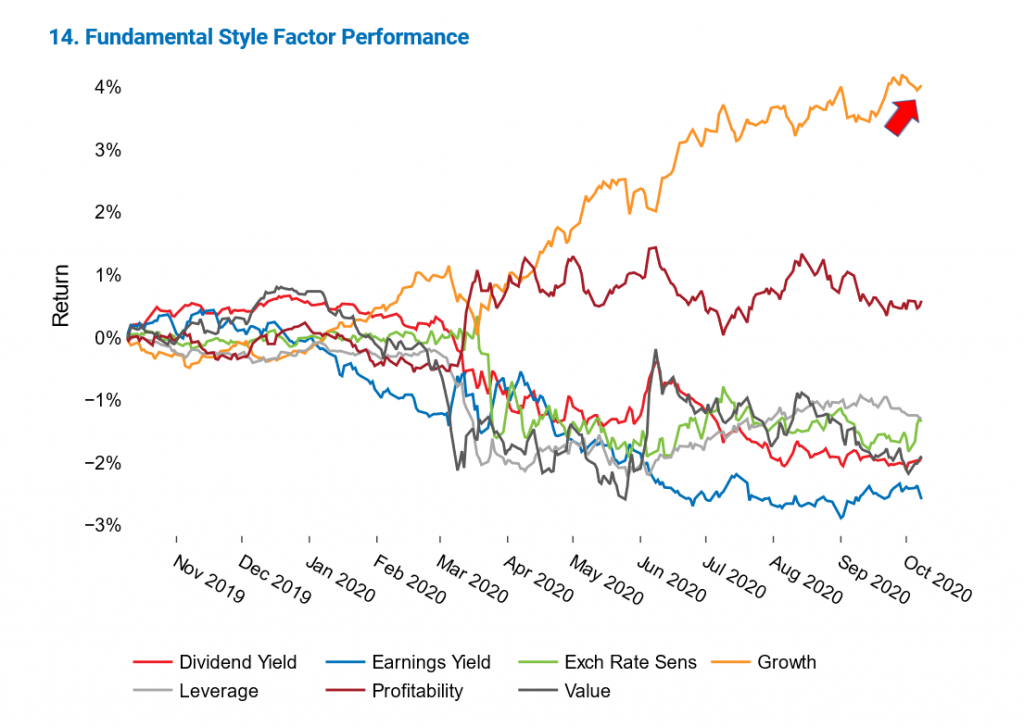

Growth takes off worldwide

The Growth style factor continued to produce positive returns in October, after a strong third-quarter performance followed an unusually good second quarter in most regions Axioma’s models track closely. Growth recorded the largest or second-largest cumulative 12-month return among fundamental style factors in all regions, except Australia and Developed Europe, with the largest gains in the US. Growth’s one-year cumulative return in the US was about 6% in both the US Small Cap and US All Cap medium-horizon models. Growth was also among the least volatile of style factors across all regions. For more details on style factor performance in the third quarter, please see Qontigo Insight Q3 2020 Risk Review {marketing please insert link}.

See graph from the Worldwide Equity Risk Monitor as of 8 October 2020:

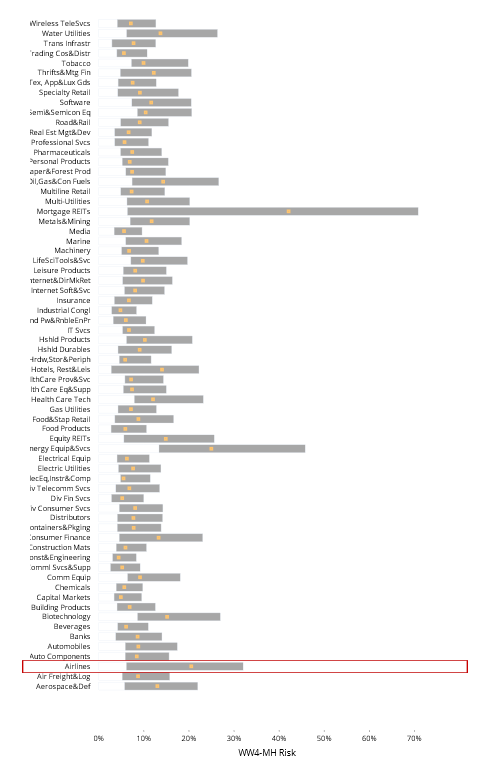

Airlines still among riskiest global industries

As COVID-19 infection cases continued to rise, and new travel restrictions threatened to further disrupt domestic and international air travel, Airlines remained one of the riskiest global industries. All industry volatilities are down from the April peaks, with most now positioned closer to the low-ends of their one-year volatility ranges, as measured by Axioma’s fundamental medium-horizon Worldwide model. As of last week, Airlines was the third riskiest industry in the Worldwide model, after Mortgage REITs and Energy, Equipment & Services. For all three industries, their current levels of risk are somewhere in the middle of their one-year volatility ranges.

See graph from the Worldwide Equity Risk Monitor as of 8 October 2020:

21. WW4 Factor Volatility Range (1 year)