- Recent market action has driven country risk higher

- In the US, Financials and Energy both contribute less risk than their weight would suggest

- UK risk rose, but underlying components do not reflect heightened concerns

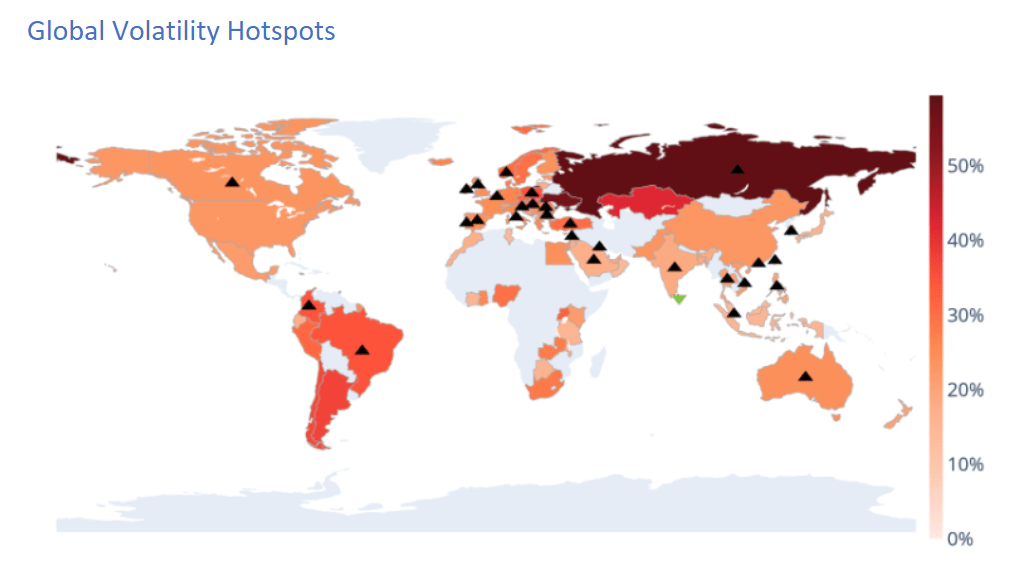

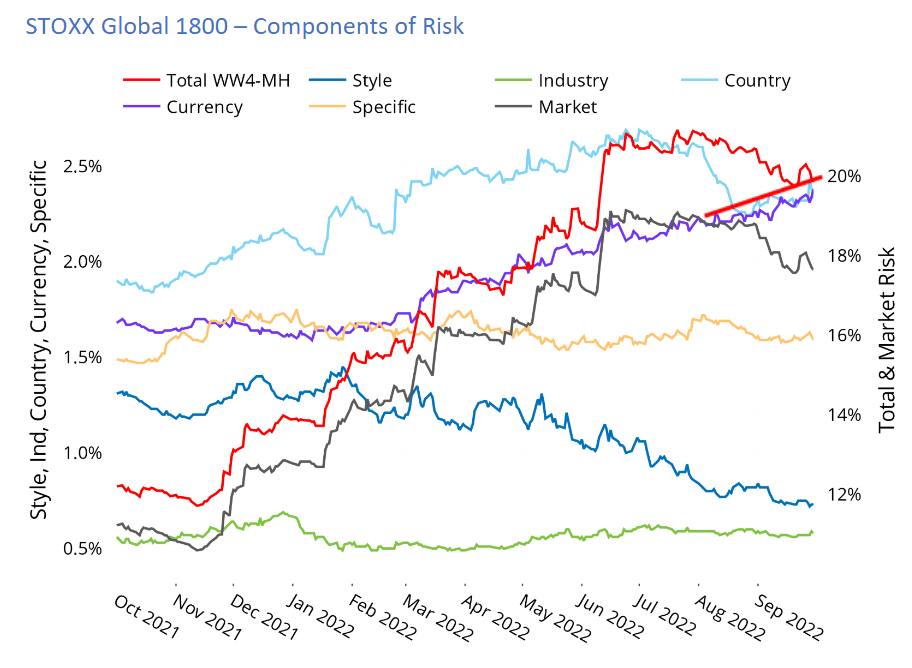

Recent market action has driven country risk higher

Although global market returns in the third quarter continued on a negative trajectory, and the market was down for the third quarter in a row, predicted risk eased as market, style and country volatility all dropped. (Although returns were negative in the third quarter, the magnitude of the decline was less in Q3 than in Q2, and there were fewer days with unusually large returns as compared with the first and second quarters of this year, thereby lowering volatility.) More recently, however, country volatility has picked up. The chart of global volatility hotspots highlights countries in which volatility changed by more than one percentage point over the past week, and this week’s chart is littered with up arrows, with the US —the highest risk among many countries — a major exception. This increase in most countries’ volatility also meant that overall country risk for the STOXX Global 1800 Index has started to tick back up. Investors with country bets may want to pay a bit of extra attention, in case this pattern continues.

See charts from the Global Developed Markets Equity Risk Monitor as of 30 September 2022:

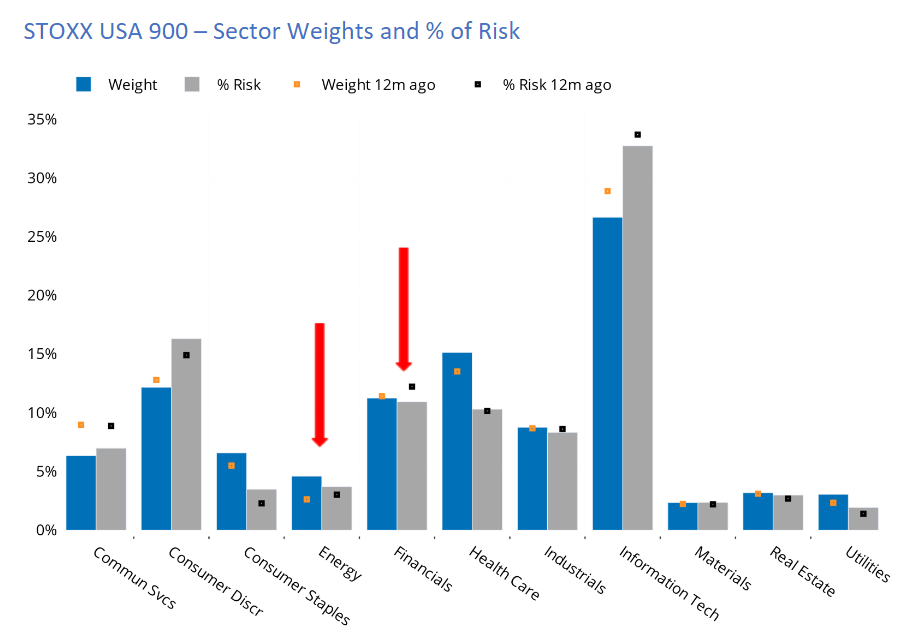

In the US, Financials and Energy both contribute less risk than their weight would suggest

A year ago, both the Financials and Energy sectors in the US contributed more to the risk of the STOXX USA 900 Index than their weights would imply, suggesting an active bet on the sector could mean more risk than expected. Since then, Financials’ weight has remained stable, but the sector’s contribution to risk has fallen. Energy, in contrast, saw its weight increase, but little change in its risk contribution. Most other sectors have not seen changes in their weight-risk contribution dynamic. For example, Information Technology’s risk contribution remained higher than its weight, although both have fallen, whereas both weight and risk contribution have increased for Consumer Staples. In both cases the proportion between them (higher weight than percent of risk) remained stable.

See chart from the US Equity Risk Monitor as of 30 September 2022:

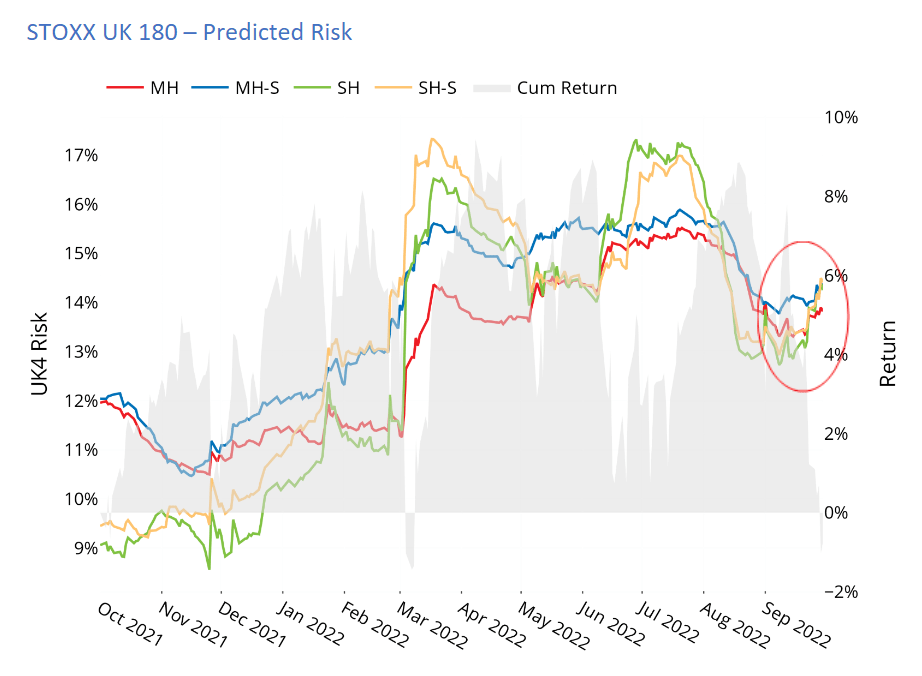

UK risk rose, but underlying components do not reflect heightened concerns

The UK market has seen heightened uncertainty from internal political turmoil, Bank of England projections of a recession, grave concerns about higher energy prices, etc. While higher energy prices are a global issue, other topics of concern are much more local. Therefore, it is not surprising to see that short-horizon fundamental risk for the STOXX UK 180 rose about 8.5% in the past month, from 13.1% to 14.2%. The increase was relatively large — during that same period, predicted volatility for the STOXX USA 900 was roughly flat. Other markets, such as the STOXX Europe 600, saw increases, but not as large. It is also interesting to note, however, that other components of risk in the UK do not stand out versus other major markets. For example, factor returns have been in line with volatility expectations, with the exception of Exchange Rate Sensitivity as discussed in last week’s highlights, and they have moved a similar direction as in other markets. Factor volatilities have not pushed up against 12-month highs and the differences between sector weights and their contributions to risk have remained similar to where they were a year ago. Still, weights have changed a lot, and Health Care now accounts for much more index risk than it used to. The UK’s risk remains lower than that of other major indices (in local currency), and its weight in the STOXX Global 1800 (denominated in USD) fell slightly, but its risk contribution remains lower than its weight would suggest. In sum, although there is a lot going on in UK fixed income and currency markets (see the MAC commentary this week), the UK equity market and its underlying risk components seem to be weathering the geopolitical storm better.

See graph from UK Equity Risk Monitor as of 30 September 2022: