While last week’s sharp reversal of factor returns has halted, higher levels of factor volatility persist.

The rotation out of Momentum and into Value has ceased for now, as market sentiment improved, encouraged by positive US economic data (strong consumer spending and industrial production), an amelioration of the US-China dispute, and expectations of an upcoming interest rate cut by the Fed. Fears of an imminent recession were also assuaged by a surge in the 10-year Treasury yields, which contributed to the correction of the inverted yield-curve.

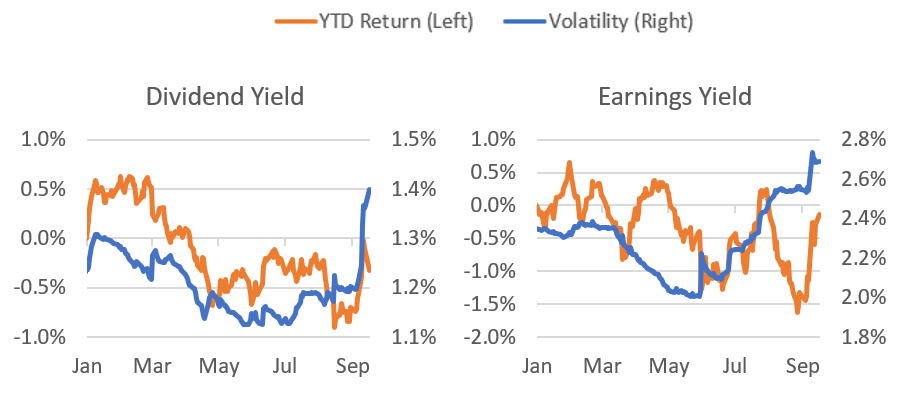

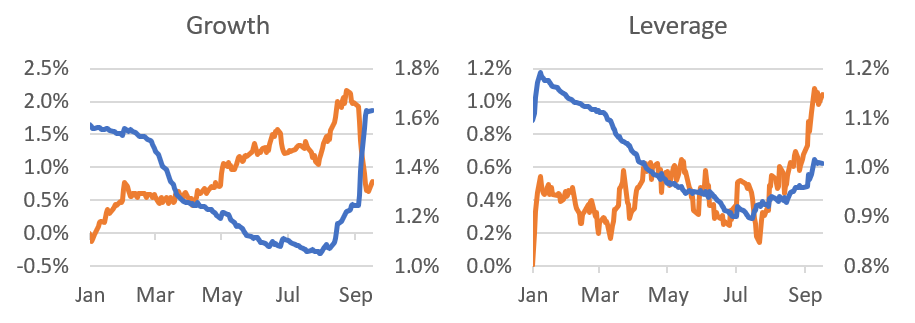

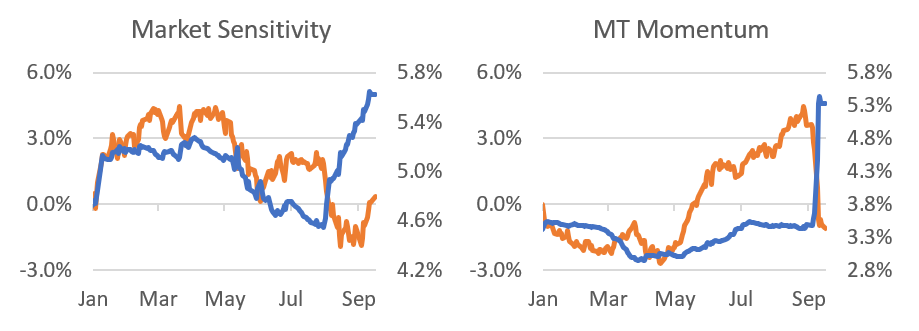

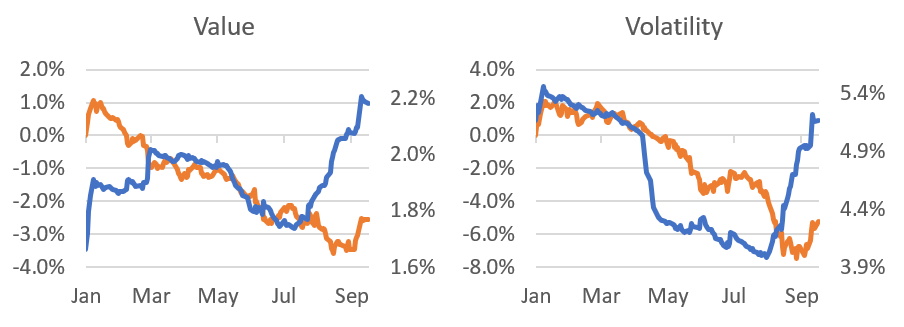

However, as a result of big daily moves last week, many US style factors experienced a surge in volatility, especially compared with the low levels seen earlier in the year. The figures below show year-to-date cumulative returns and volatilities for the US style factors that saw the largest swings in September, as measured by Axioma’s US4 medium-horizon fundamental model.

Dividend Yield, Growth and Median-Term Momentum saw the most abrupt climbs in risk in September. The 4.5% month-to date drop in Momentum’s return dragged the factor into negative territory for the year and pushed its volatility 52% higher than it was on August 30th. Growth suffered a milder month-to-date loss of 1.2%, but its risk surged 31% over the same period. While Dividend Yield and Value were among the winners, their volatility nevertheless rose by 13% and 5%, respectively, since August end.

Most other US factors have seen a steady increase in risk so far in the third quarter, with some reaching volatility peaks for 2019.

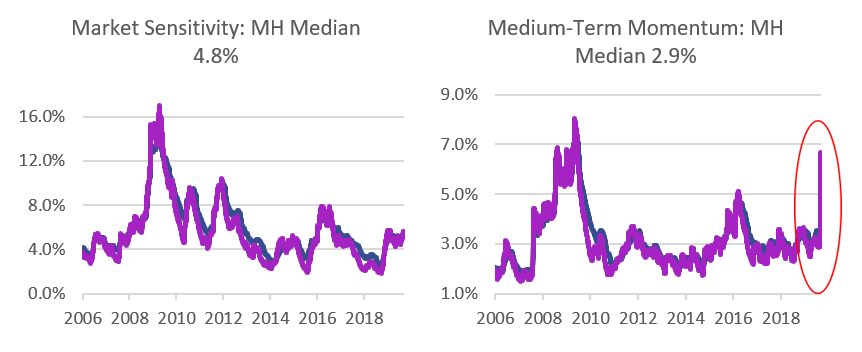

Fears of a financial crisis bubbling under the surface sent shivers through the quant world last week (see blog post Has the Factor World Gone Mad and Are We on the Brink of Another Quant Crisis?). But compared with historical levels, current factor volatility is relatively tame for all factors, except Medium-Term Momentum.

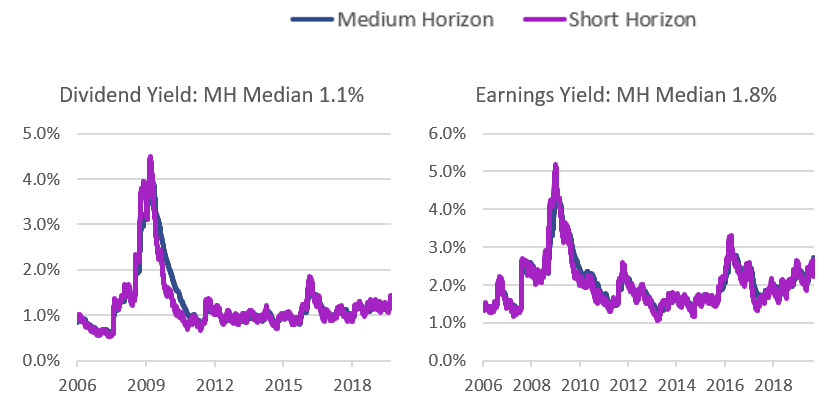

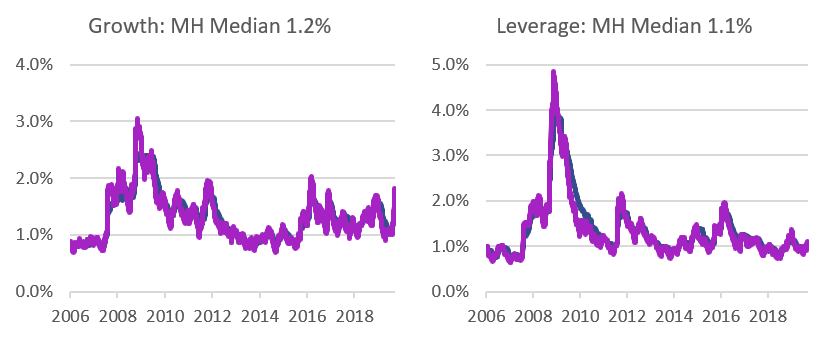

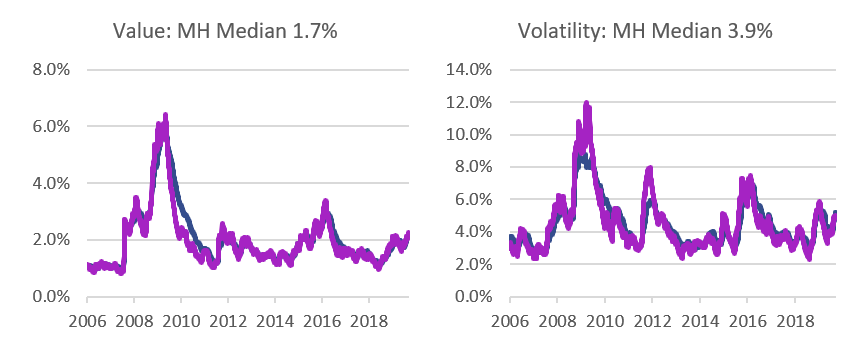

Almost every factor’s volatility was around or slightly above its median level since 1990, at both the short and medium horizons (see charts below). However, Momentum’s current level of risk is more than double its median at the short horizon and close to double at the median horizon. Momentum hasn’t seen these levels of risk—6.6% at the short horizon and 5.3% at the median horizon—since 2009.

While volatilities don’t currently stand out as being extremely high relative to history, they are considerably higher than they have been recently and are likely to drive increases in active risk, or lower exposures for investors trying to maintain target active risk levels.